- Ethereum whale that will have signaled July’s draw back has began promoting in bulk once more

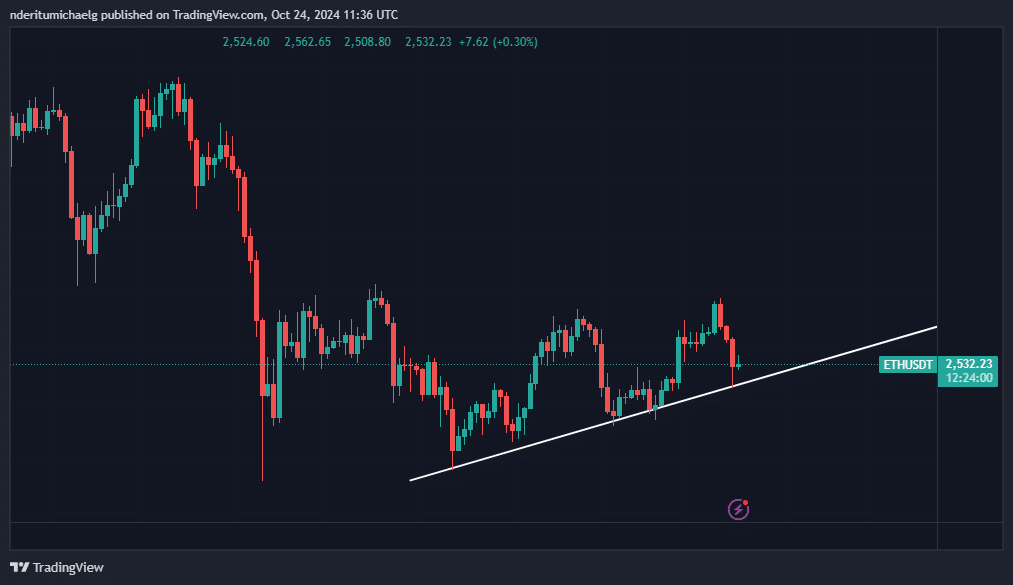

- Price assessing the potential for a assist bounce being cancelled

What occurs when a whale begins to dump a few of the ETH they acquired way back to the Ethereum ICO stage? This type of situation lately performed out, in response to Lookonchain. And, it might have important penalties.

New findings point out {that a} whale that participated within the Ethereum ICO simply offloaded 3,000 ETH. Lookonchain’s analysis revealed that the identical whale deal with beforehand offered 7,000 ETH at first of July this 12 months. Why is that this essential? Effectively, it might underscore some correlation with the altcoin’s value motion.

A 15% ETH value dip occurred after July’s sale, suggesting that information about such a big sale could also be seen as a promote occasion. This additionally alludes to the likelihood that the market might reply with a surge in promote strain within the coming days.

ETH, at press time, was already beneath a variety of promote strain. It was right down to a $2,526 on the time of writing, after pulling again by about 8% from its weekly excessive. Extra importantly, it retested a brief time period ascending assist line within the final 24 hours, with a little bit of a bounceback.

Merely put, Lookonchain’s evaluation concerning the Ethereum ICO whale means that extra promote strain might come within the coming days. This could be a opposite end result to the likelihood that ETH may bounce from the aforementioned ascending assist.

Extra ETH volatility incoming, however which path?

