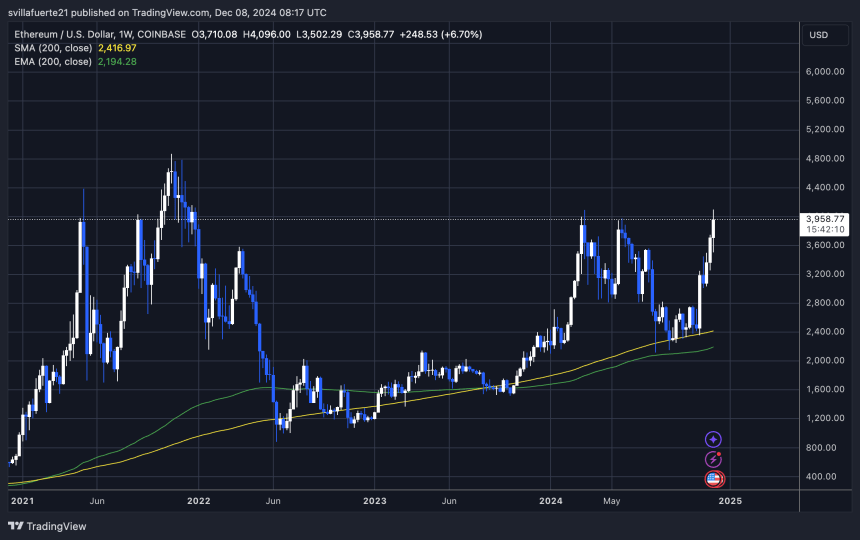

Ethereum (ETH) is making headlines because it developments towards the $4,100 mark, reaching a brand new yearly excessive of $4,096. This milestone, simply $3 above the earlier excessive set in March, indicators a possible resurgence for the second-largest cryptocurrency by market capitalization. The worth motion has caught the eye of analysts and traders, significantly as Ethereum continues to outperform expectations in a market dominated by volatility and uncertainty.

Associated Studying

Key metrics from IntoTheBlock shared by analyst Ali Martinez make clear the community’s exercise, revealing a surge in giant Ethereum transactions. Traditionally, such will increase in transaction quantity have been linked to vital value actions, suggesting that Ethereum’s present uptrend might have extra room to run. These developments trace at rising curiosity from institutional gamers and high-net-worth traders, additional solidifying Ethereum’s position as a market leader.

The subsequent few weeks promise to be pivotal as Ethereum approaches the 12 months’s finish. Will it maintain its momentum and shut the 12 months with a breakout above $4,100? Or will it face resistance and retrace? With on-chain exercise and market sentiment aligning in Ethereum’s favor, all eyes are on its subsequent transfer as merchants and traders place themselves for what might be an thrilling near 2024.

Ethereum Transactions Surge With Value

Ethereum continues to dominate market discussions after pushing to new yearly highs on Friday. The cryptocurrency surged previous $4,096, surpassing its earlier peak set in March. This upward momentum has reignited investor curiosity, however Ethereum’s value isn’t the one factor on the rise—its community exercise is booming as properly.

Based on data by analyst Ali Martinez (IntoTheBlock), giant Ethereum transactions are experiencing a big uptick. Martinez highlights that weekly transaction quantity has skyrocketed by over 300%, reaching a powerful $17.15 billion yesterday. This surge in community exercise indicators elevated confidence amongst institutional gamers and high-net-worth traders, who typically precede retail adoption throughout main bull runs.

Such progress in transaction quantity traditionally correlates with sustained upward value actions, suggesting Ethereum’s rally might not be over. Because the second-largest cryptocurrency by market cap, ETH seems well-positioned to proceed setting new highs if these developments persist.

Regardless of this optimism, ETH faces a key milestone forward—its all-time excessive of $4,878, set in November 2021, continues to be 20% away. Whereas Ethereum’s current breakout has invigorated bulls, analysts warning that reaching and sustaining costs close to the ATH would require vital buy-side stress and broader market energy.

Associated Studying

If the present trajectory holds, Ethereum might method its ATH before anticipated, additional solidifying its standing because the go-to blockchain for decentralized functions and monetary innovation. For now, traders are carefully monitoring Ethereum’s value motion and community knowledge to gauge whether or not this rally has the momentum to interrupt new floor or if a pullback is imminent.

ETH Pushing Above $4k

Ethereum is at the moment buying and selling at $3,960, exhibiting resilience after reaching an area excessive of $4,096 simply two days in the past. This rally has introduced Ethereum again into the highlight, with traders eyeing key ranges that would dictate its subsequent transfer.

A weekly shut above the important $4,000 mark would sign the very best weekly shut for ETH since December 2021, a serious milestone for the second-largest cryptocurrency. Such a detailed would reinforce the bullish sentiment surrounding Ethereum, doubtlessly attracting extra buy-side stress and setting the stage for a continued rally towards its all-time excessive of $4,878.

On the flip aspect, failure to attain a weekly shut above $3,880—its earlier highest weekly shut—might point out waning momentum. On this situation, Ethereum could enter a consolidation part as merchants take income and the market digests current beneficial properties. Consolidation under this stage would possible maintain ETH range-bound within the close to time period, with $3,880 and $4,000 performing as pivotal resistance ranges.

Associated Studying

The subsequent few days might be essential as ETH navigates this important juncture. A decisive weekly shut will possible decide whether or not Ethereum extends its present rally or pauses to consolidate, providing merchants alternatives and challenges on this dynamic market.

Featured picture from DALL-E, chart from TradingView