- Will the anticipated fee cuts by FED on 18th September spark one other BTC rally?

- Main monetary gamers additional institutional investments in Bitcoin.

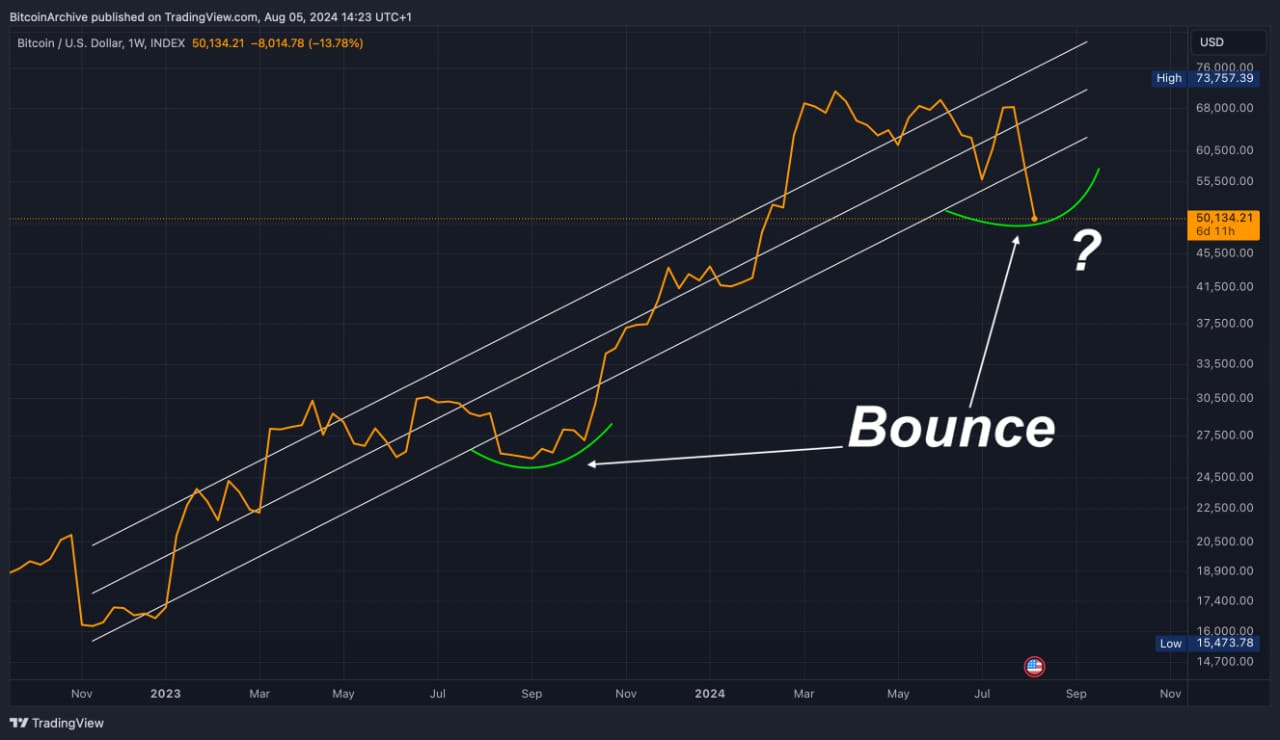

Technical evaluation of the Bitcoin [BTC] chart on TradingView confirmed that the asset has fallen out of the bull market once more this yr, signaling an entry level for buyers.

This mirrors the sample from 2023 that led to a brand new all-time excessive in 2024. Beforehand, Bitcoin rebounded sharply with the information of Bitcoin ETFs set for approval in January.

Now, with requires a 1.5% fee minimize, there’s hypothesis about whether or not this can set off an identical restoration again into the bull market channel.

Buyers are watching intently to see if the speed minimize will present the identical enhance because the ETF information did final time.

Capula and Semler Scientific add extra BTC

Capula, Europe’s fourth-largest hedge fund, has invested $500 million in BTC utilizing BlackRock and Constancy ETFs.

Moreover, Semler Scientific just lately invested $6 million in BTC and plans to lift $150 million to purchase extra. Since adopting a Bitcoin treasury technique in late Might 2024, Semler has purchased 929 bitcoins, totaling $63 million.

