- ETH was going through sturdy promoting stress as costs retrace from current excessive.

- Ethereum whales offloaded 5,677.7 ETH tokens price $14.03 million.

After market restoration, Ethereum [ETH] costs surged from a low of $1.7k to a neighborhood excessive of $2.6k. Nonetheless, since hitting these ranges, the altcoin has retraced, recording three consecutive days of losses.

In actual fact, at press time, Ethereum was buying and selling at $2457. This marked a 3.97% decline on day by day charts.

With ETH beginning to decline, the query is what’s pushing costs down?

Ethereum’s promoting exercise soars

AMBCrypto’s evaluation highlights sturdy revenue realization amongst Ethereum buyers. After being underwater for 2 months, they’re now aggressively taking income.

The pattern is very noticeable amongst Ethereum whales, with OnChainLens reporting vital sell-offs.

One whale withdrew 4,677.7 WETH from Aave V3 and bought it for 11.52 million USDC at $2,463 per ETH. This whale initially purchased the ETH tokens a month in the past for $6.8 million USDC, securing a $4.717 million revenue.

One other whale deposited 1,000 ETH price $2.51 million into Kraken after holding it for 4 years.

Initially, this whale had withdrawn and acquired 2,693 ETH price $5.7 million from Binance US, Coinbase, and a Twister Money pockets. After the current transaction, the whale nonetheless holds 1,693 ETH valued at $4.13 million.

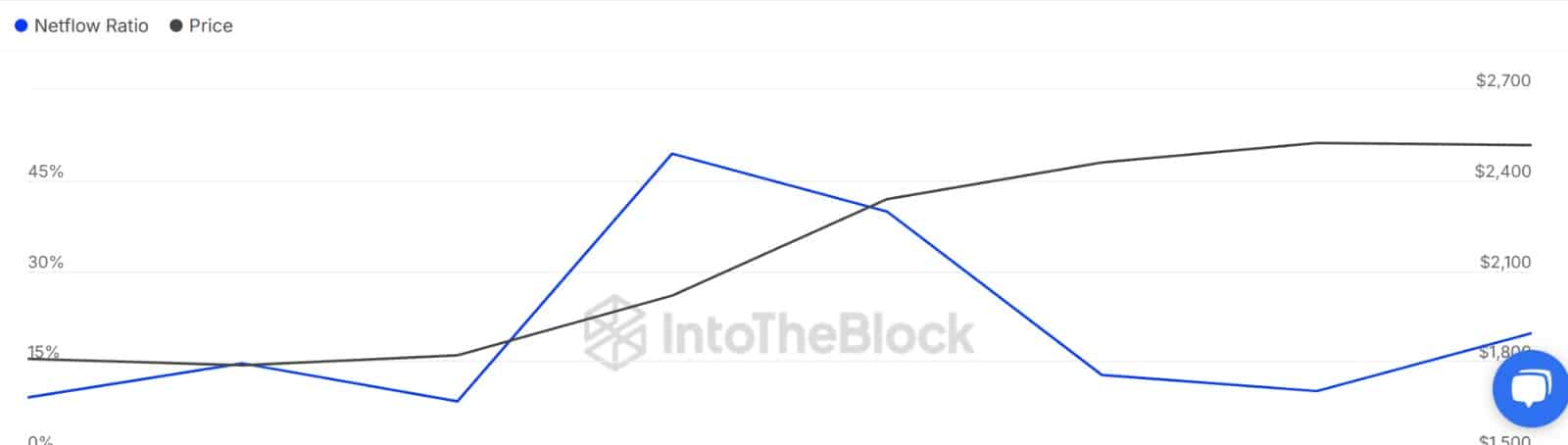

Promoting exercise seems widespread amongst Ethereum’s giant holders. The Massive Holders Netflow to Alternate Netflow Ratio dropped to 10% when ETH reached $2.5K.

As costs declined, giant holders resumed promoting, pushing whale trade movement as much as 19%. This marks a 9% enhance in whale-to-exchange exercise up to now day, signaling intensified promoting stress.

With whales turning to promoting, it appears most market members, even retailers, and sharks are promoting. Once we have a look at Ethereum Alternate Netflow, it has turned optimistic after 4 days of consecutive adverse netflows.

A optimistic netflow means that exchanges are experiencing extra deposits than withdrawals, reflecting increased promoting exercise.

As such, Ethereum’s shortage has declined as there’s a rise within the quantity of ETH accessible to promote.

Thus, the ETH Inventory-to-Circulation Ratio has declined from a weekly excessive of 47 to 18, on the time of writing. This displays rising provide on exchanges, which is often a bearish sign as oversupply results in decrease costs.

What’s subsequent for ETH?

Growing whale sell-offs have negatively impacted ETH markets, as seen in current traits. Sometimes, increased promoting stress drives costs decrease as buyers offload to safe income or keep away from deeper losses.

If the present promoting exercise persists, ETH might face additional declines, probably discovering assist round $2,188. Nonetheless, if patrons seize the retrace as an entry alternative, ETH nonetheless has development potential.

In that case, it might try an increase towards $2,864.