- Bullish sentiment builds with rising lengthy positions in BTC, ETH, SOL, and ADA, fueling volatility.

- The market dangers a cascade of liquidations if key ranges like $85K for BTC or $2K for ETH are breached.

Over the previous week, bullish sentiment has intensified throughout the crypto market, with high belongings like Bitcoin [BTC], Ethereum [ETH], Solana [SOL], and Cardano [ADA] witnessing a notable surge in lengthy positions.

This growing accumulation highlights rising dealer confidence but additionally heightens market dangers. As leverage builds, the market turns into extra vulnerable to volatility.

Even minor value actions might set off vital liquidations and speedy directional shifts within the coming week.

Longs vs. shorts: Rising bullish sentiment

Previously seven days, top cryptos have seen a clear shift towards bullish positioning. Knowledge exhibits that lengthy positions are outpacing shorts throughout Bitcoin, Ethereum, Solana, and Cardano, signaling renewed dealer optimism.

This development displays rising confidence available in the market’s upward momentum, particularly as BTC holds above key psychological ranges and Ethereum continues to learn from much-anticipated ecosystem developments.

In contrast to earlier consolidation phases, the place shorts sometimes dominated throughout uncertainty, this wave of lengthy accumulation displays optimism about sustained good points. Nonetheless, rising leverage throughout the market additionally will increase dangers.

Any surprising downturn might result in speedy liquidations and cascading results in markets closely biased towards lengthy positions.

