- Germany’s Saxony state has been promoting seized Bitcoin in current weeks, exerting strain available on the market

- Bearish sentiment round spot costs has not dispirited institutional buyers searching for publicity to Bitcoin.

Bitcoin [BTC] prolonged its rebound on the tenth of July, rising sharply above $58,000 as crypto markets displayed a way of calm.

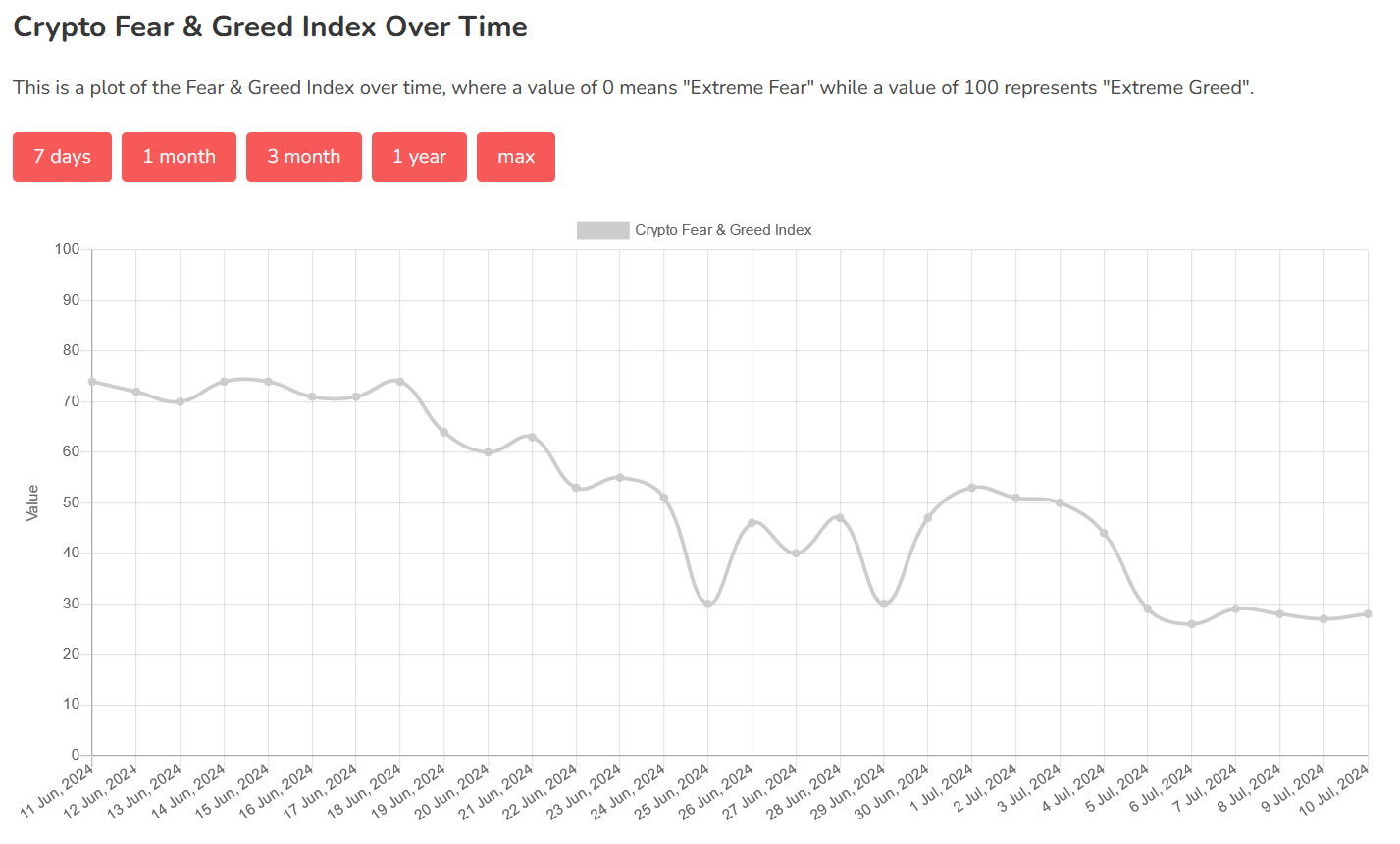

Nonetheless, detrimental market sentiment has yet to subside, with the crypto Concern & Greed Index hovering within the ‘Concern’ zone at press time.

The present ‘Concern’ index highlights the fast shift in market sentiment, given the index hovered on the ‘Impartial’ zone final week and the ‘Greed’ zone final month.

Germany BTC selloff

Germany’s state of Saxony offloaded more BTC in a collection of transactions on ninth July. The state’s Felony Police Workplace (LKA) confiscated 49,857 BTC from the operator of Movie2k.to in January.

