- Whale inflows spiked as buyers shifted focus from shortage

- On-chain metrics supported bullish sentiment with robust holder profitability and key value help zones

Over 22,000 BTC have flowed into Binance inside a span of lower than two weeks. Its newest uptick elevated the trade’s Bitcoin [BTC] reserves from 568,768 BTC on 28 March to 590,874 BTC by 9 April.

Such a pointy rise in reserves displays rising investor exercise, probably triggered by fears surrounding macroeconomic uncertainty and the looming U.S. Client Worth Index (CPI) announcement.

Whereas some could interpret these inflows as an indication of potential promote stress, others consider that it could possibly be strategic accumulation in preparation for market volatility.

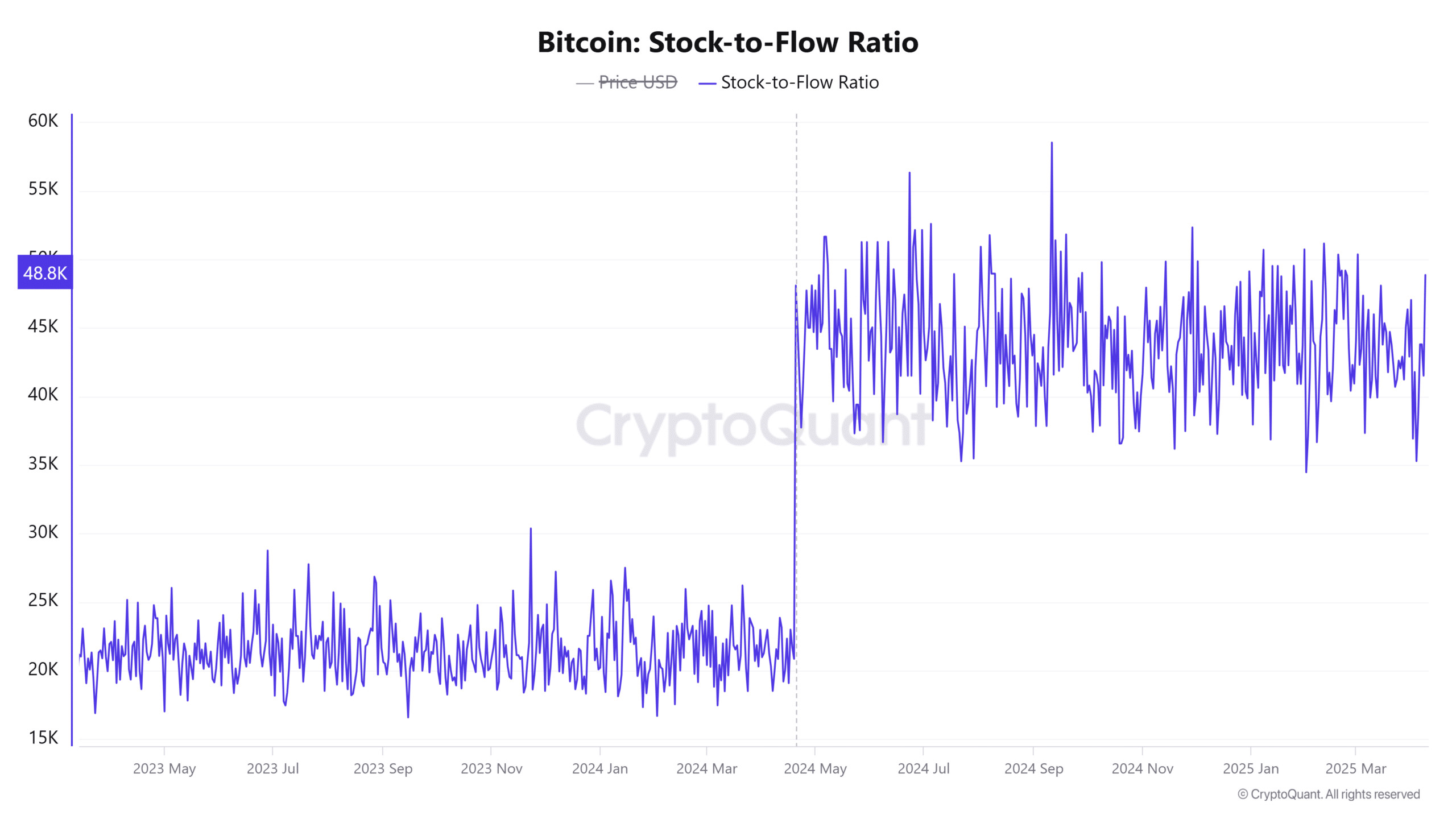

Inventory-to-flow ratio drops sharply – Has shortage misplaced its affect?

