- New and outdated Bitcoin provide revealed that the coin lacked new traders

- Lengthy-term holders are promoting – Signal of an additional worth decline

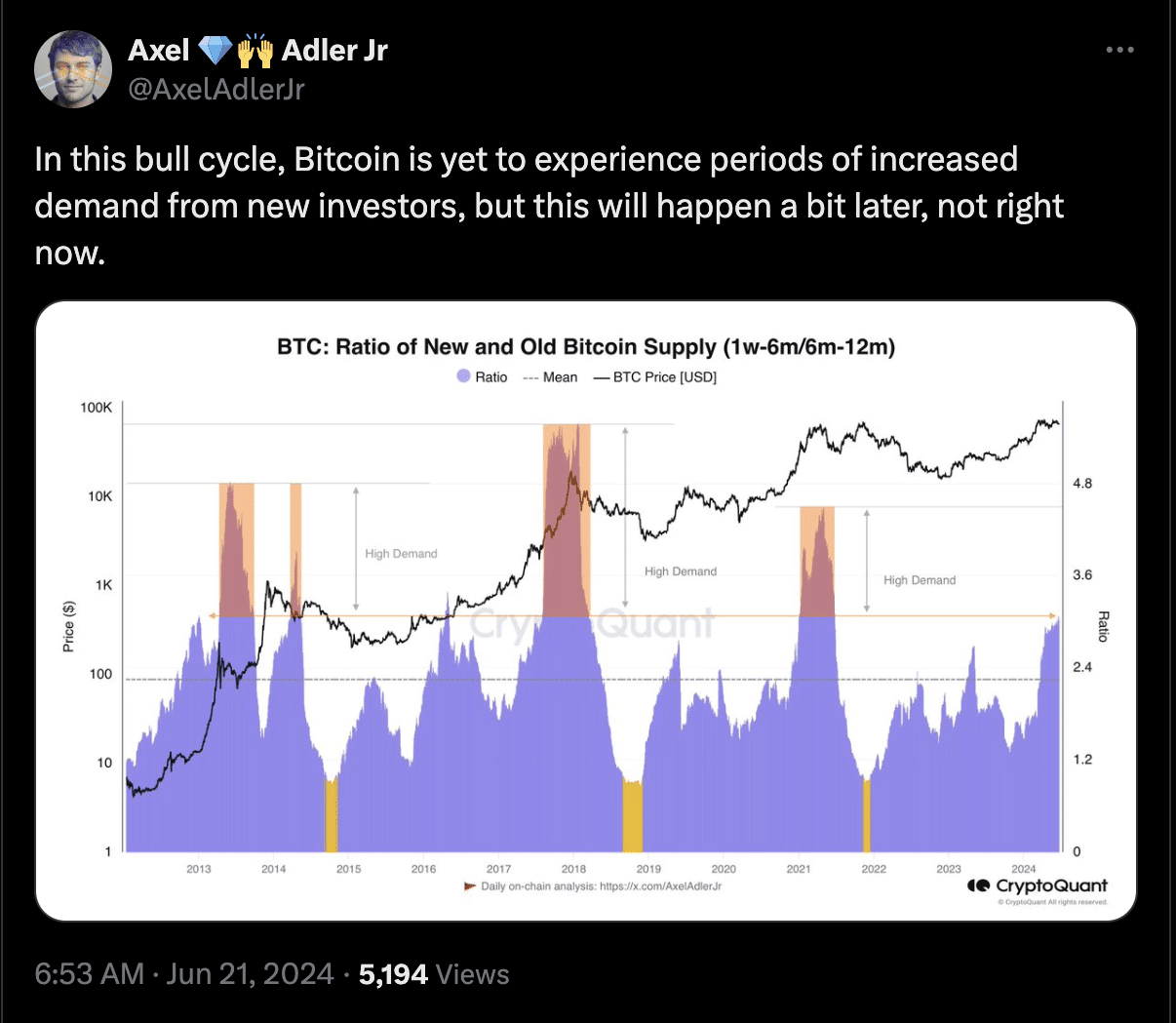

In accordance with Axel Adler, an on-chain analyst, Bitcoin [BTC] is but to hit its highest degree of demand. In accordance with him, this can be the case as a result of the demand from new traders has been low, in comparison with earlier bull markets.

