- Ethereum’s value elevated by over 25% within the final seven days.

- Most metrics hinted at a value correction within the short-term.

Ethereum [ETH] witnessed an enormous value improve over the past week as its value sat comfortably above the $3.7k mark.

Whereas the token’s value gained bullish momentum, whales acted in an attention-grabbing method as indicators of excessive accumulation emerged.

Ethereum whales are stockpiling

CoinMarketCap’s data revealed ETH had fairly a couple of much less unstable days final week. Issues modified on the twenty first of Might as ETH turned bullish. The token’s value elevated by greater than 25% over the past seven days.

On the time of writing, ETH was buying and selling at $3,789.10 with a market capitalization of over $455 billion.

Aside from value, the variety of ETH transactions additionally elevated.

As per a current tweet from IntoTheBlock, the variety of ETH transactions bigger than $100k spiked strongly, reaching its highest level since late March. Quite a lot of the transactions have been made by whales.

The tweet additionally talked about that ETH addresses holding greater than 0.1% of the provision confirmed the very best day by day accumulation in additional than a month, suggesting that whales have been shopping for ETH.

AMBCrypto then checked Ethereum’s on-chain metrics to seek out whether or not shopping for sentiment was general dominant out there.

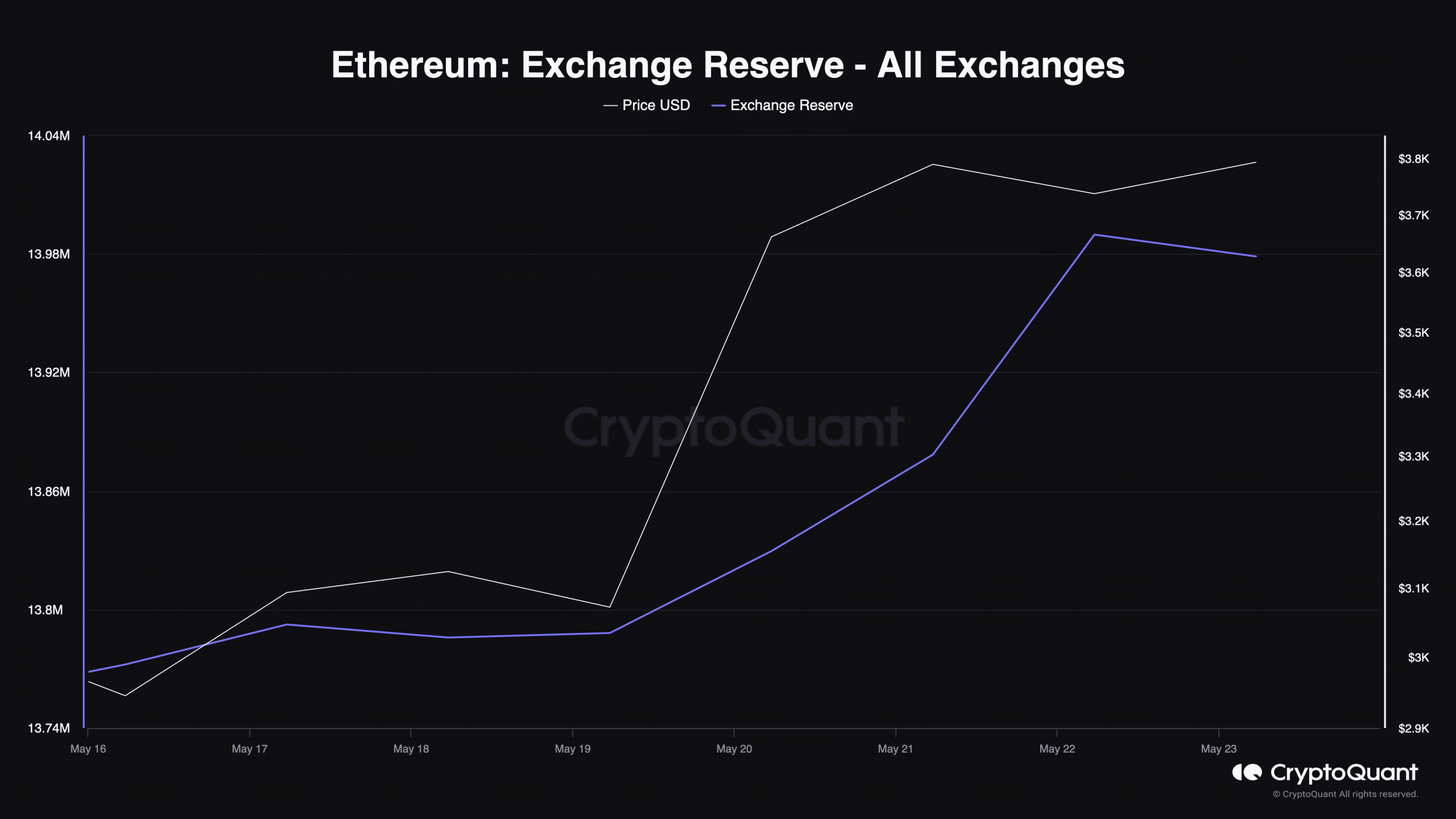

We discovered that after a spike on the twenty second of Might, ETH’s alternate reserve began to drop.

As per CryptoQuant, ETH’s internet deposit on exchanges was low in comparison with the final seven-day common, additional establishing the truth that shopping for strain was excessive.