The German police authority has been dumping these cash out there in accordance with pointers pertaining to belongings seized in prison investigations.

To this point, the German authorities has transferred out greater than half of its preliminary holdings to exchanges and different market makers.

The pockets belonging to the German Federal Felony Police Workplace (BKA) had a steadiness of twenty-two,847 BTC at press time, according to Arkham Intelligence information.

Bitcoin Funds put up robust efficiency

Apparently, the current spot value swings to the draw back haven’t diminished the enchantment of Bitcoin funds.

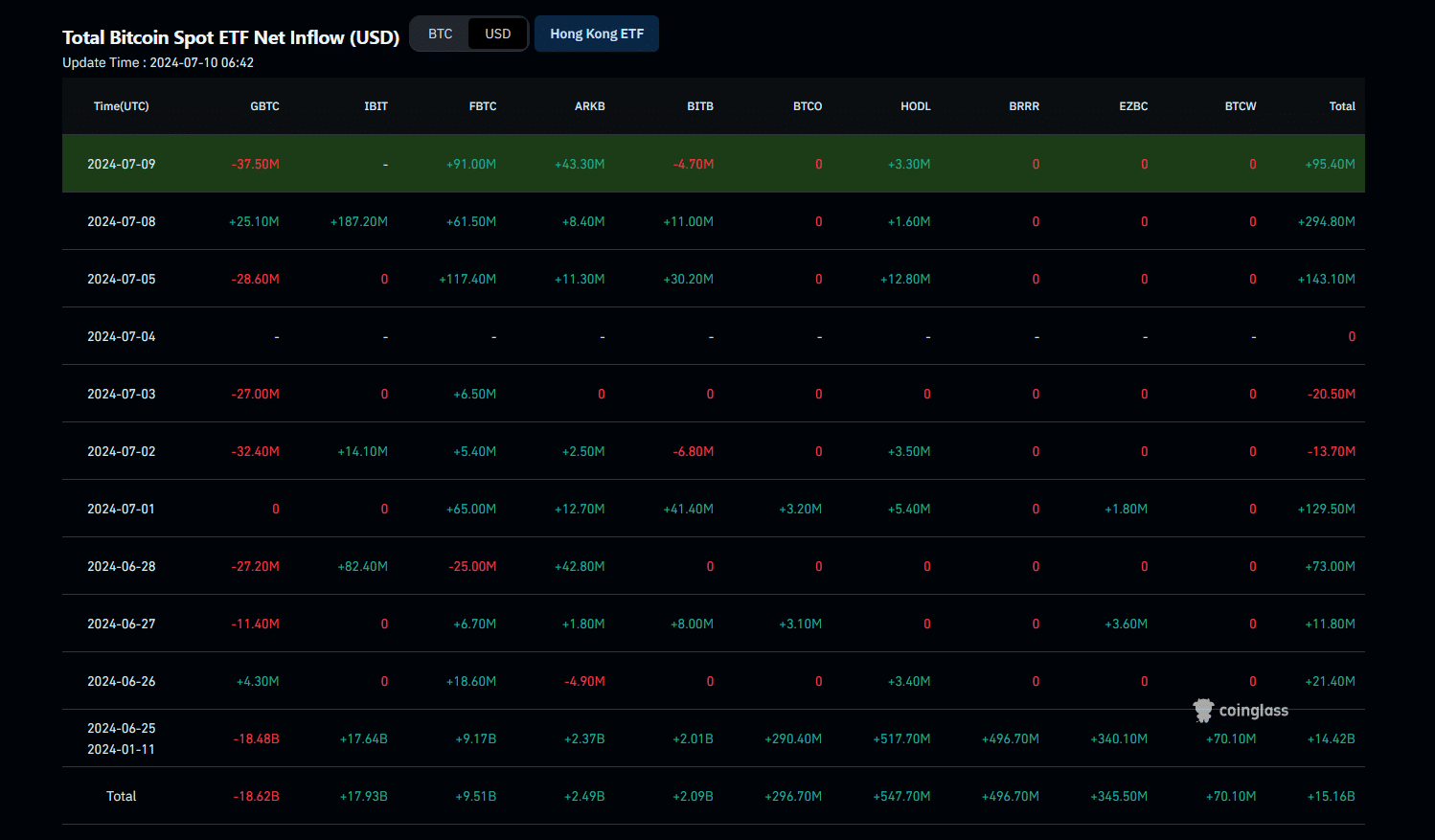

The 11 US-listed spot Bitcoin ETFs cumulatively registered $295 million in inflows on eighth July – the best single-day optimistic web stream quantity since fifth June when Bitcoin value trended above $70,000.

Additionally, not one of the ETFs recorded outflows on the day however three – Valkyrie Bitcoin Fund, Franklin Bitcoin ETF, and WisdomTree Bitcoin Fund – noticed no exercise.

