- Merchants holding Bitcoin for 1-3 months recorded the best stage of inflows as Bitcoin approached $69,000

- Revenue-taking by short-term holders might delay Bitcoin’s ATH, regardless of sturdy bullish traits

Bitcoin (BTC) was buying and selling at $68,388 at press time after 9% features inside simply seven days. On 18 October, Bitcoin hit a two-month excessive above $68,900, strengthening the market’s optimism for additional features.

A number of elements aligned collectively can assist Bitcoin’s rally to an ATH. These embody the market pricing within the end result of the U.S elections and excessive inflows to Spot Bitcoin exchange-traded funds (ETFs).

Nevertheless, short-term holders stay the important thing to how lengthy Bitcoin will take to achieve file highs. Think about this – After Bitcoin spiked to a two-month excessive, on-chain metrics confirmed that this cohort began promoting.

Analyzing short-term holder habits

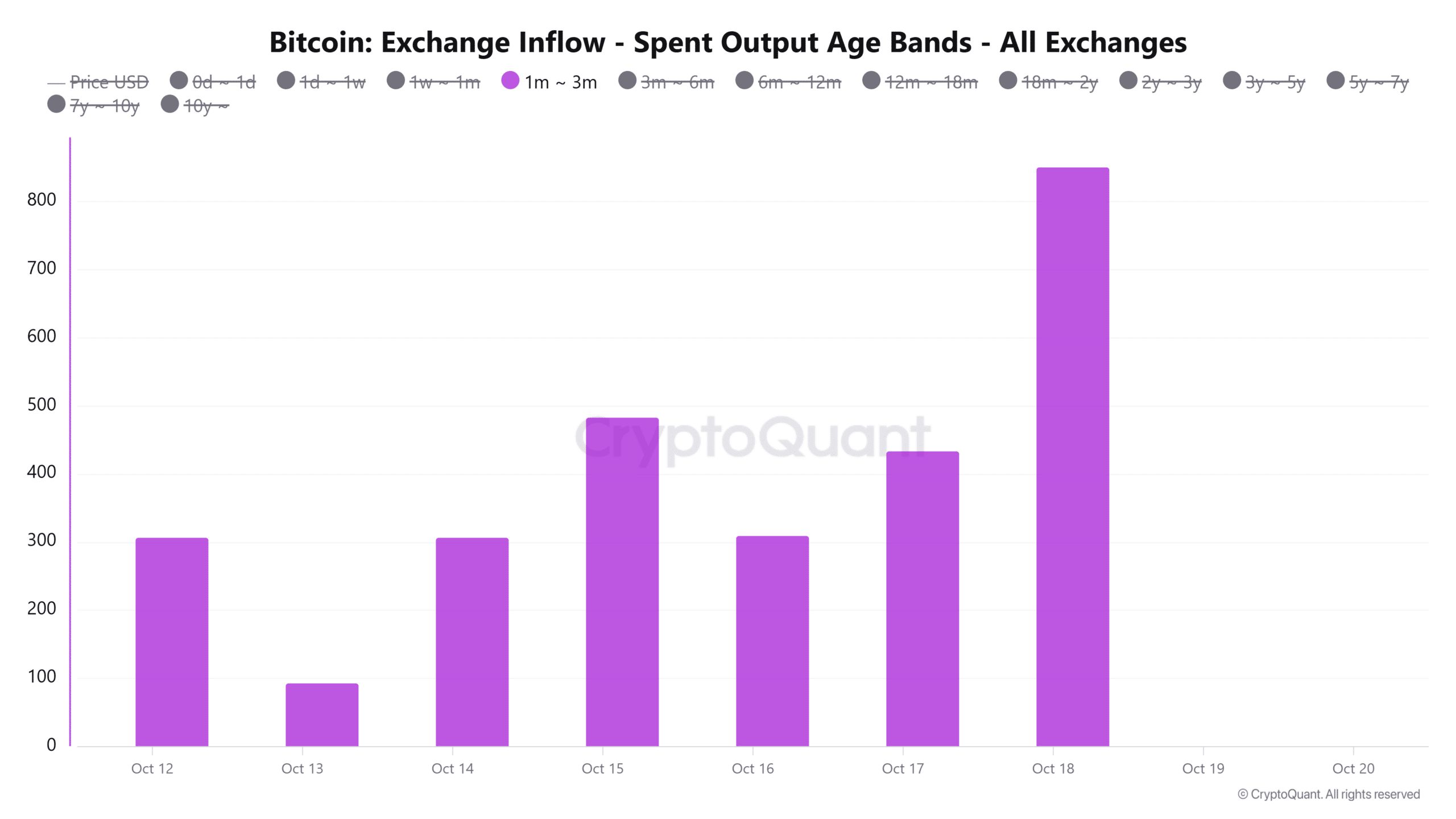

Information from CryptoQuant revealed a rise in Bitcoin alternate inflows from merchants who held Bitcoin for between one and three months. The alternate influx Spent Output Age Bands for this cohort jumped to a weekly excessive as BTC approached $69,000 on the charts.

This spike might be seen as an indication of profit-taking habits as short-term merchants look to capitalize on the favorable market situations.

