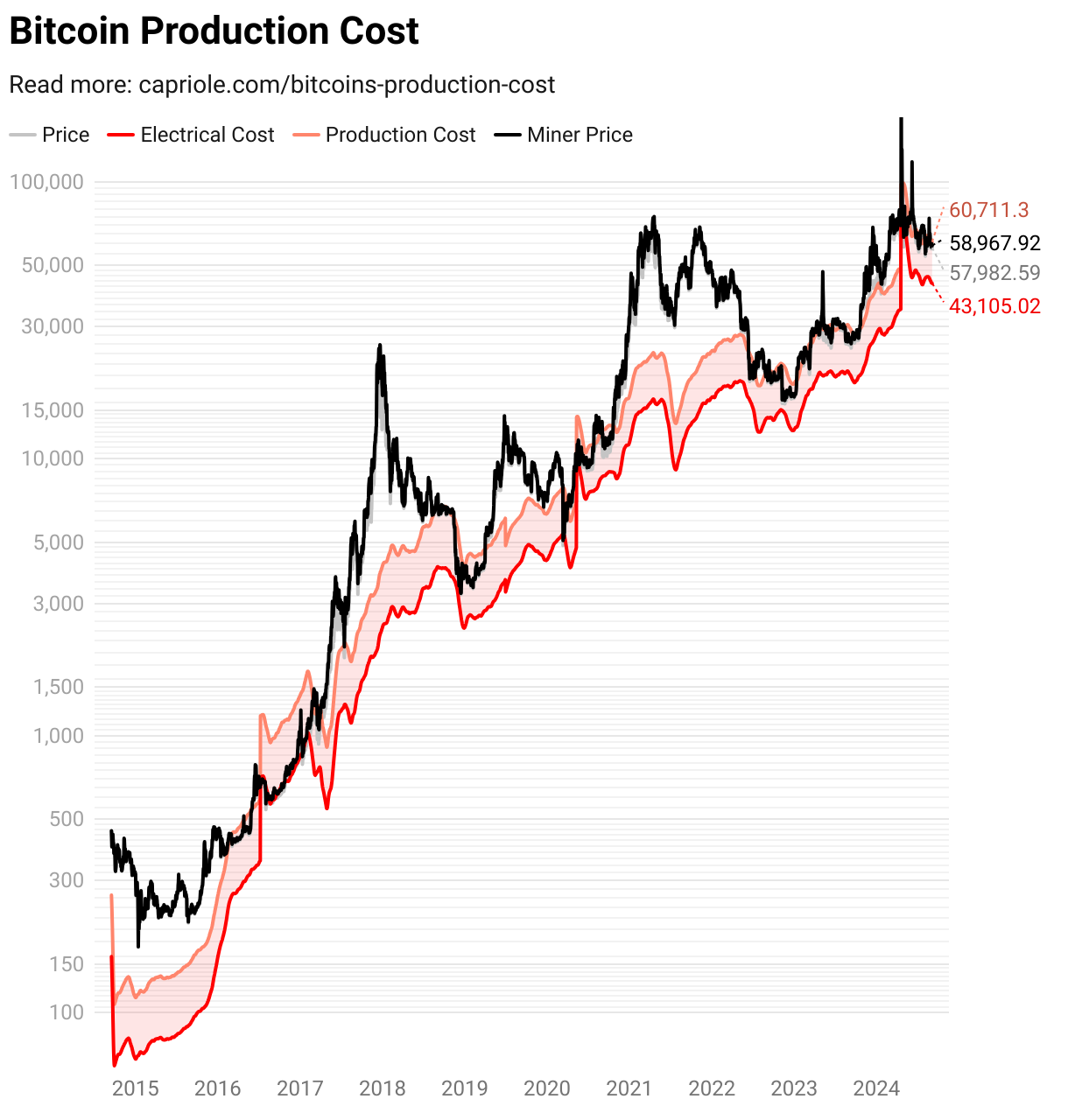

Crypto analyst Astronomer, recognized by the deal with @astronomer_zero on X, has put forth a probably compelling backside sign for Bitcoin, which hinges on the electrical energy prices incurred by miners to supply BTC. Based on him, this explicit metric has traditionally served as a dependable indicator for figuring out optimum shopping for alternatives inside Bitcoin’s worth cycles.

Is The Bitcoin Backside In?

The analysis titled “BTC Miners electrical energy price, a 100% correct backside sign,” leverages information as an example a situation the place the price of Bitcoin manufacturing dips beneath its market worth, suggesting a pivotal second for potential traders. Astronomer elaborated on his methodology and findings by referencing his earlier predictions which efficiently pinpointed market tops, notably a 30% drop from a $70,000 peak, which was guided by equally data-driven indicators.

Associated Studying

Astronomer’s present give attention to the price of mining stems from its important implications on Bitcoin’s provide dynamics. Regardless of the halving occasions designed to scale back the reward for mining Bitcoin, there stays a 0.84% annual inflation in its provide, equating to roughly $10 billion value of Bitcoin getting into the market annually. That is equal to the overall holdings of great company traders like MicroStrategy, indicating a considerable inflow of Bitcoin from miners, who’re inclined to promote step by step to maintain their operations.

Nonetheless, the present market circumstances, as described by Astronomer, have reached a uncommon state the place the market worth of Bitcoin has fallen beneath the typical weighted price of electrical energy required to mine it. This example sometimes constrains miners from promoting their holdings at a revenue, thus probably decreasing the sell pressure in the marketplace.

