- Saylor believes the world’s largest cryptocurrency is a ‘digital energy’

- MSTR outperformed BTC throughout its most up-to-date restoration

Some TradFi analysts criticized Bitcoin [BTC] not too long ago, discrediting its use as a hedge after huge volatility pulled down its worth by 15% on 5 August. And but, Chairman of MicroStrategy Michael Saylor continues to defend the world’s largest digital asset’s volatility. Terming it the “price you pay” for its utility and liquidity, he mentioned,

“The volatility is the worth you pay with the intention to create billions of {dollars} of credit score and liquidity at your fingertips all instances, in all places, for everyone.”

In accordance with Saylor,

“Nobody who understands Bitcoin is afraid of the volatility.”

Saylor’s Bitcoin recommendation to governments

That wasn’t all although as Saylor additionally took a swipe at conventional finance’s (TradFi) inefficiency towards Bitcoin. He commented,

“There’s a revolution within the world capital markets and conventional finance operates 19% of the time for 10% of the world. That makes it a 2% answer. #Bitcoin is a 100% answer. It’s not partisan; it’s simply a good suggestion.”

For perspective, conventional finance exchanges just like the NYSE halted equities buying and selling over the previous few weeks after reported glitches. Quite the opposite, Bitcoin has been up and on-line for over 99% of its existence.

Moreover, Saylor strengthened BTC as a ‘digital power’ that ought to be adopted by any authorities. In doing so, he equated it to nuclear and area energy.

Bitcoin technique development

The chief echoed a equally bullish sentiment in a current Fox Enterprise interview. In accordance with the exec, his agency’s share, MicroStrategy (MSTR), outperformed every thing as a result of it adopted the Bitcoin technique.

“MicroStrategy is outperforming every thing since they adopted #Bitcoin…It’s crushed every thing.”

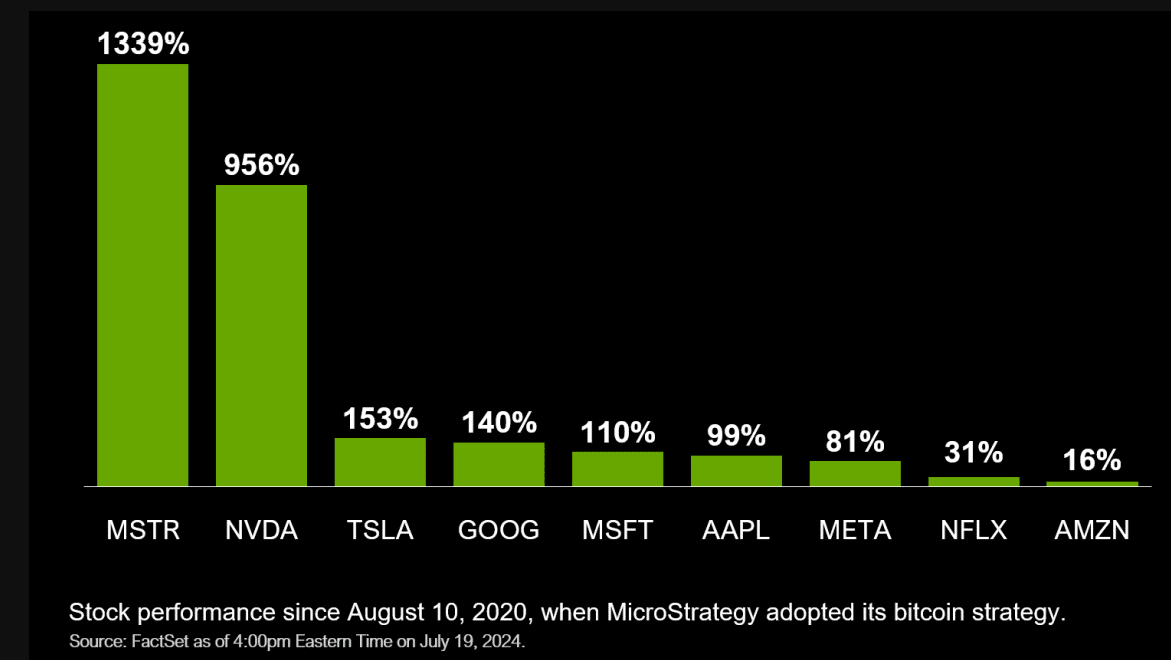

In truth, MSTR has eclipsed all its friends, rallying by over 1000% since adopting the cryptocurrency again in 2020.

As of August, MicroStrategy held over 226k BTC and planned to amass one other $2 billion price of BTC. Saylor himself holds about $1 billion in BTC in a person capability and is able to stash extra too.

Curiously, different companies have additionally adopted MicroStrategy’s Bitcoin technique. In the USA, as an illustration, Block Inc., based by Jack Dorsey and a father or mother agency to Money App, is without doubt one of the companies which have an lively BTC technique.

Abroad, Japanese funding agency Metaplanet is probably probably the most aggressive adopter of this technique. The agency not too long ago secured ¥1 billion so as to add extra BTC to its portfolio. Consequently, the agency’s TKO inventory is now up +600% in year-to-date (YTD) efficiency (in Japanese Yen phrases).

Over the identical interval, MSTR outperformed even BTC, at over 97%, towards the digital asset’s 37%.

In the meantime, MSTR’s inventory successfully carried out the 10-1 inventory break up on 8 August, meant to make the inventory extra inexpensive. Consequently, there could be 10 instances extra MSTR shares at a tenth of its earlier worth.

At press time, MSTR was trading at $135. It rebounded by 27% towards BTC’s 12% during the last 5 buying and selling days.