- Ethereum has confronted rejection from the $2.7k resistance zone since August

- The climbing leverage ratio metric highlighted why a breakout is likely to be unlikely

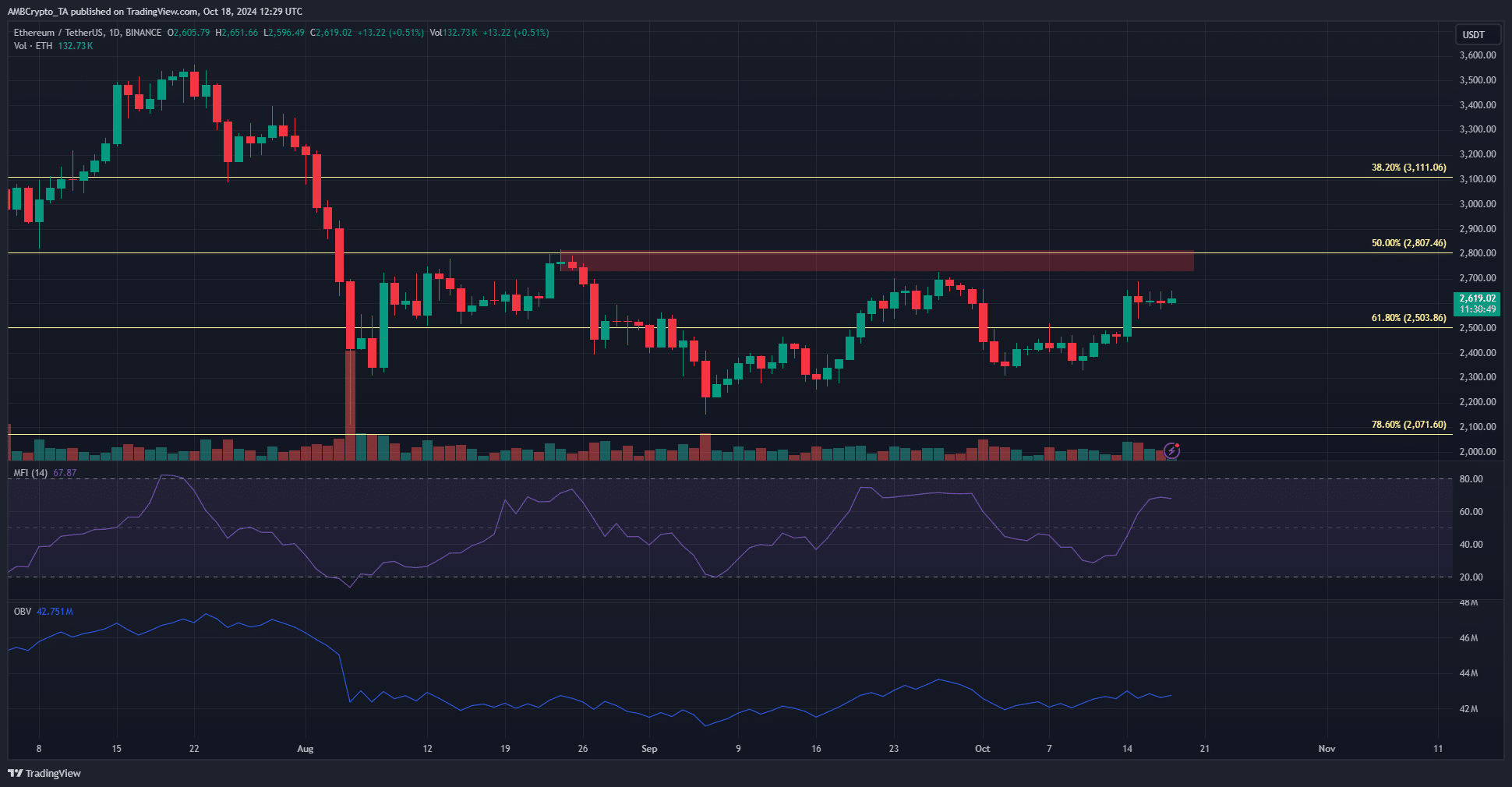

Ethereum [ETH], at press time, was buying and selling inside a variety that reached from $2.8k to $2.2k. Specifically, the $2.8k area has served as a gentle supply zone since early August. It additionally has confluence with the 50% Fibonacci retracement degree.