Liquidation threat mounts as longs crowd Bitcoin and Ethereum

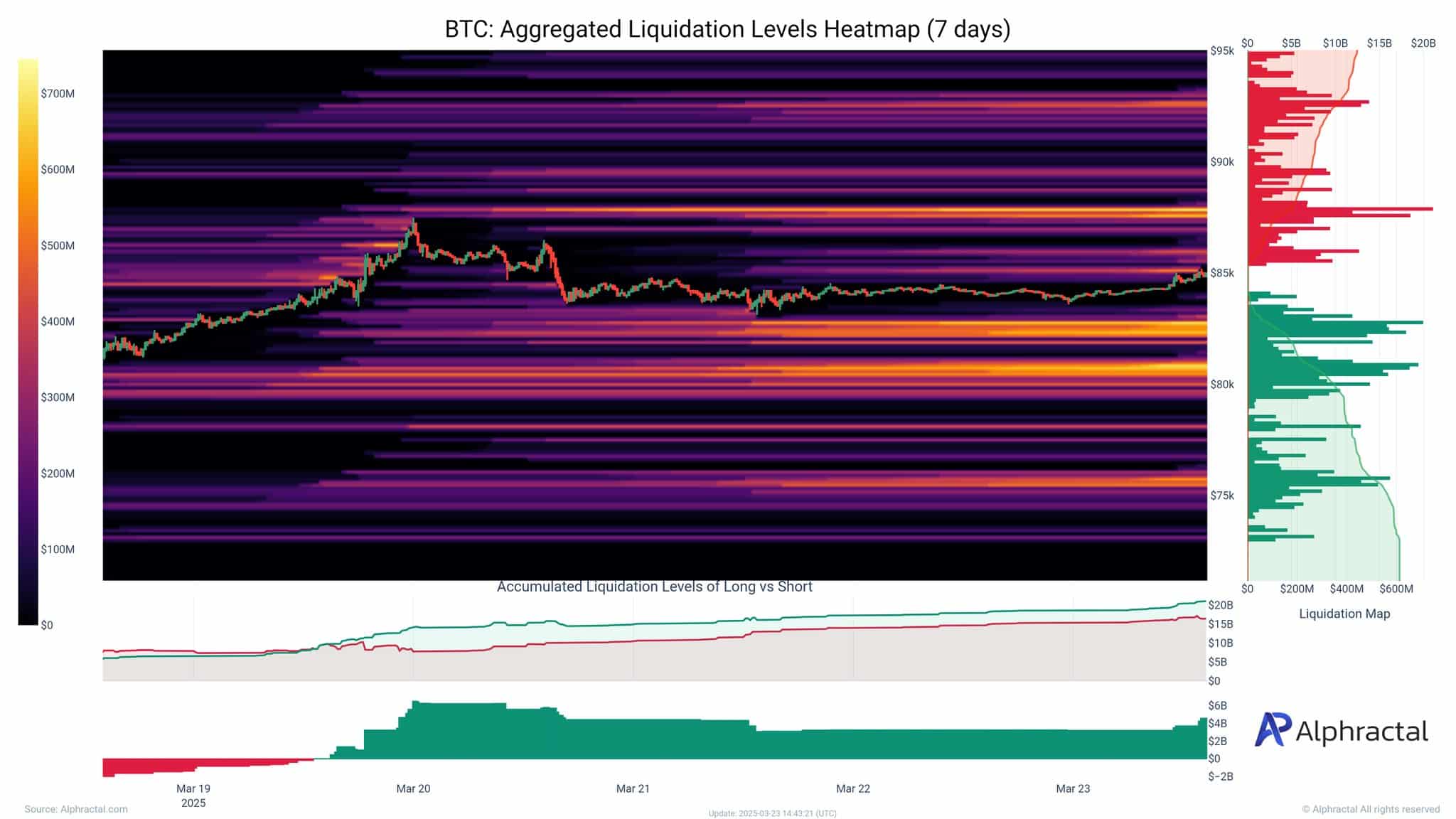

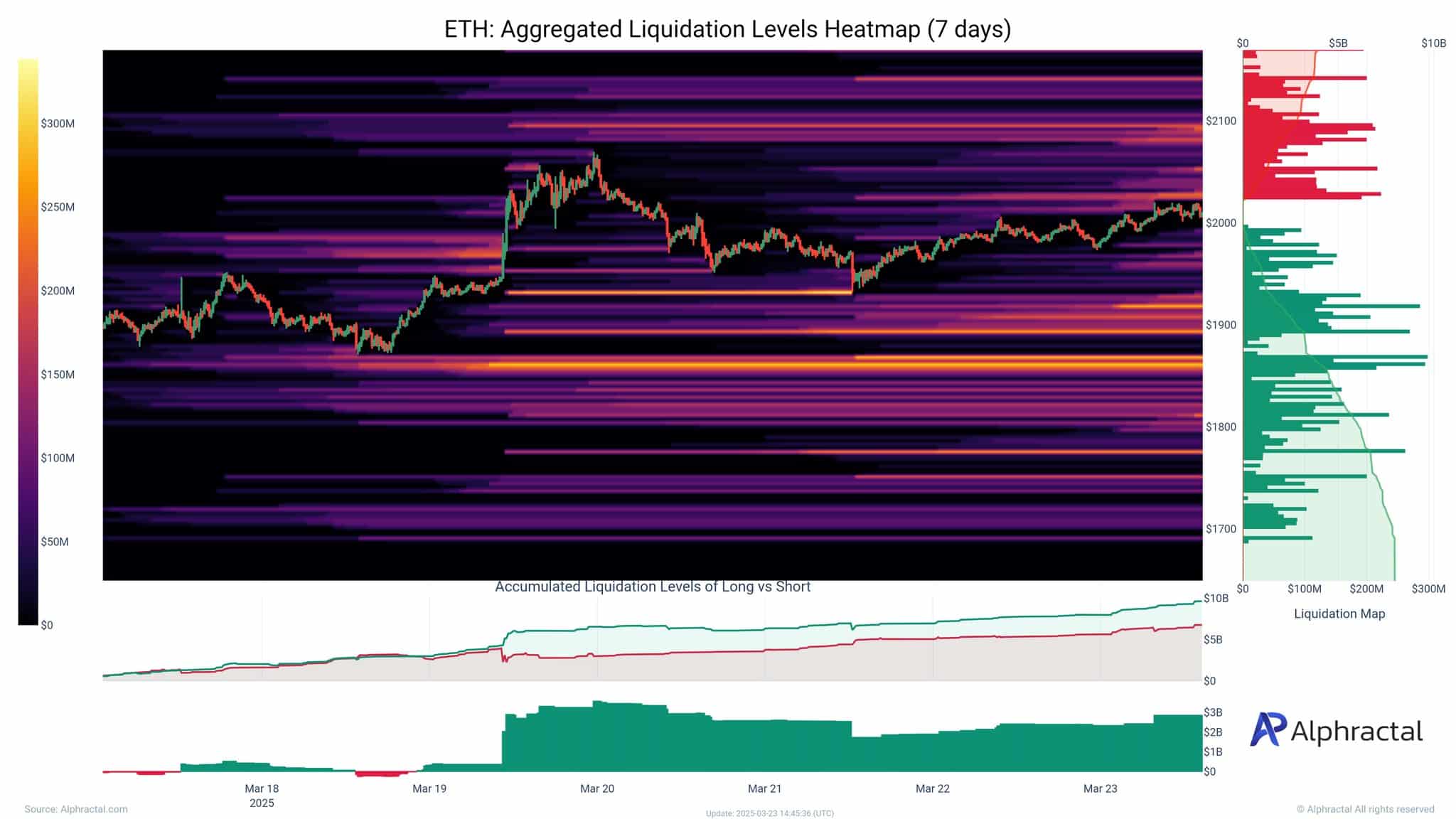

Over the previous week, Bitcoin and Ethereum have seen a pointy buildup in leveraged lengthy positions, with liquidation heatmaps revealing densely packed threat zones.