Nonetheless, Alder, in his put up on X, additionally famous that new traders would start to purchase BTC at a a lot later date. Proof of this opinion may be seen within the Ratio of Outdated and New Bitcoin Provide.

As may be seen within the chart beneath, Bitcoin is not yet close to the areas of excessive demand. Due to this fact, the probabilities of a worth hike within the mid to long-term could be larger.

New traders will not be round

At press time, Bitcoin’s worth was $63,719 after falling by nearly 5% within the final seven days. To establish if Bitcoin’s worth will hike, AMBCrypto checked out person engagement and progress on the community

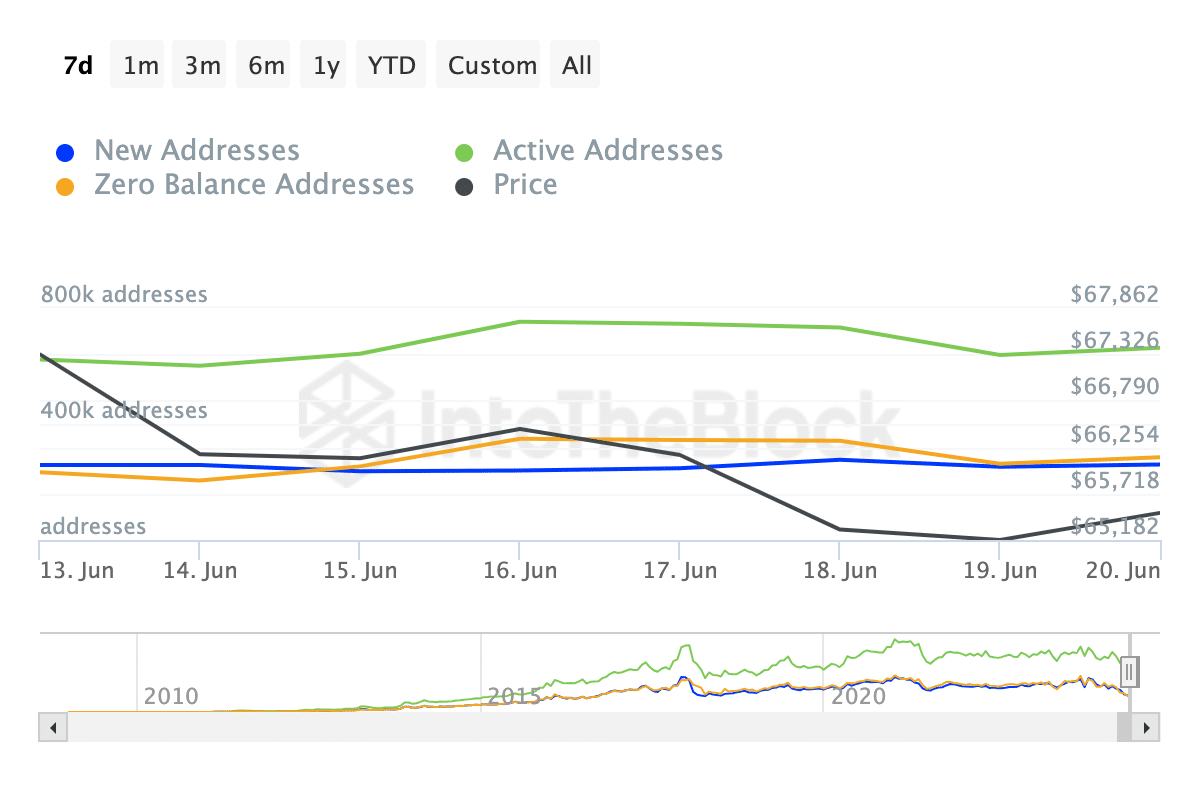

Within the metric offered by IntoTheBlock, now we have the brand new addresses, energetic addresses and zero-balance addresses. Lively addresses measure the variety of present customers transacting on the community.

New addresses, then again, imply the variety of addresses finishing their first transaction. At press time, Bitcoin energetic addresses had risen by 6.47% within the final seven days.

