The Bitcoin value kicked off the weekend within the worst means attainable, falling beneath the $115,000 stage for the primary time since early July. Contemplating the supposed significance of this price mark, there have been questions on how a lot headroom the worth of Bitcoin nonetheless has. The most recent on-chain knowledge means that the Bitcoin bull run won’t be over simply but.

BTC Lengthy-Time period Holders Begin Distributing

In an August 1st submit on X, crypto analyst Joao Wedson reported that the Bitcoin cycle for the long-term holders appears to be coming to an finish.

Associated Studying

Wedson emphasised that, whatever the ongoing pleasure round ETFs, on-chain knowledge reveals a transparent market shift. This shift alerts that the cryptocurrency’s long-term holders are starting to promote their cash, and, in giant volumes, too.

In keeping with the analyst, about 50% of the quantity of Bitcoin held in exchange-traded funds has been offered by the LTHs. No matter this case, nevertheless, Wedson expects the BTC bull market to go on for “at the least 2 extra months” and the altcoins’ bull cycle for 3 months.

Key Metrics Flash Warnings – However ‘Last Prime’ Not But Seen

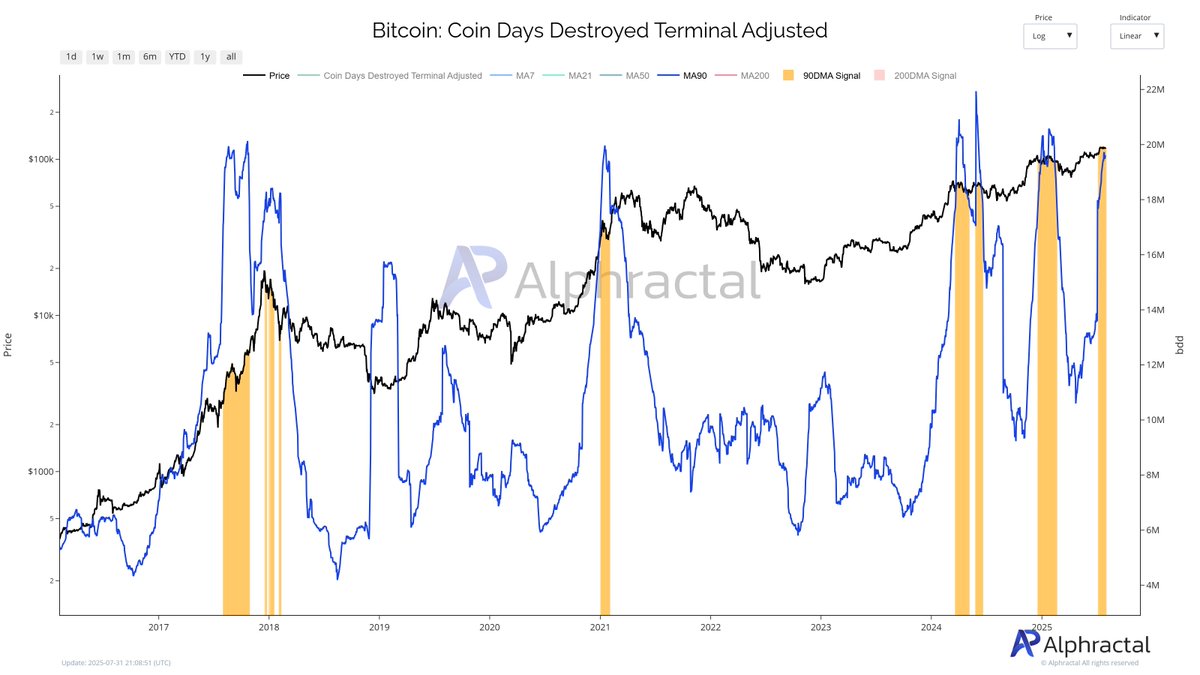

Wedson backed his declare with 4 on-chain indicators, beginning with the Coin Days Destroyed Terminal Adjusted Metric, which reveals aged cash transferring after being dormant for a protracted time frame.

The analyst defined that there was a significant movement of old BTC over the previous two years. This, Wedson emphasised, triggered three main warning indicators that coincide with a neighborhood prime.

Wedson additionally referenced the Reserve Threat Indicators to gauge present LTH conviction. This metric, from evaluation, has entered a warning zone, as there may be elevated promoting exercise and hand exchanges.

Subsequent, the net pundit quoted outcomes from the Spent Output Revenue Ratio (SOPR) Development Sign. The SOPR measures whether or not cash (on this case, Bitcoin) are moved at a revenue or loss. Wedson identified that this indicator just lately flashed a bearish sign, which suggests increased profit-taking available in the market.

