- Ethereum has surged almost 20% in two weeks, with vital accumulation by traders.

- Key metrics like lively addresses and whale transactions point out potential for value will increase.

Ethereum [ETH] has proven indicators of breaking out of its latest interval of stagnation, lastly gearing up for what might be a big bull rally. After months of underperformance in comparison with Bitcoin, Ethereum is at the moment buying and selling at $3,558.

This follows a 20% value improve over the previous two weeks, signaling renewed investor curiosity. Whereas ETH is down by 1.4% prior to now day, it stays above the essential $3,500 help stage, highlighting market resilience.

Within the midst of this value motion, market analysts have identified key tendencies that reinforce Ethereum’s potential for sustained development. A CryptoQuant analyst, often called theKriptolik, shared insights that make clear ETH’s enduring attraction to main traders.

The analyst emphasised that regardless of Ethereum’s cheaper price ranges in comparison with earlier highs, the ETH Trade Provide Ratio has dropped to ranges final seen in 2016. This lower signifies that traders are transferring their holdings off exchanges, suggesting long-term accumulation.

At the same time as circulating provide has elevated, the decline in exchange-held ETH highlights that traders proceed to view ETH as a protected haven asset.

Key metrics sign rising momentum for Ethereum

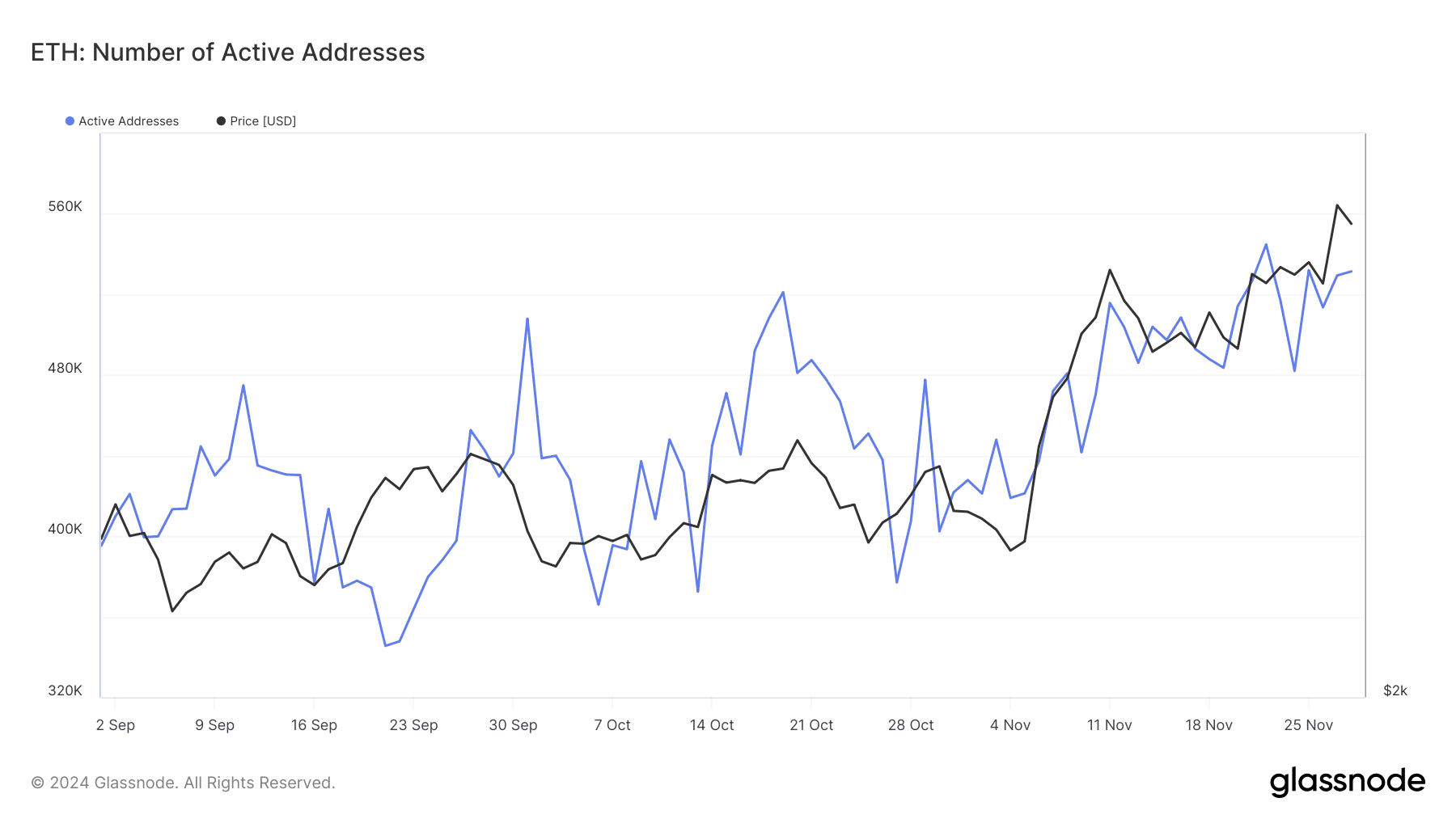

Analyzing Ethereum’s broader metrics reveals further insights into the asset’s efficiency and investor conduct. One notable indicator is the expansion in Ethereum’s lively addresses, a metric typically related to retail investor curiosity.