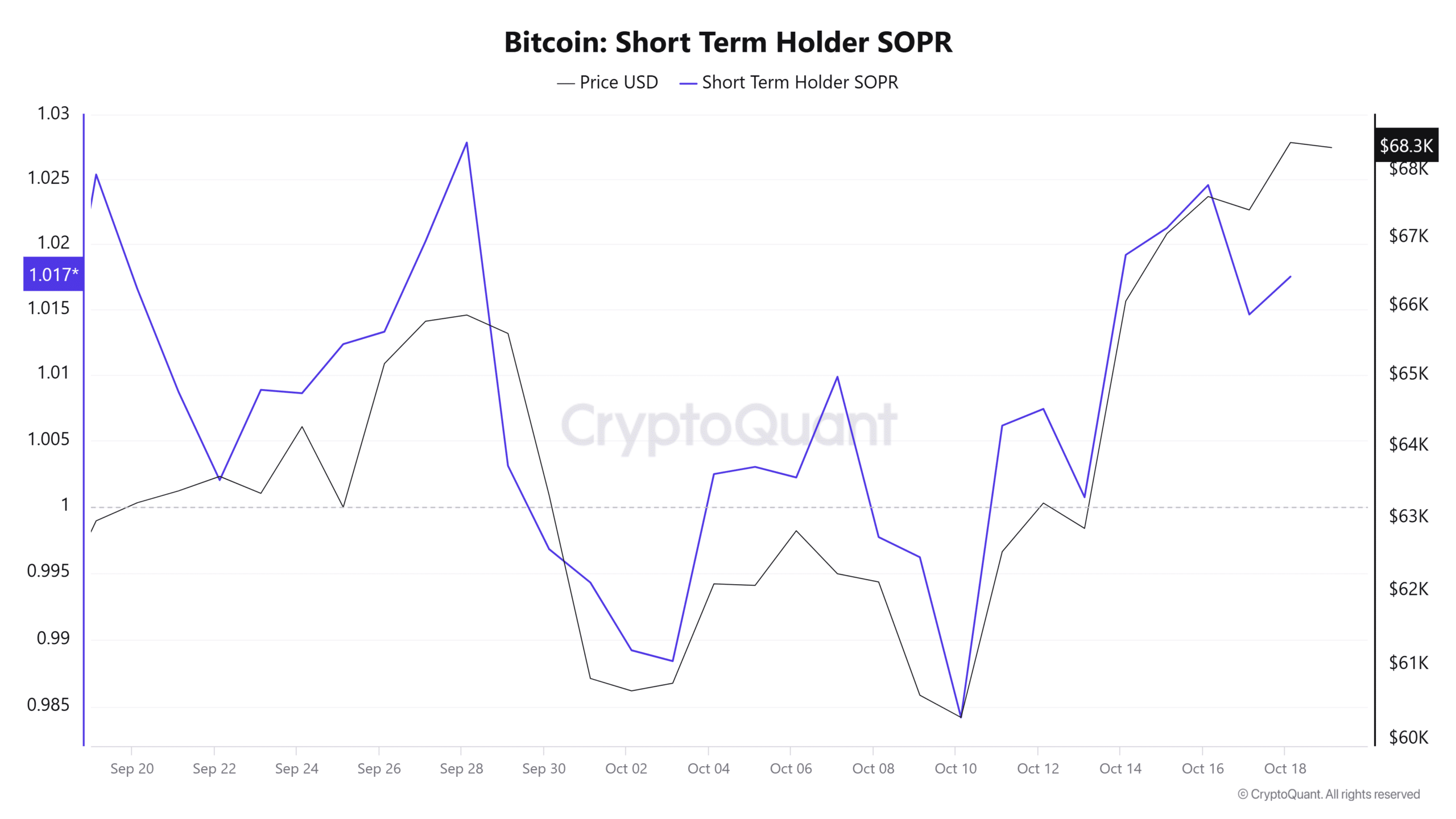

The short-term holder Spent Output Revenue Ratio additional highlighted that these merchants have been promoting BTC at a revenue. Particularly for the reason that metric has been above 1 for over per week now.

Whereas an SOPR ratio above 1 means that the final market sentiment is constructive, it might additionally imply a excessive chance of profit-taking. If Bitcoin’s uptrend exhibits indicators of weak spot, this cohort will probably begin promoting extra, inflicting a value reversal.

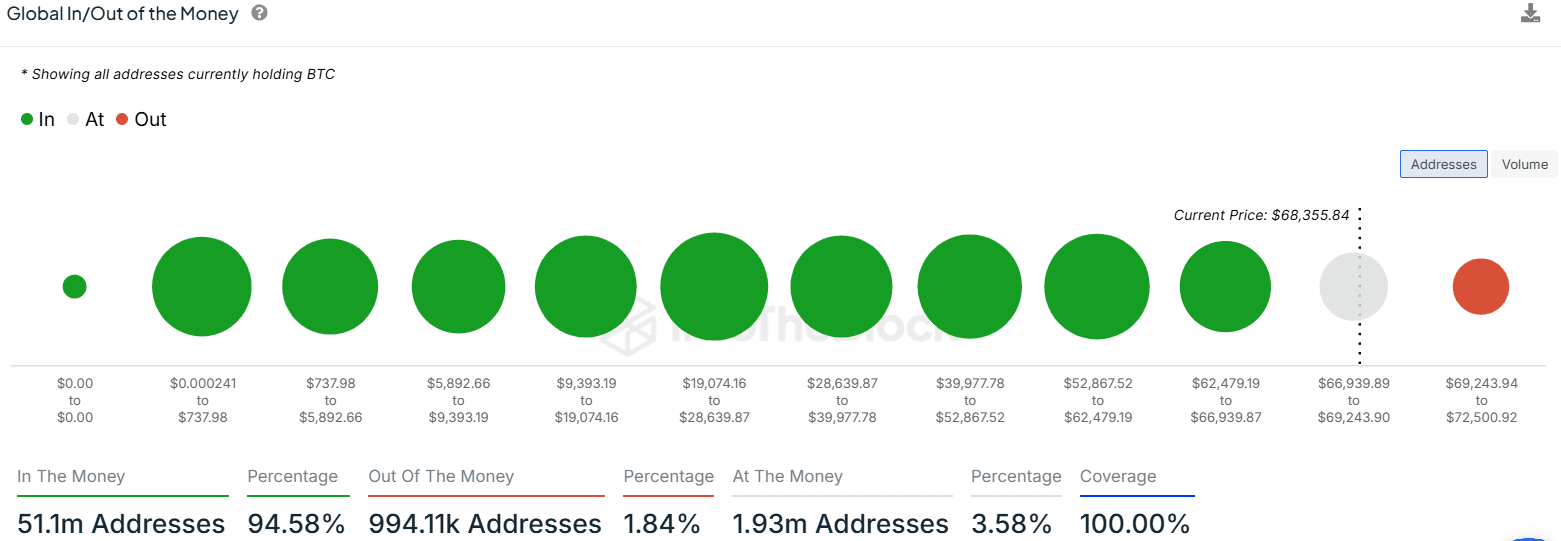

In addition to short-term holders, the opposite group that might delay a Bitcoin ATH are the 1.9M addresses that purchased BTC between $66,900 and $69,200. Based on IntoTheBlock, these addresses, at press time, had been at a break-even level.

Bitcoin is certain to face resistance because it approaches $69,000 as these addresses may begin promoting as soon as they flip in a revenue.

However, short-term holder habits is unlikely to dampen market sentiment round Bitcoin. Particularly since it is just 7% shy of its ATH now.

Technical indicators present bullish indicators

Bitcoin’s every day chart projected sturdy bullish momentum, on the time of writing. The Relative Energy Index (RSI) at 68 indicated that purchasing strain was sturdy. The RSI has additionally been making greater highs, additional suggesting that the uptrend could also be gaining power.

On-balance quantity has additionally been tipping upwards and trending above the smoothing line. This appeared to bolster the bullish sentiment because it confirmed capital has been flowing into Bitcoin. This might spike shopping for exercise and stir features.

If these bullish indicators persist and Bitcoin breaks above $69,000, the subsequent resistance stage would lie at $75,250, at which level Bitcoin may have fashioned a brand new ATH. Conversely, if profit-taking actions proceed, the asset will probably drop to check assist on the 0.618 Fibonacci stage ($65,130).

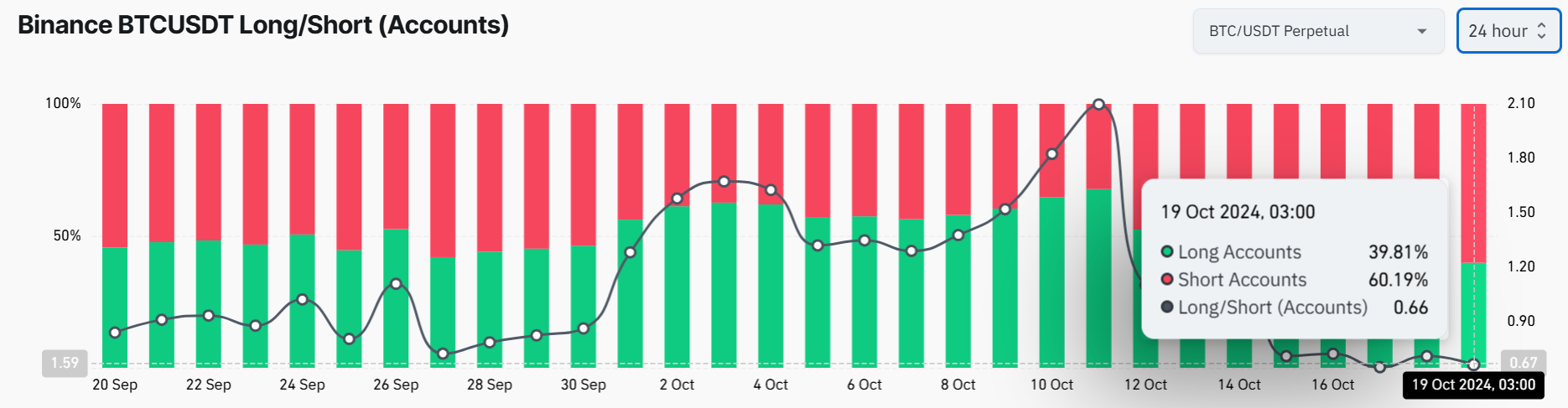

The truth is, some merchants are already anticipating such a drop. For instance – Information from Coinglass revealed that 60% of open positions are short sellers betting on a failed uptrend.