- Bitcoin might decline by 6.5% to achieve its subsequent help at $77,400 if it stays beneath the 200 EMA.

- Ethereum might decline by 15% if it breaches a key stage of $1,780.

The tariff pressure is already impacting the cryptocurrency market, with property experiencing an enormous value decline as traders take strategic motion forward of at the moment’s announcement.

Tariff fears within the crypto market

Since Donald Trump’s presidential inauguration in the US, the general cryptocurrency market has fallen considerably and is about for additional decline as his tariffs present no indicators of ending quickly.

On the 2nd of April, a crypto analyst shared a publish on X (previously Twitter) stating that spot Bitcoin ETFs noticed a $157.8 million outflow, whereas spot Ethereum ETFs noticed a $3.6 million outflow on the first of April.

This means that traders are withdrawing their cash from these property. Giant outflows are sometimes seen as a bearish signal, as they will create promoting strain and result in additional value declines.

In the meantime, the publish on X additionally famous that establishments are lowering danger forward of at the moment’s tariff announcement.

Present value momentum

Regardless of these uncertainties, BTC and ETH stay constructive, holding good points of 1% and 0.35%, respectively, over the previous 24 hours, in contrast to different cryptocurrencies.

In accordance with CoinMarketCap information, BTC was buying and selling close to $84,300, whereas ETH traded close to $1,860. Nevertheless, the asset’s value good points gave the impression to be fading, because the each day chart flashed indicators of a possible decline.

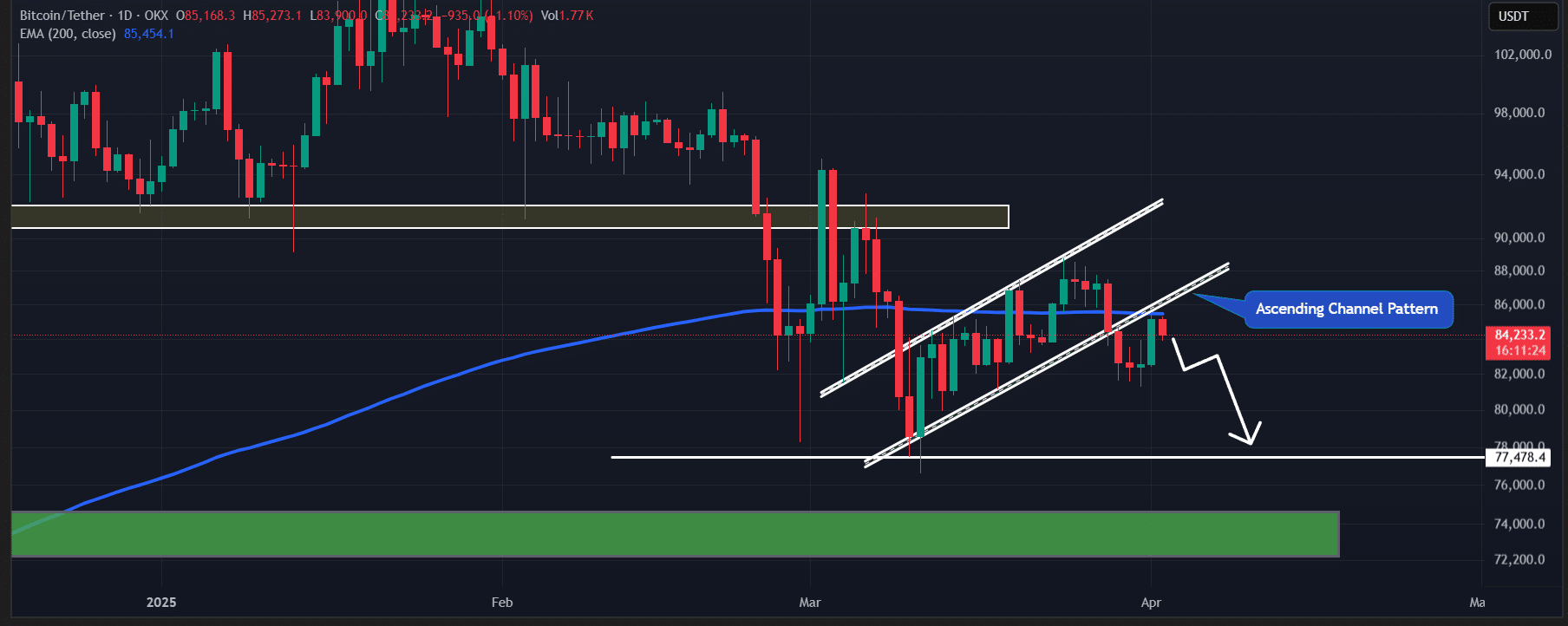

The king coin has efficiently retested the breakdown of the ascending channel sample and is now dealing with a value drop after encountering resistance on the 200-day Exponential Transferring Common (EMA) on the each day timeframe.

Primarily based on latest value motion and present market sentiment, if BTC stays beneath the 200-day EMA, there’s a sturdy chance it might decline by 6.5% to achieve its subsequent help at $77,400.

The chart signifies that BTC’s key stage is the 200-day EMA on the each day timeframe.

