- 460,000 beforehand dormant BTC have re-entered the market, impacting provide and demand

- Elevated liquidity from reactivated cash might result in short-term volatility and worth fluctuations

In a stunning flip of occasions, 460,000 beforehand dormant Bitcoin [BTC] have not too long ago re-entered circulation, sending ripples by way of the market. These “misplaced” cash, as soon as regarded as inaccessible, are actually actively circulating once more.

This shift raises vital questions on BTC’s perceived shortage and its potential impression available on the market.

Understanding Bitcoin’s shortage and its impression on worth

Bitcoin’s worth is intrinsically tied to its shortage. With a complete provide capped at 21 million cash, Bitcoin is designed as a restricted useful resource, and this finite provide has lengthy been a key driver of its worth.

The precept of provide and demand dictates that when an asset is scarce, its perceived worth will increase – particularly when demand stays regular or rises. This shortage narrative has bolstered Bitcoin’s popularity as “digital gold,” a retailer of worth.

The return of dormant Bitcoins

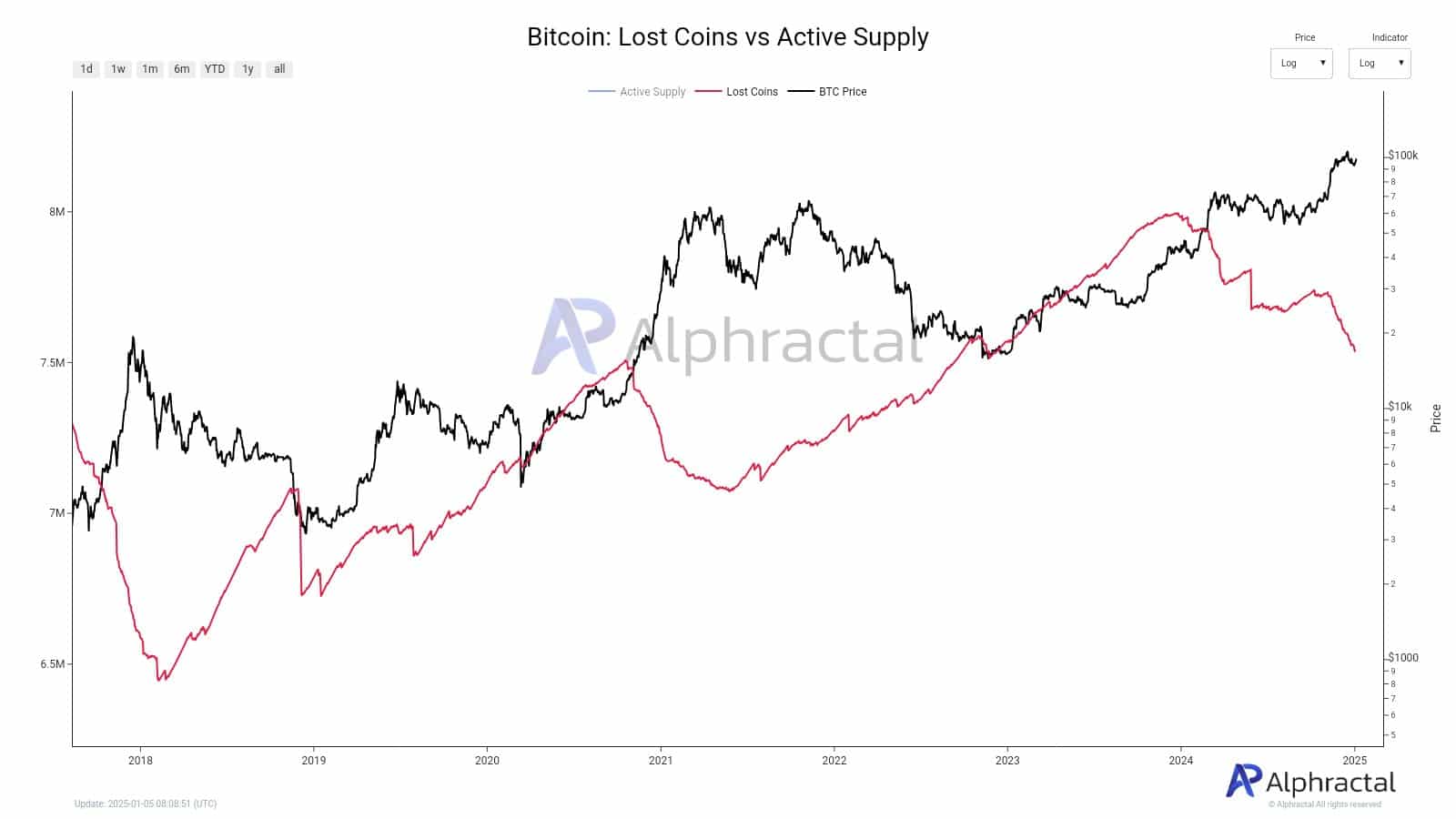

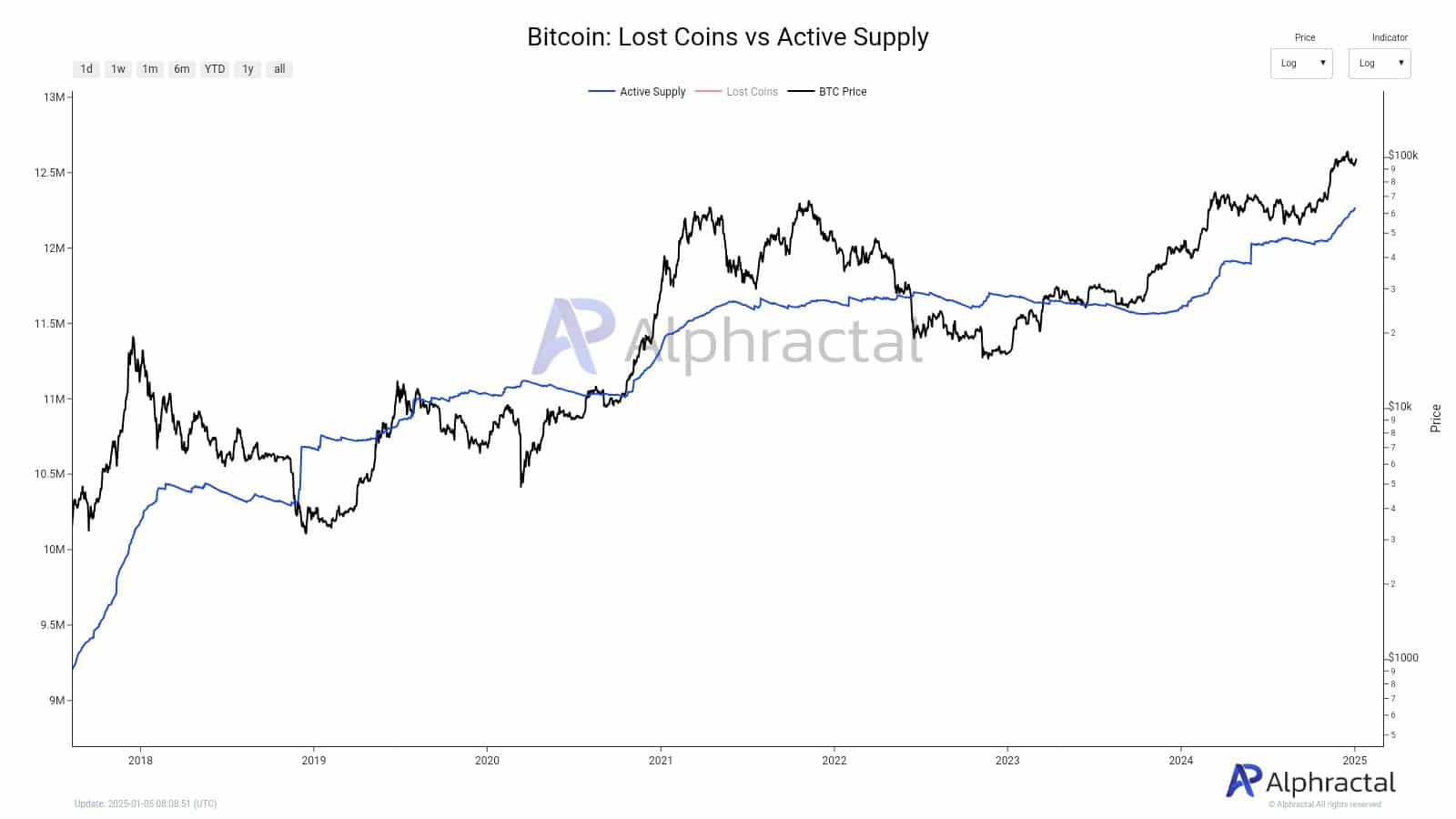

The reactivation of dormant BTCs, notably since 2024, marks a shift in Bitcoin’s market dynamics. Round 460,000 BTC, as soon as thought misplaced, have resurfaced, largely pushed by the launch of the Bitcoin ETF.

This surge in long-held cash suggests rising confidence amongst LTHs, who’re capitalizing on the present bullish cycle. As these cash turn into energetic once more, the accessible circulating provide of Bitcoin will increase, which might have broader implications for its shortage narrative.

Whereas BTC’s complete provide is fastened, the provision of dormant cash re-entering the market challenges the notion of shortage.

This inflow might quickly dilute the asset’s perceived shortage, particularly if these cash are bought rapidly into the market, probably creating short-term volatility.

How reactivated cash have an effect on BTC’s shortage narrative

The return of dormant cash might disrupt the long-standing shortage narrative that has outlined Bitcoin’s worth. Though Bitcoin stays restricted in complete provide, the reactivation of those cash will increase the efficient circulating provide, altering the steadiness between provide and demand.

Within the quick time period, this might undermine BTC’s perceived shortage, particularly if vital quantities of BTC are moved onto exchanges and bought. This inflow of provide would possibly quickly weigh on BTC’s worth till the market absorbs the cash.

Bitcoin’s future in a extra liquid market

The scenario introduces further liquidity into the Bitcoin market, with each constructive and unfavourable implications. On one hand, elevated liquidity facilitates smoother buying and selling and extra market effectivity.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

However, a sudden surge in energetic provide might result in worth volatility, notably if massive quantities of Bitcoin are bought directly.

Over time, this enhance in liquidity might affect BTC’s worth stability, probably lowering speculative spikes and fostering extra sustainable development.