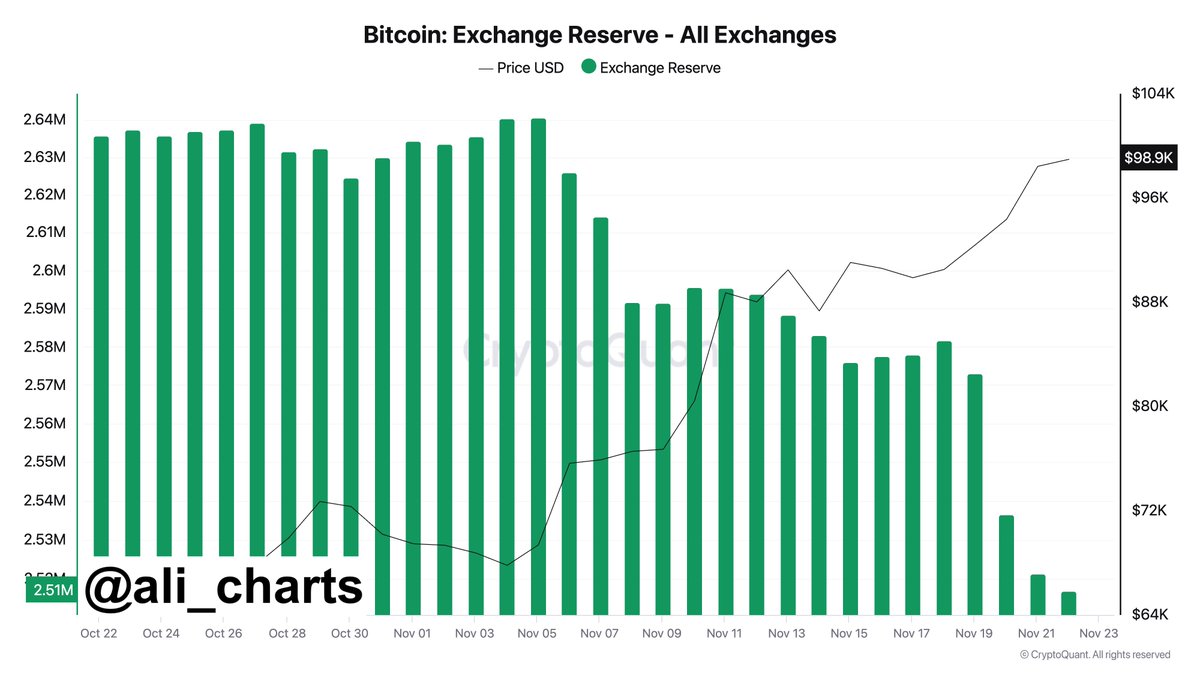

- Bitcoin withdrawals from exchanges have totaled $6.37 billion within the 96 hours.

- Social media mentions of $100K Bitcoin have hit a report excessive as nicely.

Bitcoin’s [BTC] rally to a six-figure valuation is a fraction away, and the rally could also be fueled additional by notable alternate withdrawals.

Based on a famend analyst’s tweet, about 65K BTC, valued at $6.37 billion, have been pulled out of reserve exchanges.

Traditionally, such important outflows indicate that holders are transferring belongings to chilly wallets, signaling diminished promoting strain.

A provide squeeze on the exchanges typically precedes bullish worth actions, as decrease availability promotes upward worth momentum.

As an example, in earlier BTC cycles, giant alternate withdrawals preceded important worth rallies.

The present sustained outflows recommend elevated investor confidence within the rising worth in the long run, extra in order Bitcoin has reached an ATH of $99K.

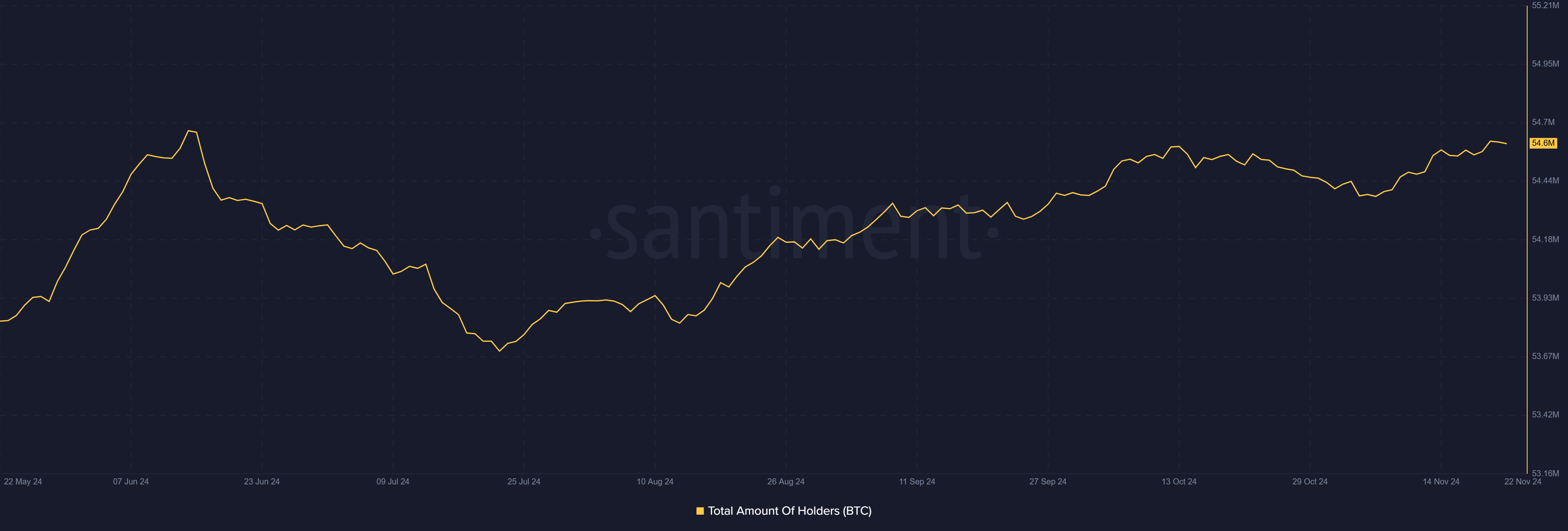

Bitcoin rising holders and report social mentions

Based on AMBCrypto’s evaluation of Santiment’s information, the variety of Bitcoin holders additionally surged within the final 24 hours.

This comes at a time when mentions of $100K Bitcoin are hovering on platforms similar to X, Reddit, and Telegram. Social media talks about BTC’s six-figure worth have reached traditionally excessive ranges.

Notably, the concern of lacking out has amplified, with some merchants anticipating a fast rise past $100K.

Alternatively, mentions of cheaper price ranges, similar to $60K-$79K, mirrored residual concern of correction within the brief time period.

What subsequent for BTC?

Traditionally, Bitcoin’s worth tends to surge upward after intervals of heightened withdrawals and diminished alternate reserves. The following crucial milestone can be the psychological barrier of $100K.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

If this bullish momentum continues, it may strongly propel Bitcoin into new highs.

Nevertheless, whereas concern of lacking out fuels worth motion, the concern of corrections may set off a profit-taking at this key section.