Although buyers drew out from Grayscale Bitcoin Belief and Bitwise Bitcoin ETF on ninth July, the full web stream nonetheless remained optimistic.

These regular ETF inflows amid subdued costs recommend that institutional buyers are capitalizing on the current market volatility to build up.

Bitcoin ETFs are seeing rising recognition

Institutional-focused crypto funding merchandise are additionally receiving heat reception outdoors the US and Europe.

In Australia, DigitalX introduced the approval of its spot ETF product for an upcoming itemizing on the Australian Securities Trade (ASX) on eighth July.

The DigitalX Bitcoin ETF will likely be listed below the ticker BTXX and is anticipated to start buying and selling on twelfth July, the funding firm stated in an announcement post on X.

VanEck’s related product, the VanEck Bitcoin ETF (VBTC), acquired regulatory approval on fifteenth June and have become the primary spot Bitcoin ETF to commerce on the Australian Securities Trade 5 days later.

Extra potential issuers, together with Sydney-based capital market firm BetaShares, are anticipated to record their Bitcoin ETF merchandise on Australia’s main securities change earlier than the tip of the yr.

BTC/USDT technical evaluation

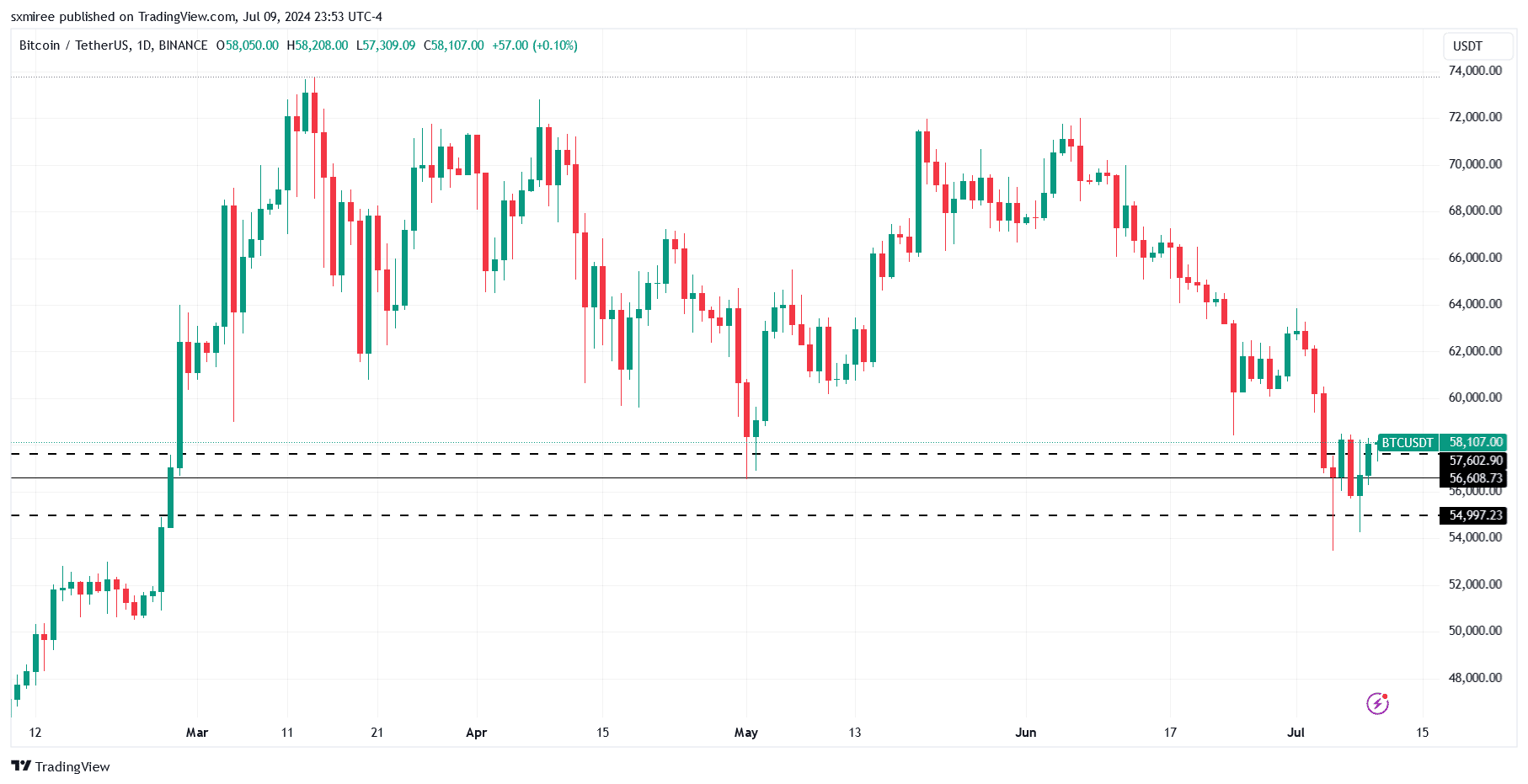

Bitcoin led altcoins in a modest market-wide restoration on ninth July, claiming an intraday excessive of $58,239 per CoinMarketCap information. Speculators have now shifted their consideration to resistance ranges round $60K.