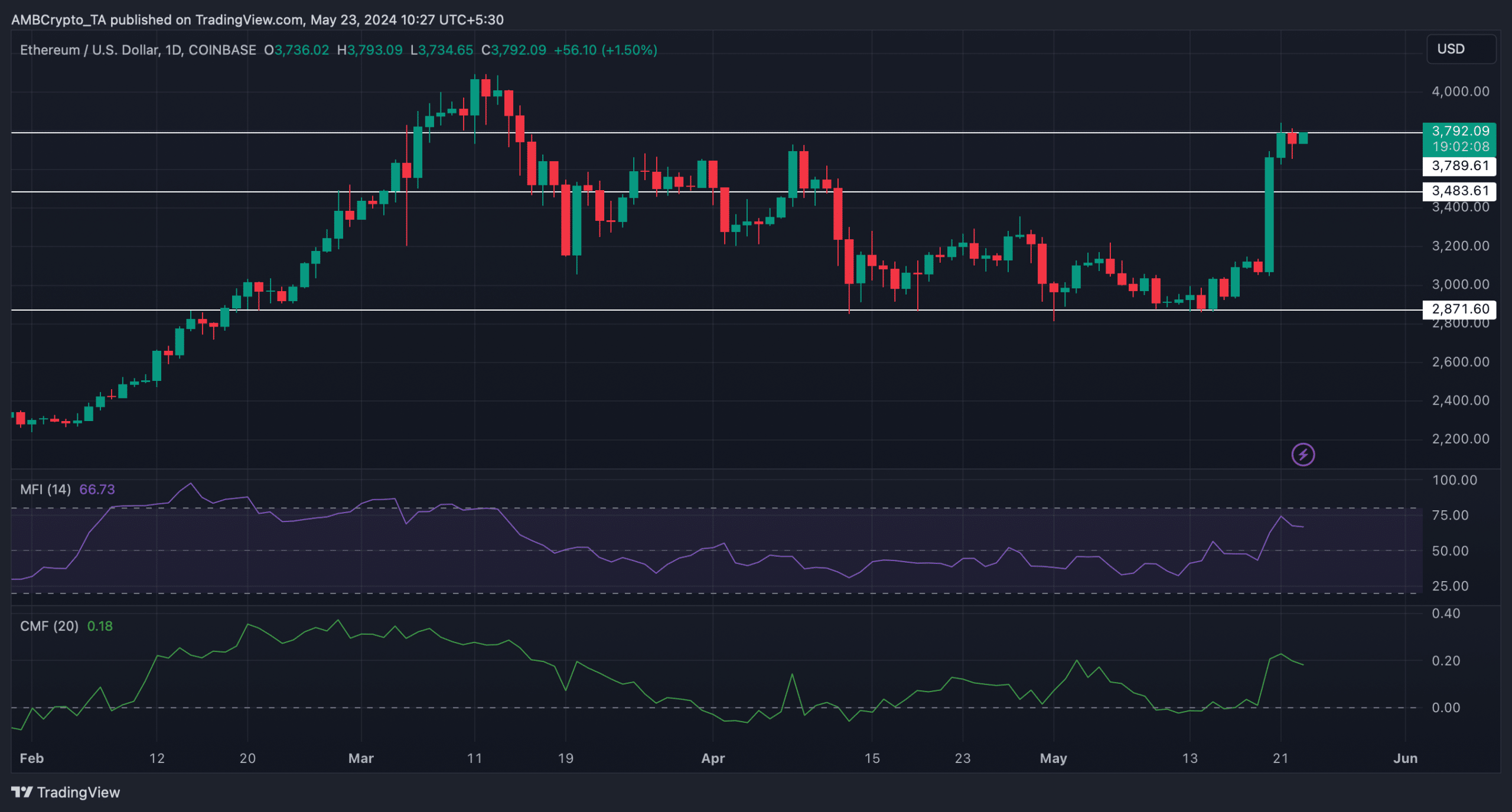

Nevertheless, the buildup section would possibly finish quickly as ETH’s Relative Power Index (RSI) entered the overbought zone.

This would possibly encourage traders to promote and, in flip, push the token’s value down in coming days.

Is a value correction inevitable?

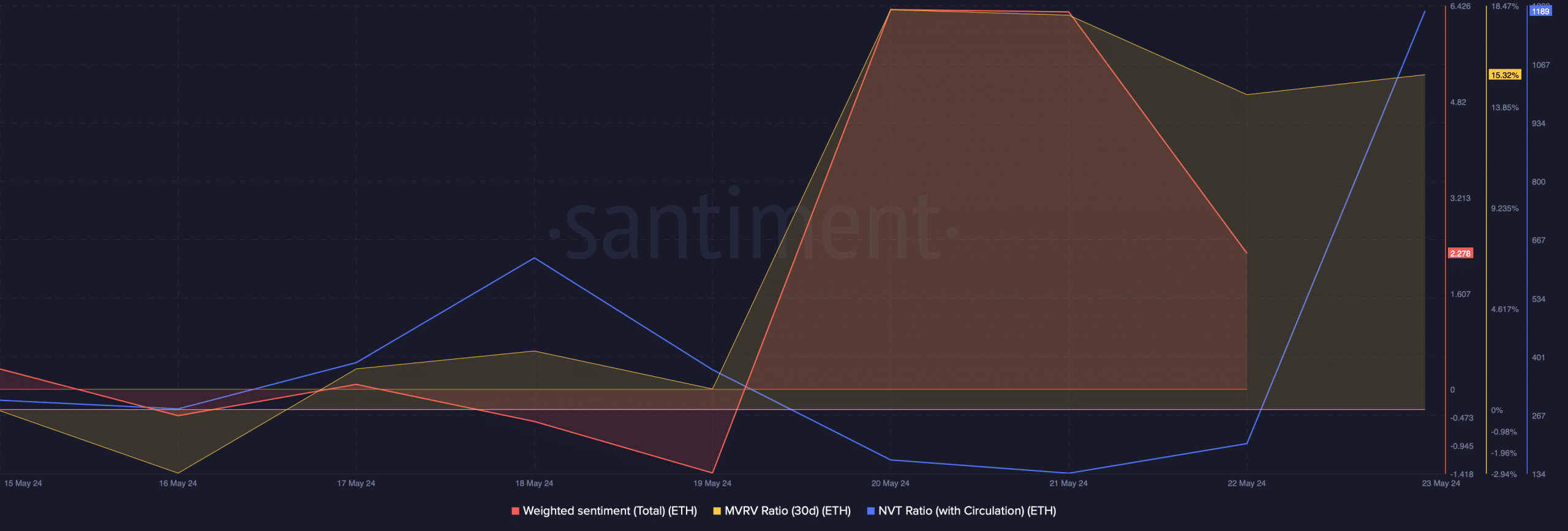

AMBCrypto then analyzed Santiment’s information to grasp whether or not the token was awaiting a value drop.

We discovered that ETH’s Weighted Sentiment declined in the previous few hours, that means that bullish sentiment across the token dropped. Its NVT ratio additionally registered an enormous spike.

An increase within the metric signifies that an asset is overvalued, rising the possibilities of a value drop.

Nonetheless, the MVRV ratio remained bullish, because it had a price of over 15% at press time.

Is your portfolio inexperienced? Try the ETH Profit Calculator

Like most metrics, a couple of market indicators additionally seemed bearish. For instance, the Cash Stream Index (MFI) registered a downtick. The Chaikin Cash Stream (CMF) adopted an analogous development, hinting at a value correction.

If ETH turns nearish, then traders would possibly witness ETH falling to $3.4k. On the contrary, with a purpose to maintain the complete rally, ETH should flip its $3.79k resistance into its help.