Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

After every week of unstable value motion, Bitcoin has as soon as once more returned to familiar territory across the $106,000 value stage. Nevertheless, on-chain knowledge exhibits that traders are nonetheless cautious, with the crypto Worry & Greed Index now within the impartial zone.

Alternatively, technical evaluation of Bitcoin’s value motion on the 4-hour candlestick timeframe chart exhibits that its value conduct has accomplished a big correction, one that’s paving the way for a significant rally to $130,000.

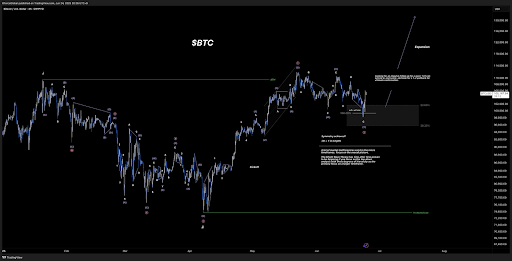

Bitcoin’s Wave 2 Correction Would possibly Be Full

In line with XForceGlobal, a crypto analyst who posted a detailed Elliott Wave chart on the social platform X, Bitcoin’s current correction matches neatly inside a accomplished WXY sample. The second wave, which began following the all-time excessive of $111,814 on Could 22 and fashioned the corrective construction, has now retraced into the anticipated Fibonacci vary between the 23.6% and 38.2% ranges. Notably, the best minimal goal for this correction transfer was within the $90,000 area, and Bitcoin fulfilled that situation with the pullback to just under $98,200 over the weekend.

Associated Studying

A very powerful factor was in preserving the macro wave construction. Instead of drawing out a deeper pullback into the 0.618 to 0.886 Fibonacci ranges, which is usually attribute of bear market retracements, the evaluation maintains the concept this was a wave 2 correction inside a bigger bullish impulse.

This distinction is vital. If the WXY correction is certainly full and wave 2 has concluded, the subsequent logical transfer within the Elliott Wave sequence is a 3rd wave advance. In line with Elliott Wave evaluation, the third wave is usually probably the most explosive by way of value enlargement. Its consequence might due to this fact push the worth of Bitcoin to new heights which can be considerably larger than its most up-to-date all-time excessive.

Why $130,000 Is A Lifelike Goal For Bitcoin

The analyst’s technical projection on Bitcoin’s 4-hour candlestick timeframe chart exhibits an anticipated wave 3 trajectory extending beyond $111,800, with an enlargement arrow reaching up above $130,000. That is the enlargement transfer and relies on the same projection of Wave 1.

Associated Studying

Within the accompanying chart, the analyst marks the important thing pivot zone between $98,000 and $102,000 because the Wave C termination space. If this zone certainly marks the completion of the second wave, the subsequent motion would require validation by means of the formation of a transparent 1-2 construction inside Wave 3.

Because of this affirmation of the bullish rely additionally relies on the worth making a brand new native excessive above the present vary after which pulling again with out breaching the current lows. If that construction performs out, then the market would probably be within the early stages of a powerful third wave.

Bitcoin has already made an 8% value acquire after it dropped to a low of $98,200 following U.S. airstrikes on Iranian nuclear websites. Essentially the most important upward transfer got here on Tuesday, June 24, when reports of a Middle East cease-fire pushed Bitcoin up roughly 4%. On the time of writing, Bitcoin is buying and selling at $106,330.

Featured picture from Pixabay, chart from Tradingview.com