- Ethereum fell 24% in seven days amidst the broader crypto market massacre.

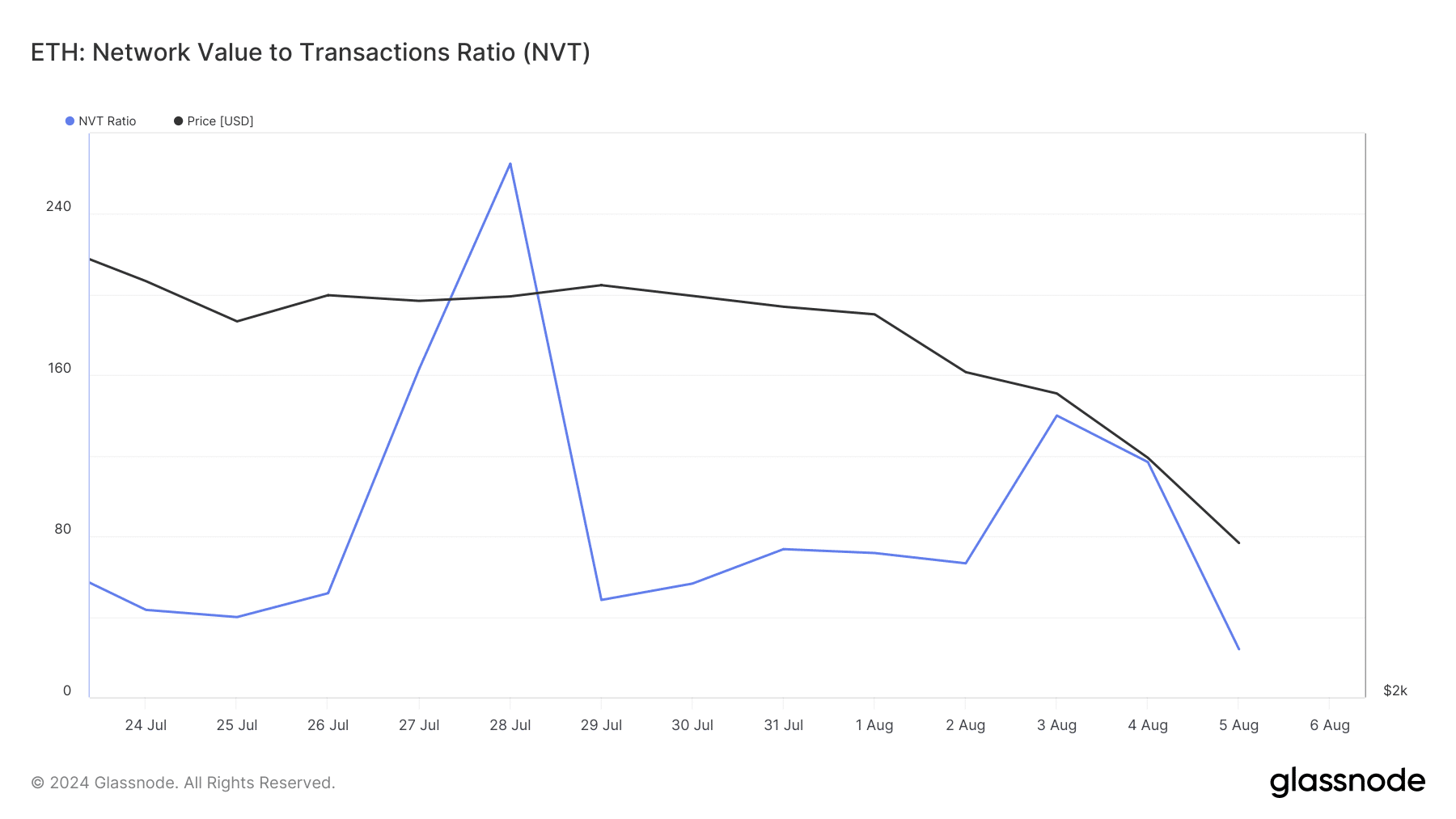

- Although promoting strain remained excessive, the NVT ratio dropped, exhibiting elevated probabilities of a value rebound quickly.

Ethereum [ETH] has witnessed a serious setback final week as its value dropped in double digits. Nevertheless, the token has proven indicators of restoration within the final 24 hours.

Let’s have a greater have a look at Ethereum’s present state to know what’s happening with the token.

