- Ethereum mirrors its 2019 sample.

- Largest holders of ETH have steadily amassed extra since 2019.

Ethereum [ETH] remained the second-largest cryptocurrency, with market sentiment shifting from bearish to bullish as 2024 nears its finish.

The value motion of Ethereum was mirroring the 2019 sample on the ETH/USD pair, the place an ascending wedge was shaped.

The upper lows of this cycle’s wedge have been ten occasions bigger than these seen in 2019.

Again in 2019, Ethereum’s worth dropped under its ascending wedge earlier than the primary Federal Reserve price minimize, a scenario related to what’s taking place in 2024.

After the speed minimize in 2019, ETH/USD and ETH/BTC each bottomed, forming a robust confluence.

The present sample is anticipated to copy this success, with the value more likely to break under the wedge, capturing liquidity earlier than reversing to the upside in late This fall 2024 or early Q1 2025.

Nevertheless, if the value stays under the ascending wedge for an prolonged interval, additional evaluation could also be obligatory to regulate methods or decrease potential losses.

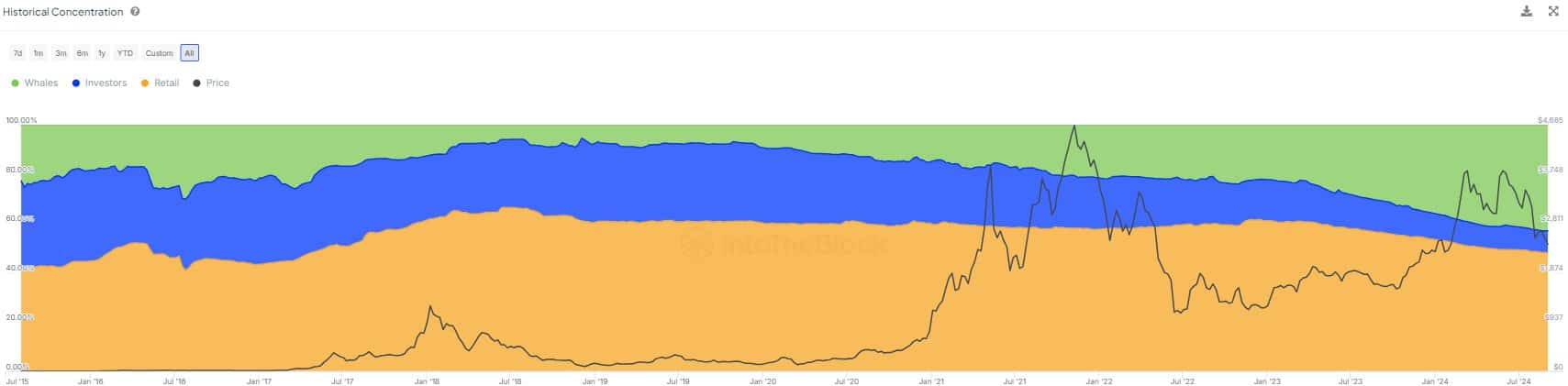

Whales proceed to build up

Whales are enjoying a big position in supporting this anticipated upward motion. Ethereum’s largest holders have been steadily accumulating extra ETH since 2019, and this development intensified after the Shanghai improve in early 2023.

As of press time, whales managed over 43% of Ethereum’s circulating provide, closing in on the 48% held by retail buyers.

This accumulation signifies that these main gamers count on Ethereum’s worth to maneuver increased over time.

