- Grayscale continued to have the biggest market share in ETH spot ETFs.

- Shopping for strain was rising, and a metric advised that ETH was undervalued.

Ethereum [ETH] ETFs have showcased commendable efficiency over the previous few days. In truth, its netflows have as soon as once more reached a brand new excessive, reflecting excessive adoption and traders’ belief. Regardless of this, ETH has been struggling to cross the $4k barrier.

Ethereum ETFs set a brand new report

Lookonchain’s latest tweet identified that previously month, 9 Ethereum ETFs have accelerated their holdings of ETH, totaling 362,474 ETH, which have been value over $1.42 billion.

This marked a 4,363% improve in comparison with the earlier month, throughout which solely 8,121 ETH, value over $31.8 million, have been added.

The higher information was that the ETH ETFs inflows reached a excessive. As per Coinglass information, ETH ETF netflows have been on the rise for the previous few weeks. On the fifth of December, netflows hit a whopping $428.5 million, setting a brand new report.

Mentioning the market share, Grayscale ETF had the biggest market share of 47%, as per Dune Analytics’ data.

Grayscale was adopted by Grayscale Mini and BlackRock, which had 13% and 12%, respectively. Whereas Grayscale’s holdings touched $5.8 billion, BlackRock’s holdings stood at $2.9 billion.

ETH’s wrestle continues

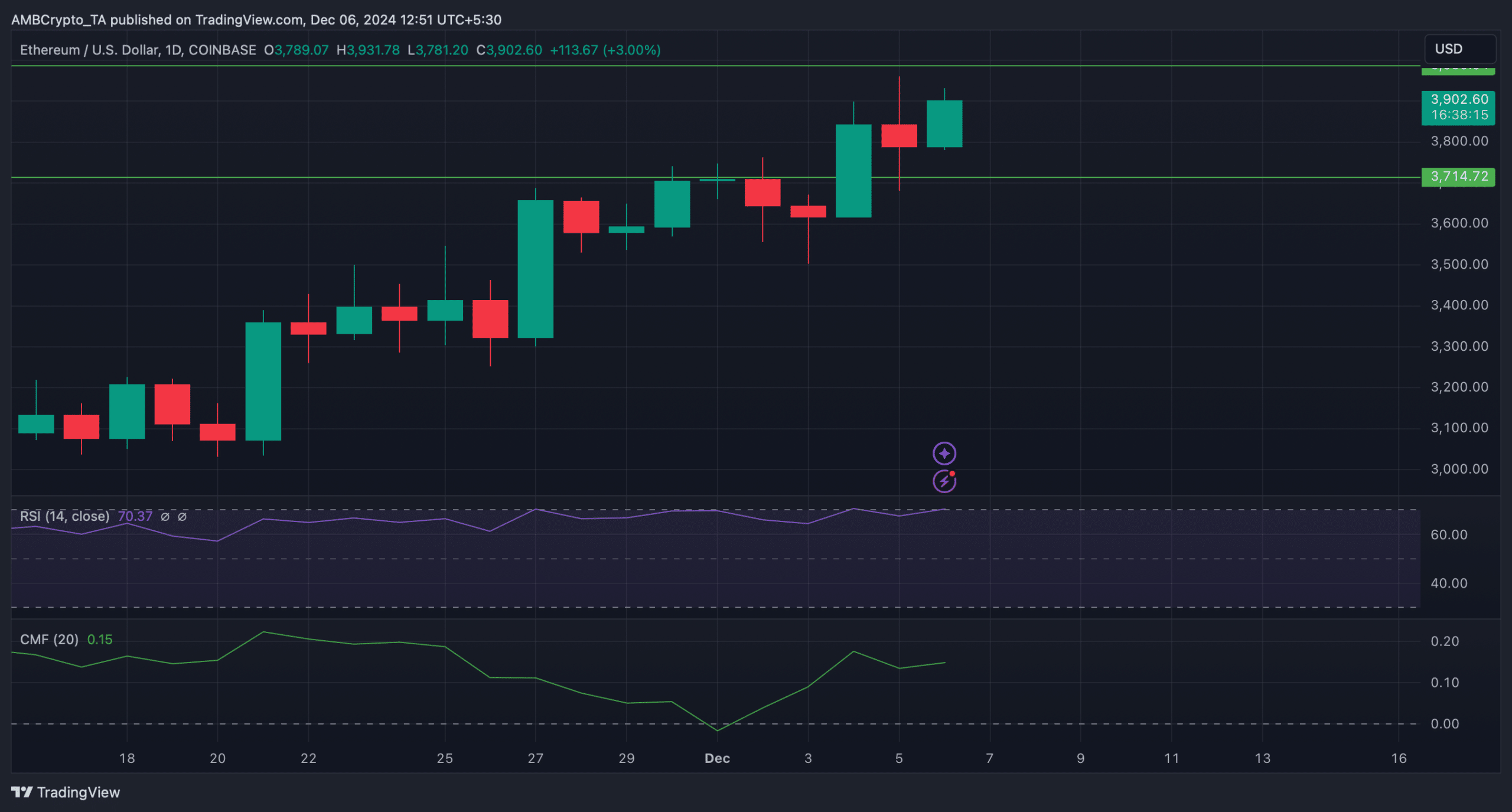

Whereas Ethereum ETFs set a brand new report, ETH was getting rejected on a number of events close to the $4k resistance. At press time, the king of altcoins was buying and selling at $3,912.25 with a modest 1.3% worth rise previously 24 hours.

Although the token was struggling to breach a barrier, the Ethereum Rainbow Chart advised traders stay affected person. As per the chart, ETH worth was within the HOLD zone, that means that the possibilities of the token marching upward within the coming days are excessive.

In truth, a number of different information units additionally hinted at the same chance. In accordance with Glassnode’s information, Ethereum’s NVT ratio registered a pointy decline. Each time the metric drops, it implies that an asset is undervalued, indicating that the possibilities of a worth improve are excessive.

The technical indicator Relative Power Index (RSI) moved northward. This meant that purchasing exercise was rising. A hike in shopping for strain typically ends in worth upticks.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Notably, the Chaikin Cash Movement (CMF) additionally adopted the same growing pattern.

If ETH as soon as once more approaches the $4k resistance and is backed by sturdy shopping for strain, then it gained’t be formidable to count on the token flipping the $4k resistance into its new help within the coming days.