- Ethereum reserves on Binance fell by 300K ETH, lowering centralized promote stress and boosting bullish sentiment.

- 81% of holders sit in revenue, with key pockets clusters close to $2,665, rising the chances of profit-taking or breakout.

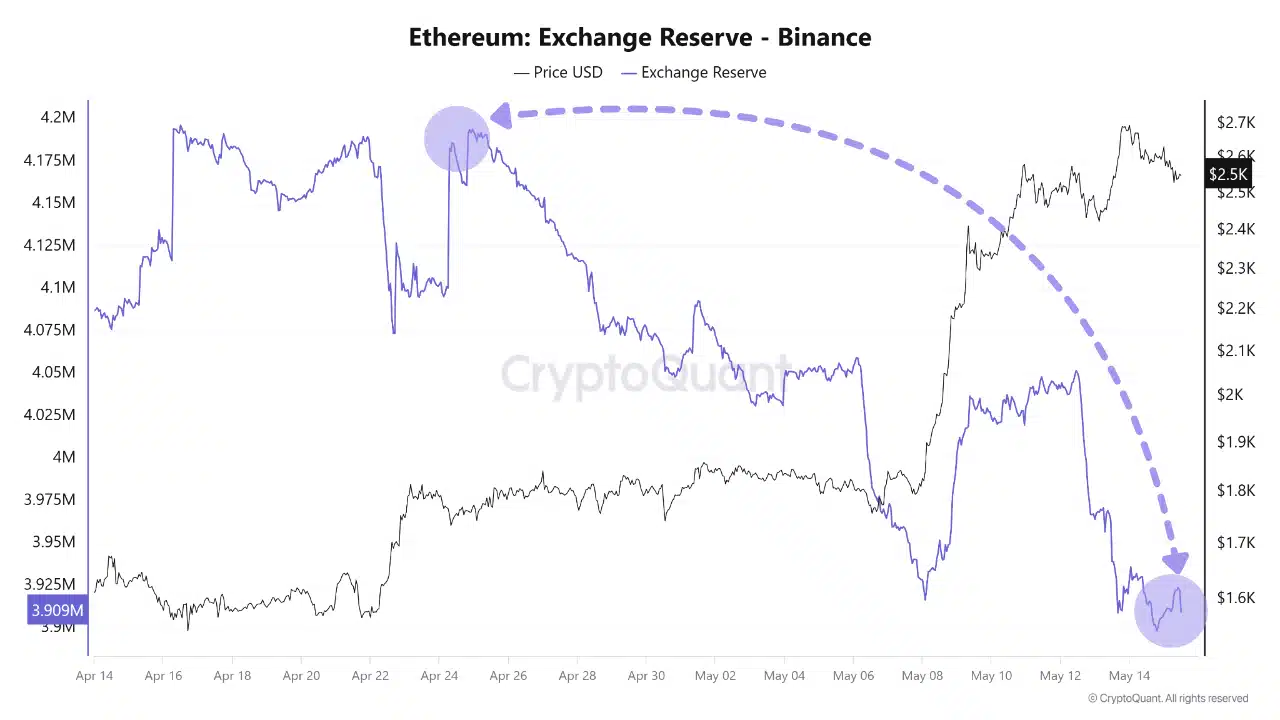

Ethereum [ETH] reserves on Binance have dropped sharply, falling from 4.1 million ETH to three.9 million ETH since mid-April.

This 300,000 ETH reduction indicators elevated investor confidence in long-term holding and decentralized protocols.

In consequence, centralized sell-side stress continues weakening. At press time, ETH modified palms at $2,605.85, up 2.77% in 24 hours.

With fewer cash obtainable for quick sale, bulls could acquire management. After all, this provide dynamic might tilt the scales in favor of bulls, particularly if withdrawals persist.

ETH’s whole Trade Reserves stood at $18.9 million, marking a 0.78% day by day dip. Although the drop seems minimal, it highlights a cautious stance amongst traders.

Many want holding ETH off centralized platforms. This aligns with broader accumulation traits seen throughout main wallets. Due to this fact, the lower in reserve worth suggests diminished promoting urge for food.

Can ETH clear $2,665 amid rising liquidations?

The Liquidation Heatmap revealed thick liquidation zones between $2,600 and $2,665, forming a powerful resistance cluster. This space might spark volatility as leveraged positions get examined.

Nonetheless, Ethereum’s regular advance towards these zones exhibits rising purchaser confidence. If ETH breaks above $2,665, cascading quick liquidations might enhance the rally additional.

Even so, merchants ought to watch intently—value could stall or briefly consolidate earlier than persevering with its climb.

Ethereum fuel utilization dropped to 14.09 billion, marking a major decline from earlier highs. This discount could mirror improved payment effectivity or a short lived dip in high-volume exercise.

Having stated that, it doesn’t suggest weakening fundamentals.

Decrease fuel prices usually allow extra reasonably priced consumer participation throughout DeFi and NFT platforms. Due to this fact, this drop could help broader community engagement fairly than hinder it.

Elements nonetheless supporting ETH’s power

On the time of writing, Ethereum registered 555,880 Every day Lively Addresses and 1.42 million transactions.

These metrics spotlight sturdy consumer engagement regardless of altering payment dynamics. Due to this fact, Ethereum’s underlying utility stays intact.

Constant exercise displays continued belief within the community’s capabilities throughout completely different use instances. This user-driven power, mixed with declining change reserves, presents structural help for value progress.

Moreover, 81.07% of holders have been in revenue. The most important focus sat between $2,460 and $2,665—proper the place ETH faces resistance.

Nonetheless, ETH stays above key help, and on-chain indicators stay bullish. If value breaks above $2,665 with quantity, quick positions could unwind.

This might set off a pointy rally.

Due to this fact, merchants ought to monitor this zone intently. A confirmed breakout might mark the start of Ethereum’s subsequent impulsive transfer towards increased ranges not seen in current months.

Is a breakout imminent?

Ethereum’s fundamentals stay sturdy, supported by diminished reserves, rising consumer exercise, and excessive profitability amongst holders.

Resistance round $2,665 stays the important thing barrier.

Nonetheless, if bulls push previous this degree with conviction, a breakout might observe. On-chain information favors upside continuation, however momentum should maintain. Merchants ought to watch this crucial zone intently.

A profitable breakout might verify the beginning of Ethereum’s subsequent rally section.