Zero-balance addresses jumped by 22% whereas new addresses remained nearly the identical. The stagnancy in new addresses is a mirrored image of Adler’s opinion above. For the worth, this might result in one other lower.

Not too long ago, AMBCrypto reported how an analyst predicted that the coin might drop to $54,000. Whereas this won’t occur within the quick time period, BTC can fall in direction of $61,000 on the charts.

Holders proceed to promote

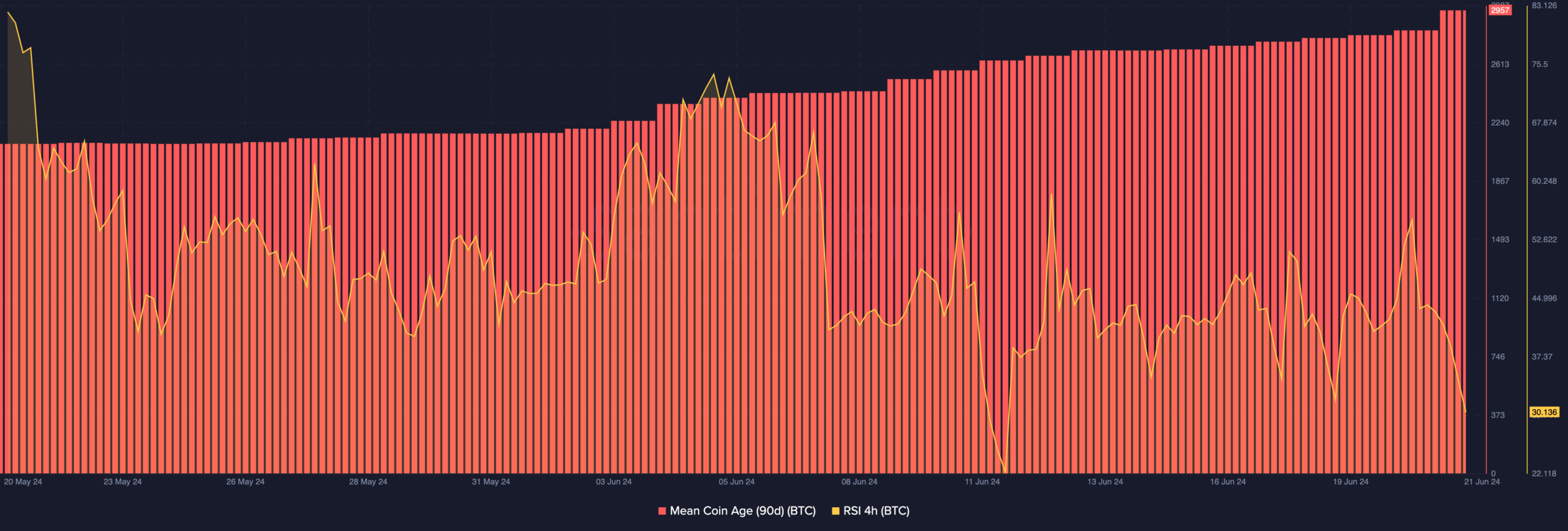

We additionally analyzed the Imply Coin Age (MCA). The MCA reveals the typical age of all cash primarily based on the weighted buy worth. When the metric rises, it implies that outdated cash are shifting from their earlier storage.

Generally, which means long-term holders are selling. Nonetheless, when the MCA falls, it implies that holders of the coin don’t wish to promote. As a substitute, market individuals are accumulating new cash and retiring them to a chilly pockets.

At press time, Bitcoin’s 90-day MCA was nonetheless on its uptrend from 1 June. Ought to this go on, the worth of the coin may drop, and the $61,000 prediction might become a reality.

As well as, the Relative Power Index (RSI) on the 4-hour chart fell. The RSI is a technical oscillator that tracks an asset’s momentum.

It additionally tells us when a cryptocurrency is overbought or oversold. Values of 70 or above imply overbought whereas readings beneath 30 means oversold. At press time, Bitcoin’s RSI was near the oversold area.

Is your portfolio inexperienced? Test the Bitcoin Profit Calculator

This means that momentum has been bearish. As such, an additional worth fall could possibly be doable.

Nonetheless, if shopping for stress will increase, the worth may rebound. So far as demand is anxious, it would stay low for the subsequent few weeks.