- Ethereum’s value drops to $3,867 amid elevated change withdrawals, signaling potential market volatility.

- Energetic addresses and leverage ratios recommend heightened retail curiosity and attainable short-term market shifts for ETH.

Ethereum [ETH] has seen a notable price adjustment after reaching the $4,000 threshold late final week. On the time of writing, ETH traded at $3,867, marking a 2.2% dip up to now day.

Whereas the asset stays practically 30% increased for the month, the drop beneath $4,000 positions ETH 20.5% away from its all-time excessive of $4,878, recorded in 2021.

Regardless of this correction, market exercise surrounding Ethereum presents some compelling insights. In line with a CryptoQuant analyst generally known as Mignolet, there was a noticeable surge in Ethereum withdrawal transactions from exchanges.

Whereas some would possibly interpret this as a bearish indicator, Mignolet means that it alerts the potential of “elevated market volatility.”

The analyst highlights a sample of heightened exercise in Ethereum transactions usually correlating with declines in Bitcoin dominance, probably indicating a broader market pullback as buyers take income.

Key metrics spotlight U-turn for Ethereum

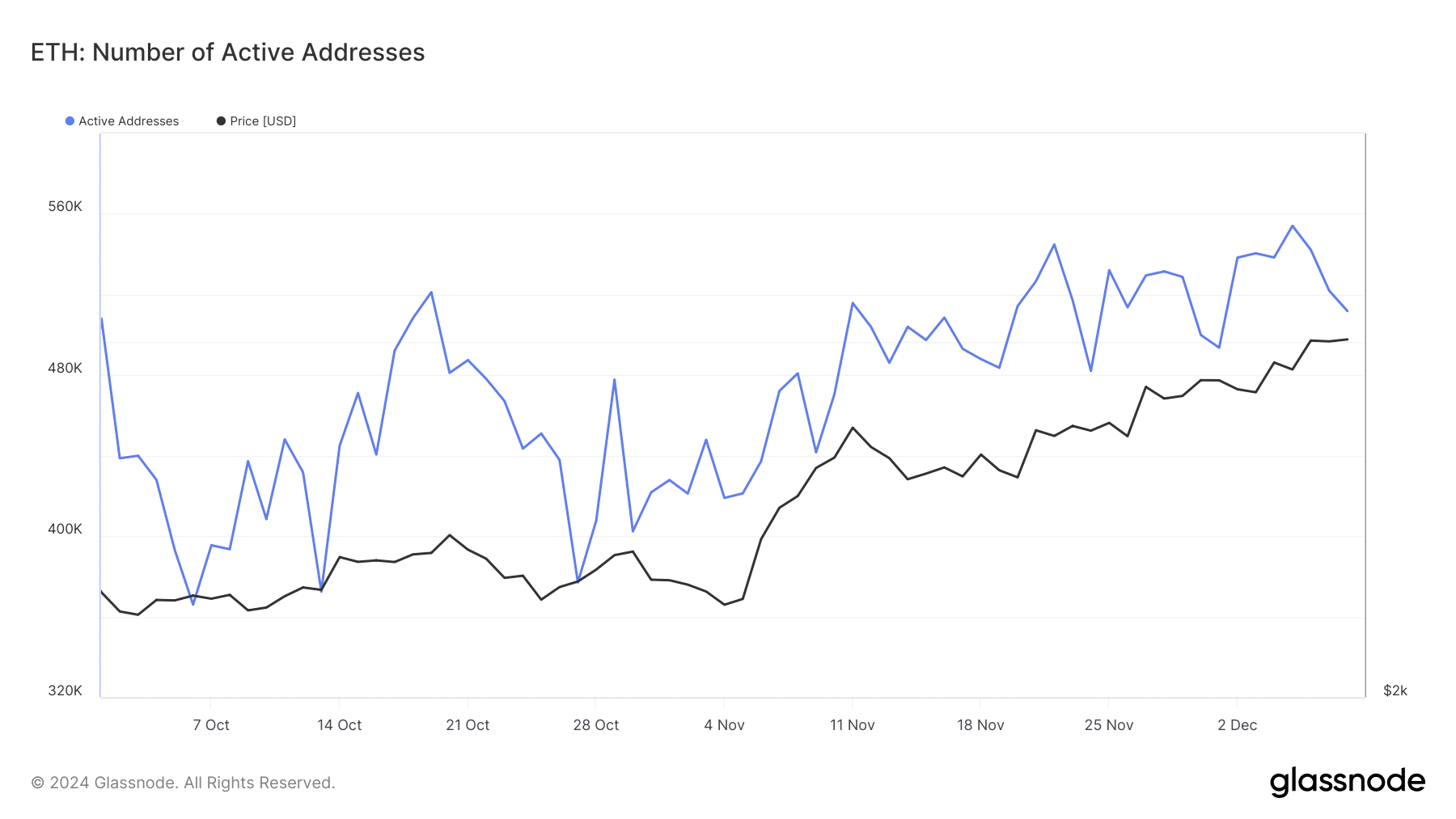

In the meantime, Ethereum’s energetic addresses, a important indicator of retail investor curiosity, have demonstrated an upward development in current months.