Analyzing the worrying value traits

The ETH/BTC chart has been trending south for simply over 18 months. Whereas Bitcoin [BTC] is buying and selling 8% under its ATH, Ethereum is 46.3% away from its ATH. The altcoin’s efficiency have to be checked out inside the context of Vitalik Buterin’s imaginative and prescient for the subsequent doable improve, “The Surge.” Particularly a few of its targets concerning transactions per second and maximizing interoperability between L2s.

The efficiency of an asset is a transparent perception into what the market believes the asset’s worth is, and what it may be. Generally, hype and misinformation can skew these beliefs, resulting in overvalued or undervalued belongings.

The efficiency of Ethereum might be partly defined by inflationary considerations because the Dencun improve, however it’s only a small a part of the puzzle. The proposed enhancements for the Proof of Stake system and the upgrades thought of for the community at giant might, when carried out, tackle community income, consumer progress, adoption, and different points.

In flip, this might drive demand. As issues stand, a rocky journey might be forward for ETH on the value charts.

Clues from the derivatives market

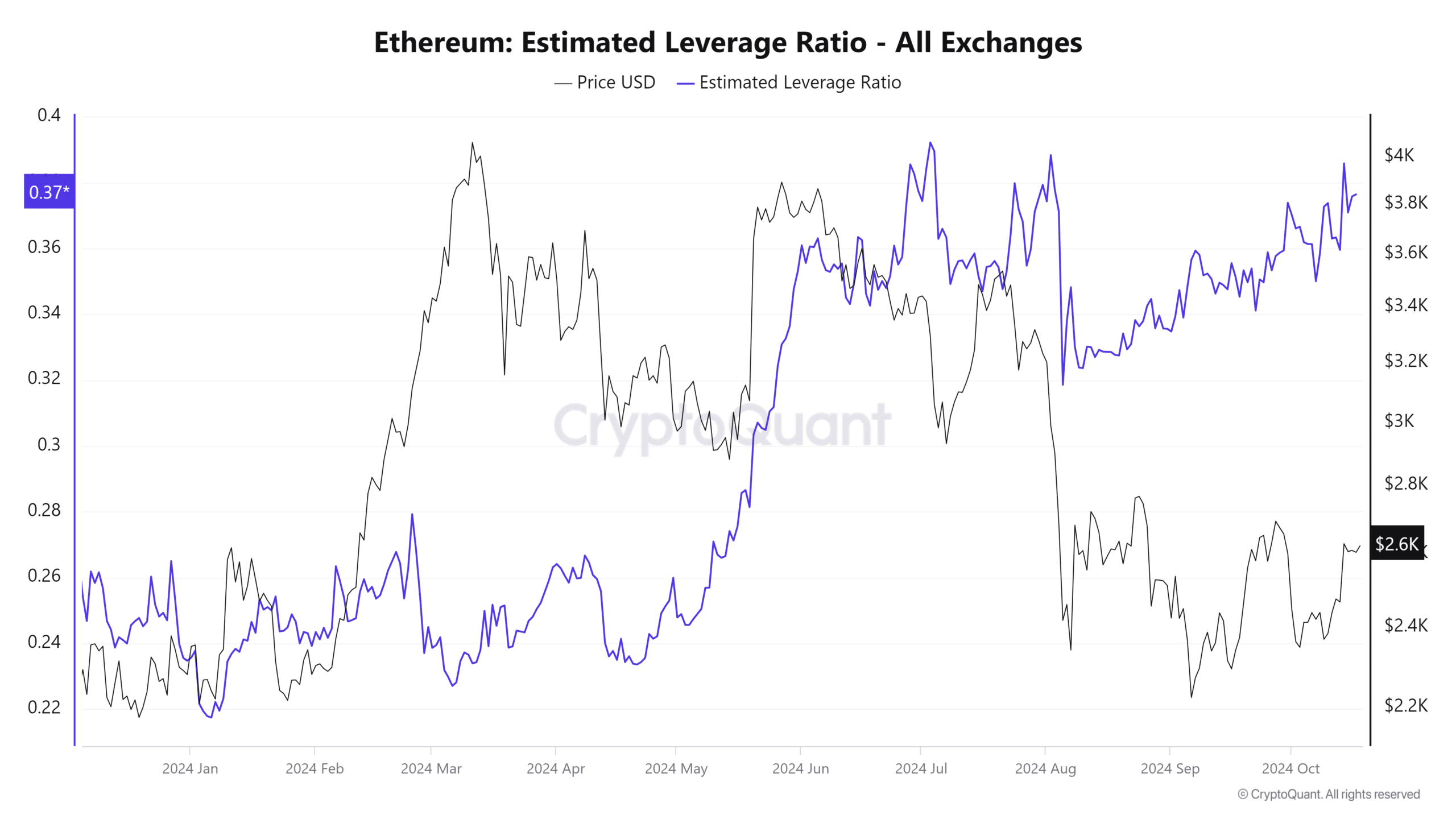

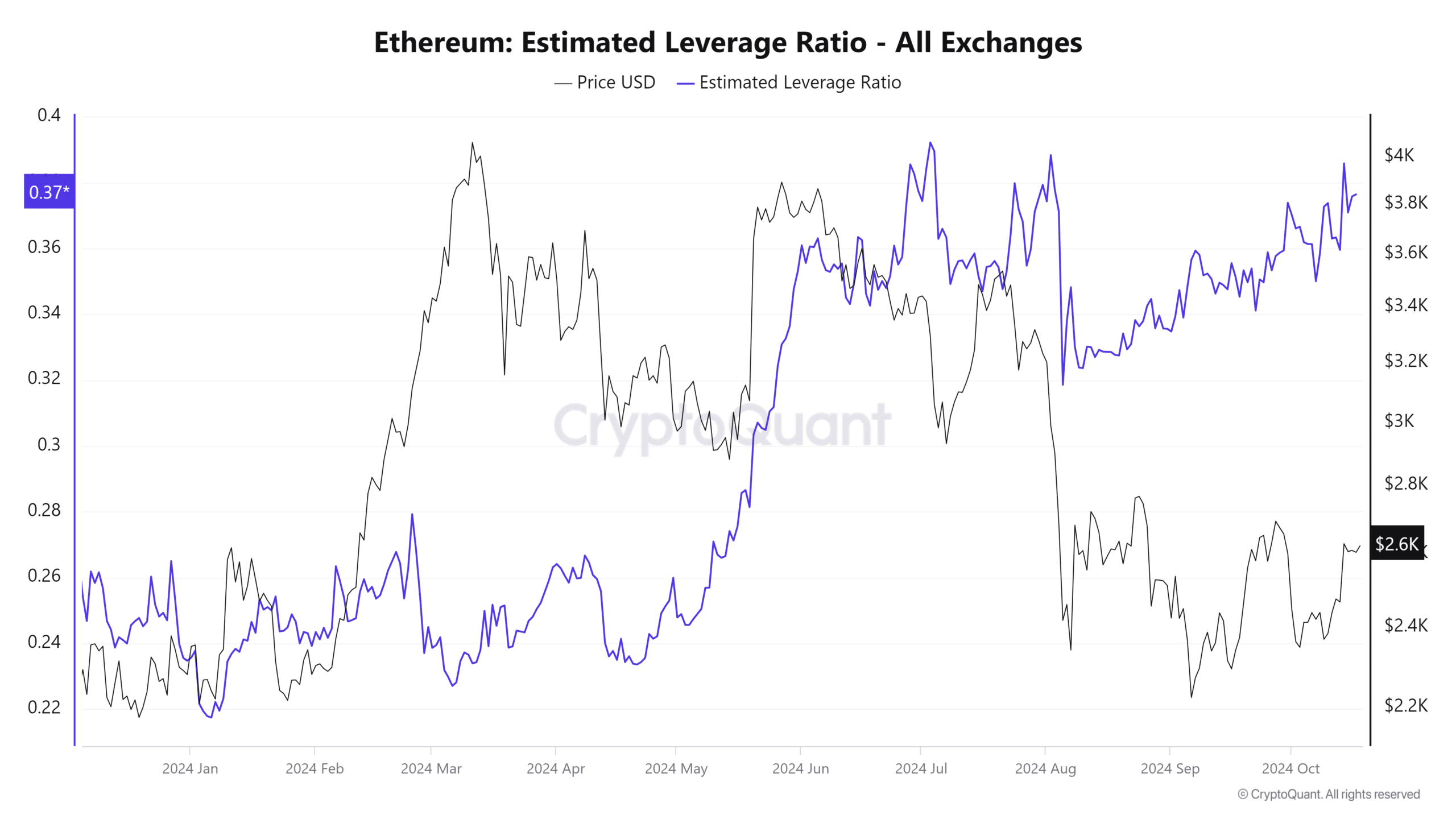

Supply: CryptoQuant

The estimated leverage ratio (ELR) is calculated by dividing the Open Curiosity by the alternate’s coin reserves. Coinglass information additionally revealed that Open Curiosity has risen from $10 billion to $13 billion for ETH because the second week of August.

This helped clarify the rising ELR. Nevertheless, with the value buying and selling beneath a key resistance, it may be interpreted as a warning signal for merchants.

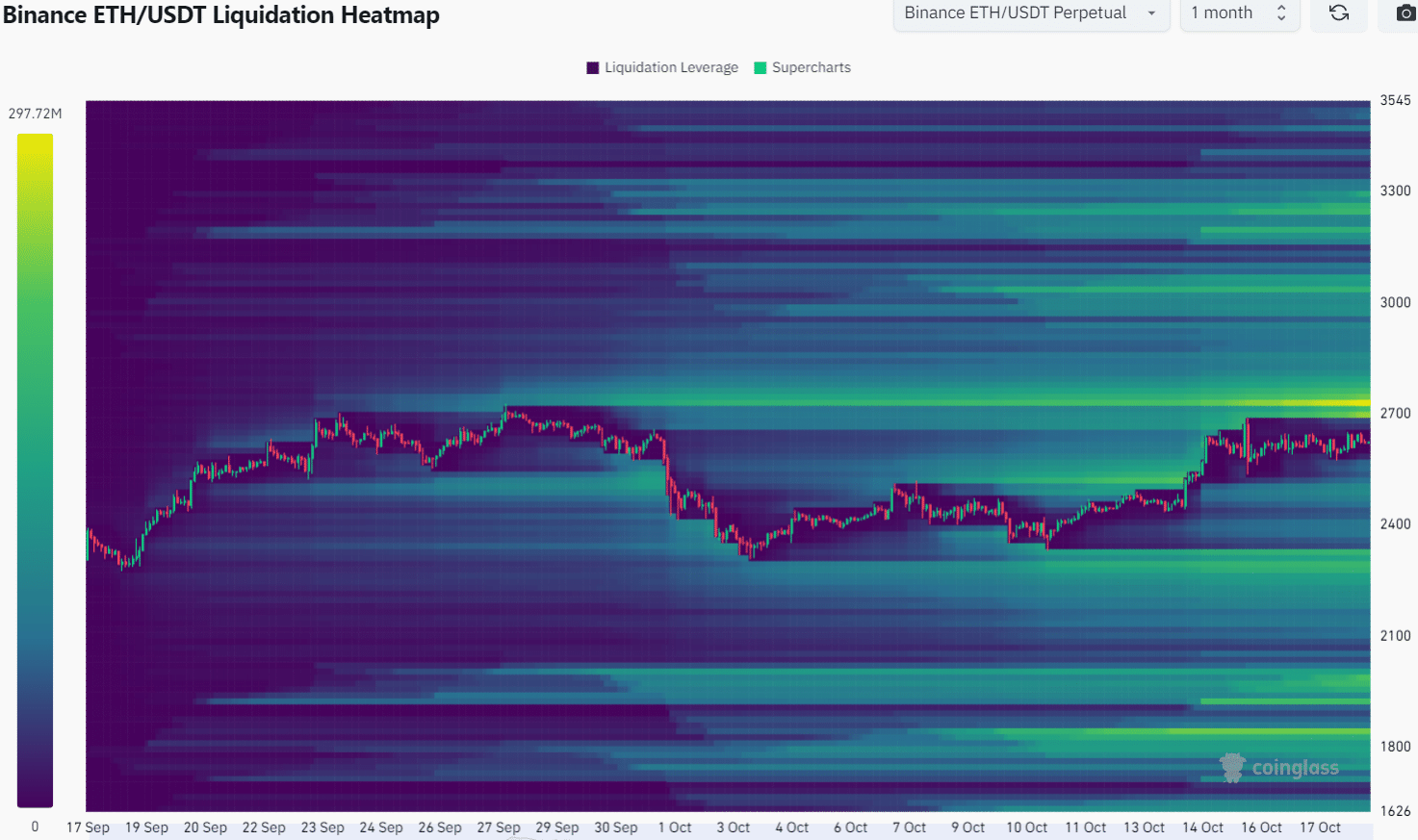

Supply: Coinglass

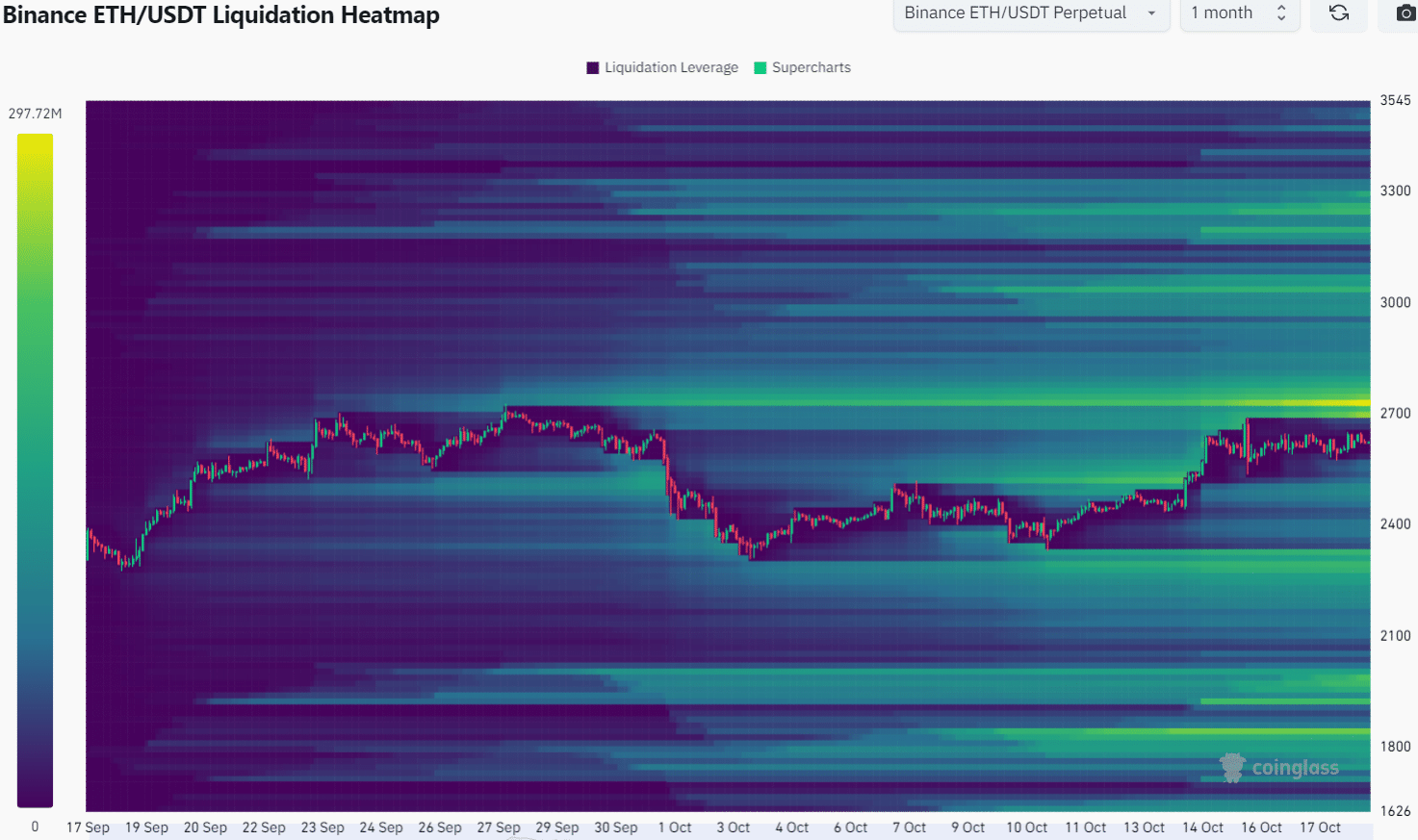

The liquidation heatmap with a 1-month lookback interval famous that the $2,730 zone is cluttered with liquidation ranges. The three-month chart confirmed that the $2,730-$2,850 space is essential.

Along with the value motion, we will see {that a} bearish reversal from these ranges is a chance that merchants have to be ready for.

Learn Ethereum’s [ETH] Price Prediction 2024-25

General, the dearth of natural demand and L2s capturing extra individuals and transaction exercise stays an issue for the mainnet and its traders. Technical evaluation gave clues that ETH bulls would possibly lack the energy to drive the crypto’s value past $2.9k too.