- Jack Mallers asserted Bitcoin is the final word hedge in opposition to financial uncertainty.

- Regardless of volatility, important investor curiosity in Bitcoin continued.

Ever because the approval of the Bitcoin [BTC] spot ETF, the king of cryptos has remained within the limelight.

As extra institutional traders enter the crypto markets, the query arises — why has Wall Avenue abruptly turn into so bullish about crypto?

Jack Mallers’s perception on the present macroeconomy

In a dialog with Anthony Pompliano, Jack Mallers, CEO of Strike, implied that this renewed curiosity in cryptocurrency could also be due to the deep-rooted issues that we’ve got within the present geopolitical setup.

He additional said that permitting the banking system to fail could also be one answer, whereas the second concerned debasing the foreign money. Mallers thought-about the latter extra probably, suggesting that,

“I believe Bitcoin is the very best factor you may personal.”

Right here, Maller is viewing Bitcoin as a hedge in opposition to foreign money debasement and macroeconomic uncertainty.

Additional, when questioned about why traders transferring away from the greenback and investing in property like shares, actual property, Bitcoin, and gold together with Wall Avenue, Mallers famous,

“I believe it’s the very best expression of fiat debasement. It’s the antithesis of fiat foreign money. It has no Central Financial institution, it has no authorities, its financial coverage is fastened, its provide is capped, it’s every part that fiat isn’t. And, so, in case your downside is Fiat debasement then it’s greatest expressed by way of Bitcoin.”

Diverging opinions on Bitcoin

Nevertheless, amidst Bitcoin’s value volatility, many are nonetheless divided on whether or not they need to purchase or promote Bitcoin.

Clearing the air across the identical, fashionable crypto analyst Ali Martinez, in his latest X (previously Twitter) put up, shared that there was important shopping for exercise amongst sure traders in latest days.

This confirmed continued confidence within the long-term potential of Bitcoin and optimism about its future worth.

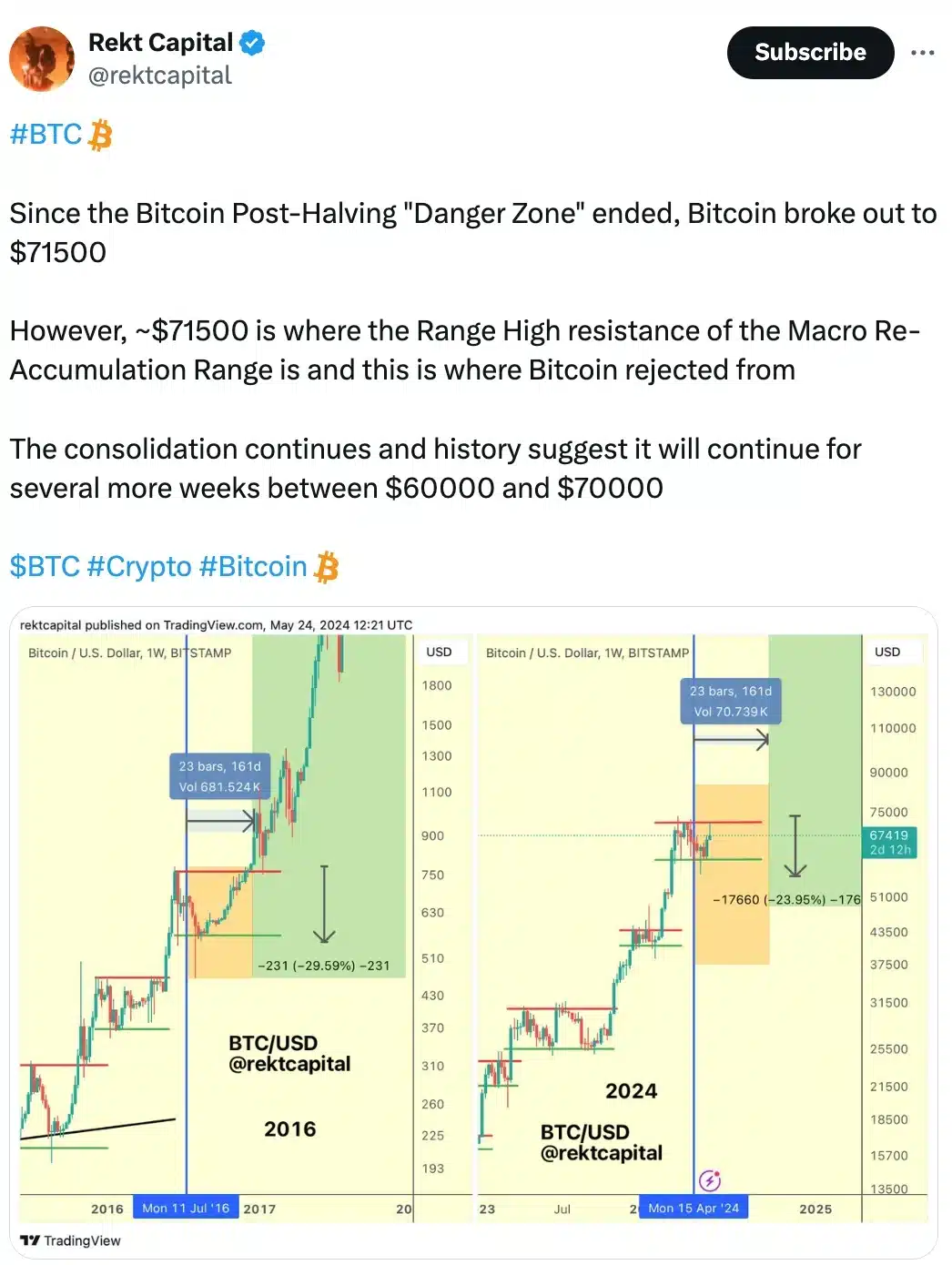

Quite the opposite, pseudonymous dealer Rekt Capital predicted that though the “hazard zone” has subsided, Bitcoin should expertise a possible dip of roughly 13% from its present worth.

Bitcoin vs. shitcoins

Amid the hypothesis and uncertainties enveloping Bitcoin, Mallers staunchly championed a maximalist perspective, affirming Bitcoin’s supremacy because the quintessential type of cash.

Moreover, Mallers scrutinizes Ethereum [ETH] for straying from elementary financial rules, attributing its selections to founder affect and exterior pressures prompting protocol adjustments.

He stated,

“What bothers me is the intentional conflation Ethereum was based to be the higher Bitcoin and it usually rides the coattails of Bitcoin and it usually conflates itself with Bitcoin story and numerous these items.”

He ended the dialog giving his opinion on meme cash –

“I imply to be sincere like I don’t actually give a s**t about s**tcoins to be completely candid.”