- Ethereum leads in social dominance and improvement exercise, sustaining a stronger developer presence.

- Each Ethereum and Solana present related whale curiosity, whereas Solana has decrease liquidation volumes.

With bullish sentiment from each crowd and good cash indicators, Solana [SOL] exhibits important upward momentum, sparking curiosity in whether or not it might rival Ethereum [ETH] as a number one platform for decentralized purposes (dApps).

At press time, Ethereum trades at $2,680.82, marking a 2.17% improve over the previous 24 hours.

In the meantime, Solana was priced at $178.27, reflecting a 1.43% decline throughout the similar interval. Inspecting key metrics—social dominance, improvement exercise, whale exercise, and liquidation information—highlights every community’s distinct place and strengths.

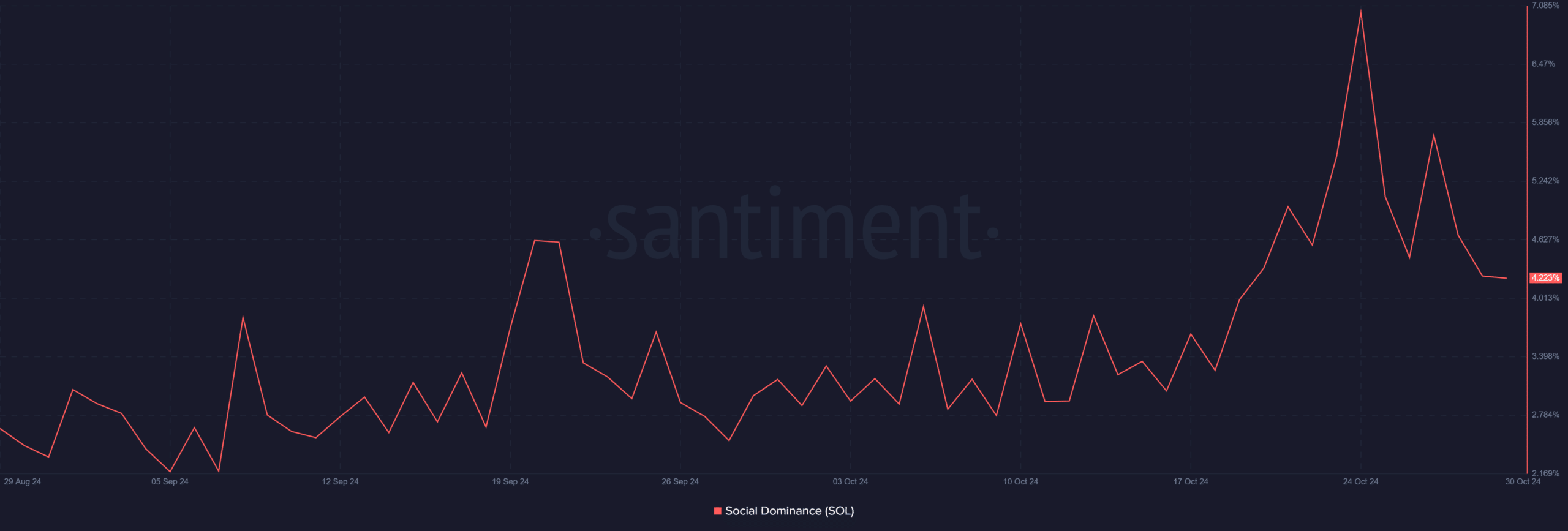

Social dominance: Does Ethereum nonetheless lead the dialog?

Ethereum instructions greater social dominance than Solana. Over the previous month, Ethereum’s social presence constantly peaked above 6%, whereas Solana’s highest level reached round 4.22%.

This metric measures the share of discussions and mentions on social platforms, reflecting the group’s curiosity ranges.

Consequently, Ethereum dominates on-line conversations greater than Solana. Nevertheless, Solana’s rising person base signifies upward momentum in its social presence, exhibiting rising consideration across the community.