Ethereum’s destiny

CoinMarketCap’s data revealed that ETH was down by greater than 24% over the past seven days. On the time of writing, ETH was buying and selling at $2,514.29 with a market capitalization of over $302 billion.

Whereas that occurred, Lookonchain, a preferred X (previously Twitter) deal with, not too long ago posted a tweet concerning a notable growth.

As per the tweet, a pockets of LonglingCapital transferred 20,000 ETH, value over $50.3 million, to pockets “0x3478” after being dormant for practically two years.

Subsequently, AMBCrypto deliberate to have a greater have a look at the token’s state to search out out what to anticipate.

Which means is ETH headed?

As per our evaluation of Glassnode’s information, Ethereum’s NVT ratio dropped sharply. Each time the metric drops, it means that an asset is undervalued, indicating that the probabilities of a value enhance are excessive.

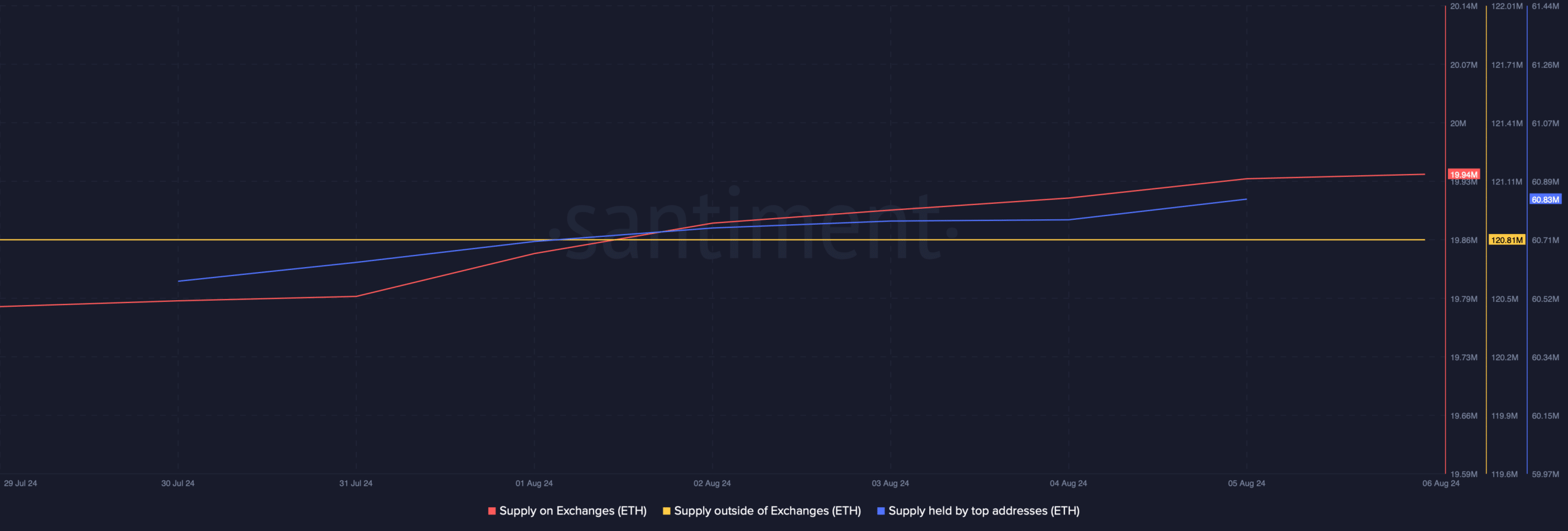

AMBCrypto then took a have a look at Santiment’s information. As per our evaluation, ETH’s provide on exchanges elevated over the past seven days. This meant that promoting strain was excessive.

Its provide exterior of exchanges was flat, that means that traders weren’t actively shopping for ETH at press time. Nevertheless, whales have been shopping for ETH, which was evident from that rise in its provide held by prime addresses

