- Bitcoin long-term holders understand a big 92.7 million in earnings.

- Metrics and indicators level to potential short-term worth corrections.

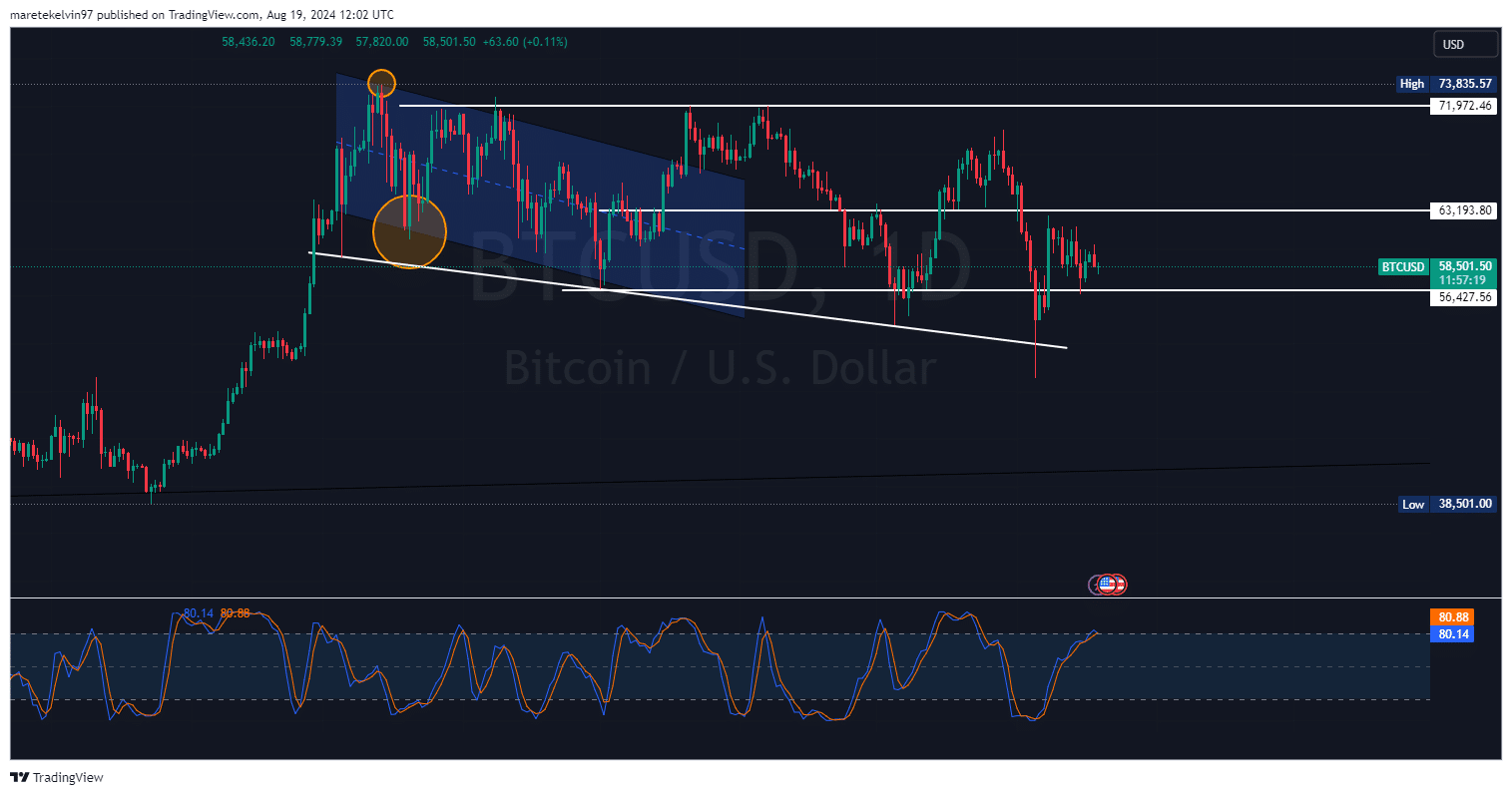

Bitcoin [BTC] was buying and selling at round $58,185 at press time. The king of crypto was testing a key assist stage at $56,427 at press time. This extraordinarily vital stage corresponds to a big trendline that has traditionally acted as a robust assist up to now.

