- Polygon community has seen a surge in RWA curiosity, together with a latest ECB trial.

- MATIC traction on the value charts has slowed barely, with $0.51 as a key worth stage.

Polygon [MATIC] founder Sandeep Nailwal has acknowledged rising Actual World Asset (RWA) curiosity within the Ethereum [ETH] L2 community. His remarks adopted the European Central Financial institution’s (ECB) latest bond issuance trial.

‘So many RWA’s launching on Polygon organically could be very encouraging…Polygon POS is already second solely to Ethereum mainnet when it comes to the RWA worth created.’

Nonetheless, in accordance with RWA.xyz data, the assertion was overstated. The platform confirmed that Polygon was the fifth-largest community based mostly on complete market cap, particularly within the US tokenized securities market.

Will the RWA curiosity enhance MATIC worth?

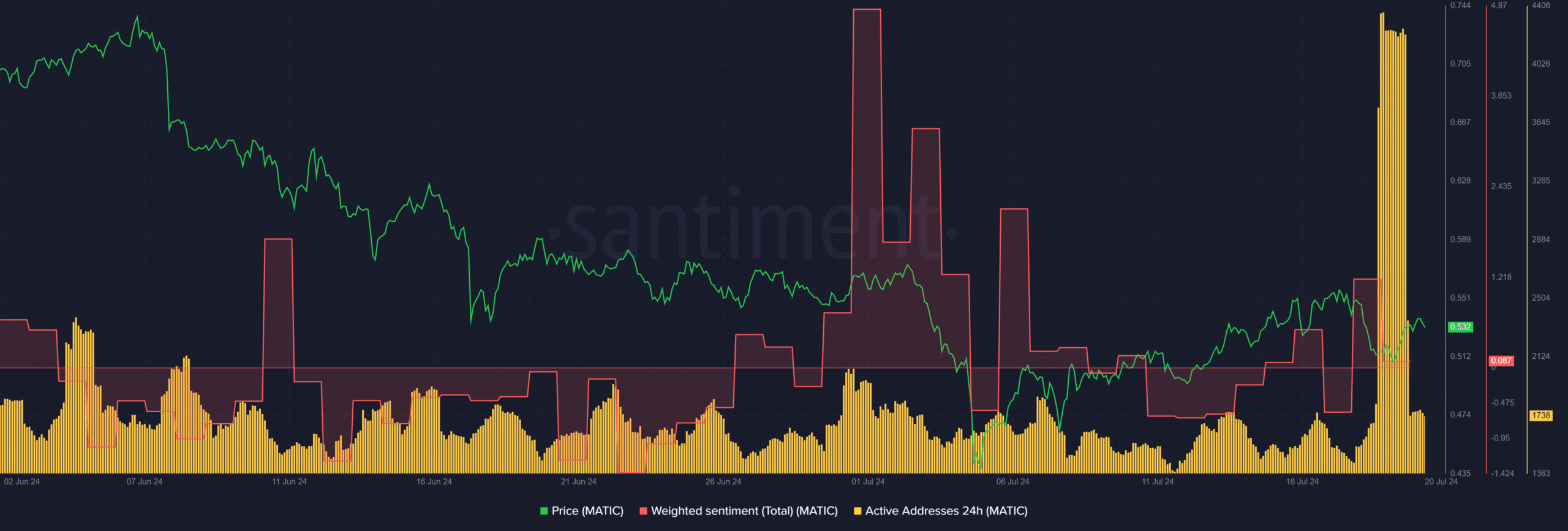

The rising RWA curiosity revealed some optimistic community results, as denoted by a surge in MATIC’s every day lively addresses, per Sentiment information.

Moreover, the information replace on the ECB trial on the community flipped MATIC’s Weighted Sentiment to optimistic. Nonetheless, the metric dropped in the direction of the impartial stage as of press time, which might dent market sentiment on MATIC.

On the time of writing, the every day lively deal with additionally tanked, which might derail additional worth upside with fewer customers partaking with the altcoin.

MATIC restoration cooled off

On the value entrance, MATIC surged 3% on nineteenth July after Nailwal’s remarks. Nonetheless, MATIC’s total restoration in July stalled above $0.55 and retraced to $0.51. The blended studying on key worth chart indicators signaled merchants’ warning.

Notably, the RSI (Relative Energy Index) recovered however remained muted under the typical stage (50). It meant that the latest restoration didn’t collect sufficient shopping for strain to ensure a stronger upside.

Moreover, CMF (Chaikin Cash Move) was above common however hovered close to the equilibrium stage, denoting inflows surged however stagnated previously few days.

The above readings urged that MATIC might wrestle to interrupt the overhead hurdle and every day order block above $0.55 (crimson).

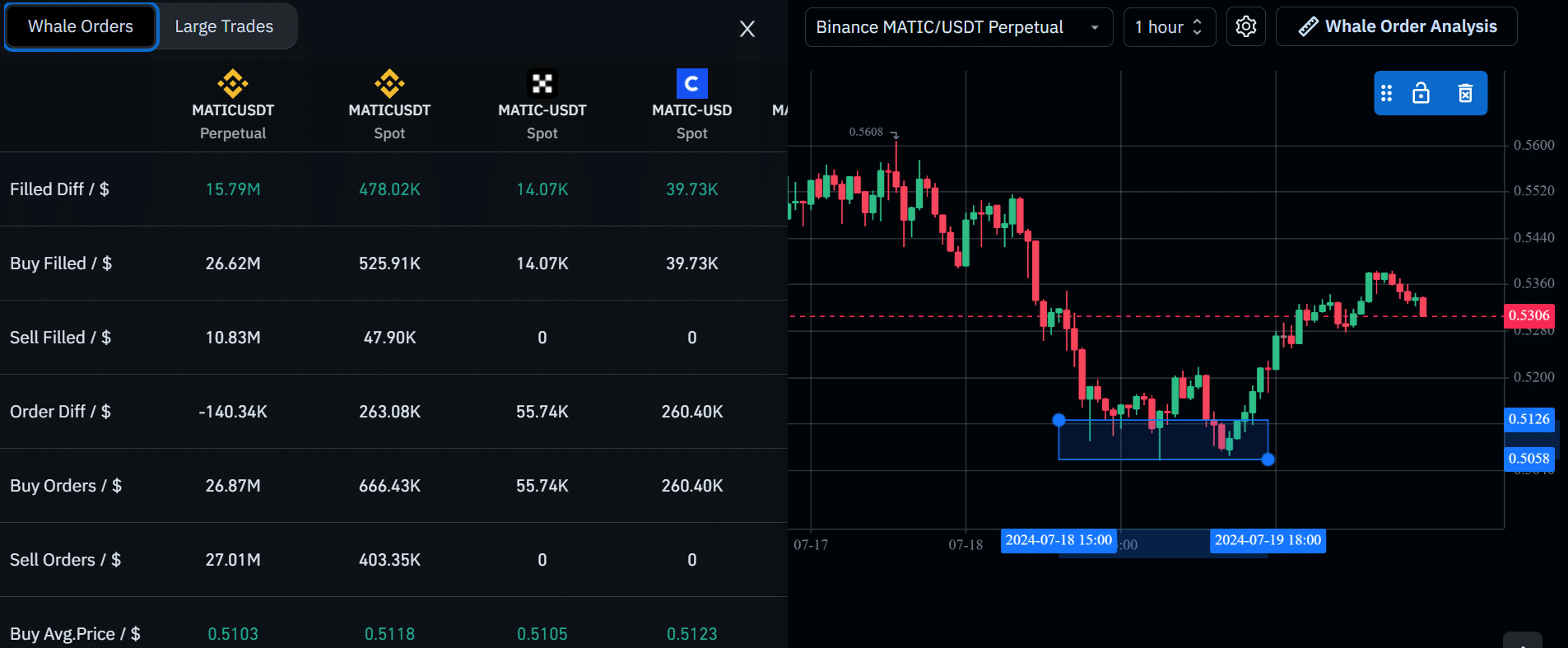

Nonetheless, the $0.51 stage was additionally an important demand curiosity stage, as proven by the chart and whale order data.

The bounce at $0.51 was marked by about $26 million in purchase orders within the derivatives market on Binance change. Moreover, demand surged within the MATIC spot market, with over $500K in bids on the stage.

Therefore, given the whale curiosity and large quantity at $0.51, it was an important stage for any MATIC speculator searching for market entry into the altcoin.

![Polygon [MATIC]](https://ambcrypto.com/wp-content/uploads/2024/07/MATICUSDT_2024-07-20_14-29-39.png)