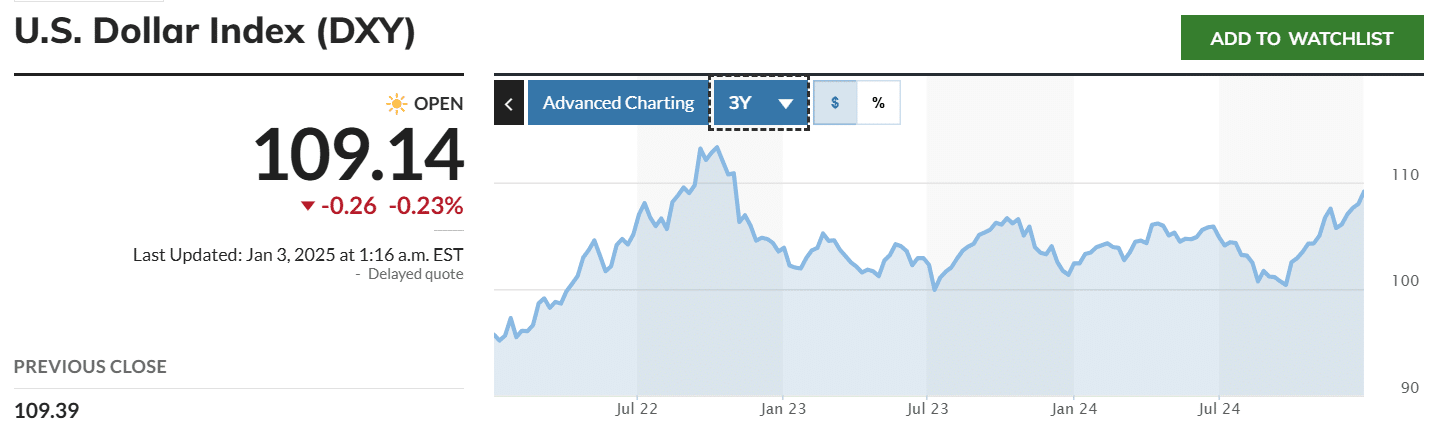

- U.S greenback index has surged to 109, marking its highest stage since November 2022

- A powerful greenback might weaken the demand for danger belongings akin to Bitcoin, which might restrict the crypto’s uptrend

Bitcoin (BTC) fell beneath $100,000 in mid-December. Since then, the king coin has struggled to regain its momentum on the charts. At press time, BTC was buying and selling at $96,789 following beneficial properties of 1.5% in 24 hours, with the crypto nonetheless simply over 10% shy of its ATH.

Whereas Bitcoin might stage a restoration later this month due to Donald Trump’s inauguration as U.S President, two key components might proceed to weigh on the worth.

U.S greenback index soars to two-year highs

The U.S greenback index (DXY), which measures the efficiency of the U.S greenback towards main currencies, has surged to 109 – its highest stage since November 2022. What this hike signifies is that the U.S greenback has been gaining energy these days.

The DXY is inversely correlated with Bitcoin’s worth, which means {that a} hike limits the coin’s upside potential. Moreover, a stronger greenback tends to weaken the demand for danger belongings akin to cryptocurrencies.

In truth, the autumn in demand is already evident within the exchange-traded fund (ETF) market. On the primary day of buying and selling in 2025, the BlackRock iShares Bitcoin Belief (IBIT) ETF recorded $332M in outflows, marking its highest outflows in historical past. The whole outflows from all 11 Bitcoin ETFs hit $242M, as per SoSoValue.

If these outflows persist, it might gasoline a surge in sell-side stress. This can, in flip, gasoline a downtrend for BTC on the charts.

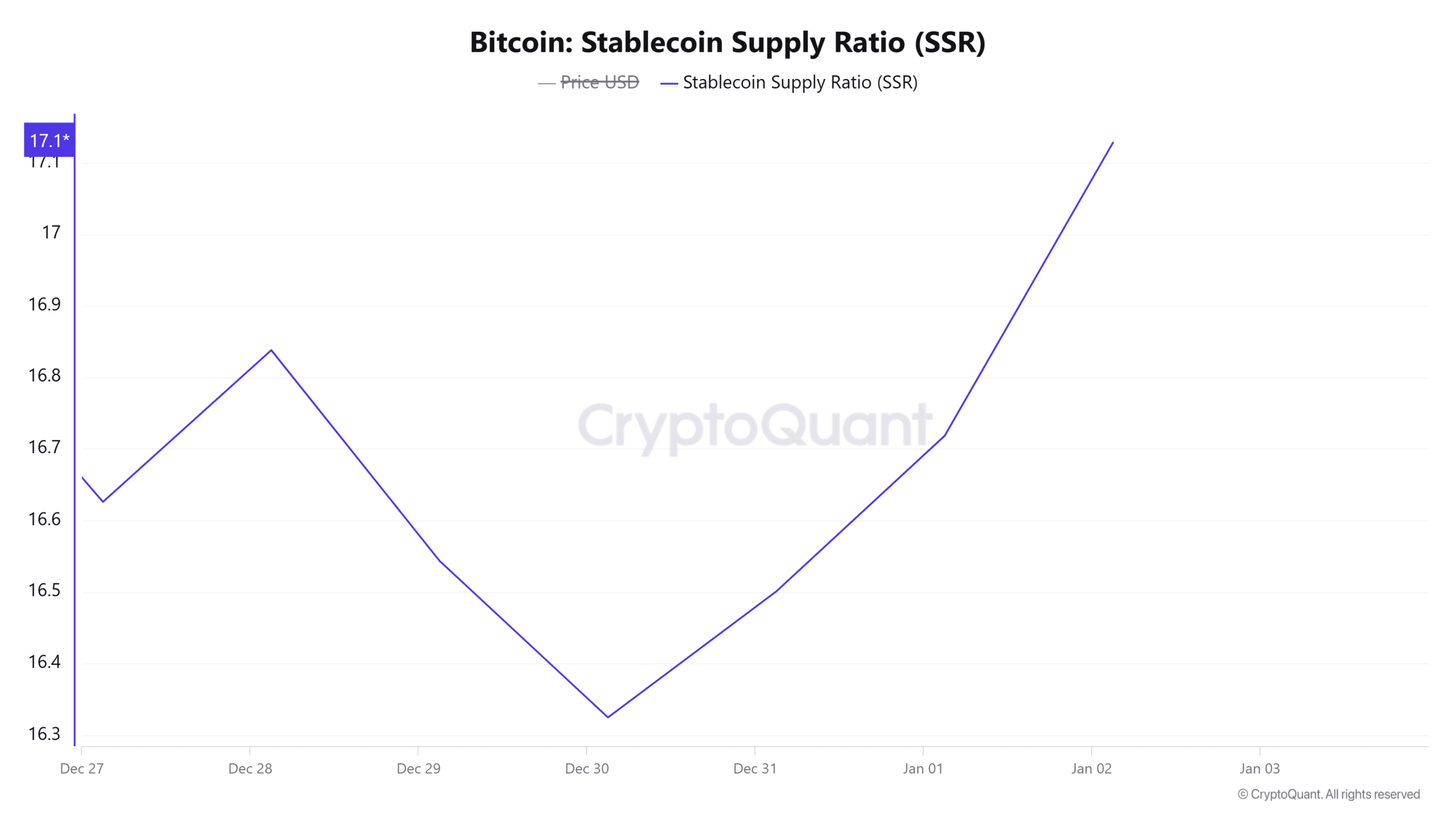

Rising stablecoin provide ratio

The weakened demand appeared not solely evident amongst institutional buyers, but additionally within the retail market. As an example – In keeping with CryptoQuant, Bitcoin’s Stablecoin Provide Ratio (SSR) surged to 17 – Its highest stage in seven days.

A better ratio implies that the provision of stablecoins is low, in comparison with BTC’s market cap. This ends in low shopping for stress that might exert downward stress on the worth.

Bitcoin’s worry and greed index remains to be bullish

Regardless of market components pointing to decreasing demand and shopping for stress, the Fear and Greed Index, which measures the market sentiment, revealed that merchants are nonetheless bullish.

This index had a price of 74 at press time, suggesting that almost all merchants are optimistic about BTC’s worth motion. For the reason that index climbed from 65 earlier this week, it may very well be excellent news for BTC if merchants begin shopping for.

Nevertheless, if the buy-side stress shouldn’t be sufficient to soak up the bought cash, it might restrict the beneficial properties on the charts.