On the each day chart, the $55,000 – $57,500 vary has, within the final week, fashioned a base for BTC/USDT with a key help degree round $56,600, which coincides with earlier lows noticed at the beginning of Could.

Learn Bitcoin’s [BTC] Price Prediction 2024-2025

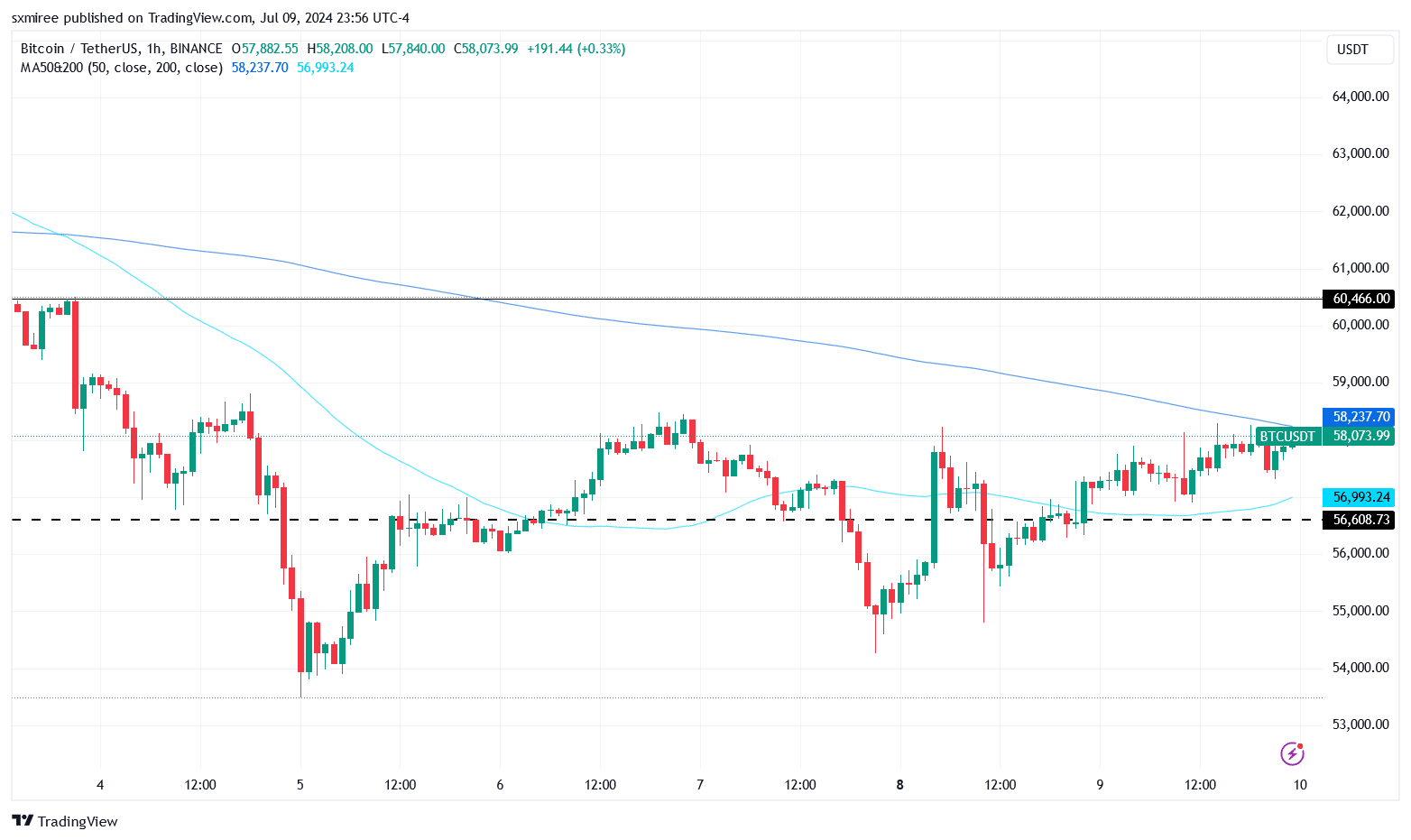

Clearing this vary will place Bitcoin on the trail to reclaiming key trendlines misplaced final week, together with the 200-day easy transferring common (MA), at the moment at $58,240.

Although additional upside potential in the direction of $60K continues to be conceivable, positive aspects from the bullish countertrend will seemingly be short-term and fleeting.