In keeping with Glassnode, the variety of lively Ethereum addresses has steadily elevated from beneath 500,000 in October to 531,000 as of twenty eighth November.

This upward trajectory alerts heightened community exercise, which generally correlates with elevated demand and potential value appreciation.

The rise in lively addresses signifies a rising variety of contributors partaking with Ethereum’s ecosystem, whether or not for transactions, decentralized functions, or staking, additional strengthening the community’s fundamentals.

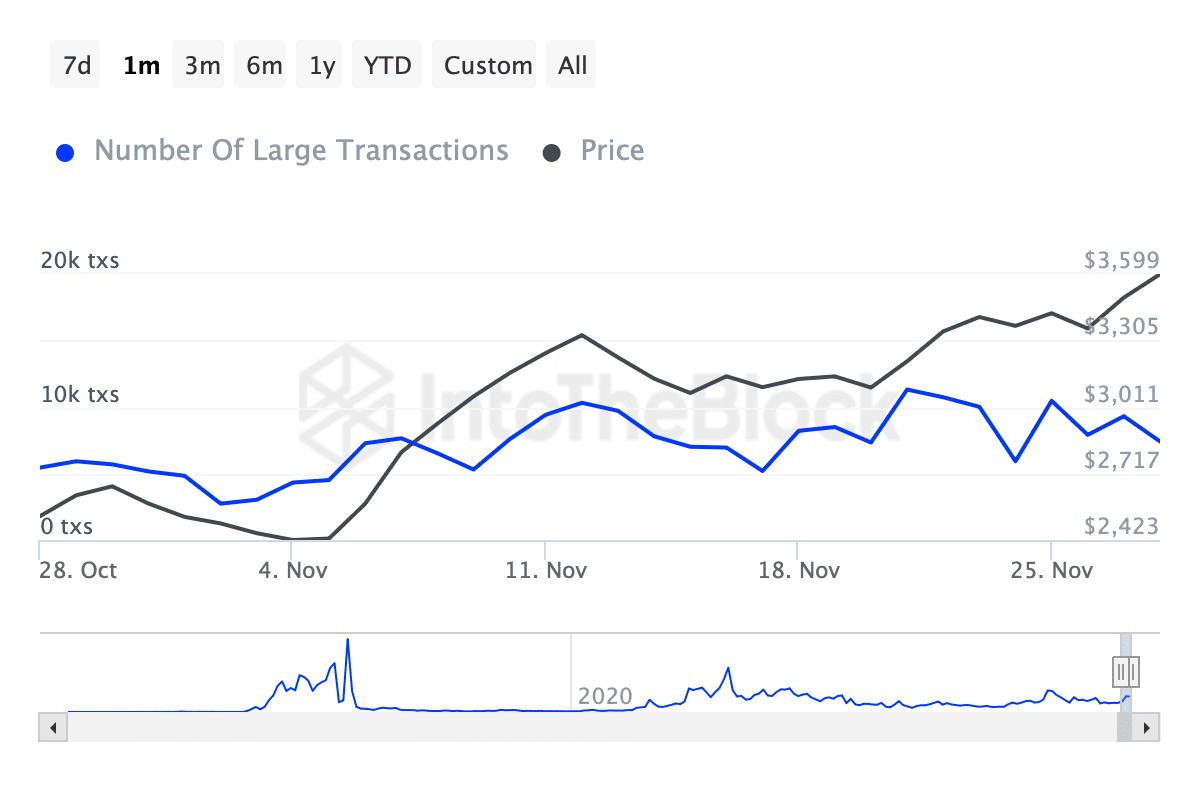

One other vital metric is the exercise of Ethereum whales—traders conducting transactions exceeding $100,000. Data from IntoTheBlock reveals that the variety of whale transactions noticed a peak of 11,210 earlier this month, reflecting heightened institutional exercise.

Nonetheless, this determine has lately declined, with Ethereum recording 7,410 whale transactions as of November 28.

Learn Ethereum [ETH] Price Prediction 2024-2025

Whereas the slight lower may point out short-term profit-taking, the sustained exercise of large-scale traders suggests continued curiosity and confidence in Ethereum’s long-term worth proposition.

Sometimes, an uptick in whale exercise can result in greater value volatility, whereas a discount might sign consolidation or preparation for the following market transfer.