- Bitcoin ETFs confirmed indicators of restoration, with internet inflows of $73 million as of the twenty eighth of June.

- Regardless of current bearish indicators for BTC, ETH, and SOL, declining worth volatility steered a stabilizing market.

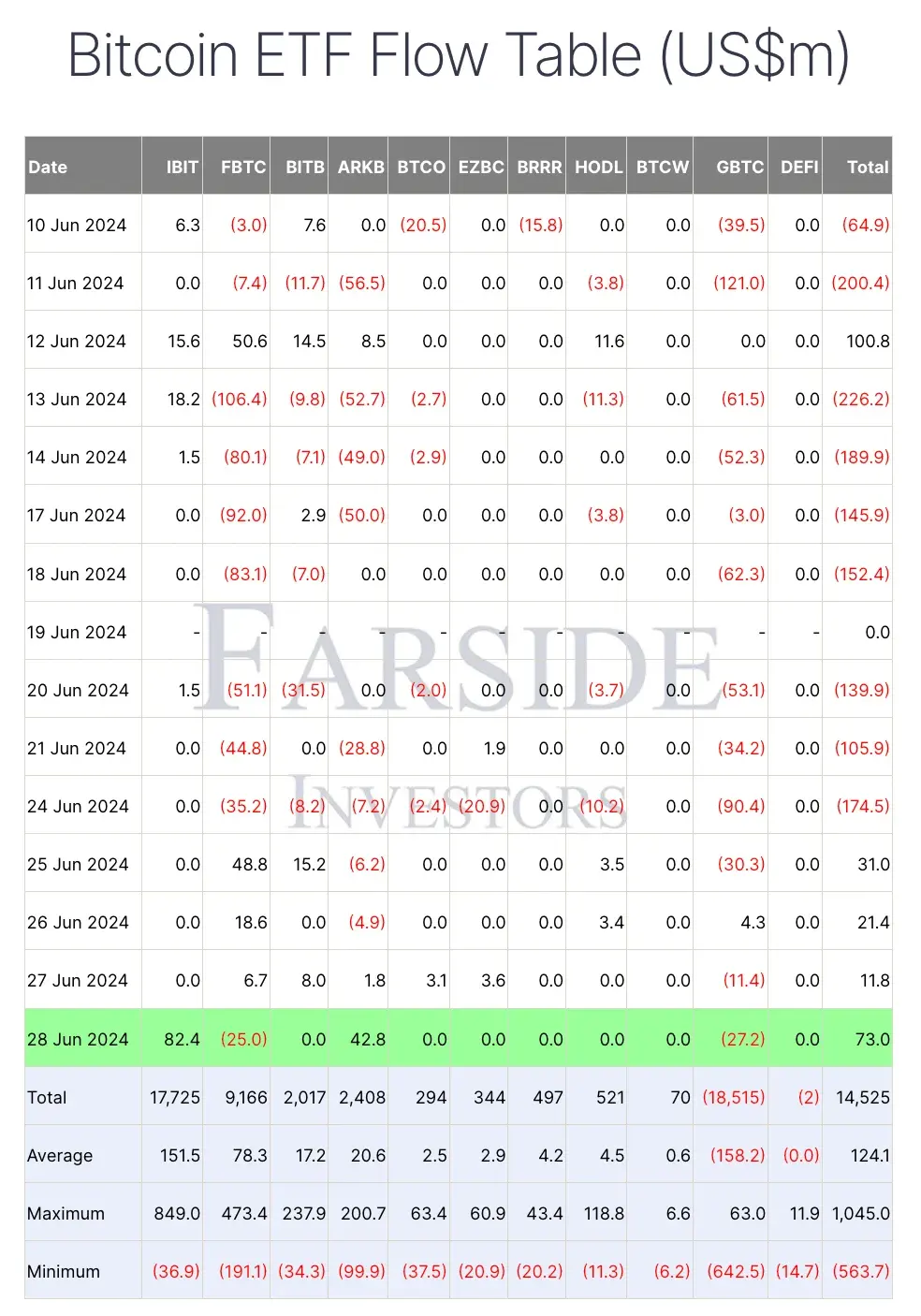

After experiencing steady outflows, Bitcoin [BTC] ETFs gave the impression to be recovering. As of the most recent replace, on the twenty eighth of June, BTC ETFs recorded a internet influx of $73 million.

Bitcoin ETF cashflow: Evaluation

Main the pack was BlackRock’s iShares Bitcoin Belief (IBIT) with $82.4 million in inflows. In distinction, Grayscale Bitcoin Belief (GBTC) noticed outflows of $27.2 million, adopted by Constancy’s FBTC with $25 million in outflows.

This was fairly the other of what occurred on the twenty sixth of June when FBTC and GBTC had been the one ones to document inflows, with $18.6 million and $4.3 million respectively, together with VanEck’s HODL, which noticed $3.4 million.

All different ETFs had net-zero flows, apart from ARK 21Shares’ ARKB, which recorded outflows value $4.9 million.

Peter Schiff critiques BTC ETF

Seeing the uncertainty round BTC ETFs, stockbroker and monetary commentator Peter Schiff, the endlessly Bitcoin critic, determined to not miss this chance.

Drawing parallels with the Gold ETFs, Schiff took to X (previously Twitter) and famous,

“#Gold closed Q2 with a 4% achieve. #Bitcoin nonetheless has two extra days left to commerce, however as of now it’s down over 15%.”

He even went forward and questioned numerous traders’ choices and stated,

“Traders who bought gold ETFs on the finish of Q1 to purchase Bitcoin ETFs are 20% worse off. The unhealthy information for these traders is that it’s going to doubtless get a lot worse from right here.”

Nevertheless, X consumer Bitcoin Clown responded to his tweet by asking,

Does Schiff’s evaluation maintain floor?

This highlighted that Schiff’s evaluation of the underperformance of Bitcoin ETFs lacked correct proof.

It is because, over the previous 4 days, U.S. Spot Bitcoin ETFs have skilled rising funding, with constructive inflows recorded for 3 consecutive days.

In complete, these ETFs have obtained $137.2 million in new investments throughout this era, indicating rising investor curiosity and confidence in these monetary merchandise.

Remarking on the identical, an X consumer Lord Cryptotook to X and defined,

Nevertheless, it stays unsure whether or not this robust investor sentiment surrounding BTC ETFs will proceed following the ultimate approval and launch of Ethereum [ETH] ETFs for buying and selling.

Moreover, with VanEck and 21Shares formally submitting for a spot Solana [SOL] ETF, the uncertainties develop even additional.

Affect on the token’s worth

Within the meantime, Bitcoin, together with Ethereum and Solana, confirmed bearish indicators with declines of 0.88%, 1.68%, and a couple of.22%, respectively, prior to now 24 hours, based on CoinMarketCap.

Nevertheless, AMBCrypto’s evaluation of Santiment knowledge on worth volatility revealed a decline, indicating that the asset’s worth is changing into much less unstable.

This implies the worth is experiencing smaller fluctuations and stabilizing, suggesting a extra predictable and fewer dangerous marketplace for traders.