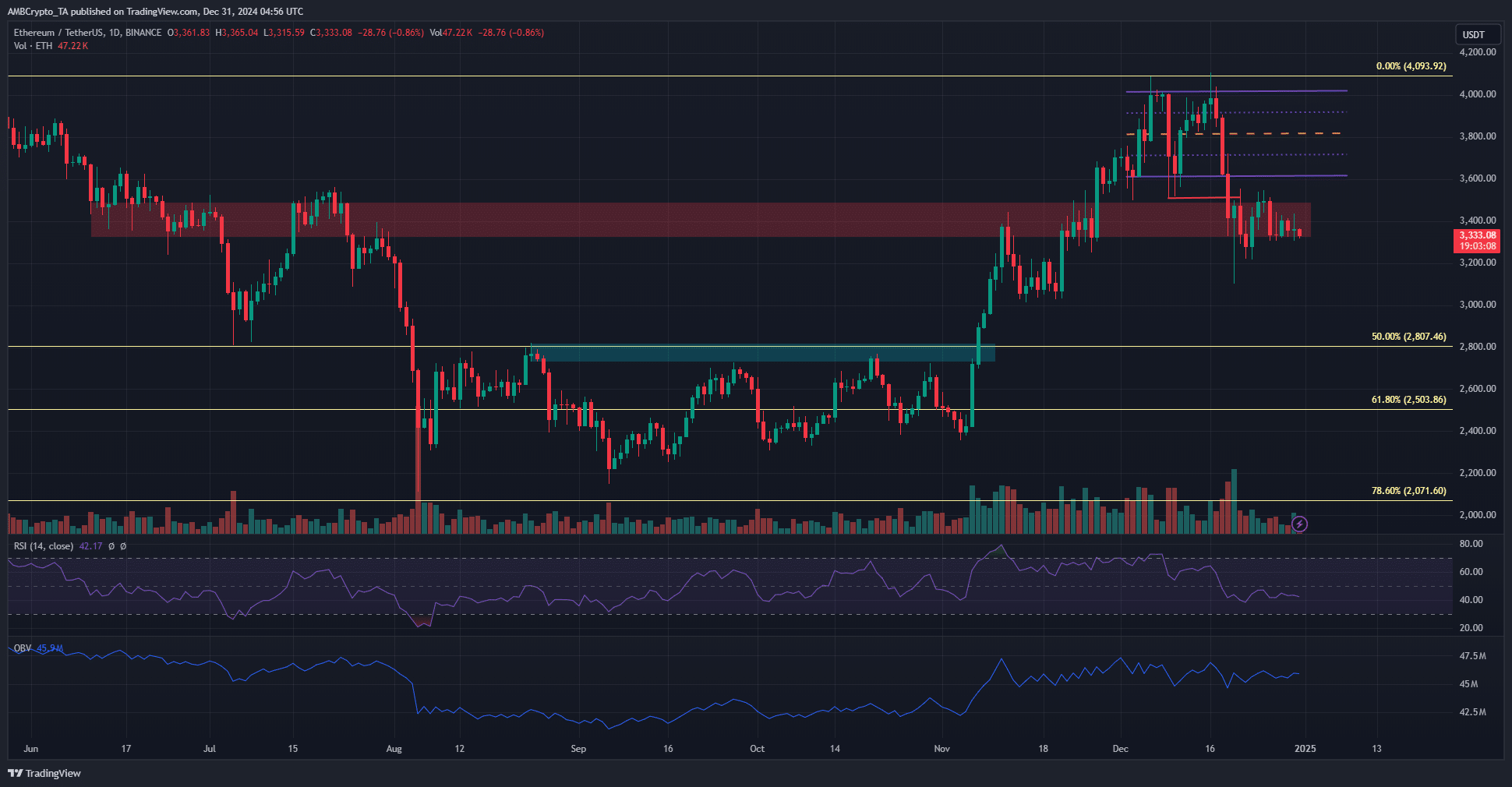

- The construction and momentum of ETH had been bearish on the each day chart.

- The shortage of shopping for stress over the previous month was a regarding sight.

Ethereum [ETH] has shaped an inverse head and shoulder sample within the 2-week timeframe. This was a strongly bullish signal for the upper timeframes. If the sample witnesses a bullish breakout, it might take the Ethereum price to $12,000.

The each day timeframe and decrease confirmed that sentiment was strongly bearish. The worth has misplaced the short-term vary and fallen under the $3.4k assist zone. Based mostly on the momentum, extra losses appeared probably.

Bearish construction and assist failure

The drop within the worth under $3,509 on the nineteenth of December signaled a bearish market shift on the each day charts. This was accompanied by an RSI drop under the impartial 50 mark. In the meantime, the OBV has been ranging over the previous two months.

