Ethereum has been struggling beneath the $2,800 mark for days, unable to reclaim it as assist to kickstart a restoration rally. This key stage stays a big barrier for bulls, and because the value continues to consolidate beneath it, bearish sentiment is rising. Many analysts name for a continuation of the downtrend, reflecting the downbeat temper out there. Traders, who as soon as believed Ethereum would rally alongside Bitcoin this 12 months, are actually exhibiting indicators of doubt.

Associated Studying

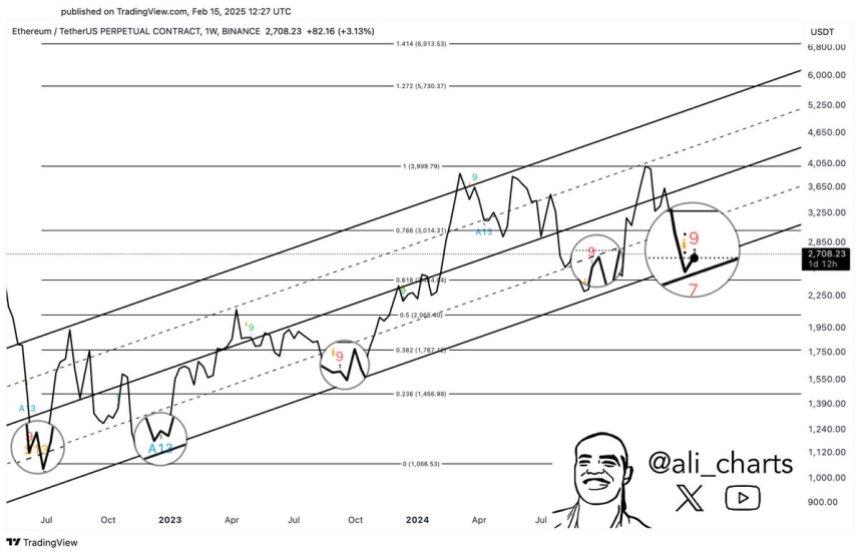

Nevertheless, not everyone seems to be bearish. Some buyers stay optimistic, pointing to indicators that Ethereum could also be gearing up for a restoration section. Crypto analyst Ali Martinez just lately shared a technical evaluation revealing that the TD Sequential indicator has flashed a purchase sign on Ethereum’s weekly chart. This uncommon occasion has traditionally indicated the start of a big development reversal. Martinez factors out that at any time when this indicator is triggered in the course of the weekly timeframe, Ethereum typically follows with sturdy upward momentum, signaling a possible bullish section forward.

As Ethereum hovers beneath the $2,800 resistance, merchants and buyers are watching intently. If historical past repeats itself and the TD Sequential sign proves correct, Ethereum could surprise the market with an aggressive transfer into increased value ranges.

Ethereum Prepares For A Restoration Section

Ethereum is testing vital liquidity beneath the $3,000 stage, a big psychological value level that analysts imagine will decide Ethereum’s efficiency within the coming weeks. This stage has grow to be a battleground between bulls and bears, with sentiment out there remaining extremely divided.

Retail buyers, shedding confidence within the potential for a near-term restoration, proceed to promote, contributing to downward strain on the worth. In the meantime, bigger gamers seem like benefiting from the dip, accumulating Ethereum at an accelerated tempo, signaling confidence within the asset’s long-term potential.

Martinez just lately shared a technical analysis on X, highlighting a big historic sample on Ethereum’s weekly chart. Martinez famous that every time the TD Sequential indicator has flashed a purchase sign close to the decrease boundary of Ethereum’s long-term ascending channel, costs have traditionally rebounded with energy. This indicator, extensively utilized by merchants to identify development reversals, means that Ethereum could also be nearing a pivotal second.

In accordance with Martinez, an analogous setup is unfolding now as Ethereum consolidates just under key resistance ranges. If the TD Sequential sign performs out because it has previously, Ethereum might be gearing up for a strong restoration rally. Reclaiming the $3,000 stage and holding it as assist would mark step one towards reversing the bearish development and initiating a long-term uptrend. The approaching weeks will likely be essential for Ethereum as buyers look ahead to indicators of a breakout or an extra decline.

Associated Studying

ETH Consolidates Earlier than A Large Transfer

Ethereum (ETH) is buying and selling at $2,690 after days of sideways buying and selling and market indecision. This era of stagnation has left buyers speculating concerning the short-term route of ETH, as sentiment stays divided between bullish restoration and additional draw back potential. The dearth of momentum above key resistance ranges has contributed to uncertainty, with each bulls and bears struggling to take decisive management.

For Ethereum to provoke a restoration uptrend, bulls should reclaim the $2,800 mark as assist. This vital stage has acted as a key barrier in current weeks, and breaking above it will pave the way in which for a push towards the $3,000 mark. A profitable transfer above $3,000, a psychological and technical resistance stage, would affirm a reversal of the downtrend and set up bullish momentum out there.

Associated Studying

Nevertheless, the chance of additional draw back stays if ETH fails to reclaim the $2,800 stage. A retracement might take the worth into decrease demand zones round $2,500, the place stronger assist could also be discovered. The following few buying and selling classes will likely be vital, as Ethereum’s value motion will doubtless dictate market sentiment and affect its short-term trajectory. Traders are watching intently for a decisive breakout or additional consolidation because the market stays unsure.

Featured picture from Dall-E, chart from TradingView