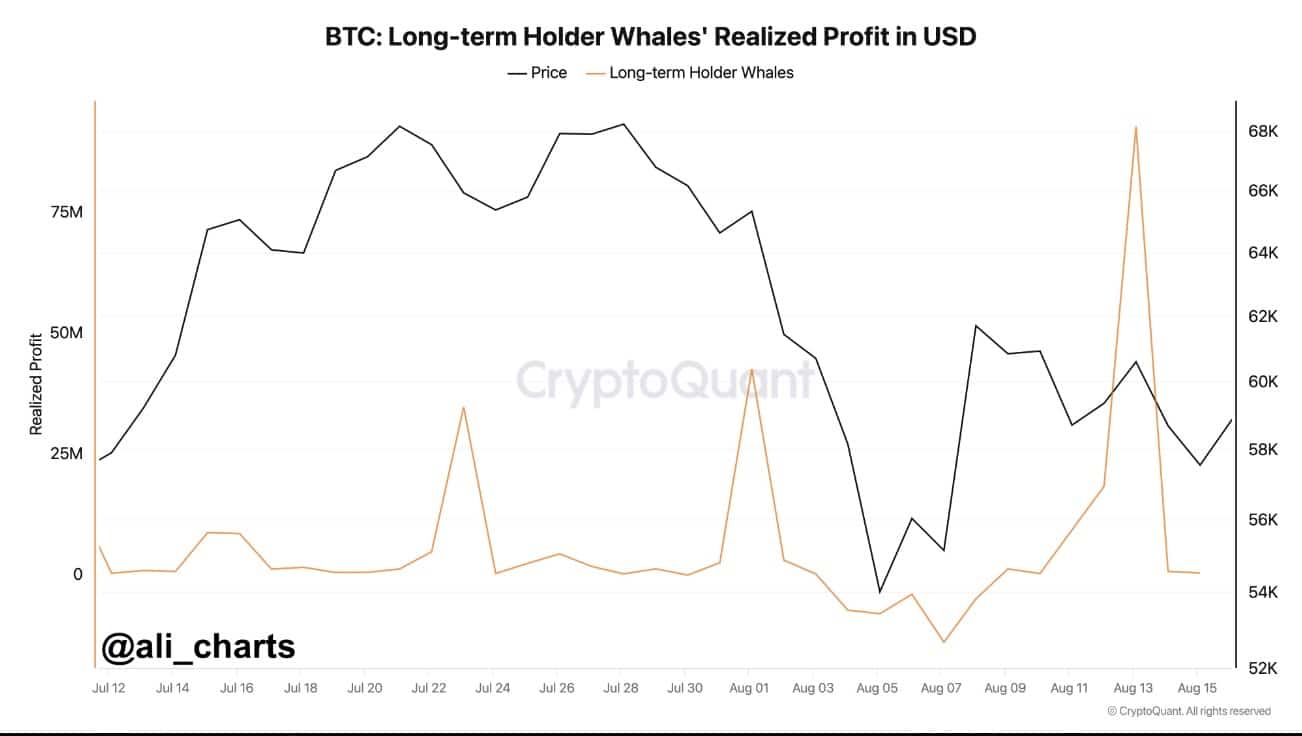

Whales money in, warning forward?

In line with whale realized revenue knowledge, long-term whales revamped $92.7 million in earnings not so way back. Such enormous profit-taking signifies cautious indicators amongst these gamers and should portend a bearish development forward.

Traditionally, when the massive market gamers begin taking their money dwelling, there may be some short-term promoting stress. This resultant elevated stress could in flip create market uncertainty on Bitcoin.

Supply: CryptoQuant

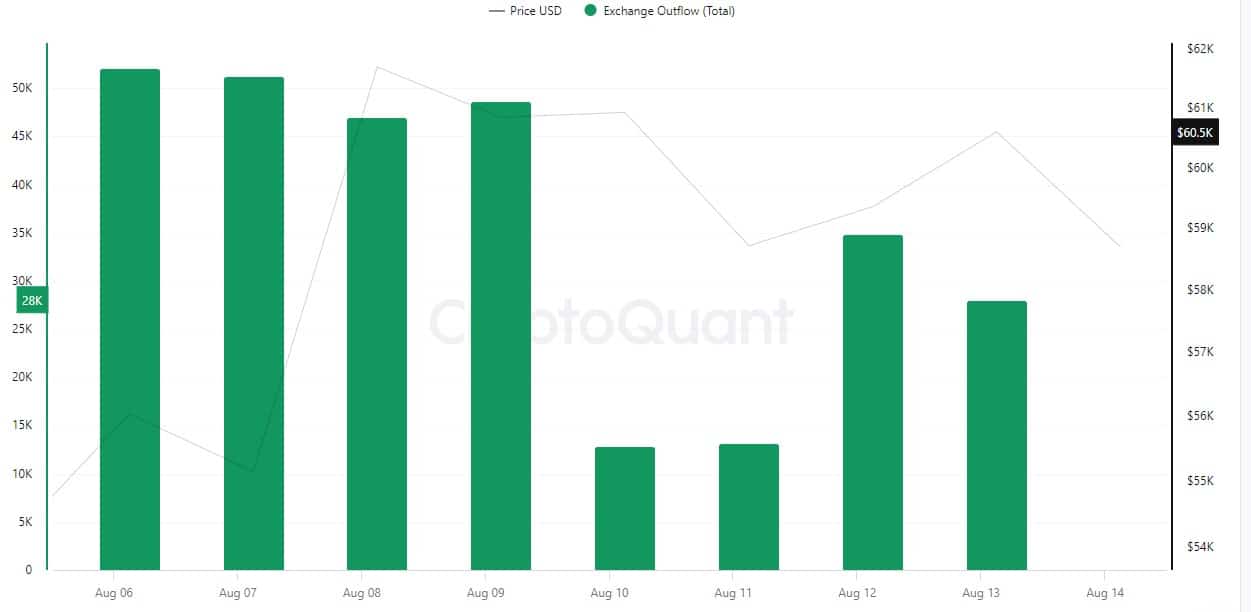

Change outflow factors to bullish sentiment

In distinction, trade outflow knowledge signifies that substantial portions of Bitcoin moved off exchanges, with a peak round August 9 hitting over 50K BTC.

By giant, that is taken positively because it means buyers are shifting cash into chilly storage, thus much less chance of fast gross sales taking place.

Usually, lowered BTC’s on varied exchanges translate into decreased promoting stress, which might maintain costs and even provoke a rally.

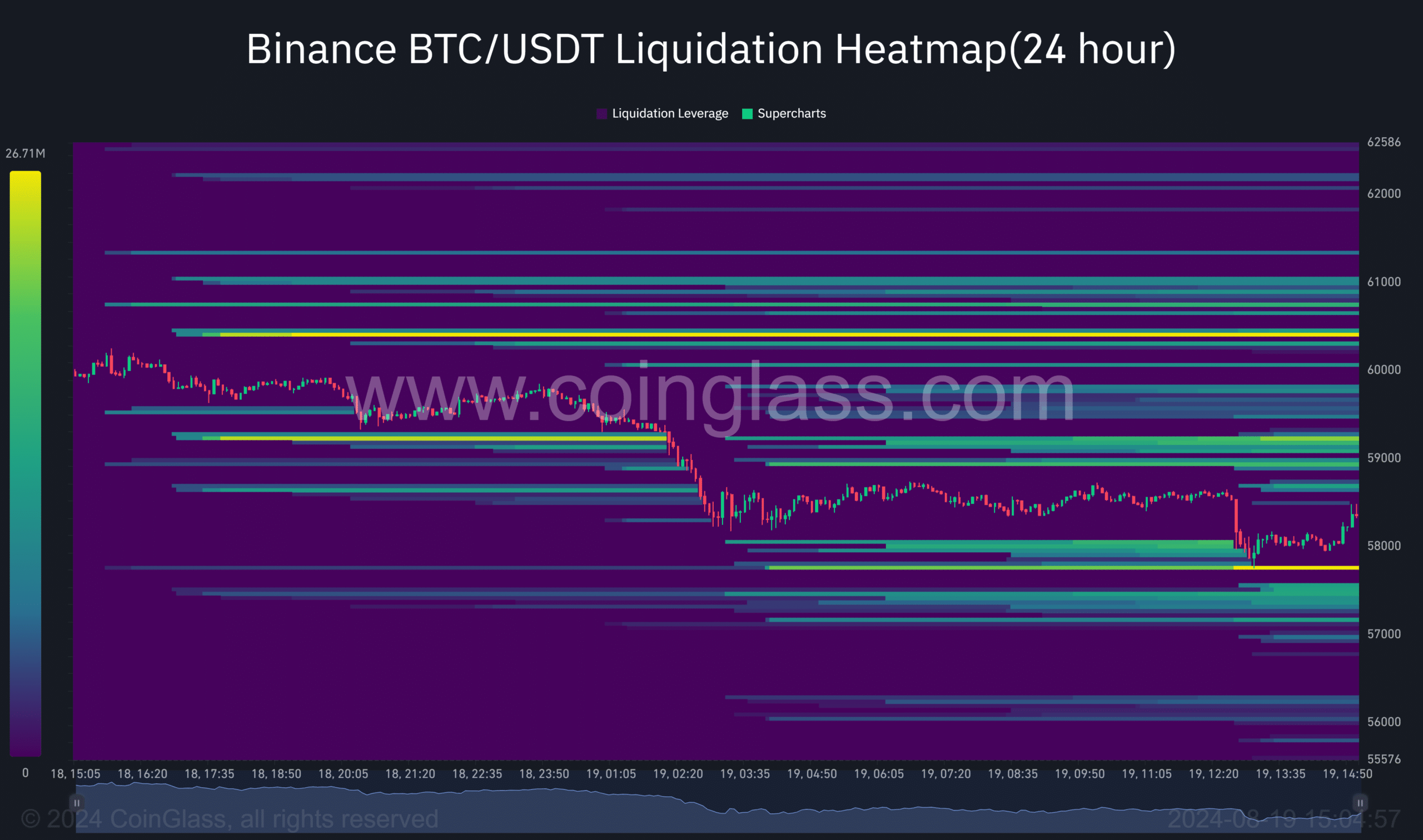

Bitcoin liquidation dangers loom giant

But there’s a critical danger on the horizon. If worth crosses above $60k, then the liquidation heatmap exhibits greater than 100 million {dollars}’ value of BTC will probably be bought off very quickly in any respect.

Thus, any upward motion will result in large liquidations, inflicting sharp fluctuations in costs.

Volatility forward for Bitcoin

Lastly, Bitcoin’s current worth motion implies that the market could expertise elevated volatility.

Is your portfolio inexperienced? Try the BTC Profit Calculator

The $56,427 assist stage nonetheless stays vital; nevertheless, the $60k spot ought to be on watch as there may be appreciable liquidation stress at this level.

Normally, whale conduct, trade outflows, and a few technical facets level to an attentive market standing.