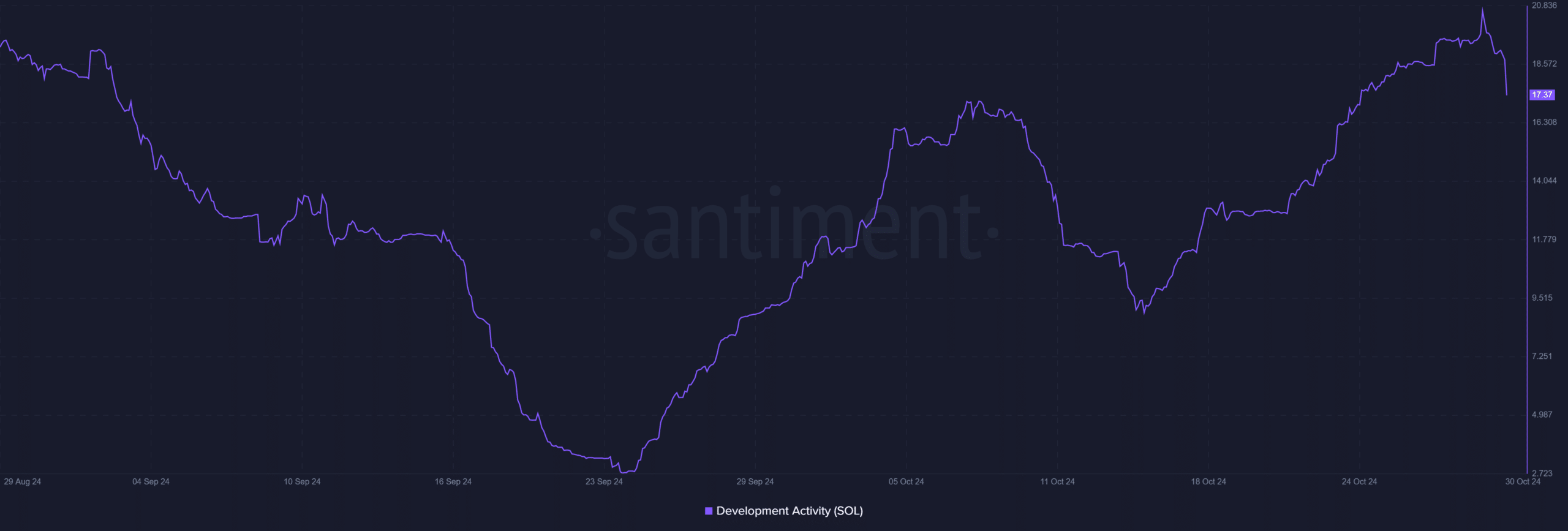

Growth exercise: Is SOL innovation rising quicker?

Ethereum at the moment leads in improvement exercise, with a rating of 25.5 in comparison with Solana’s 17.37. Growth exercise displays code updates, undertaking contributions, and ongoing upkeep, exhibiting the well being and progress of every ecosystem.

Subsequently, Ethereum advantages from a extremely energetic developer group centered on innovation and enhancements.

Moreover, Solana’s improvement exercise exhibits a optimistic pattern, indicating rising developer engagement. Nevertheless, it nonetheless trails Ethereum in absolute phrases, underscoring Ethereum’s longstanding developer dominance.

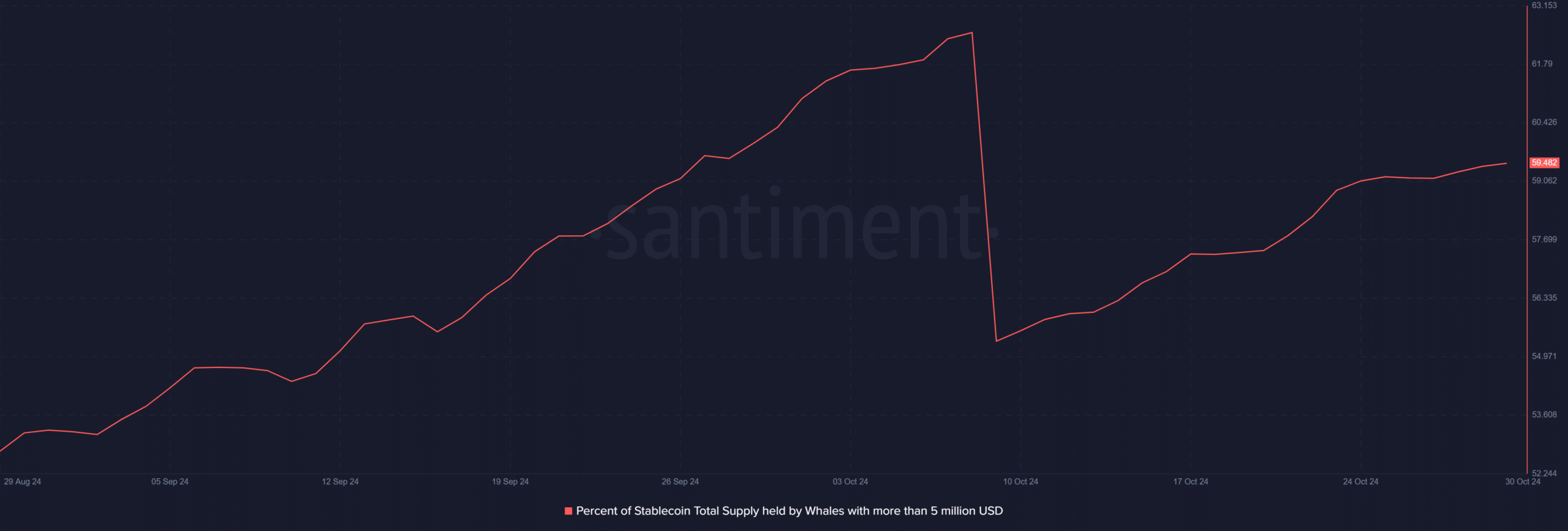

Whale exercise: Does SOL entice the larger traders?

Each Ethereum and Solana present important whale exercise, with every community’s high holders controlling roughly 59.48% of their stablecoin provide.

This excessive focus amongst massive holders displays robust curiosity from main traders throughout each ecosystems.

Consequently, whale curiosity is equally distinguished in Ethereum and Solana, suggesting that large-scale traders view each networks as precious belongings throughout the blockchain panorama.

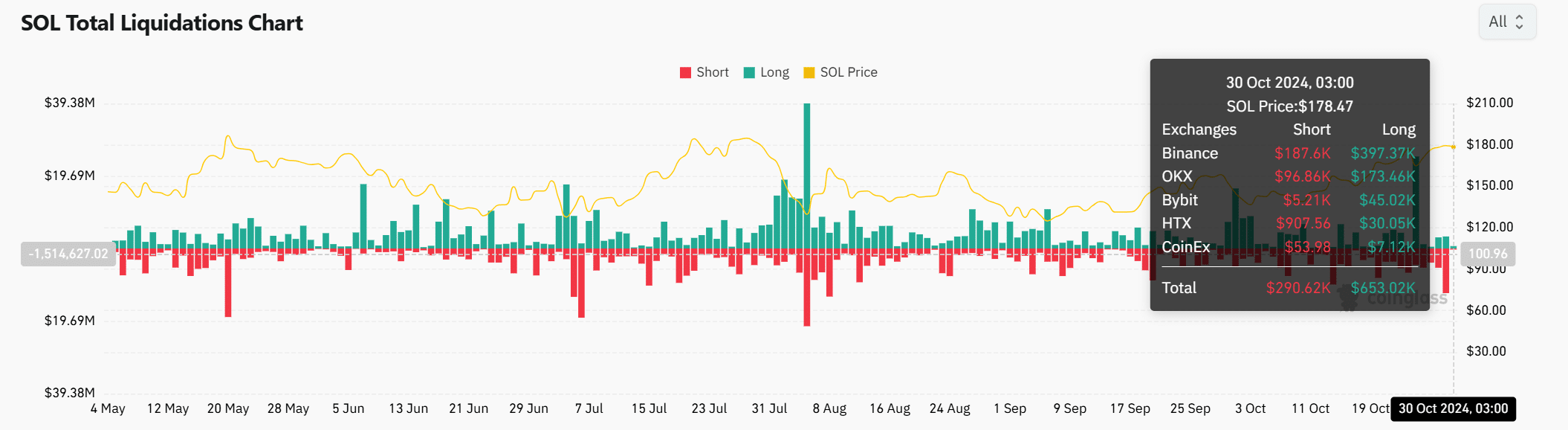

Liquidation information: Which community faces extra volatility?

Liquidation information supplies perception into leverage-driven exercise. At the moment, Solana has skilled $653K in lengthy liquidations and $290K in shorts. By comparability, Ethereum noticed greater liquidation volumes, with $1.93M in lengthy liquidations and $3.94M in shorts.

Subsequently, Ethereum’s greater leveraged buying and selling exercise suggests it could encounter extra frequent worth swings, whereas Solana’s decrease liquidation ranges indicate comparatively much less volatility below sure circumstances.

Is your portfolio inexperienced? Take a look at the SOL Profit Calculator

Conclusion

Throughout social dominance, improvement exercise, whale involvement, and liquidation information, Ethereum maintains an edge in a number of metrics. Nevertheless, Solana exhibits concentrated funding from massive holders and rising developer curiosity, signaling potential progress.

Whereas Ethereum’s broader person and developer base at the moment reinforces its dominance, Solana’s upward trajectory makes it a aggressive drive within the blockchain house.