For BTC, lengthy liquidations are stacked above $85K, with almost $20B in amassed liquidation ranges – signaling a possible cascade if costs reverse even barely.

Ethereum displays comparable patterns, with concentrated lengthy positions above $2,000 and over $10 billion in liquidation threat. Merchants present confidence in continued value development, however such heavy positioning creates market fragility.

A sudden drop under $80K for BTC or $1,900 for ETH might set off compelled liquidations, intensifying draw back volatility.

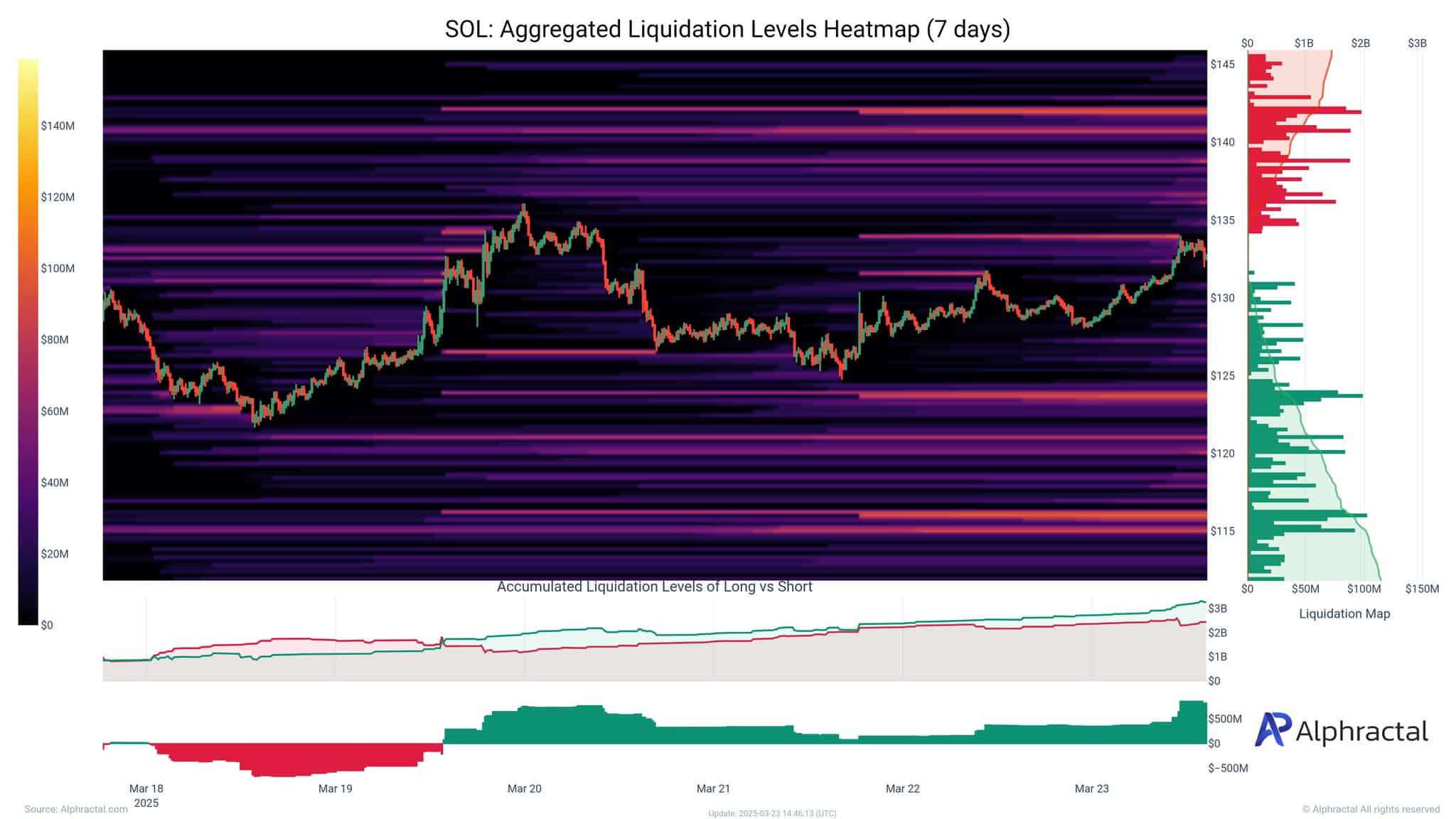

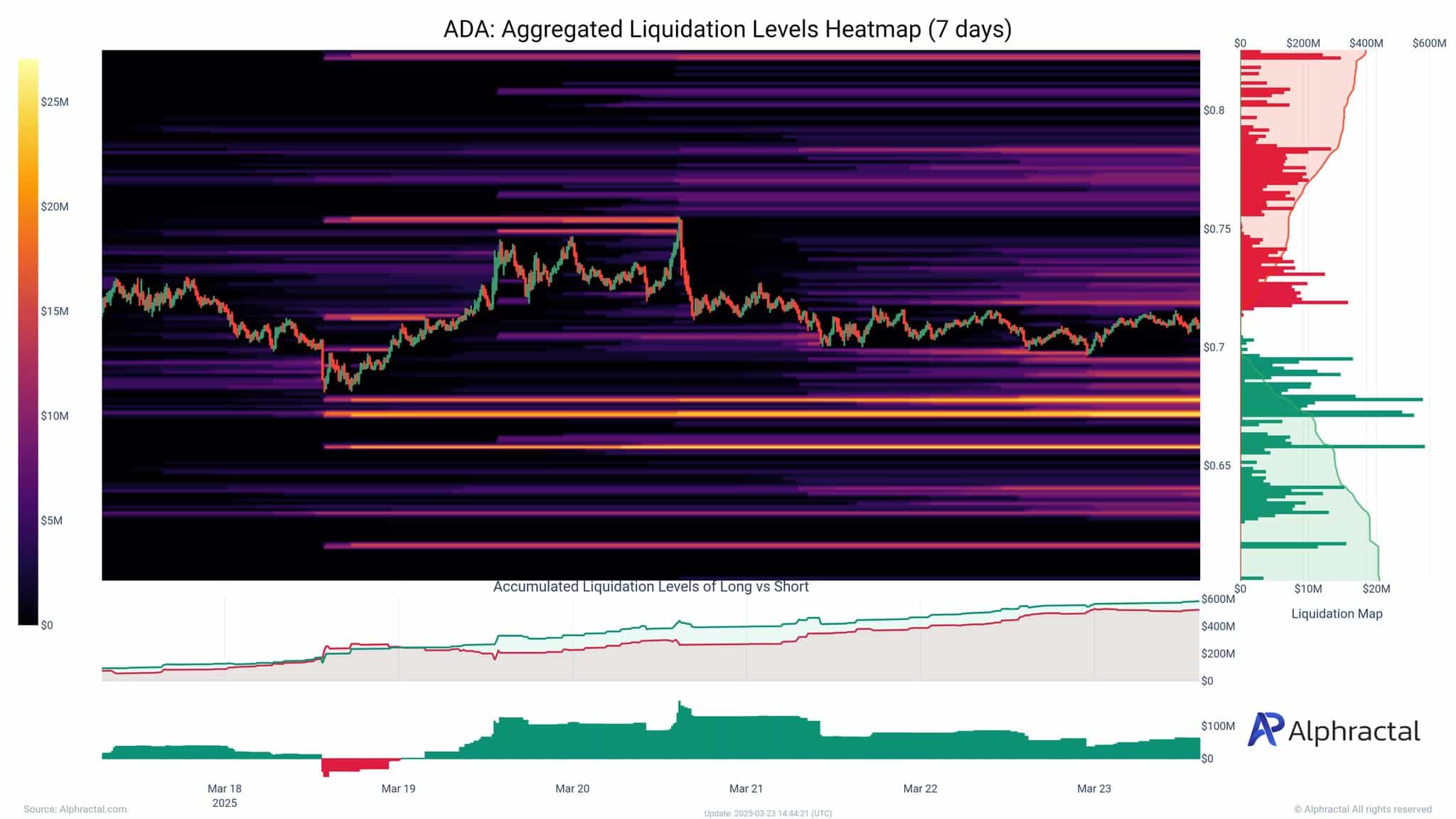

Solana and Cardano: Excessive-stakes zones

Solana exhibits a notable focus of lengthy liquidations clustered between $140 and $145, with amassed lengthy positions exceeding $3B. This means a rising threat of sharp draw back volatility if value momentum stalls.

The heatmap highlights decrease assist zones round $125 and $115, the place vital liquidity sits – doubtlessly performing as magnetic ranges if sentiment turns bearish.

For Cardano, the heatmap reveals lengthy liquidations densely packed round $0.75, aligning with a current surge. With over $600M in amassed positions, any retracement towards the $0.65–$0.68 area might set off cascading liquidations.

These zones symbolize each threat and alternative, as merchants anticipate reactive value conduct round them.