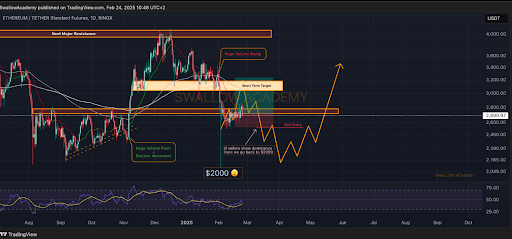

Ethereum’s worth trajectory has taken a pointy downturn, with technical evaluation exhibiting a attainable crash to $2,000. Crypto analyst SwallowAcademy identified on the TradingView platform that some bearish indicators are forming in smaller timeframes, particularly as consumers have failed to keep up a key help zone at $2,700. Notably, the broader market downturn over the previous 24 hours has solely strengthened the case for additional declines for Ethereum.

Ethereum Plunges Over 12% In 24 Hours As Market Suffers Steep Losses

The crypto market has taken a heavy hit, with Bitcoin falling below major support at $90,000 and shedding 6.9% over the previous 24 hours. An already struggling Ethereum has fared even worse, with its worth plunging 12.6% in the identical timeframe. Significantly, Ethereum broke beneath help ranges at $2,600, $2,500, and $2,400 in fast succession.

Associated Studying

This steep decline has aligned with SwallowAcademy’s warning about Ethereum’s weak point on smaller timeframes, additional lending weight to the potential for a extra profound drop to $2,000. SwallowAcademy had initially emphasised that Ethereum remained in a strong shopping for zone as a result of presence of EMAs on the $2,700 help. Nonetheless, with worth motion shifting, the analyst acknowledges that bearish stress on decrease timeframes might open the door for additional declines.

Apparently, this Ethereum worth crash prior to now 24 hours got here as a shock, as bulls managed to carry above a key help stage of $2,700 despite the fiasco of Bybit’s $1.5 billion hack that came about all through the weekend.

Though the quick fallout from the trade’s hack appeared contained, the market now appears to be experiencing a delayed response, and concern is step by step setting in amongst buyers. This rising uncertainty, mixed with persistent outflows from crypto funding merchandise, together with Spot Bitcoin and Spot Ethereum funds, has added extra downward stress on Ethereum’s worth.

Because it stands, the present Ethereum each day candle is firmly within the palms of sellers, with no indicators of easing stress. It is a vital change from the beforehand sturdy shopping for sentiment.

Bearish Momentum Might Lengthen To $2,000

The weakening weekly candle has tipped the scales in direction of extra declines than a bullish uptrend, although it’s nonetheless early within the week to determine. cautions that it’s nonetheless early within the week. Ethereum is already buying and selling beneath the EMAs within the each day timeframe, so the essential issue is whether or not it may maintain above the EMAs within the weekly timeframe.

Associated Studying

If the present promoting momentum continues and the value breaks beneath $2,200, the following main draw back goal is $2,000 earlier than any notable bounce can happen.

On the time of writing, Ethereum is buying and selling at $2,395 and is on the threat of extra declines over the following 24 hours. Regardless of the sharp drop, the RSI has but to succeed in oversold circumstances, which implies that sellers should still have room to push costs decrease earlier than exhaustion units in.

Featured picture from Adobe Inventory, chart from Tradingview.com