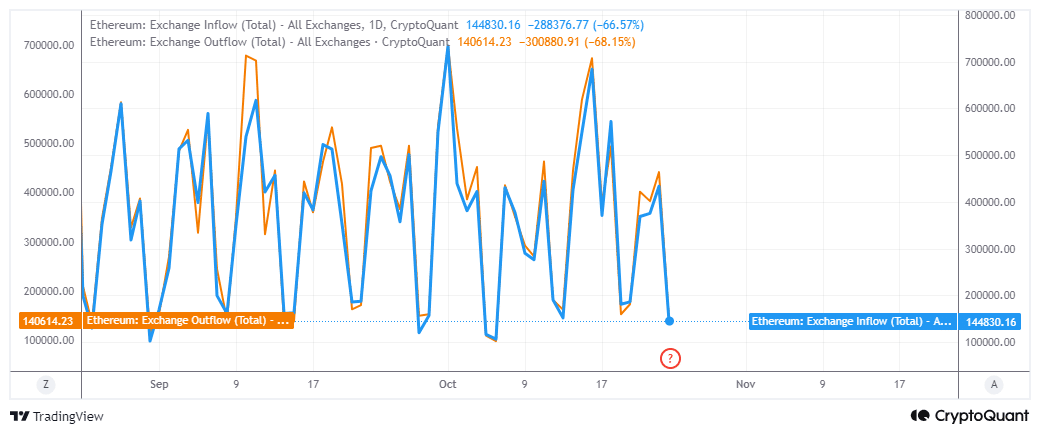

ETH’s alternate circulation information revealed that each alternate inflows and outflows dropped to ranges the place they’re more likely to pivot within the subsequent few days.

This implies we might observe one other surge in volatility. Nonetheless, this might nonetheless go both means.

Change influx information was greater during the last 24 hours at 144,830 ETH. As compared, alternate outflow information was decrease at 140,614 ETH, on the time of writing. This meant that there was greater promote strain than purchase strain. Nonetheless, the value appeared to have bottomed out on the assist degree and the explanation for this will likely have been whale exercise.

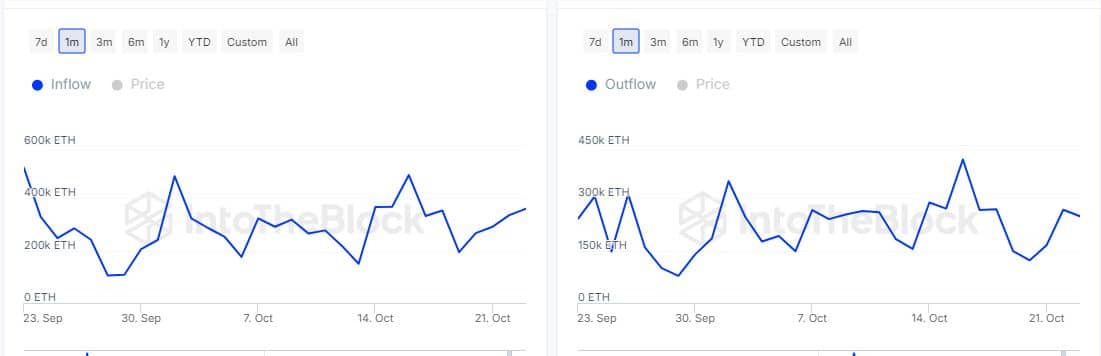

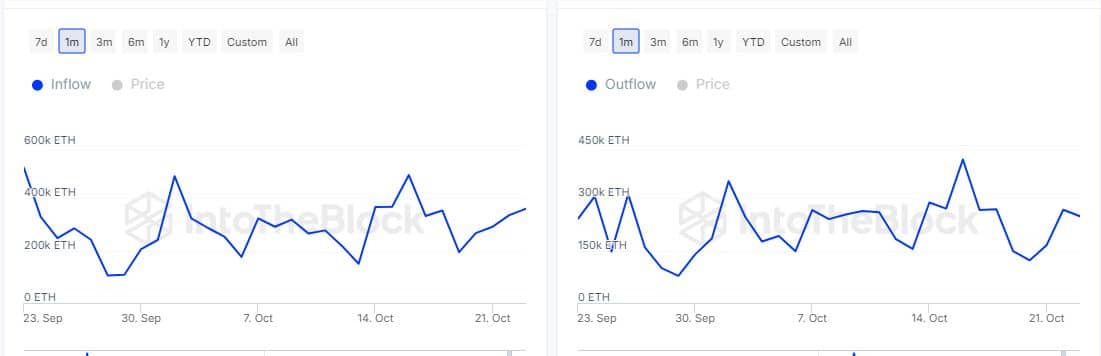

Information from IntoTheBlock additionally revealed that the quantity of ETH flowing into giant holder addresses was greater at 360,320 ETH. In the meantime, outflows from giant holder addresses had been right down to 248,590 cash.

Supply: IntoTheBlock

Lastly, the possession information confirmed that whales have been accumulating at latest lows.

Nonetheless, the shortage of a big value uptick over the last 24 hours confirmed a big diploma of uncertainty, one which might result in weak demand.