Data from Coinglass revealed that Ethereum’s energetic addresses have risen from beneath 400,000 in early October to surpassing 500,000 as of press time.

This improve suggests rising participation from smaller, retail-focused buyers. An increase in energetic addresses usually displays heightened community exercise, which may contribute to Ethereum’s value stability and long-term progress.

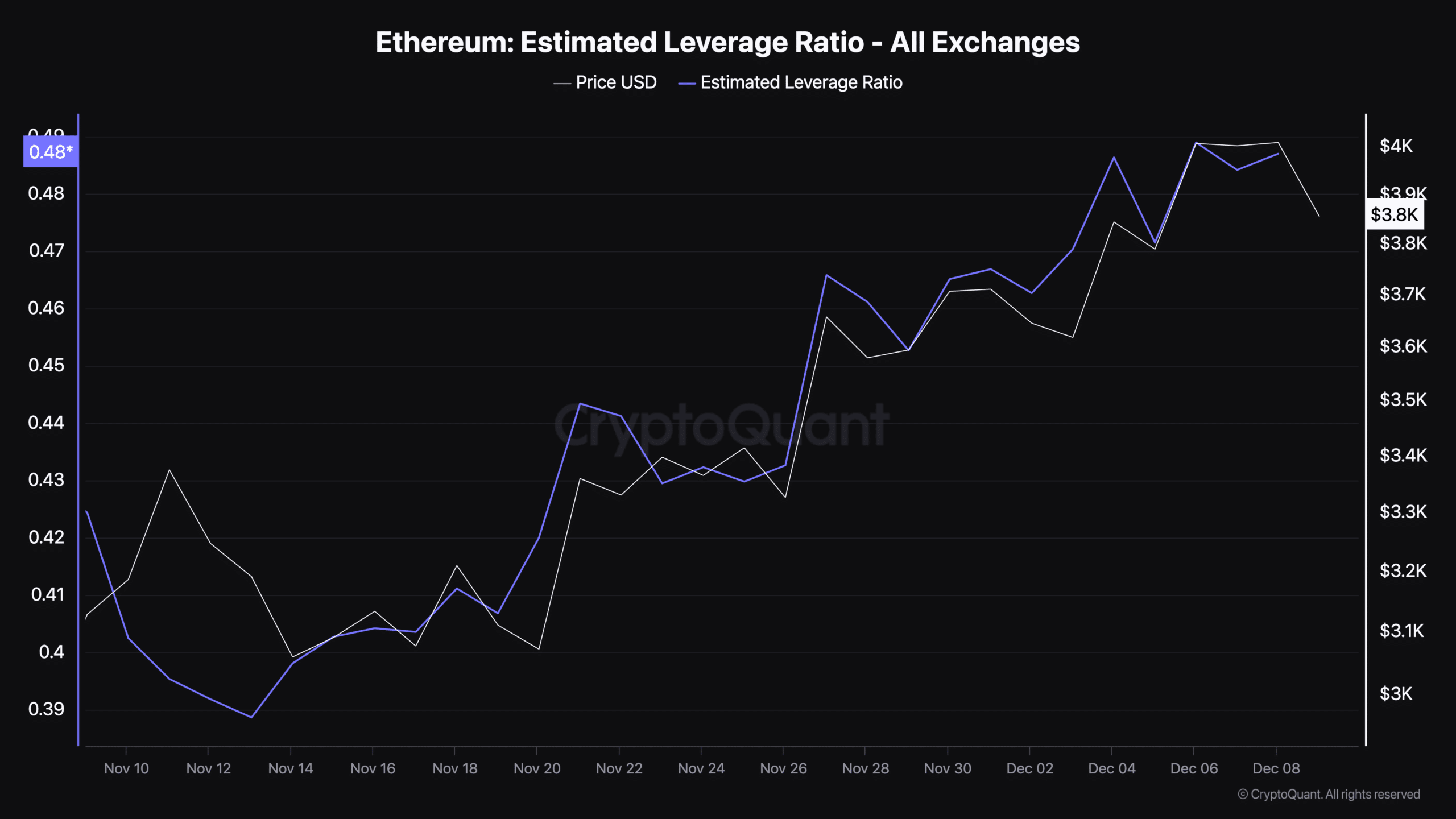

One other key metric, Ethereum’s estimated leverage ratio, at present stands at 0.487, in keeping with CryptoQuant.

The estimated leverage ratio measures the extent of leverage utilized by merchants within the derivatives market, calculated because the ratio of open curiosity to the overall coin steadiness held on exchanges.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

A better leverage ratio signifies elevated risk-taking, as extra merchants use borrowed funds to amplify their positions. At its present stage, Ethereum’s leverage ratio suggests average leverage available in the market.

Whereas not excessively excessive, it highlights the potential for sharper value actions as merchants place themselves for future market traits.