“Not solely does that imply that the miners can’t promote their BTC for a revenue. It additionally implies that it’s merely cheaper to only log right into a CEX and purchase 1 Bitcoin, as a substitute of going by way of the ache of mining 1 Bitcoin. So not solely does this make the miners (the individuals controlling BTC) not wish to promote, it additionally makes them wish to purchase, as a result of it’s cheaper to only purchase as a substitute of mine them,” Astronomer suggests.

Associated Studying

This shift not solely impacts the promoting habits of miners but in addition their shopping for methods, contributing to a lower in provide stress and probably triggering upward worth actions. Astronomer helps his declare by stating that traditionally, when the price of manufacturing fell beneath the market worth, it has constantly led to substantial worth recoveries.

He detailed cases from the current previous, together with notable dips in March 2023 when Bitcoin hit $19,500, November 2022 at $16,500, June 2022 at $18,000, Could 2020 at $8,900, March 2020 at $4,700, and November 2018 when it bottomed out at $3,500. Every of those moments was adopted by strong bull runs, underlining the potential reliability of this sign.

“What number of occasions? 17 out of 17 occasions, it meant that worth was at ranges that, in accordance with historical past (with excessive statistical significance), you’d wish to purchase, or would miss and remorse it for a really very long time,” the analyst provides.

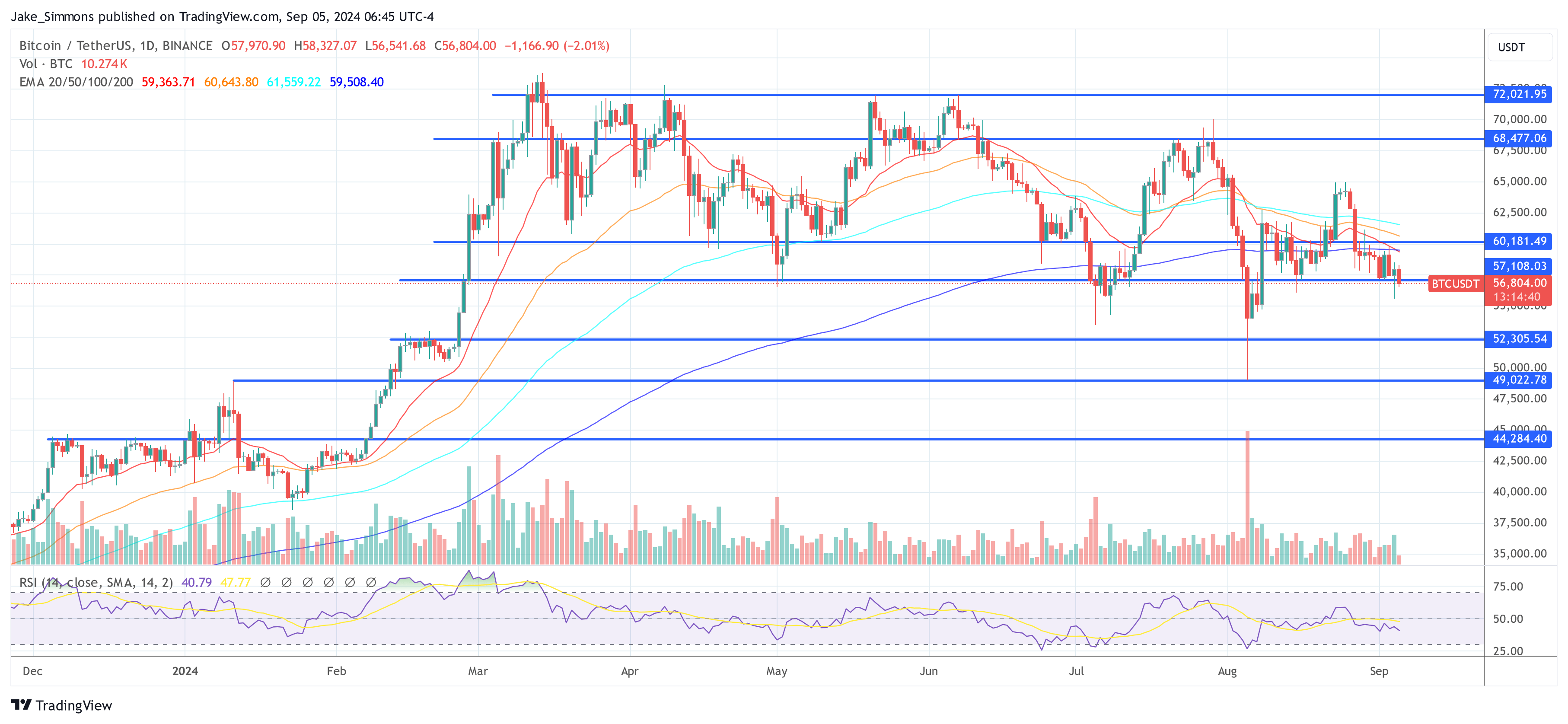

At the moment, with the manufacturing price of Bitcoin, in accordance with Capriole Funding’s information, standing at $60,711 and the worth lingering at $56,713, the circumstances described by Astronomer are manifesting but once more. This juxtaposition poses a vital query to the market: Is now the time to purchase?

Whereas Astronomer’s evaluation is backed by historic information and detailed market statement, he stays cautiously optimistic in regards to the outcomes, encapsulated in his closing comment, “Will this time be completely different? Possibly.”

At press time, BTC traded at $56,804.

Featured picture created with DALL.E, chart from TradingView.com