These investments by main monetary gamers recommend rising acceptance of Bitcoin within the monetary sector and should encourage additional institutional investments resulting in BTC worth rally.

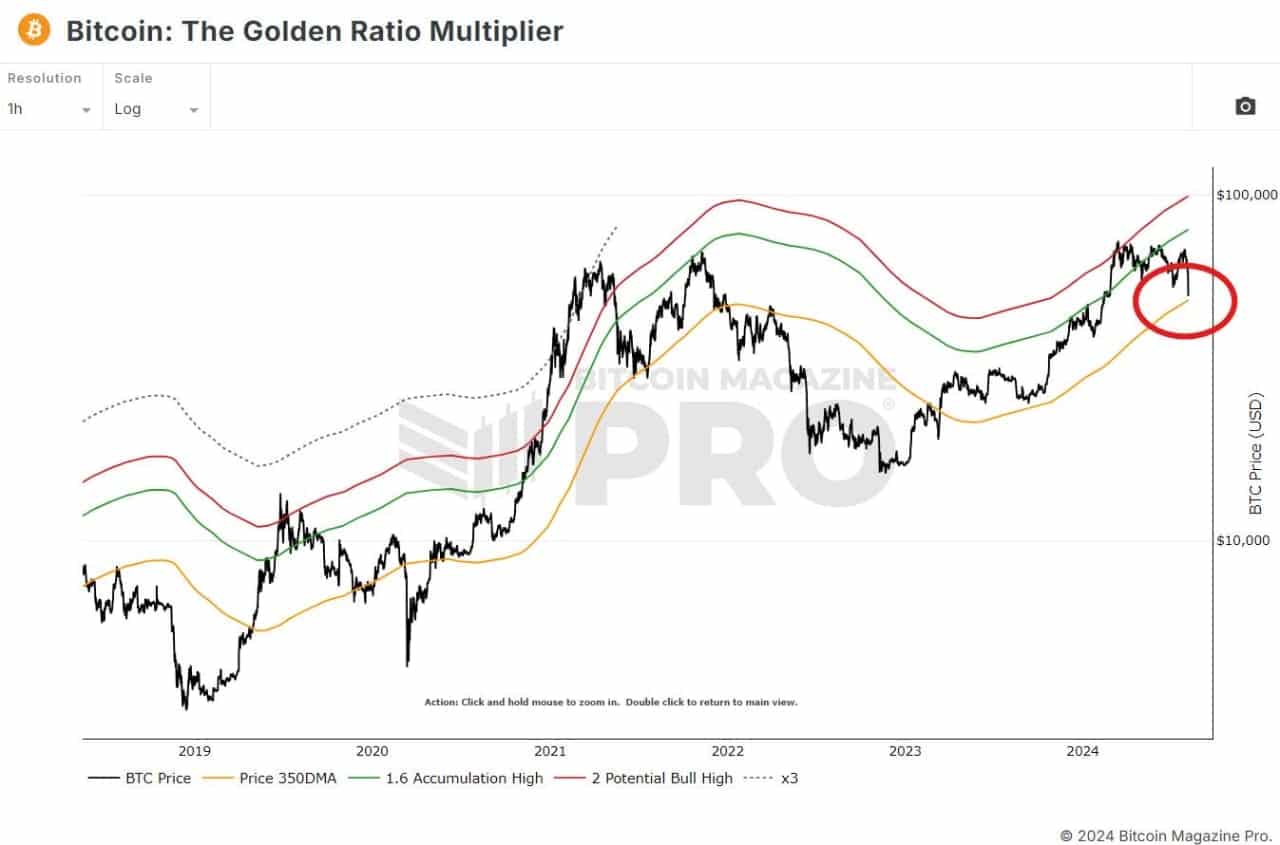

Will BTC safe the 350DMA help?

Bitcoin’s worth was hovering across the 350-day transferring common, in response to the Golden Ratio Multiplier. This long-term projection instrument coupled with anticipated fee cuts means that Bitcoin’s worth is about to rise.

The 350DMA serves as help when the asset is trending upward. Contemplating this and the opposite components, the latest crypto crash could possibly be a wonderful alternative to purchase earlier than Bitcoin rallies.