Ethereum value evaluation and key ranges

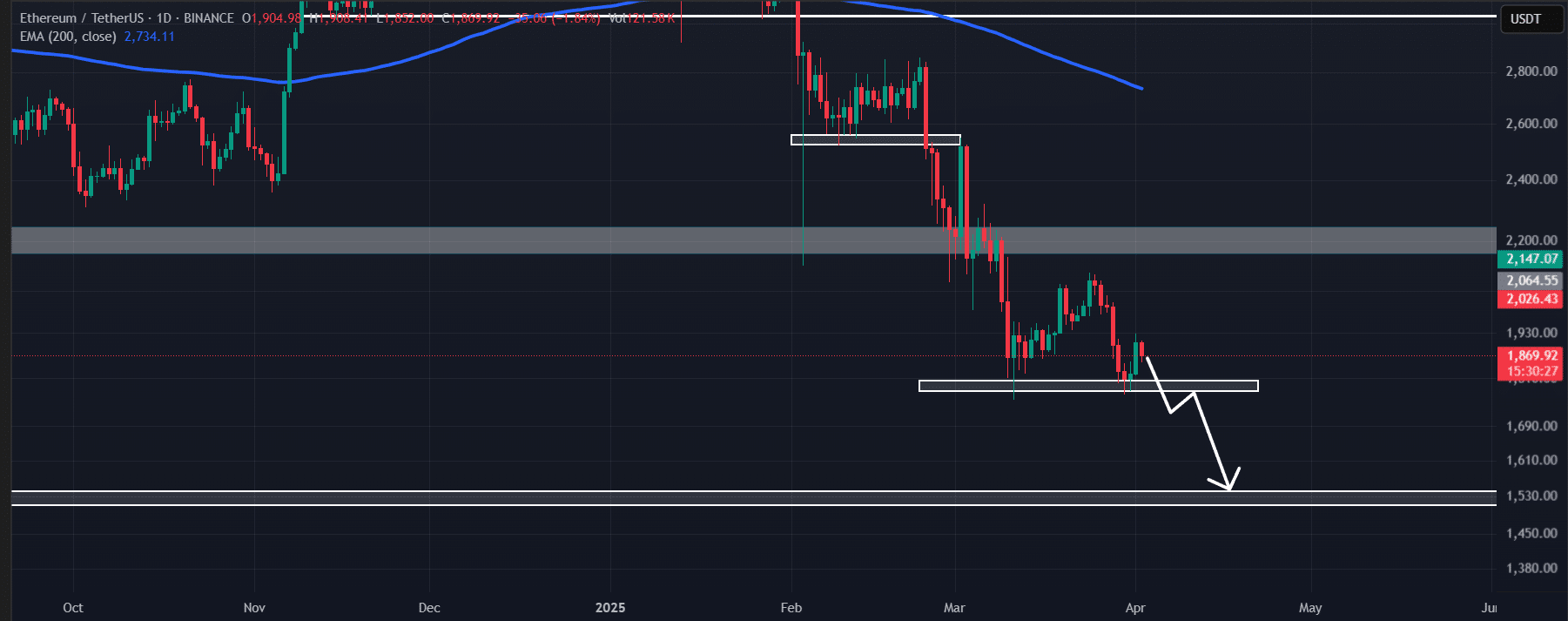

In the meantime, Ethereum was additionally close to a key stage at $1,780. If ETH continues to say no and breaches this stage, there’s a sturdy chance of a pointy 15% drop, doubtlessly bringing the worth right down to $1,550.

The Ethereum each day chart signifies that $1,780 is a key stage that might decide ETH’s subsequent transfer.

Merchants’ bearish view on BTC and ETH

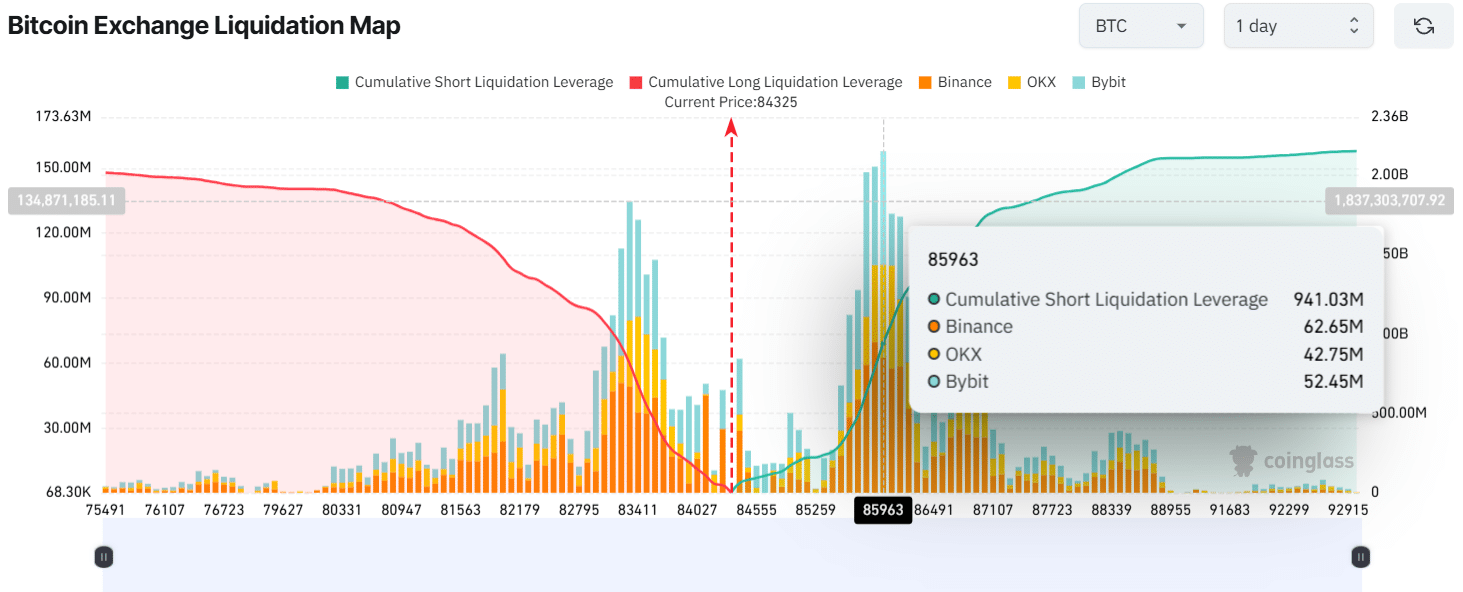

Knowledge from the on-chain analytics agency Coinglass reveals that merchants had been over-leveraged at press time, with key ranges at $83,320 on the decrease aspect and $85,960 on the higher aspect.

They’ve constructed $811 million and $941 million value of lengthy and quick positions, respectively, indicating that bears are presently in management.

Moreover, the upper bets on quick positions have the potential to push the worth decrease, which is a purple flag for BTC.

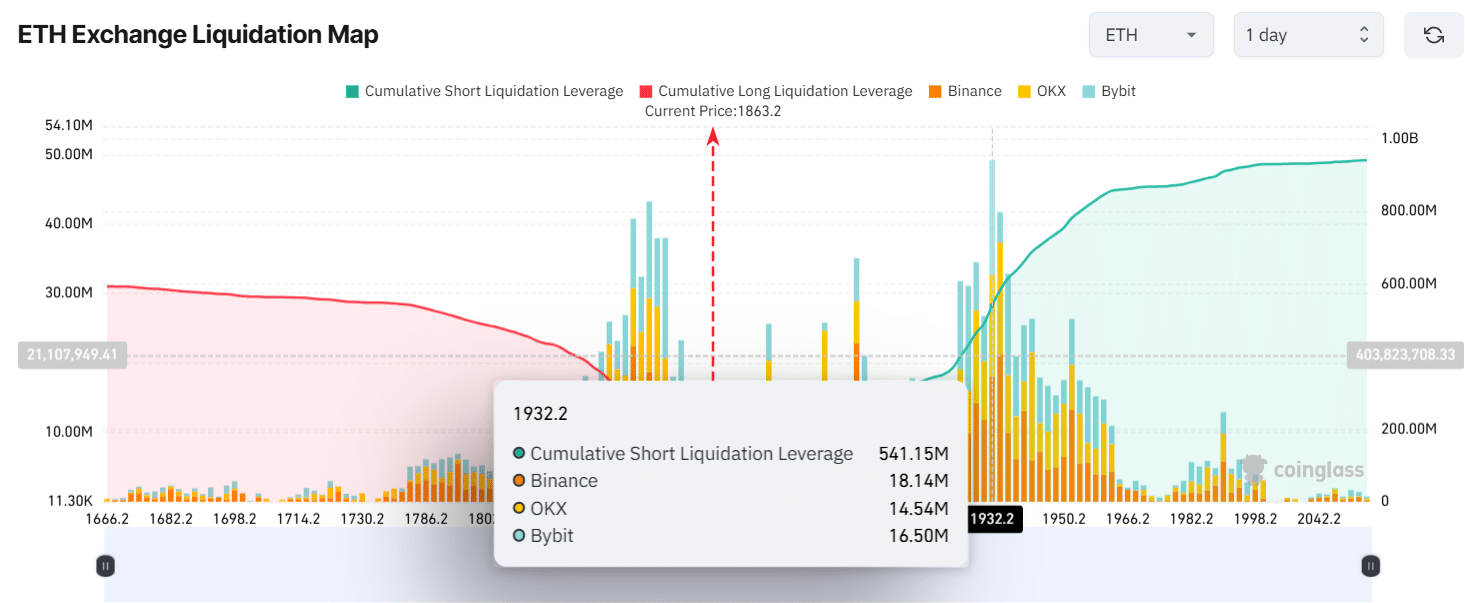

Alternatively, merchants gave the impression to be strongly bearish on ETH.

Knowledge reveals that ETH’s over-leveraged ranges had been at $1,932 and $1,840, with merchants constructing $541 million briefly positions and $185 million in lengthy positions over the previous 24 hours.

This means that bears are presently in management, doubtlessly as a result of upcoming tariff announcement.