- Bitcoin has a bearish trajectory within the short-term.

- Liquidity swimming pools might pull the worth to $63k within the coming days.

Bitcoin [BTC] miners noticed a big drop of their revenue margins when the worth fell to $49k two weeks in the past. This led to miner capitulation and elevated outflows from miners.

The spike in hash fee and mining problem put the smaller miners in a tough spot.

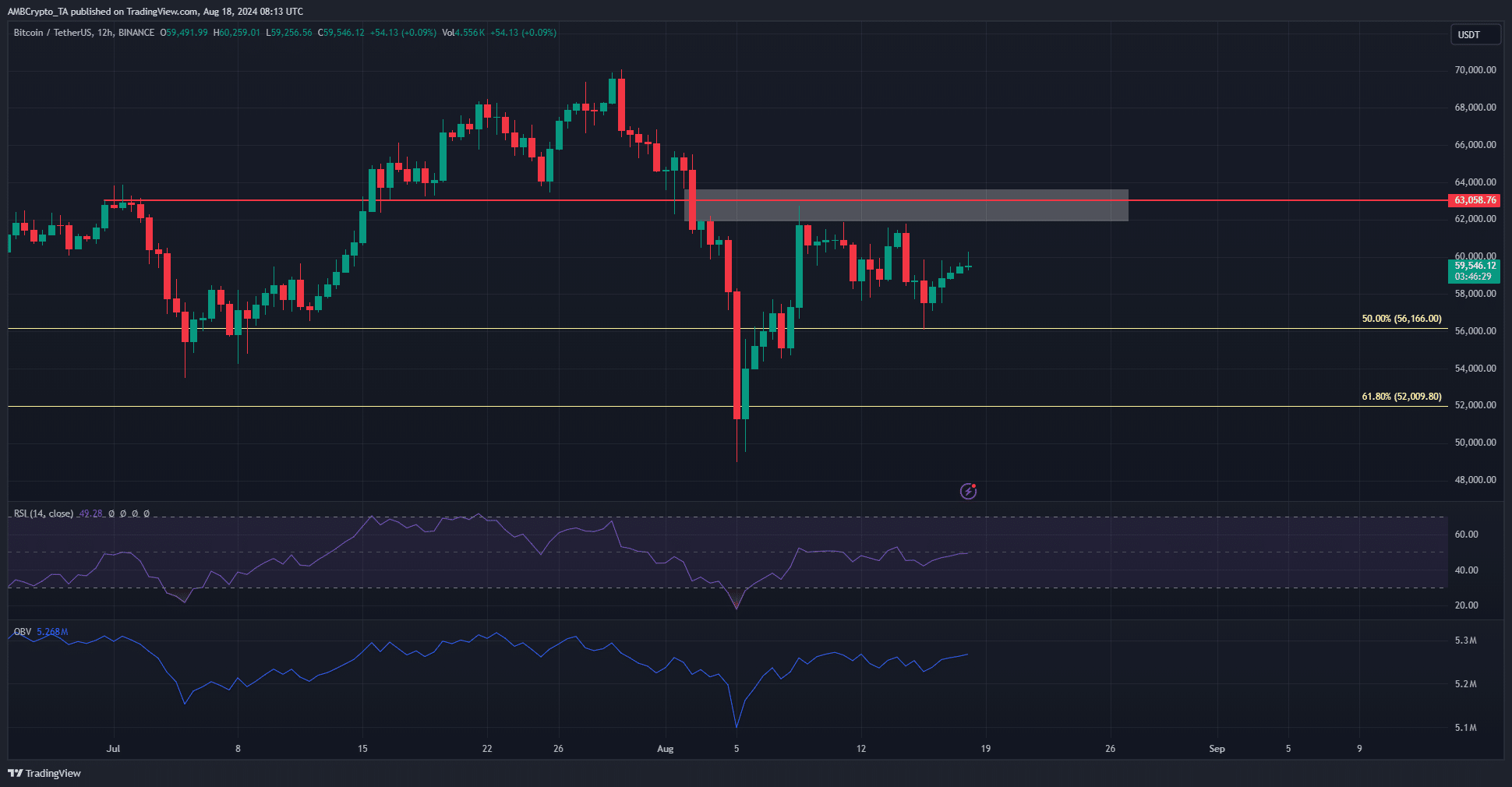

The technical evaluation and the liquidation heatmap gave clues {that a} BTC restoration would face an enormous hurdle above the $60k psychological resistance. Do the bulls have sufficient ammunition to interrupt this barrier?

