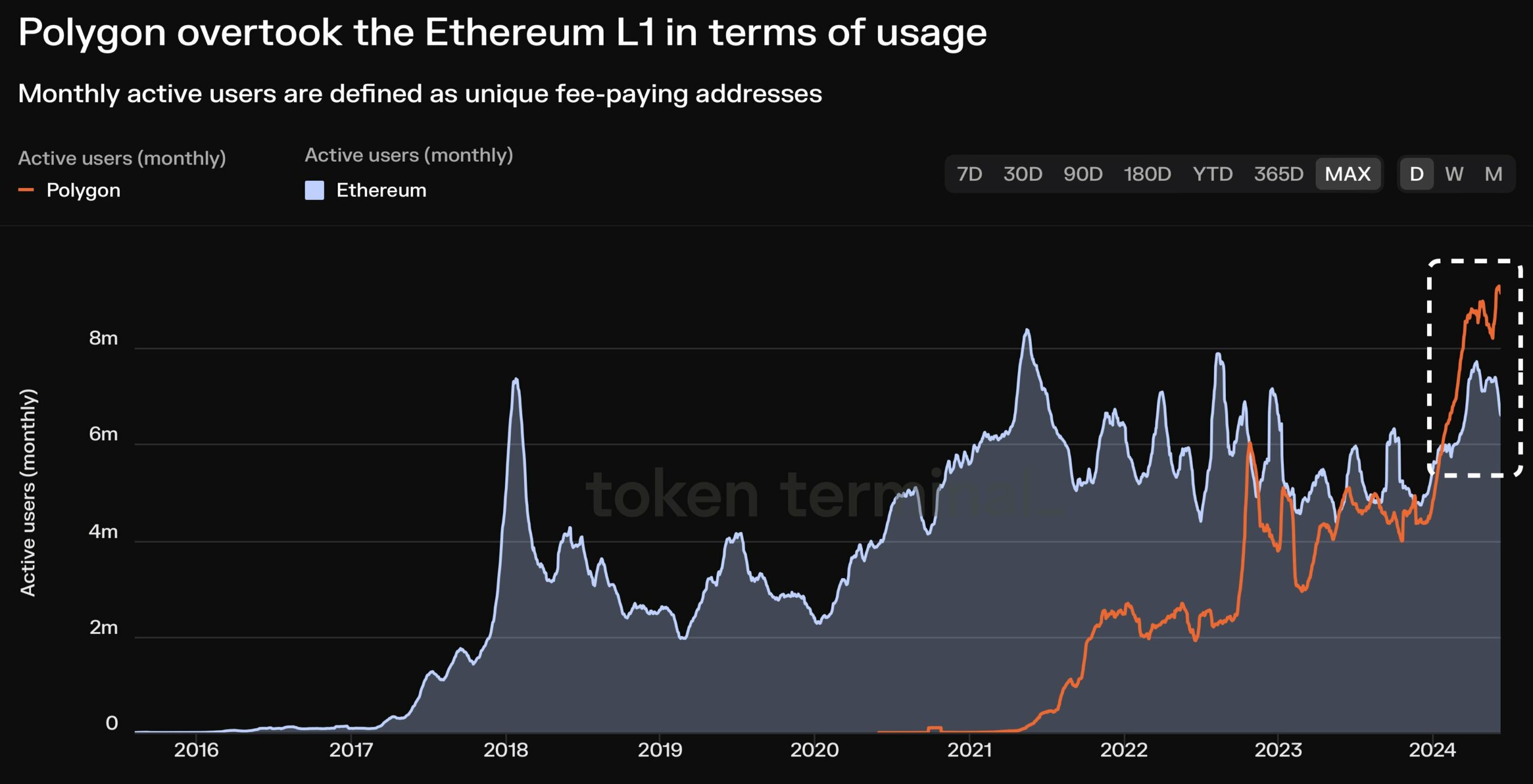

- Polygon has crushed Ethereum when it comes to gasoline utilization and total exercise.

- The worth of MATIC fell significantly over the previous couple of days.

Polygon [MATIC] witnessed an enormous uptick in exercise over the previous couple of months and has slowly and steadily garnered consideration from a number of customers.

Polygon races to the highest

As a result of rising reputation of Polygon, it outperformed Ethereum when it comes to gasoline utilization. Furthermore, Polygon had outdone Ethereum when it comes to month-to-month lively customers.

If customers are flocking to Polygon for its decrease charges and quicker transactions, it might decelerate Ethereum’s adoption fee.

Nonetheless, it’s necessary to keep in mind that Polygon isn’t a direct competitor, however quite a Layer-2 scaling resolution constructed on high of Ethereum. In the long term, a thriving Polygon ecosystem might really profit Ethereum.

What about MATIC?

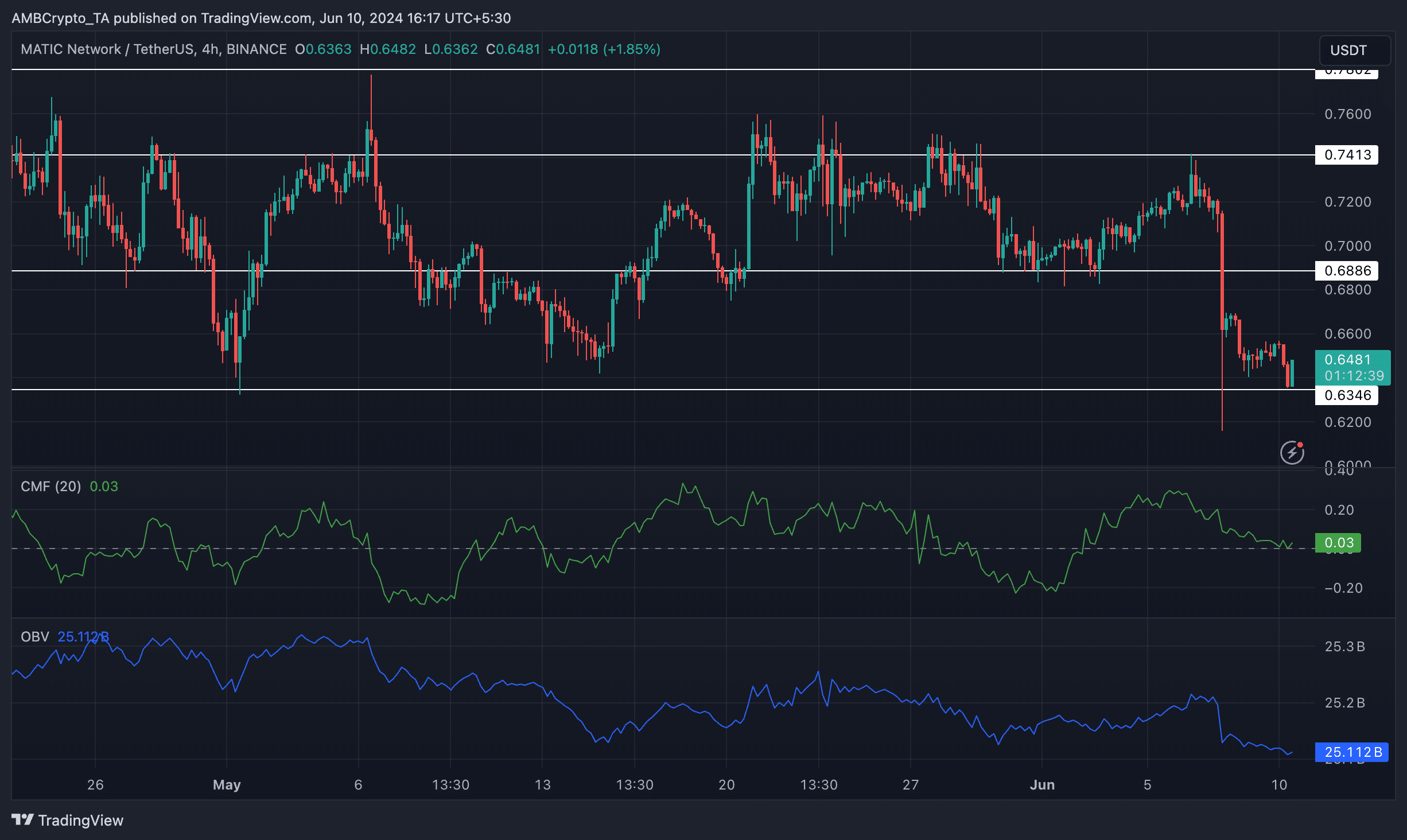

Regardless that the Polygon community made vital progress, MATIC wasn’t capable of see inexperienced.

