The Bitcoin market recorded a minor 0.67% value acquire within the final 24 hours, amid a quick return to the $118,000 value territory. This modest value improve kinds a part of a rebound noticed over the earlier 48 hours, following a major 4% value correction earlier final week. Looking forward to the brand new week, famend market analyst with X username KillaXBT has recognized two potential value improvement eventualities for the premier cryptocurrency.

Bitcoin Sees Bounce From Key Demand Zone, However What’s Subsequent?

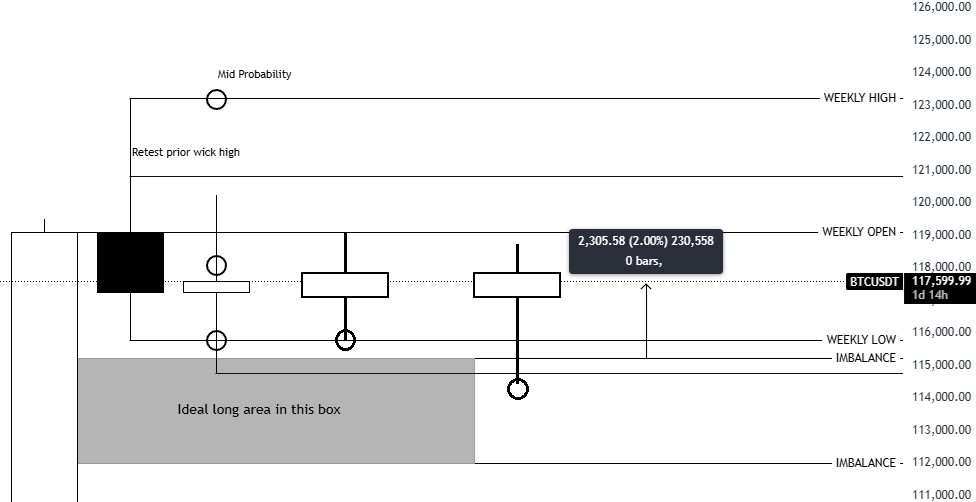

In an X post on July 26, KillaXBT offers an in-depth technical evaluation of the Bitcoin market to map out the asset’s potential value trajectory on this new week. The favored market skilled duly notes that Bitcoin skilled a value bounce after dipping right into a key demand zone round $115,000, which in addition they described as a really perfect lengthy entry area.

As earlier acknowledged, the crypto market chief has since climbed to $118,000 following this value rebound. Nonetheless, KillaXBT notes there may be a longtime CME Gap round $117,071, which is prone to function a value magnet within the brief time period. For context, CME gaps are value gaps on the Chicago Mercantile Alternate (CME) Bitcoin futures chart that happen when Bitcoin’s value strikes considerably on the spot market when CME markets are closed, sometimes over the weekend.

In view of subsequent week, KillaXBT explains state of affairs 1 through which the Bitcoin market opens on a bullish observe. On this case, the analyst states buyers ought to count on Bitcoin to ultimately type a better low, ideally by a sweep of liquidity across the $116,000 space. Nonetheless, if Bitcoin bulls can successfully maintain this value pocket, it might set off recent lengthy setups with cease losses tucked beneath the prior week’s low.

In state of affairs 2, KillaXBT paints a extra aggressive state of affairs through which Bitcoin performs a double sweep of final week’s wick low round $114,800, thereby effecting a ruthless liquidity seize earlier than an upward reversal. Nonetheless, the market skilled favours the truth of state of affairs 1, following the sooner liquidity seize with the worth dip to $115,000.

The Invalidation Danger

No matter which state of affairs, KillaXBT has highlighted sure developments that might neutralize the prospects of a bullish reversal. Particularly, the analyst explains that failure for the worth to carry above the latest wick lows following a retest would drive Bitcoin costs to deeper imbalance zones between $112,000 – $113,800.

On the time of writing, Bitcoin trades at $117,900, reflecting a 0.21% acquire within the final seven days.