The momentum is likely to be shifting in direction of the bulls

The RSI on the 12-hour chart has skirted in regards to the impartial 50 degree over the previous week. The $61.5k area has persistently rebuffed the worth throughout this era.

At press time, the RSI gave the impression to be making an attempt to maneuver above 50 as soon as extra.

The OBV has additionally climbed increased over the previous two days. This indicated that demand is likely to be sufficient to drive BTC to the $63k mark. Nevertheless, an imbalance and a resistance degree coincided there.

Bitcoin bulls could have a tricky time battling the sellers, however they’ve one issue that might assist.

Magnetic zones favor the BTC bulls within the short-term

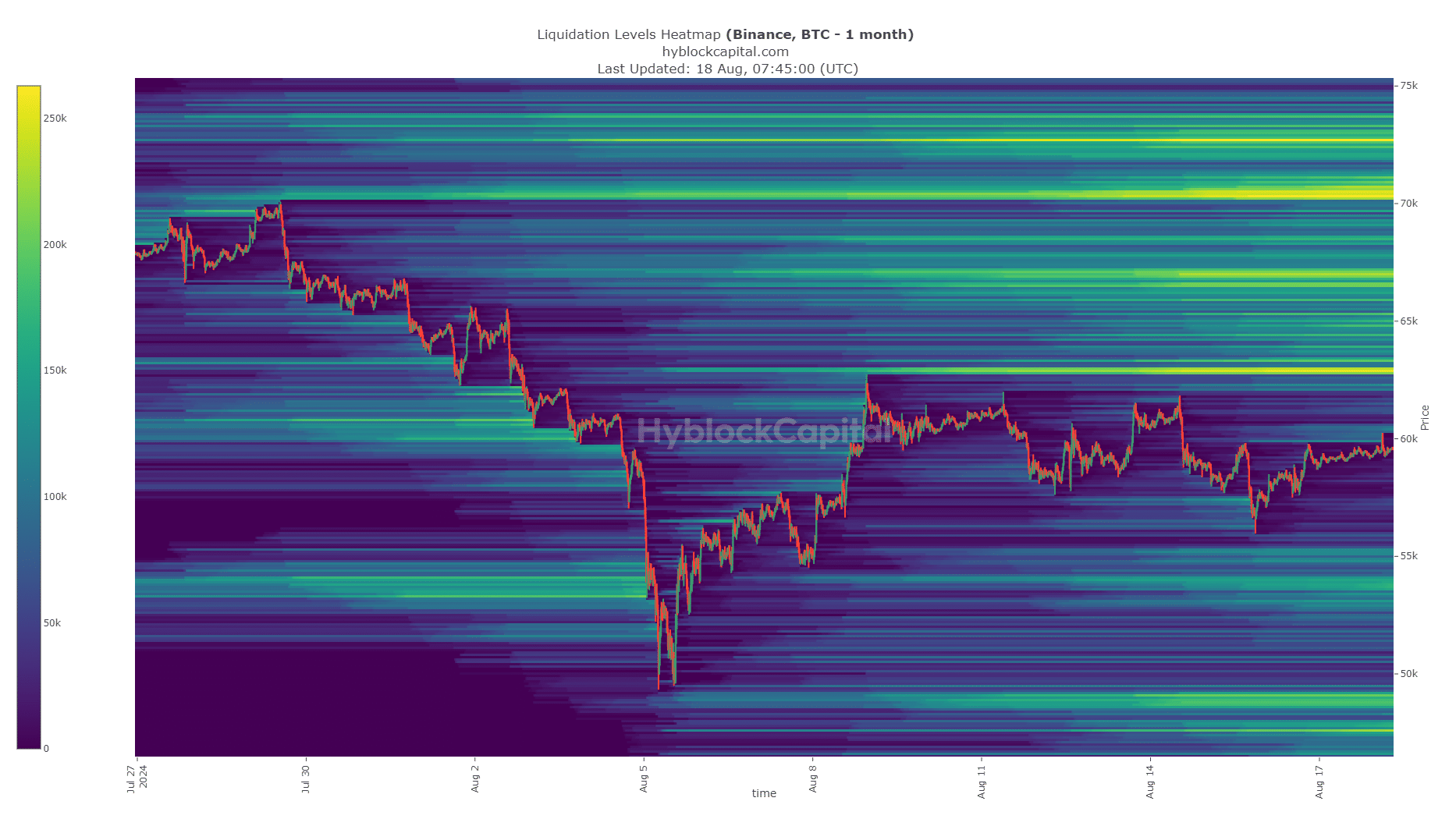

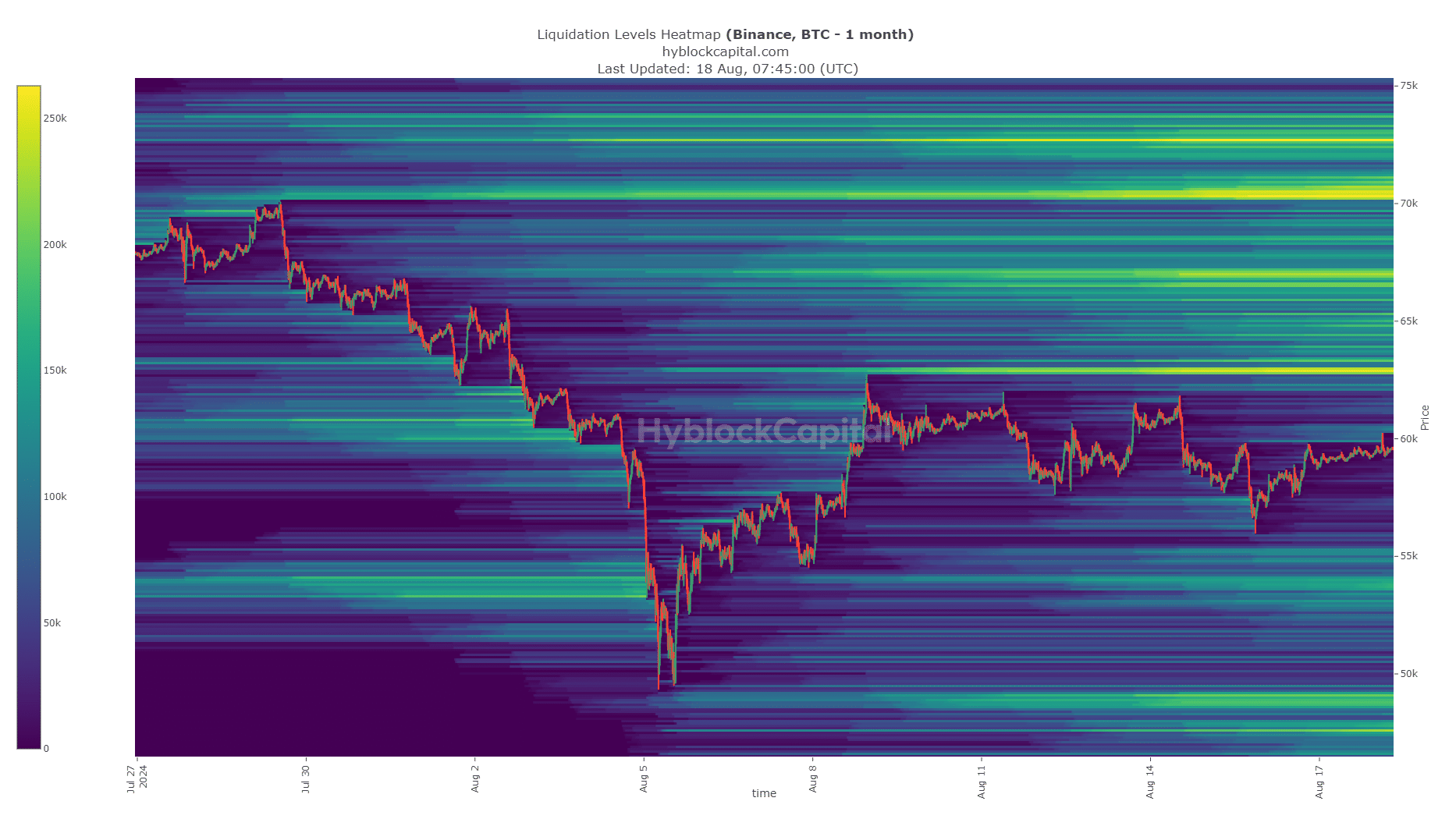

Supply: Hyblock

The liquidation heatmap confirmed a excessive focus of liquidation ranges at $63k and $67.1k.

The proximity and density of the liquidity cluster at $63k might see Bitcoin leap increased to comb the area earlier than a pullback.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

The liquidity above $65k was additionally a magnetic zone, and a transfer to $67.1k can’t be discounted.

Nevertheless, merchants should do not forget that BTC has a bearish market construction on the weekly chart and wishes a transfer previous $69.5k to alter this example.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion