- ETH customers flip to non-public transactions over frontrunning

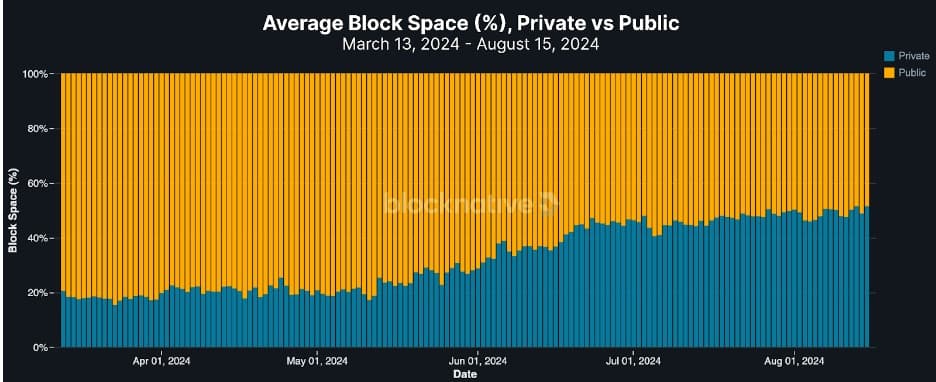

- Personal transactions comprised 30% of the full quantity, however consumed 50% of Ethereum’s gasoline.

All year long, crypto markets have skilled vital adjustments, growth, and elevated volatility.

Amidst these market adjustments, Ethereum [ETH] has witnessed development in community exercise, income, and tackle. Equally, the previous 12 months has seen a substantial surge in personal transaction order circulate.

Ethereum customers favor personal transactions

In response to analysis by Blocknative, the Ethereum community has witnessed a excessive improve in personal transaction order circulate.

Information indicated that personal transactions consumed greater than 50% of complete ETH L1 block house primarily based on gasoline utilization. However regardless of this, personal transactions solely make up 30% of all transactions inside the ETH L1 block.

Customers select to transmit transactions privately for MEV safety, particularly when conducting advanced transactions.

Such transactions are basically gasoline intensive and thus eat extra gasoline per transaction than non-MEV transactions.

Primarily, gasoline used straight pertains to the financial worth of block house. Due to this fact, each unit of gasoline represents a share of the block’s capability and financial development.

Base charges volatility will increase

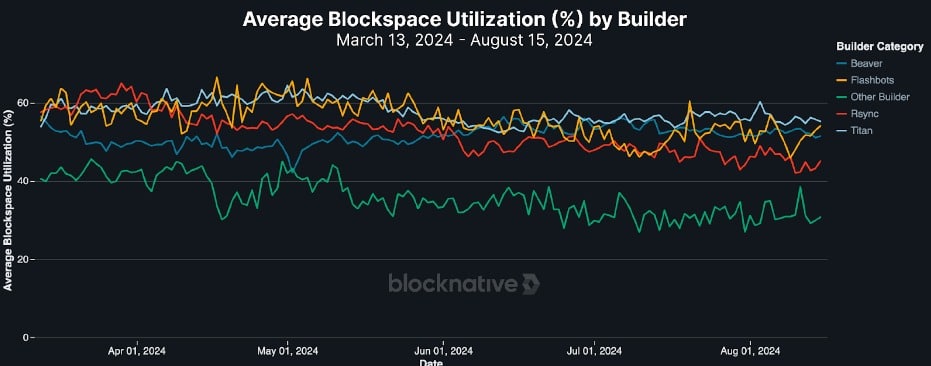

The rise in personal transactions and gasoline use has affected ETH’s base charges. The 2021 EPI-1559 improve modified the dynamic base charges, which might change primarily based on the house’s dimension.

Due to this fact, the elevated personal transactions have influenced base charges, rising volatility. Due to this fact, personal transactions end in “vanilla blocks,” making the bottom charges unstable.

Such volatility is an obstacle for community customers, as elevated personal transactions have an effect on base charges, particularly when coping with main customers corresponding to Titan, Rsync, Beaver, and Flashbots.

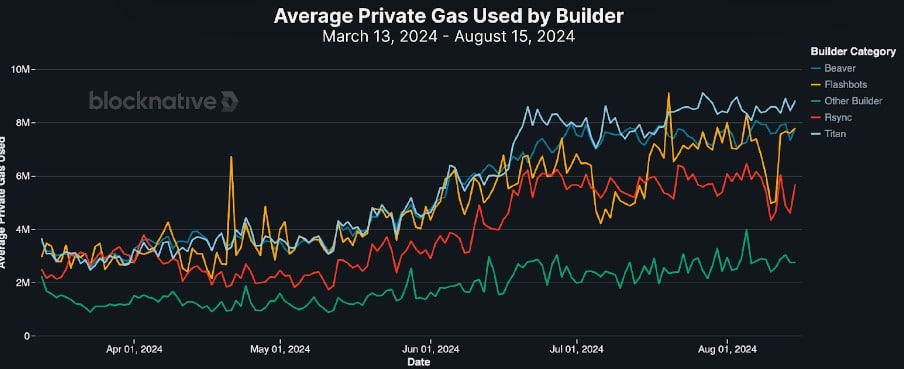

For example, prime builders have elevated their personal transactions all year long.

As mirrored within the chart above, Titan elevated their gasoline utilization from 3.5 million to eight.5 million by personal transactions from March.

Is your portfolio inexperienced? Take a look at the ETH Profit Calculator

Different prime gamers, corresponding to Beaver, have elevated their utilization from 3 million to 7.5 million, and Rsync from 2.5 million to six million.

This surge has big implications, pushing many customers out of the sport. That is evident as small builders are declining gasoline utilization as most wrestle to achieve 15 million set by the 2021 EIP-1559 improve.