With trade reserves rising, one other metric took a noticeable hit.

The Inventory-to-Circulation (S2F) ratio plunged by 16.66% within the final 24 hours. Right here, it’s price noting that this metric tracks Bitcoin’s shortage by evaluating provide to mined cash.

Its decline introduced the press time worth right down to roughly 1.0586 million – Indicative of a decreased market emphasis on Bitcoin’s shortage mannequin.

Whereas the S2F typically aligns with long-term bullish developments, latest conduct underlined the main target shifting to inflation and rate of interest components.

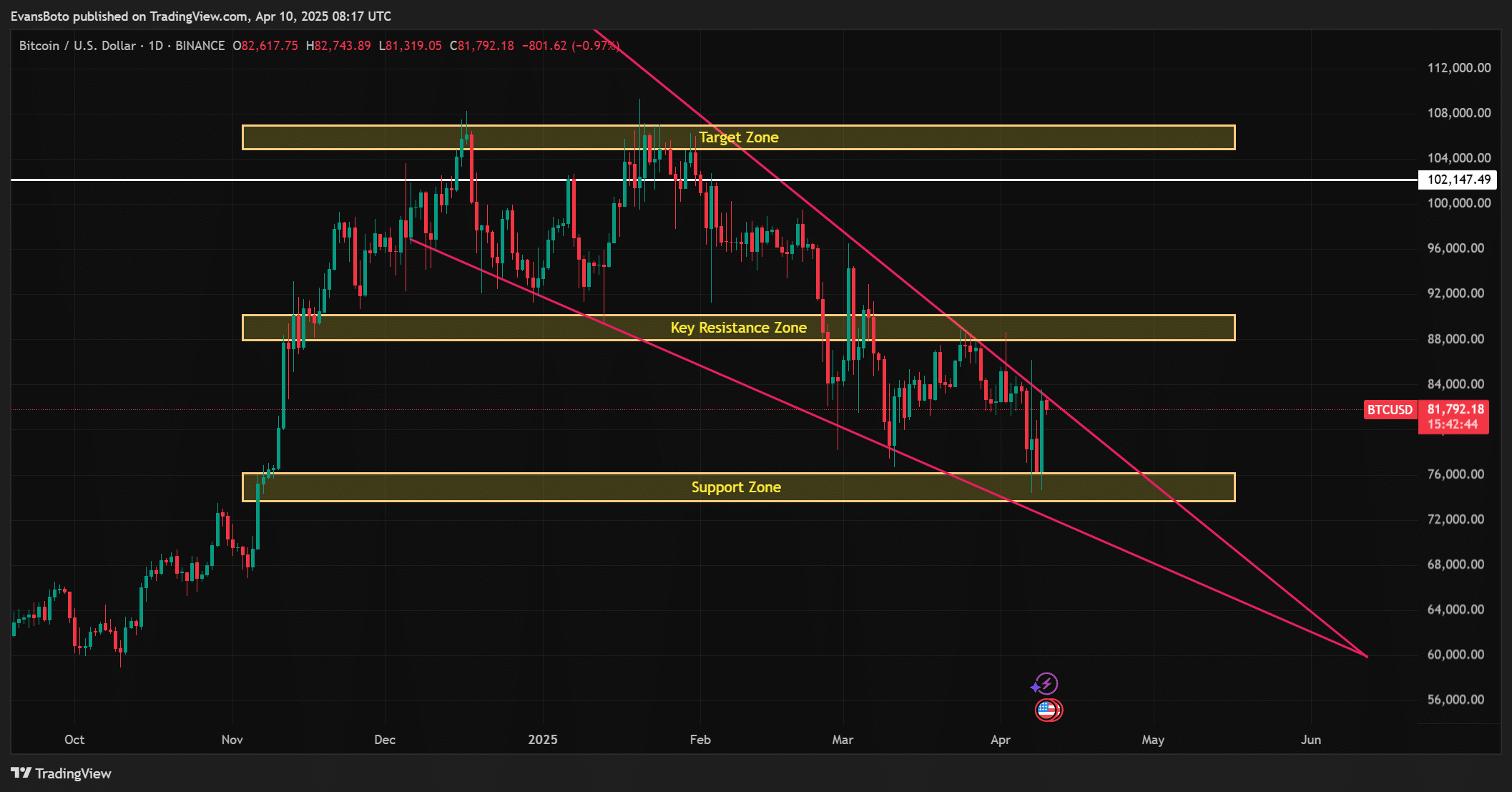

Bitcoin value compresses below key resistance

On the time of writing, Bitcoin was buying and selling at $81,715.99, following beneficial properties of 5.57% over the previous 24 hours.

