- Ethereum whales scooped up over 1.49 million ETH during the last 30 days.

- Binance information 100k ETH value $250 million in influx, signaling aggressive promoting exercise.

Ethereum [ETH] hovered between $2.4K and $2.5K over the previous two weeks, struggling to interrupt out after final month’s drop from $2.8K to $2.1K.

This continued worth stagnation sparked diverging reactions throughout the board, from whales accumulating to different traders aggressively closing positions.

Whales scoop up ETH on the quiet

Whereas Ethereum has did not report vital positive factors over the previous month, whales took the chance to build up.

Massive holders have accrued 1.49 million ETH over the previous month, elevating their complete stability by 3.72%. In truth, this wasn’t only a one-off, both.

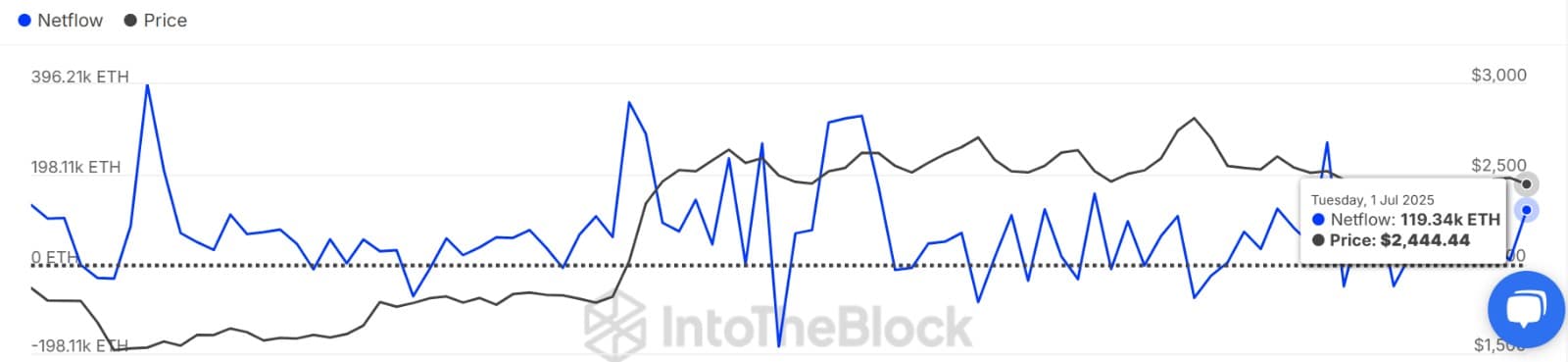

On the first of July, whale purchases hit 704K ETH, outpacing the 585K ETH bought, resulting in a soar in Massive Holders’ Netflow from 9.8K to 119.3K.

Naturally, this sort of internet influx indicators accumulation. When whales purchase greater than they promote, it typically means they’re positioning forward of a transfer.

However wait!

Surprisingly, whereas whales are aggressively accumulating different gamers, together with establishments and small-scale traders, are promoting.

Take the Ethereum Basis, for instance. As reported by Lookonchain, the group has been transferring 1,000 ETH value $2.46 million every day to Multisig.

Up to now, they’ve offloaded a whopping complete of 13k ETH value $32 million.

This divergence raises a key query: Is that this simply profit-taking or a cautious shift?

Retail is sending ETH to exchanges

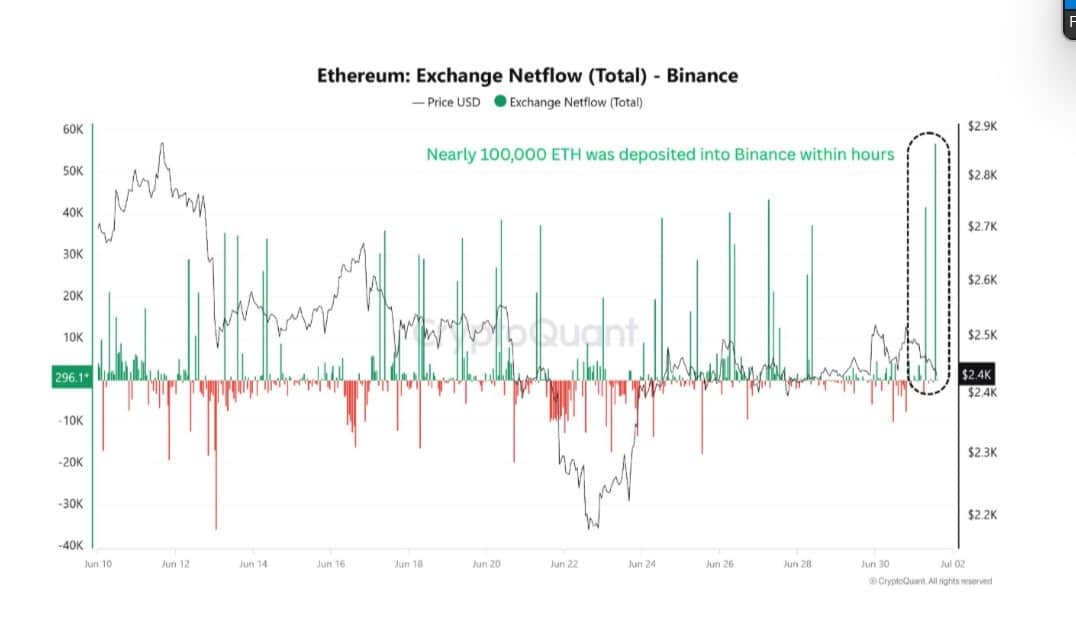

Supply: CryptoQuant

On high of that, CryptoQuant information confirmed a big spike in Ethereum’s Alternate Inflows. Binance alone noticed 100K ETH value $250 million enter its reserves in a single day.

Massive Alternate Inflows usually counsel a rise in Ethereum reserves held on exchanges. Traditionally, such actions precede short-term worth declines, particularly if accompanied by low capital influx.

The 2 conflicting paths for Ethereum

As noticed above, whereas whales accumulate, different market gamers are promoting. This accumulation offered a powerful help flooring, contrasting with small-scale traders who’ve been taking revenue.

This tug-of-war has pushed Ethereum right into a state of indecision.

The altcoin’s RSI Divergence Indicator hovered round 48.62 at press time.

At these ranges, this momentum indicator instructed that markets are in a cool-down interval, ready for the following catalyst.

Due to this fact, the following transfer depends upon who finishes the battle strongly between the accumulating addresses and the revenue takers.

If consumers proceed whereas sellers exhaust, the altcoin will reclaim $2548 and eye a breakout to $2.7k.

Nonetheless, if sellers outweigh consumers, Ethereum may decline to $2,372, breaching the decrease boundary of the consolidation.