Key Notes

- Sharplink Gaming’s institutional backing validates Ethereum as a most well-liked company reserve asset for treasury diversification methods.

- ETH’s technical breakout above Bollinger higher band suggests continued momentum towards the $4,100-$4,350 resistance zone forward.

- Rising institutional adoption creates favorable circumstances for sustained value appreciation regardless of RSI approaching overbought ranges.

Ethereum shattered the $4,050 resistance stage on August 8, marking its highest value level since December 2024 because the digital asset posted a stable 6% day by day rally.

The ETH value rally was initially triggered on August 7 by a big announcement from strategic treasury investor Sharplink Gaming, confirming a $200 million direct providing backed by world institutional traders. The corporate revealed that proceeds will likely be used to expand its Ethereum treasury to over $2 billion, reinforcing its dedication to ETH as a core reserve asset.

“SharpLink is proud to be joined by globally-recognized institutional traders, augmenting our sturdy current investor base and additional validating our mission to be the world’s main ETH treasury,” said Joseph Chalom, SharpLink’s Co-Chief Govt Officer.

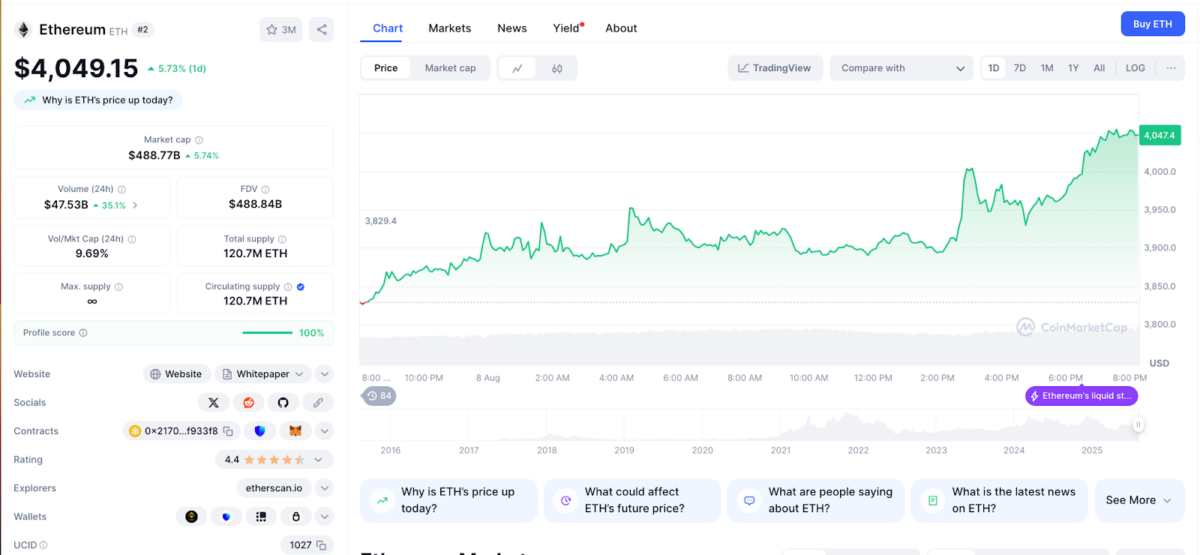

Ethereum value motion | CoinMarketCap Aug. 8, 2025

Ethereum markets reacted positively. According to CoinMarketCap, Ethereum traded between a low of $3,864 and a excessive of $4,065, with day by day volumes rising 35% to hit $47.1 billion at press time.

As Ethereum’s institutional adoption grows, particularly amongst US-based corporate investors, short-term merchants could proceed to position upside bets, anticipating imminent capital inflows.

Ethereum Value Prediction: Bulls Eye $4,350 Breakout as RSI Strengthens

Ethereum closed the August 8 session at $4,045, printing a clear bullish engulfing candle that pierced above the Bollinger Band’s higher band at $4,000. This marks ETH’s first decisive shut above the higher band since late July, suggesting rising volatility and momentum in favor of the bulls. Notably, ETH reclaimed the midline help on the 20-day common earlier this week at $3,719, which might function a gentle consolidation base as merchants place for additional features.

ETH is now buying and selling within the higher volatility vary between $4,009 and $4,350, with the RSI climbing to 68.99. The Bollinger Bands have began increasing once more, indicating renewed directional momentum. With ETH firmly positioned above each the midline and the higher band, value motion suggests continuation somewhat than exhaustion, but RSI nearing 70 requires warning.

If ETH confirms a day by day shut above $4,100, it will mark a technical breakout from the two-week consolidation vary. With minimal resistance between $4,100 and $4,350, Ethereum might shortly speed up towards all-time highs. The RSI would probably enter overbought territory, however this may occasionally not deter bullish momentum if quantity rises concurrently.

Ethereum value forecast

On the flip aspect, failure to keep up a day by day shut above $4,000 would probably see ETH revisit the $3,695 to $3,719 help zone, with Bollinger’s midline and former resistance flipping again to help. A breakdown beneath $3,695 would expose ETH to the $3,600 and $3,500 vary, the place the decrease Bollinger band at the moment supplies speedy help. An in depth beneath that may shift the pattern again to impartial.

Finest Pockets Presale Positive factors Momentum as Ethereum Attracts Institutional Demand

Whereas Ethereum strengthens its place because the institutional favourite for crypto treasuries, Best Wallet is rising as a presale alternative aligning itself with Ethereum’s increasing on-chain economic system.

Finest Pockets Token Presale

With over $14 million raised, the BEST presale presents traders precedence entry to future undertaking listings, diminished transaction charges, and staking rewards with excessive APY. The undertaking is positioning itself as a DeFi-native pockets for brand new market entrants trying to profit from Ethereum’s anticipated breakout section amid rising institutional inflows.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any selections based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.