These findings assist the concept that extra losses are imminent. The $3.4k former assist zone has flipped to resistance. Moreover, the OBV didn’t present important good points within the second half of November.

The OBV shaped a spread from the 14th of November to the nineteenth of December. Throughout this era, Ethereum’s worth examined the $4k resistance from $3k and confronted rejection, retracing to $3.3k. This means a bearish pattern and an absence of shopping for stress.

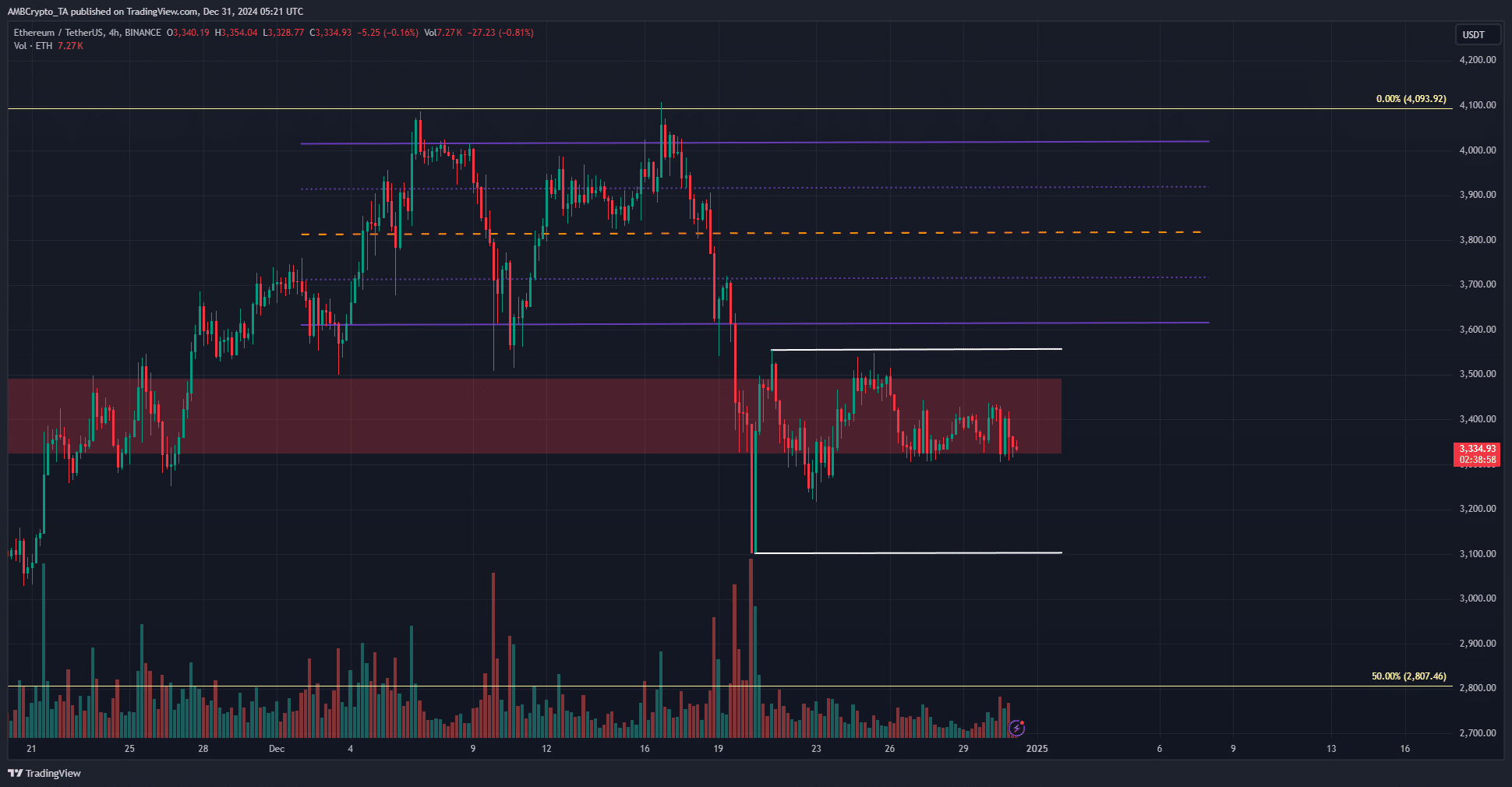

The 4-hour chart marks key ranges for the Ethereum worth

Highlighted in white had been the 2 fast ranges of assist and resistance that ETH market members must be cautious of. The $3,555 and $3,101 would dictate the following worth transfer’s path.

Learn Ethereum’s [ETH] Price Prediction 2024-25

Within the decrease timeframes, the $3,314 degree served as assist and will see a 3.4%-5.8% worth bounce. Nonetheless, this may not flip the each day timeframe bias bullish. An inflow of shopping for stress, absent prior to now month, is required to revive bullish hopes.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion