- Bitcoin noticed a slight restoration after the decline.

- Liquidation has tapered off after the worth decline brought about a spike.

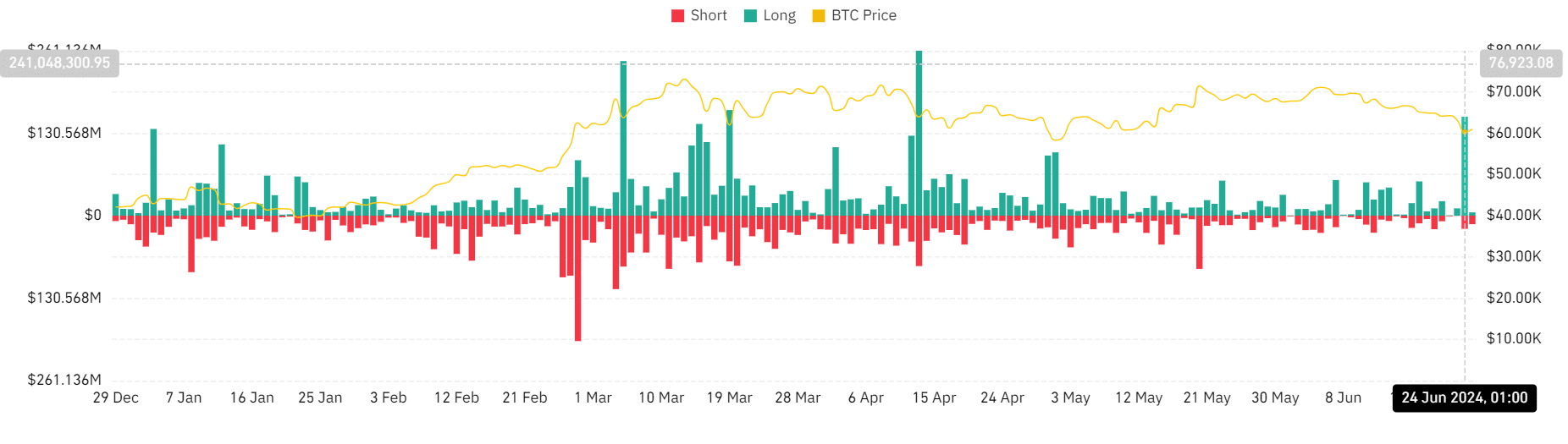

Bitcoin [BTC] skilled a major drop within the final buying and selling session, which resulted in a surge in liquidations. As a result of this decline, merchants who bought Bitcoin up to now 30 days are actually going through losses.

Bitcoin liquidations spike

AMBCrypto’s evaluation of Bitcoin’s liquidation chart on Coinglass revealed a major improve in liquidation quantity on the twenty fourth of June. The spike was primarily triggered by a pointy drop in Bitcoin’s value.

It resulted in substantial liquidations, particularly amongst lengthy positions, which accounted for over $156 million.

In distinction, quick positions noticed liquidations amounting to round $21 million, indicating that merchants who had wager on a value improve had been essentially the most affected.

As of this writing, though there had been a slight improve in Bitcoin’s value, quick positions had been experiencing extra liquidations.

The amount of quick liquidations was round $13.5 million, whereas lengthy liquidations had been decrease, at round $5.2 million.

This shift instructed that merchants who anticipated a continued value decline had been now going through losses because of the value rebound.

Bitcoin sees a slight improve

AMBCrypto’s take a look at Bitcoin’s value pattern revealed a notable drop on the twenty fourth of June, with its worth plunging to a low of $58,414 in the course of the buying and selling session.

By the session’s shut, it had partially recovered to round $60,263 but nonetheless recorded a 4.60% decline from its opening worth. This drop triggered important liquidations available in the market.

As of this writing, its value had risen to roughly $61,300, reflecting a rise of round 1.70%. Throughout the decline, the Relative Energy Index (RSI) for Bitcoin fell under 30, signaling a robust bearish pattern.