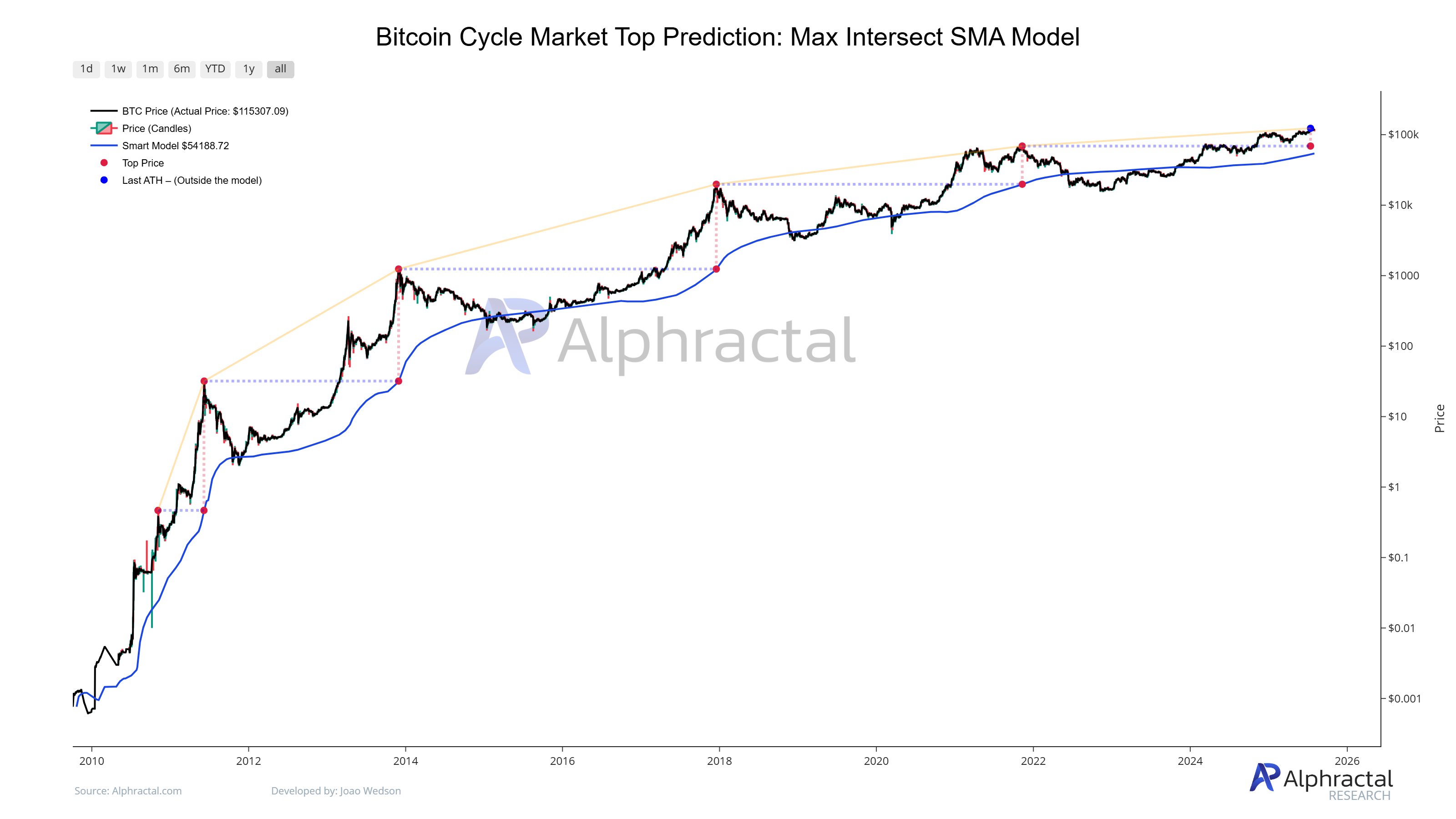

Referring to it as ‘essentially the most correct metric on this planet’ used to establish Bitcoin’s macro tops, the Bitcoin Cycle Market Prime Prediction: Max Intersect SMA Mannequin was put out final. Wedson highlighted that this metric is but to flash any bearish sign. Utilizing the chart under, the analyst defined that till the blue line reaches the $69,000 stage, the ultimate prime is but to reach.

In the end, the analyst preached warning towards panicking, as historic cycle patterns counsel that the ultimate market prime has but to reach. As of this writing, Bitcoin is valued at about $113,052, reflecting a 1.2% value decline prior to now 24 hours.

Associated Studying

Featured picture from iStock, chart from TradingView