Legendary dealer Peter Brandt, with almost 5 many years of expertise in buying and selling since 1975, has shared a bullish forecast for the Bitcoin value trajectory in 2025. Taking to X, Brandt said: “Bitcoin $BTC is now within the candy spot of the bull market halving cycle that ought to prime within the $130k to $150K vary subsequent Aug/Sep. I measure cycles in another way than most.”

How Excessive Can Bitcoin Go In 2025?

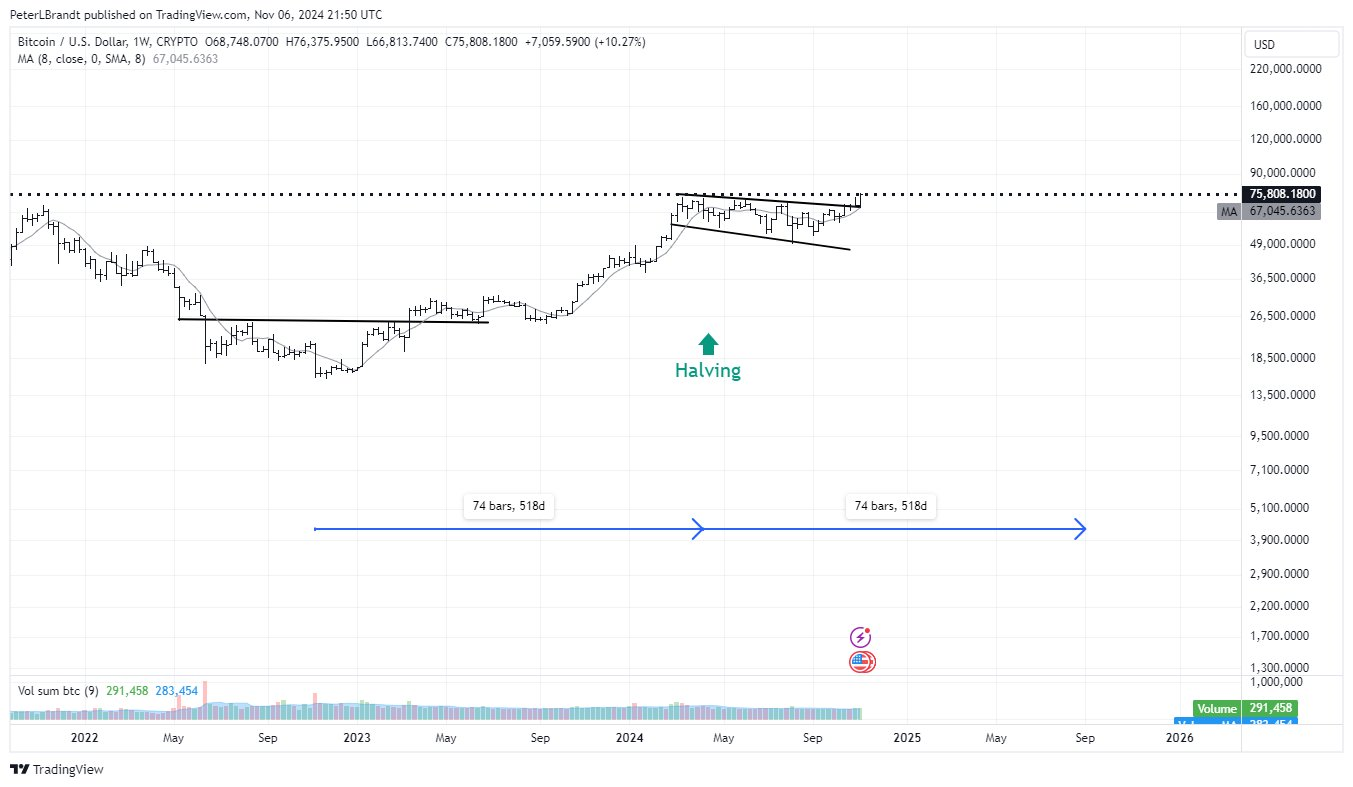

Brandt’s evaluation is rooted within the historic patterns noticed in Bitcoin’s halving cycles. His chart, overlaying Bitcoin’s value motion from early 2022 with projections into 2026, highlights two important durations of 518 days every. These durations signify essential phases in Bitcoin’s market habits, representing the cyclical nature of its value actions.

A notable technical sample recognized in his chart is the breakout from a broadening wedge. This formation, characterised by diverging help and resistance traces, suggests growing market volatility as costs make progressively larger highs and decrease lows. The profitable breakout from this sample is taken into account a robust bullish sign.

Associated Studying

In an in depth weblog post from June titled “The Stunning Symmetry of Previous Bitcoin Bull Market Cycles,” Brandt elaborated on the importance of halving occasions. He noticed that the halving dates have “represented the half-way factors of previous bull market cycles,” exhibiting an nearly excellent symmetry inside these cycles. Particularly, the variety of weeks from the beginning of every bull market cycle to the halving dates has been almost equal to the variety of weeks from the halving dates to the next bull market highs.

Based mostly on this symmetrical sample, Brandt posits that if the sequence continues, “the following bull market cycle excessive ought to happen in late Aug/early Sep 2025.” He means that the highs of previous bull markets align properly with an inverted parabolic curve, and if this tendency persists, “the excessive of this bull market cycle might be within the $130,000 to $150,000 vary.”

Associated Studying

Regardless of his optimistic projection, Brandt maintains a cautious stance. He emphasizes that “no technique of research is fool-proof” and admits to avoiding being “dogmatic about any thought.” Whereas this view is his most popular evaluation, he acknowledges it isn’t his solely interpretation. Brandt notes that he continues to position a 25% likelihood that Bitcoin’s value has already topped for this cycle. Ought to Bitcoin fail to make a decisive new all-time excessive and decline under $55,000, he would increase the likelihood of an “Exponential Decay.”

The crypto neighborhood has been actively partaking with Brandt’s evaluation. Widespread crypto analyst Astronomer (@astronomer_zero) responded on X, agreeing with Brandt’s prime estimation and highlighting the significance of precisely calling the market prime. Astronomer remarked: “I feel you’re spot on with that prime estimation Peter! As for calling the underside, now it’s our obligation to name the highest ideally in a single single attempt. The terminal value does that very properly. I’ve 6 different metrics in place. If all of them line up, it’s a promote. Location at $160,000.”

In an additional change, an X person inquired concerning the implications for the Bitcoin to gold (BTC/GLD) ratio, suggesting it would suggest a a lot larger value. Brandt responded, “Finally, sure. However let’s take one step at a time with out change into too dogmatic.”

At press time, BTC traded at $74,940.

Featured picture created with DALL.E, chart from TradingView.com