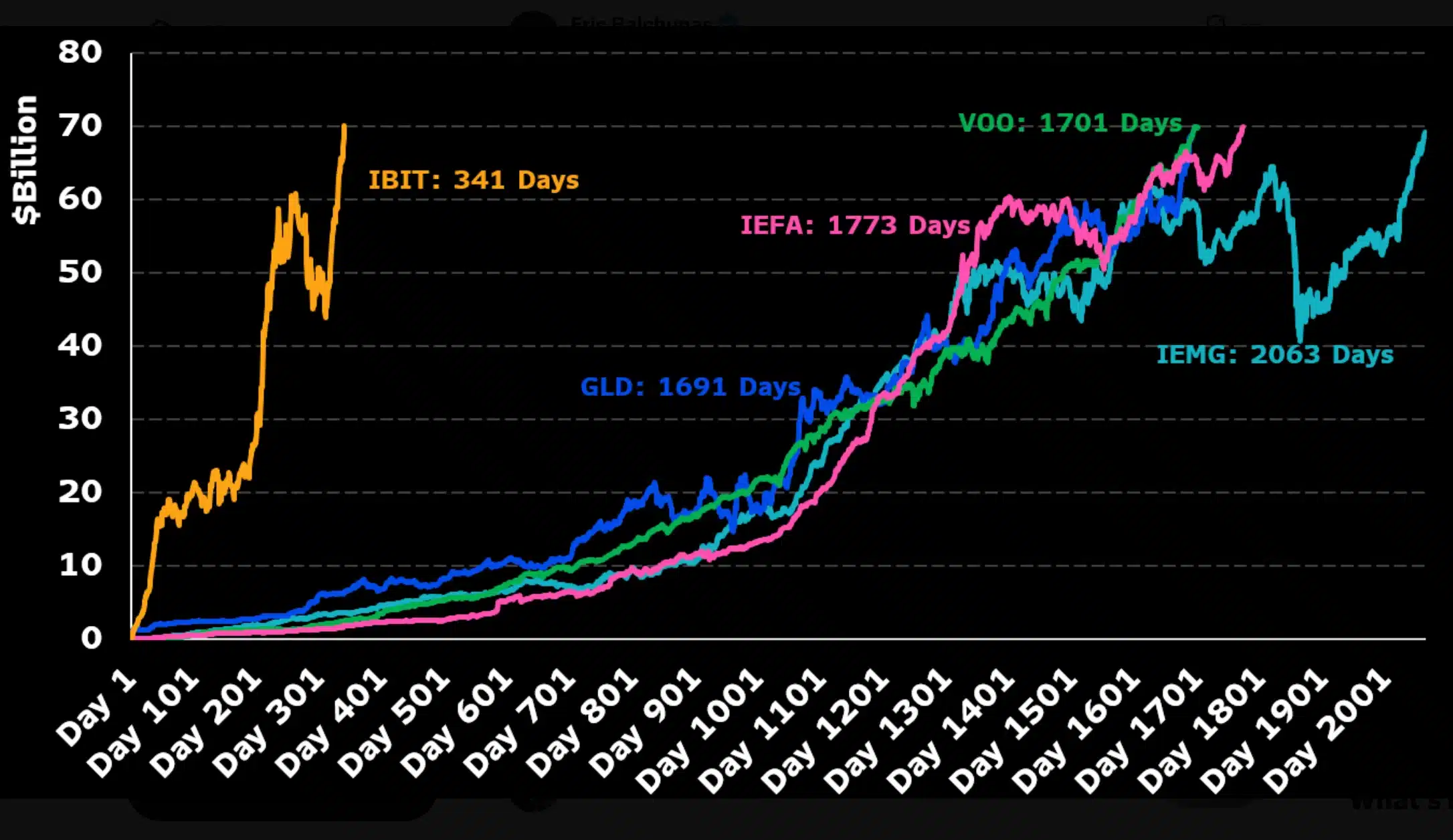

- BlackRock’s IBIT turned the quickest ETF to surpass $70 billion AUM in simply 341 days.

- IBIT held 661,000+ BTC, making it the biggest institutional Bitcoin holder globally.

BlackRock’s spot Bitcoin [BTC] ETF has made historical past by turning into the quickest exchange-traded fund to exceed $70 billion in property underneath administration.

The milestone displays broader market confidence and positions BlackRock’s providing as a possible game-changer within the evolution of crypto funding merchandise.

Analyst appreciates BlackRock’s IBIT development

Remarking on the identical, Eric Balchunas took to X (previously Twitter) and famous,

“IBIT simply blew by way of $70B and is now the quickest ETF to ever hit that mark in solely 341 days.”

Balchunas additionally highlighted that BlackRock’s IBIT is surpassing expectations, reaching $70 billion in property underneath administration practically 5 occasions quicker than SPDR Gold Shares (GLD)—the earlier record-holder.

Whereas GLD took over 1,600 buying and selling days to attain the milestone, BlackRock’s IBIT completed it in a fraction of the time, reinforcing its explosive market entry.

That being stated, since its 2024 debut, the ETF has secured over $9 billion in inflows in 2025 alone, incomes a spot among the many prime 5 U.S. ETFs.

This coincided with BlackRock just lately acquiring 2,704 Bitcoins valued at roughly $283.9 million, together with 28,239 Ethereum [ETH] tokens price an estimated $73.2 million.

Establishments leaping into IBIT

This rise in BlackRock’s prominence can also be being mirrored within the variety of establishments becoming a member of the checklist of embracing IBIT.

As an example, the Moscow Inventory Alternate has listed Bitcoin Futures tied to IBIT.

Moreover, JPMorgan has additionally deliberate to roll out ETF-backed loans, starting with BlackRock’s flagship crypto fund, indicating rising confidence and utility in Bitcoin-focused funding merchandise.

Therefore, with over 661,000 BTC underneath administration, BlackRock’s IBIT has formally grow to be the biggest institutional holder of Bitcoin, surpassing each Binance and Michael Saylor’s Technique.

What’s extra?

At the moment valued at $71.9 billion, the ETF’s meteoric rise has additionally positioned it to doubtlessly overtake even Satoshi Nakamoto’s estimated holdings by subsequent summer season, in accordance with Bloomberg’s Eric Balchunas.

Due to this fact, as IBIT shares commerce near $62 and Bitcoin crosses the $110,000 mark, the ETF continues to dominate its friends, securing practically $49 billion in web inflows since its 2024 debut.

As anticipated, this trajectory paints IBIT as essentially the most influential participant amongst spot Bitcoin ETFs within the U.S. market.