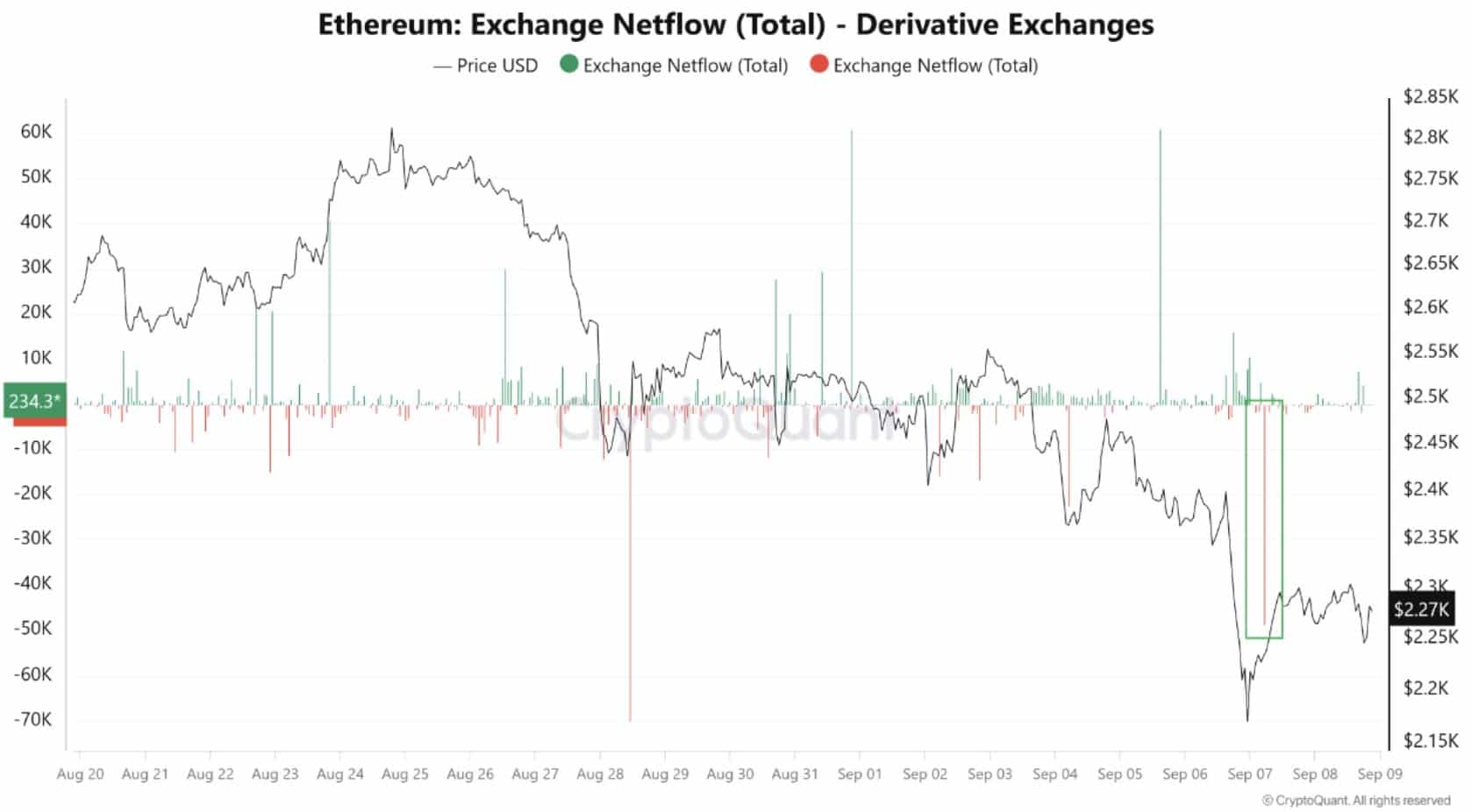

ETH alternate netflows

Taking a look at Ethereum’s alternate netflows, knowledge confirmed that the adverse netflow on by-product exchanges have surpassed 40,000 ETH.

This recommended that extra ETH was being withdrawn from these exchanges and transferred to chilly wallets, indicating lowered promoting stress.

Merchants could also be making ready for long-term positive factors, suggesting that the present decline in Ethereum’s worth is a brief correction, probably setting the stage for a big upward motion.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

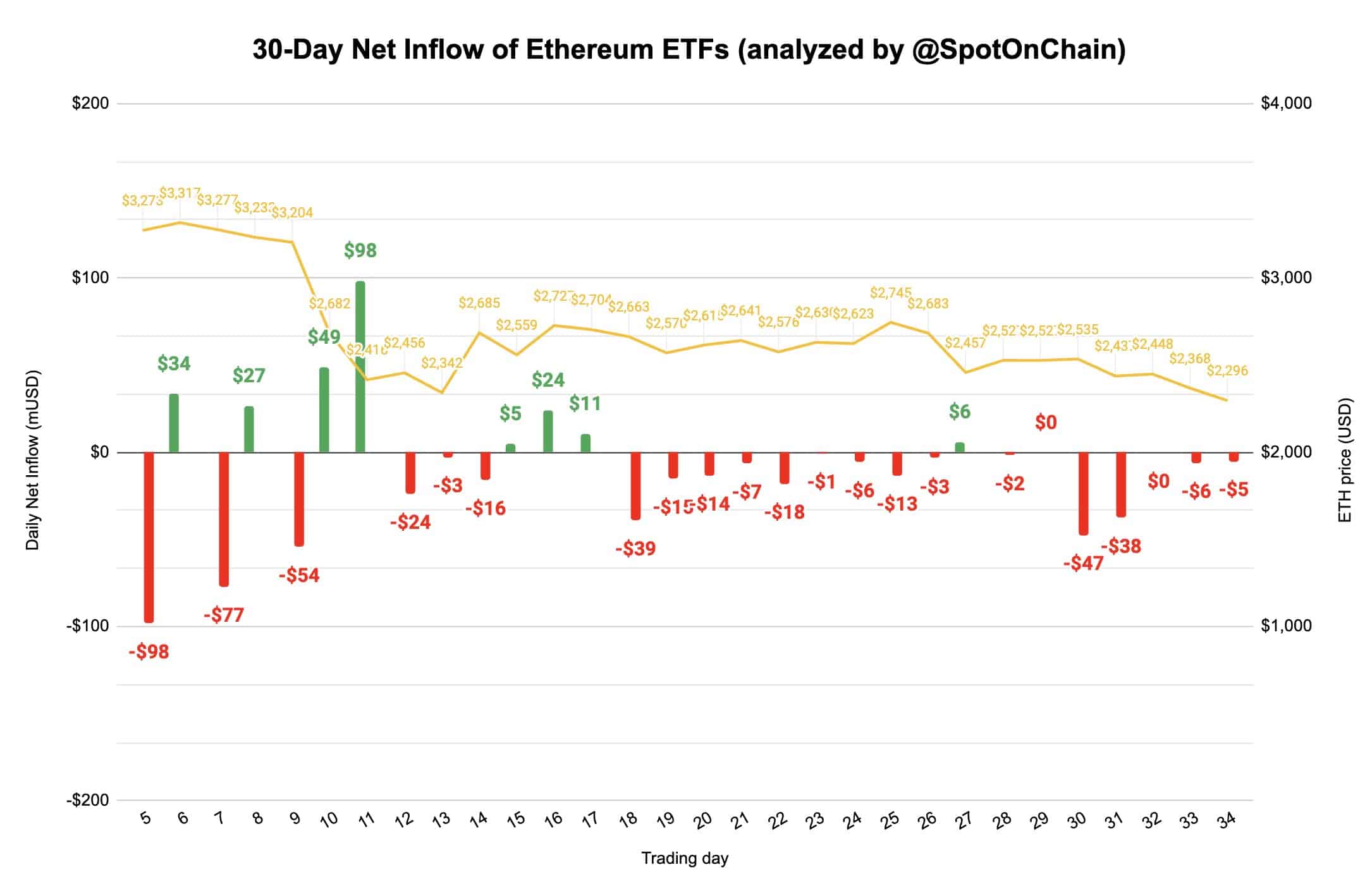

Ethereum ETF replace

Regardless of some adverse net-flows in Ethereum ETFs, there are optimistic indicators. ETH ETFs, together with Constancy’s noticed inflows over the previous 24 hours. Grayscale’s ETHE skilled the biggest and the one outflow.

Nevertheless, the general optimistic sentiment surrounding ETFs might finally assist Ethereum’s future worth progress.