Regardless of this restoration, nevertheless, the worth stays trapped inside a descending wedge sample. In actual fact, it appeared to be testing a significant resistance zone close to $84,000. Whereas the help degree round $76,000 has been holding, the narrowing sample advised {that a} breakout could also be imminent.

If the bulls handle to push by way of the higher boundary, the $102,000 goal may come into play. Nevertheless, failure to take care of help may set off a fall in the direction of $60,000. Therefore, this a make-or-break zone for BTC.

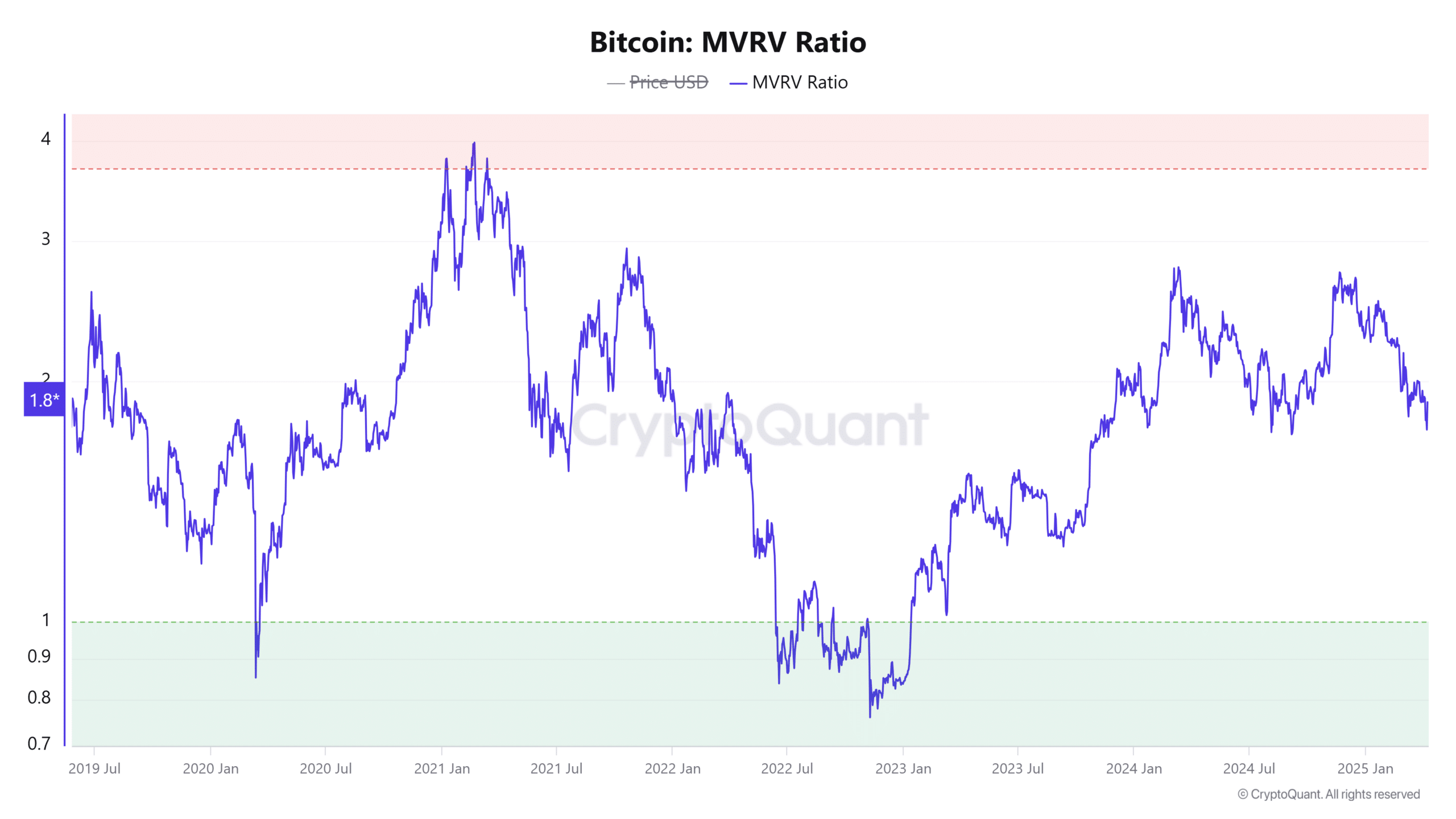

Bitcoin MVRV ratio climbs – Are buyers nonetheless assured of their positions?