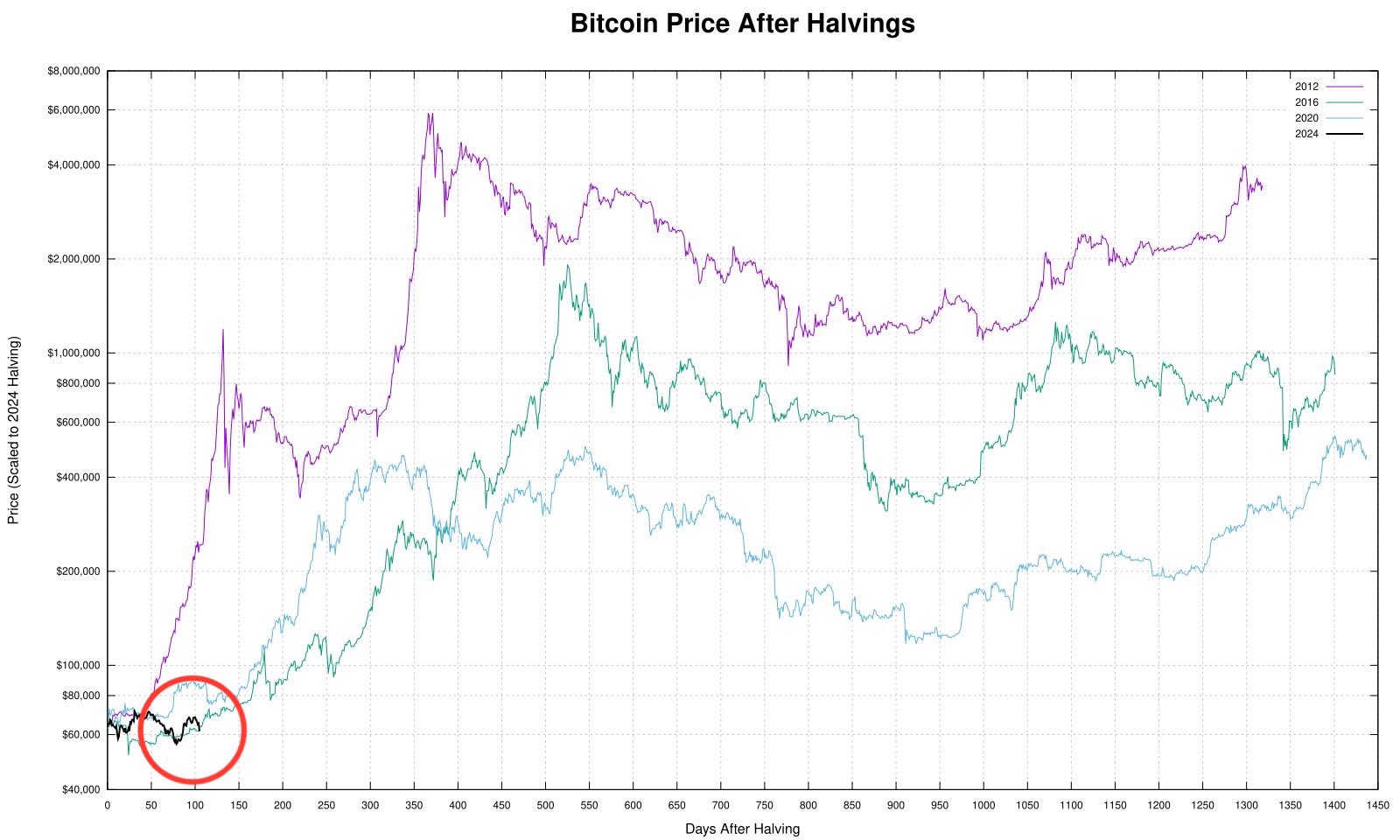

Bitcoin usually experiences a correction or consolidation interval for a number of weeks after a halving occasion earlier than it begins to rise.

Is your portfolio inexperienced? Verify the Bitcoin Profit Calculator

Presently, it has hit its lowest level on this cycle, and lots of count on it to rally within the third quarter of 2024, following replication of patterns seen in 2012, 2016, and 2020.

X consumer and market analyst Quinten noted regardless of present issues, BTC is following its ordinary cycle conduct.