- Bitcoin leads the crypto area regardless of market-wide uncertainty on the worth entrance

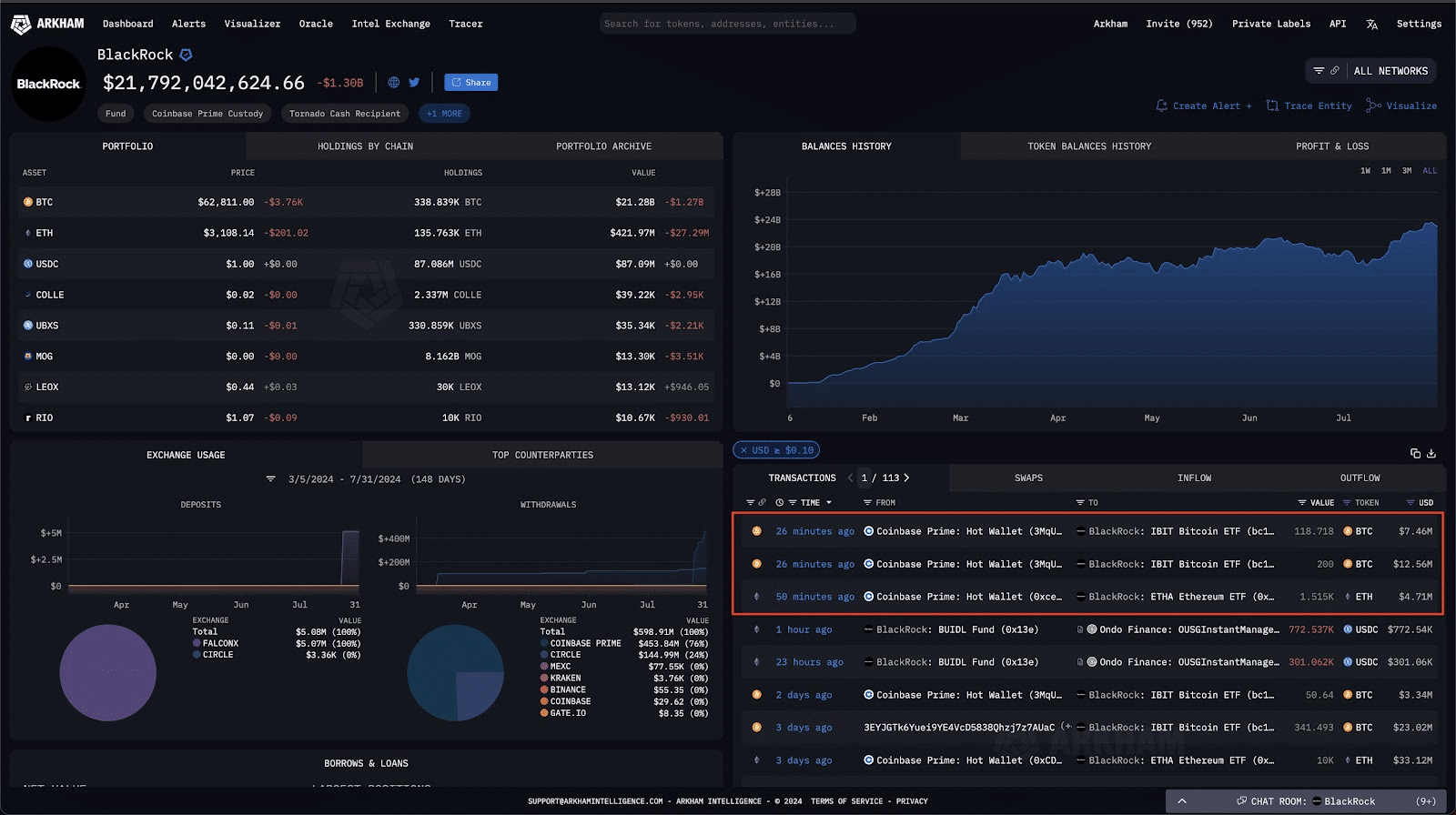

- Blackrock is continuous to purchase extra BTC, regardless of weak arms capitulating

It’s been an attention-grabbing time for lots of the market’s largest cryptocurrencies, with the likes of Bitcoin stabilizing on the charts after a bout of depreciation a couple of days in the past. On the time of writing, it was buying and selling simply above the $64,000-level, down by lower than 0.5% within the final 24 hours.

The market’s altcoins weren’t proof against such stagnancy both, with the likes of ETH, SOL, and XRP buying and selling near their $3159, $164.59, and $0.5966-levels, at press time.

Even so, the broader crypto-market’s sentiment stays cautiously optimistic. This, regardless of DOGE and SHIB buying and selling inside their warning zones on the charts.

Blackrock’s affect on BTC’s future value

Blackrock’s rising involvement within the crypto-space, regardless of the latest dumping, is a strategic transfer to capitalise on market sentiment, notably when the worry and greed index is ruling.

Issues are about to get intense as firms, establishments, and whales have continued to scoop up hundreds of Bitcoin as common analyst Lark Davis noted.

The timing is very essential right here because it comes after Russia’s new invoice on Bitcoin mining and crypto funds for worldwide commerce with strict rules.

Cumulatively, these may result in BTC recording some main value actions, primarily based largely on investments and market psychology.