Regardless that the value of MATIC moved sideways for probably the most half, there was a steep decline noticed when the value hit the $0.7413 degree on the sixth of June.

The OBV (On Steadiness Quantity) for MATIC declined materially throughout this era. A declining OBV throughout this era recommended that promoting stress outweighed shopping for stress for MATIC.

A constructive CMF, even at a low worth like 0.03, signifies that there would possibly nonetheless be some cash flowing into MATIC regardless of the OBV decline.

A constructive CMF with a decrease buying and selling quantity might counsel bigger traders or whales accumulating MATIC regardless of the short-term worth dip.

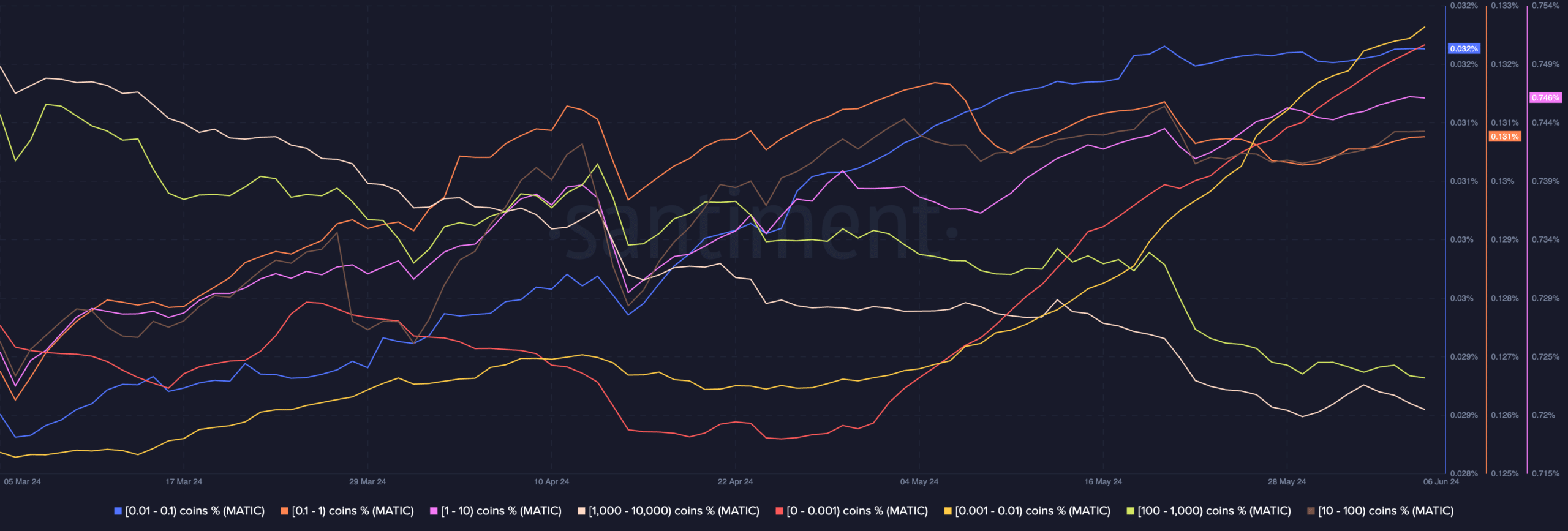

Aside from whale curiosity, there was retail curiosity in MATIC noticed as effectively.

AMBCrypto’s evaluation of Santiment’s knowledge indicated that the addresses holding wherever between 0 and 100 cash had elevated their fee of accumulation.

The rise within the accumulation of MATIC means that many merchants are wanting on the latest worth dip of MATIC as a chance to purchase the token at a reduction.

Sensible or not, right here’s MATIC’s market cap in ETH’s terms

Regardless of MATIC struggling to see progress when it comes to worth, Polygon managed to do rather well within the DeFi sector.

Notably, Polygon’s Proof-of-Stake (PoS), zero-knowledge Ethereum [ETH] Digital Machine (zkEVM), and Coconut Growth Equipment (CDK) have change into the go-to choices for DeFi builders.