What to anticipate from Ethereum

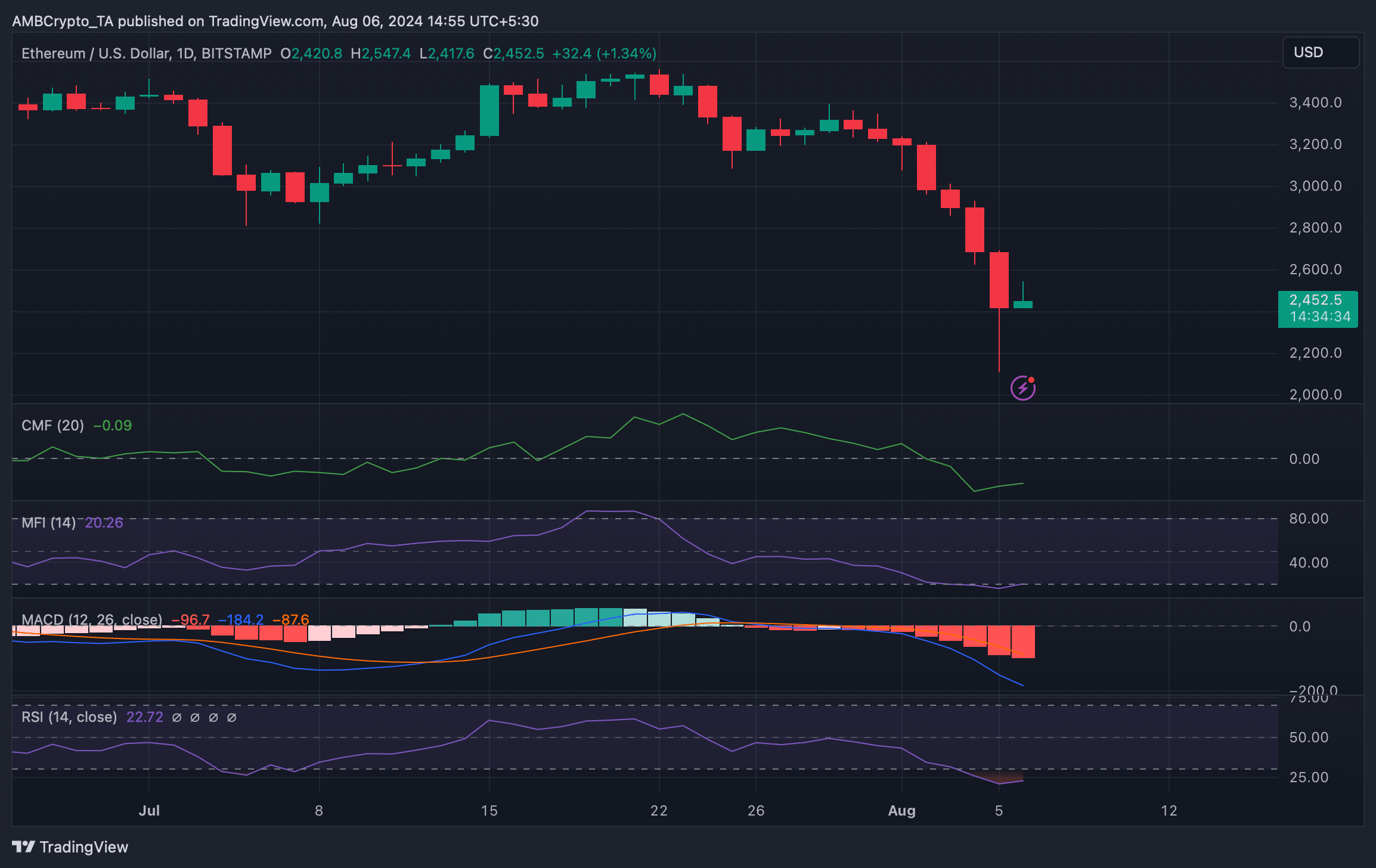

AMBCrypto took a have a look at ETH’s each day chart to raised perceive what to anticipate from it. As per our evaluation, the technical indicator MACD displayed a bearish benefit out there.

Each the Relative Energy Index (RSI) and Cash Stream Index (MI) have been within the oversold zone. These indicators steered that there have been excessive probabilities of ETH to get better from its losses.

Moreover, the Chaikin Cash Stream (CMF) registered an uptick, additional indicating that ETH’s value would possibly enhance within the coming days.

Learn Ethereum’s [ETH] Price Prediction 2024-25

Our evaluation of Hyblock capital’s information revealed that if ETH turns bullish, then it’d quickly reclaim the $3.3k mark. This was the case as liquidation would rise on the degree, which frequently ends in value corrections.

Nevertheless, if the bears proceed to manage the mallet, then it received’t be shocking to witness ETH dropping to $2k within the coming days.