Including extra context to the market temper, the MVRV ratio—which gauges whether or not BTC is over- or undervalued—was at 1.86, reflecting a 4.84% hike within the final 24 hours.

A ratio above 1 implies that holders are more likely to stay assured and maintain, fairly than promote at a loss.

Nevertheless, because the ratio climbs, so does the temptation to lock in beneficial properties. This highlights the significance of monitoring sentiment shifts in actual time.

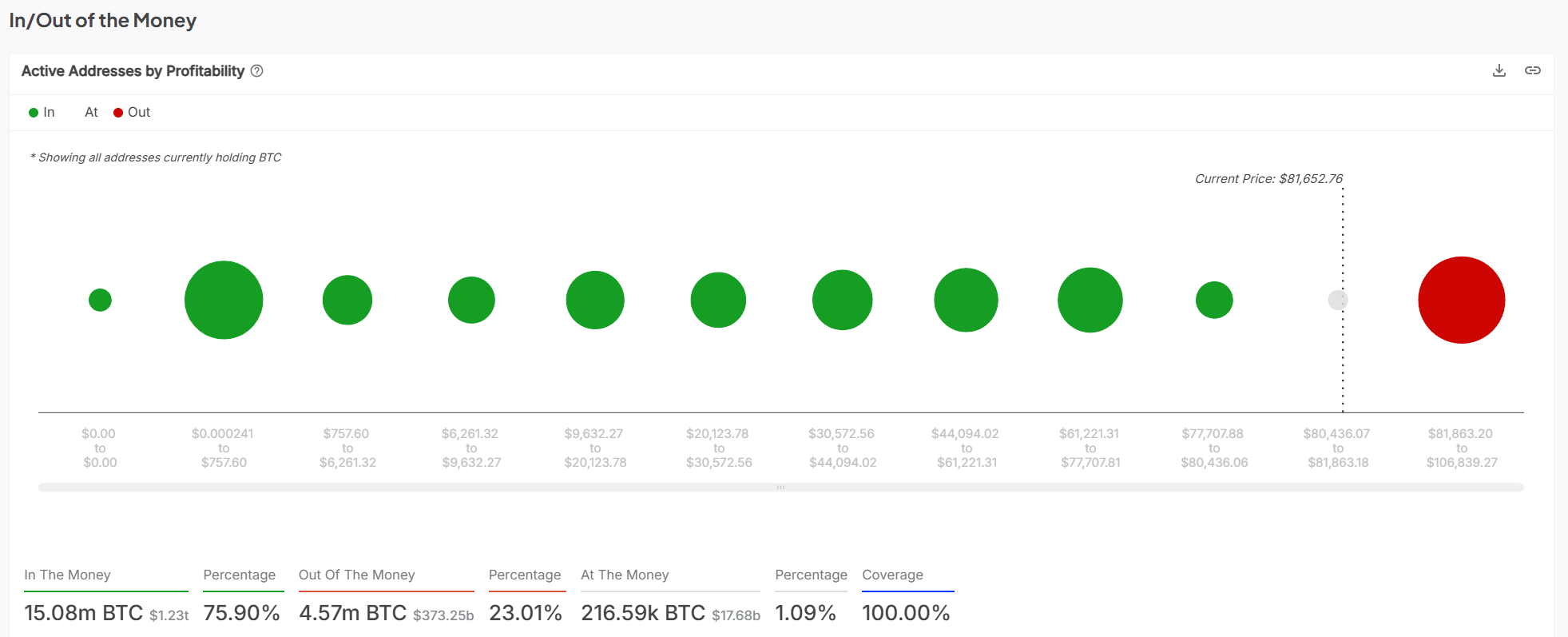

Most wallets nonetheless “Within the Cash,” however for the way lengthy?

In line with the newest in/out of the cash information, 75.90% of addresses are holding BTC at a revenue, whereas simply 23.01% are out of the cash. It is a signal {that a} majority of market contributors stay well-positioned. This could function a psychological cushion throughout pullbacks.

Moreover, the focus of holders slightly below the press time value appeared to create a robust help zone, doubtlessly limiting the draw back.

Nevertheless, with a big cluster of addresses additionally nearing breakeven, any important drop may set off panic amongst weak fingers.

Placing all of the items collectively, the info appears to favor strategic positioning over fear-driven exits.

A majority of holders stay in revenue, the MVRV ratio has been supporting a bullish outlook, and the worth remains to be respecting key help ranges.

In brief, whales aren’t bailing, they’re betting. Their accumulation conduct hinted that sensible cash has been quietly organising for the subsequent transfer, not fleeing from it.