Though the RSI has barely recovered above this essential threshold, it instructed that whereas there was a minor enchancment, BTC nonetheless predominantly exhibited sturdy bearish momentum.

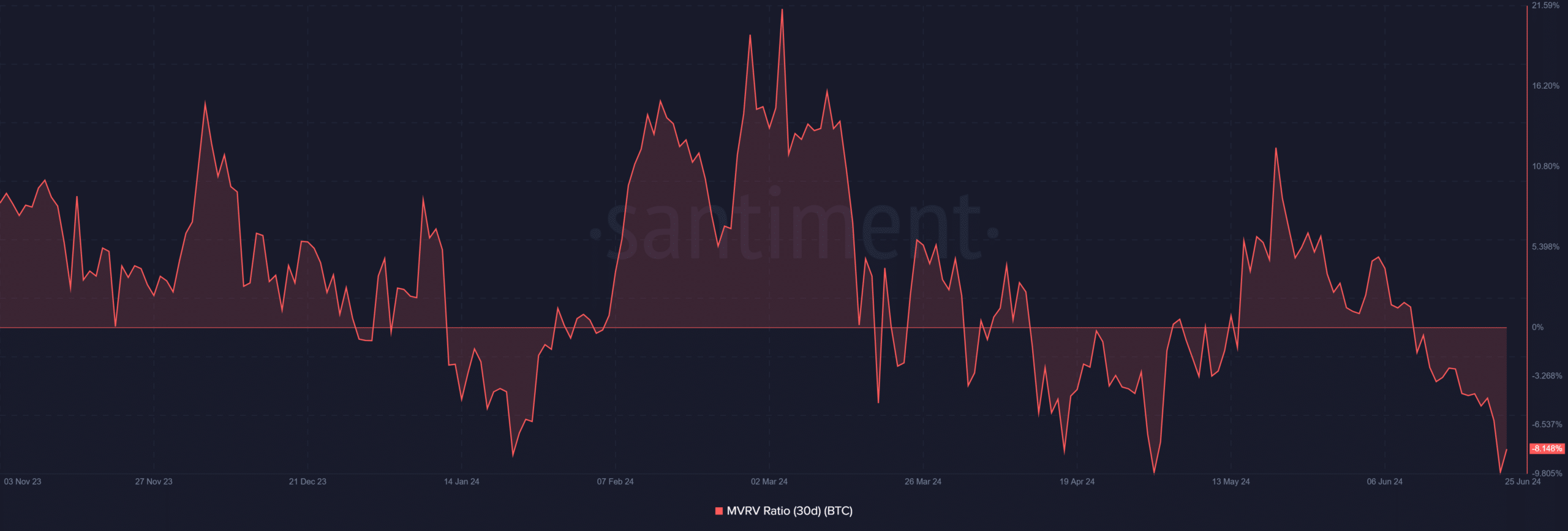

BTC holders at a loss

The evaluation of Bitcoin’s 30-day Market Worth to Realized Worth (MVRV) ratio, as reported on Santiment, revealed a regarding pattern of decline.

This ratio, which compares the market worth of an asset to its realized worth, dipped under zero across the tenth of June.

The dip indicated that the common market individuals had been holding Bitcoin at a worth decrease than their buying value.

The latest value drop exacerbated this example, with the MVRV ratio plummeting to roughly -9.7% on the twenty fourth of June.

As of this writing, there had been a slight restoration within the MVRV ratio to round -8.14%, but it remained adverse.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

This ongoing adverse worth instructed that merchants who acquired Bitcoin over the previous 30 days had been nonetheless going through losses on their investments.

A adverse MVRV ratio is commonly seen as an indicator that the asset is undervalued and that present holders have purchased at increased costs than the present market is prepared to pay, sustaining a bearish sentiment available in the market.