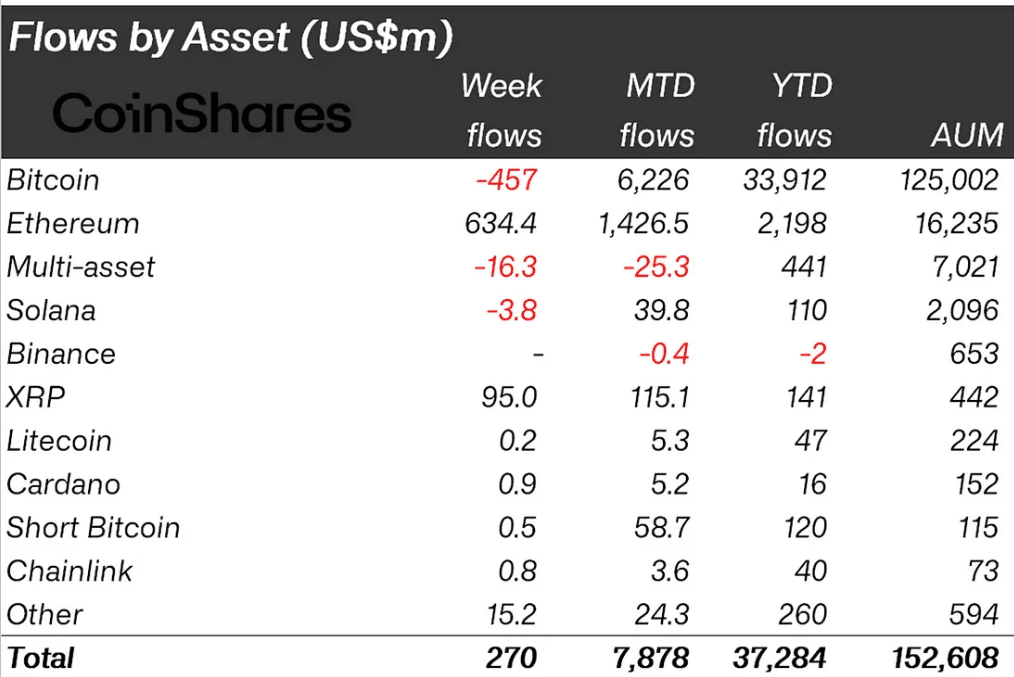

- Ethereum units a brand new year-to-date influx document at $2.2 Billion, beating its 2021 highs.

- ETH may hit $10K within the midterm if extra chain actions proceed to thrive.

Ethereum [ETH] set a brand new document for inflows, reaching $2.2B year-to-date, surpassing its earlier document of 2021.

The current inflows accounted for $634 million, indicating a big enhance in investor confidence and market sentiment.

The surge was attributed to Ethereum ETFs’ sturdy efficiency. These ETFs have develop into a most popular car for traders as they provide publicity to ETH with out direct funding within the digital forex.

The rising institutional curiosity was evident as massive sums proceed to be directed in direction of Ethereum-based funding merchandise.

Regardless of some fluctuations and market volatility, the general pattern for Ethereum appeared bullish, with the elevated institutional backing offering a stable basis for future development.

These developments coincided with total growing inflows into crypto ETPs, with Ethereum main the way in which alongside Bitcoin.

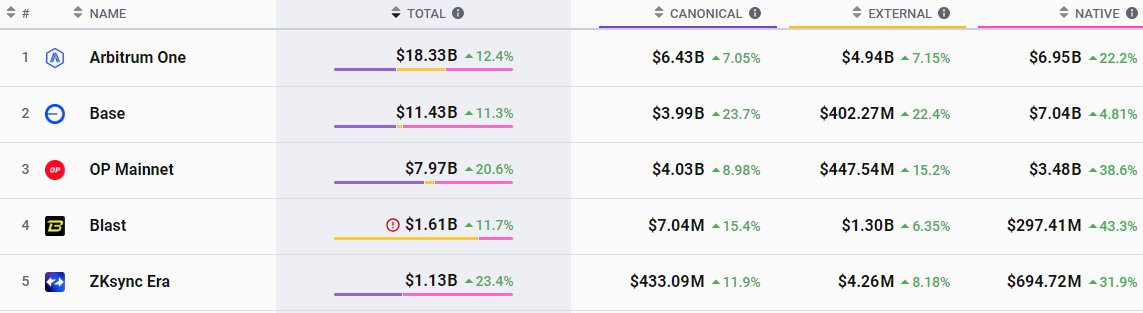

ETH TVL and Spot ETFs inflows

Previously week, Ethereum skilled a big inflow of $4.81 billion, resulting in a notable improve in its complete worth locked (TVL), as reported by Lookonchain.

These inflows have propelled Ethereum’s Layer-2 networks to a brand new excessive, with the mixed TVL reaching a document $51.5 billion—a 205% surge over the yr.

Moreover, Base’s TVL rose by $302.02 million, reflecting heightened exercise and scalability enhancements.

This document development in DeFi TVL has not solely revisited the highs of November 2021 but additionally diversified with elevated liquid staking choices, Bitcoin DeFi integrations, and enhanced contributions from Solana and different Layer-2 networks.

Additionally, Ethereum’s spot ETFs reported a considerable internet influx of $24.23 million, marking six consecutive days of optimistic influx

Main the surge, BlackRock’s ETHA ETF noticed a outstanding single-day influx of $55.92 million. Equally, Constancy’s FETH ETF confirmed sturdy efficiency, with a internet influx of $19.90 million.

Collectively, the entire internet asset worth of ETH spot ETFs has reached $11.13 billion, highlighting a sustained and rising curiosity in Ethereum as a big asset within the digital forex house.

Value motion to hit $10K

These developments may push ETH to new heights, because the chart on a 3-day timeframe reveals a breakout from a consolidation triangle and a pointy surge.

Since early 2021, ETH’s worth has maintained an total bullish pattern, with some intervals of corrections and consolidation.

ETH is on the verge of breaking free from a triangular sample, aiming for larger ranges with an anticipated surge in direction of $10,000.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

The uptrend, reaching barely previous $3600, recommended Ethereum may doubtlessly hit $10,000 within the midterm if the chain exercise continues to thrive.

Such motion indicated sturdy purchaser curiosity and stable market sentiment, presumably setting a brand new stage for Ethereum’s development.