- OKX denied claims of aiding Bybit hackers in laundering funds.

- Blended ETH projections between whales and Choices merchants.

OKX management has refuted allegations of laundering a part of Bybit’s $1.5 billion stolen Ethereum [ETH] by means of its DEX aggregator platform (OKX Web3 pockets).

Commenting on the damning headlines, Star Xu, OKX Founder, and CEO, termed the stories “incorrect” and “deceptive.”

“In line with Bloomberg report, Bybit seems in charge OKX by suggesting we help the hacker’s to launder stolen funds ($100M)…That is incorrect and deceptive.”

The Bloomberg report famous that the OKX laundering allegations had attracted scrutiny from EU regulators. Nevertheless, Xu reiterated that the agency was open to collaborating with world regulators on Web3 coverage.

For his half, Ben Zhou, Bybit’s CEO, clarified that Bloomberg misquoted them.

“We didn’t present any assertion to this Bloomberg article, I imagine after they say “in accordance with Bybit” it was referring to http://lazarusbounty.com and the info on it.”

U.S. ETH ETFs bleeds

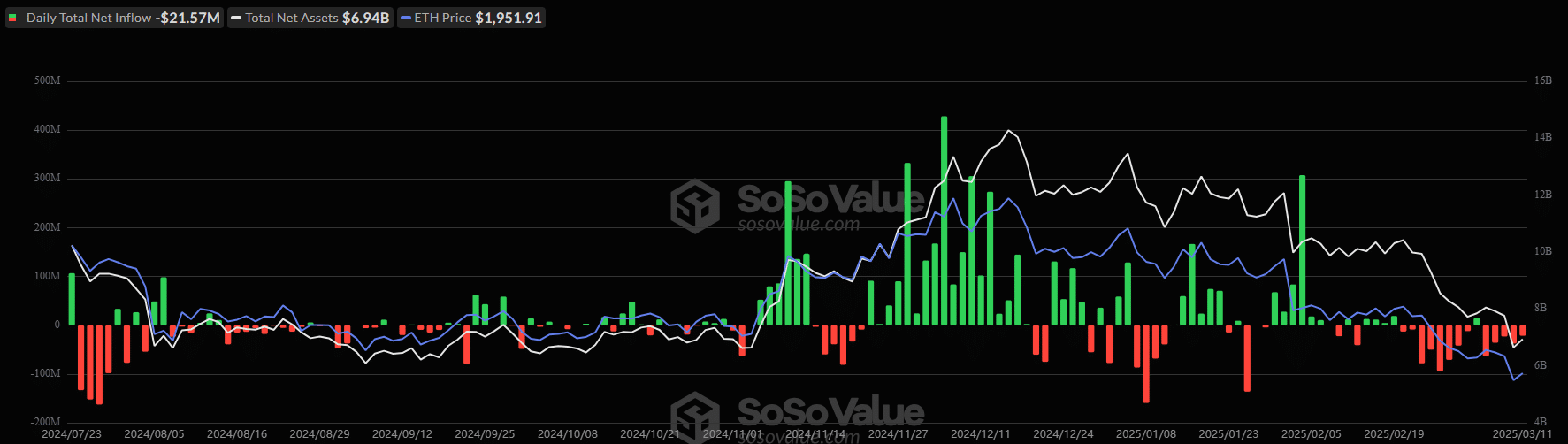

After the Bybit hack, a broader weak sentiment has dented the Ethereum market. U.S. spot ETH ETFs logged over $500M in outflows for the previous three weeks.

The truth is, for six consecutive days, the merchandise have seen constant bleed-out as buyers reacted to U.S. recession fears.

On Tuesday, they noticed $21.5m outflows, whereas $37.5m of ETH ETF merchandise have been bought on the tenth of March.

Unsurprisingly, the risk-off temper has dragged ETH worth to a 2-year low of $1.7K. This has introduced the altcoin again to ranges earlier than the present bull cycle started.

Even so, there have been mixed outlooks and sentiments from market members. Some analysts have been optimistic a couple of potential rebound for the altcoin, citing technical indicators and worth fractals.

For instance, Titan of Crypto noted that ETH’s market construction resembled BTC’s prior cycle, and a V-recovery may ship it hovering greater.

On his half, pseudonymous analyst Crypto Rover, projected that ETH may surge to $8K, citing historic trendline resistance that marked its earlier cycle tops.

ETH was valued at $1.9K at press time, down 53% from a latest peak of $4K. Whether or not the Pectra Improve will enhance restoration odds stays to be seen.

Nevertheless, at press time, Choices merchants on Deribit have been pricing lower than a 1% likelihood of ETH reclaiming $4K by the tip of March.