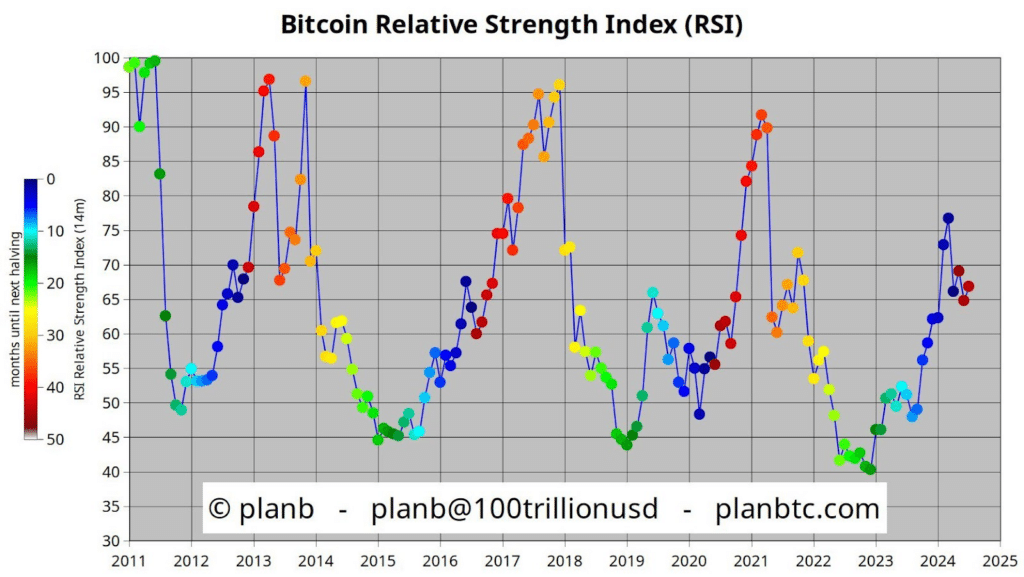

RSI evaluation suggests 2017 run may repeat itself

On the time of writing, Bitcoin’s RSI was hovering round a stage of 65. This may be interpreted to be the precursor to a serious bull rally.

Traditionally, RSI values have usually been used to foretell an asset’s future value motion, as crypto analyst Quinten noted on X utilizing this key metric.

Monitoring Bitcoin’s RSI traits will likely be essential right here.

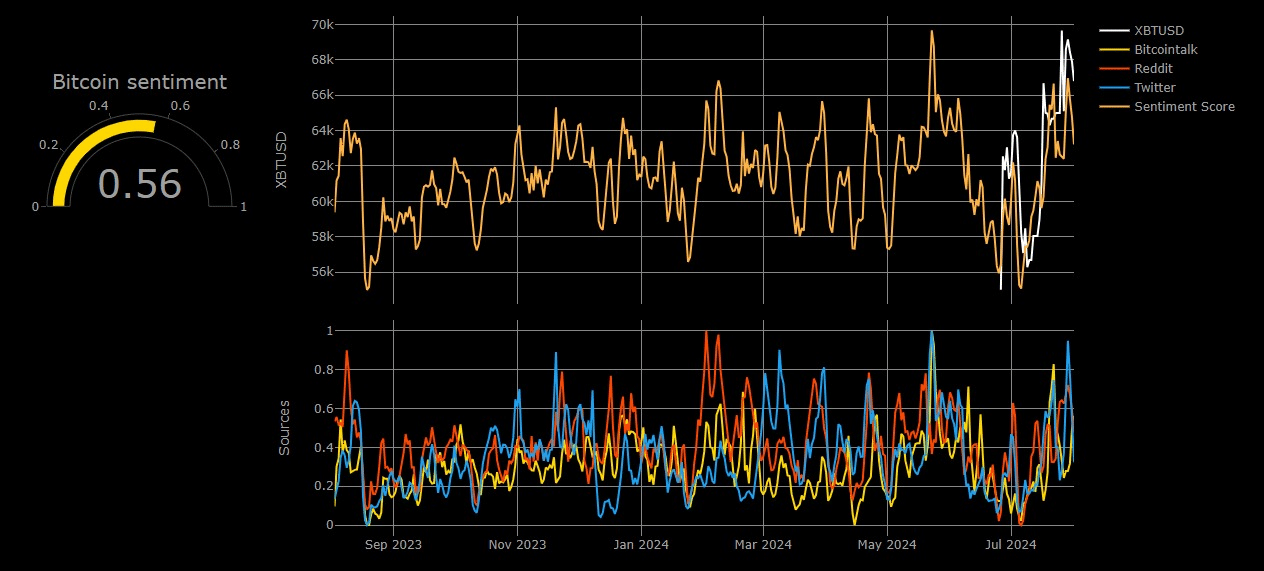

Bull & bear index shaping the longer term value of BTC

Right here, it’s value different datasets too. On-chain metrics resembling pockets exercise and transaction volumes, as an example, revealed heightened accumulation by long-term holders.

Moreover, the Bull & Bear index had a studying of 0.56 too – One other signal of BTC being in an accumulation section.

This development usually precedes an asset’s bullish value motion, supporting the speculation of a possible value surge sooner or later.

What a wedge breakout means for BTC’s value

Lastly, BTC’s rising wedge sample has damaged to the draw back as we anticipated earlier to run on stops resting beneath the trendlines.

This may lure the bears and ship again the worth to above the $70k stage in This autumn. The truth is, whereas the crypto’s value has been in consolidation recently, it has simply proven early warning indicators of an upward trajectory on the charts.

Breaking above the $70k key resistance zone may spur a run in the direction of the $100k psychological stage.

Based mostly on technical indicators, on-chain knowledge, and exterior influences like Blackrock’s involvement, Bitcoin has the potential to repeat its historic value actions.