- ETH has seen rising curiosity from company treasuries.

- Is the institutional curiosity sufficient to push ETH to the $3K psychological degree?

Strategic Ethereum [ETH] Reserve (SER) has picked up momentum to rival booming Bitcoin and Solana [SOL] company treasuries.

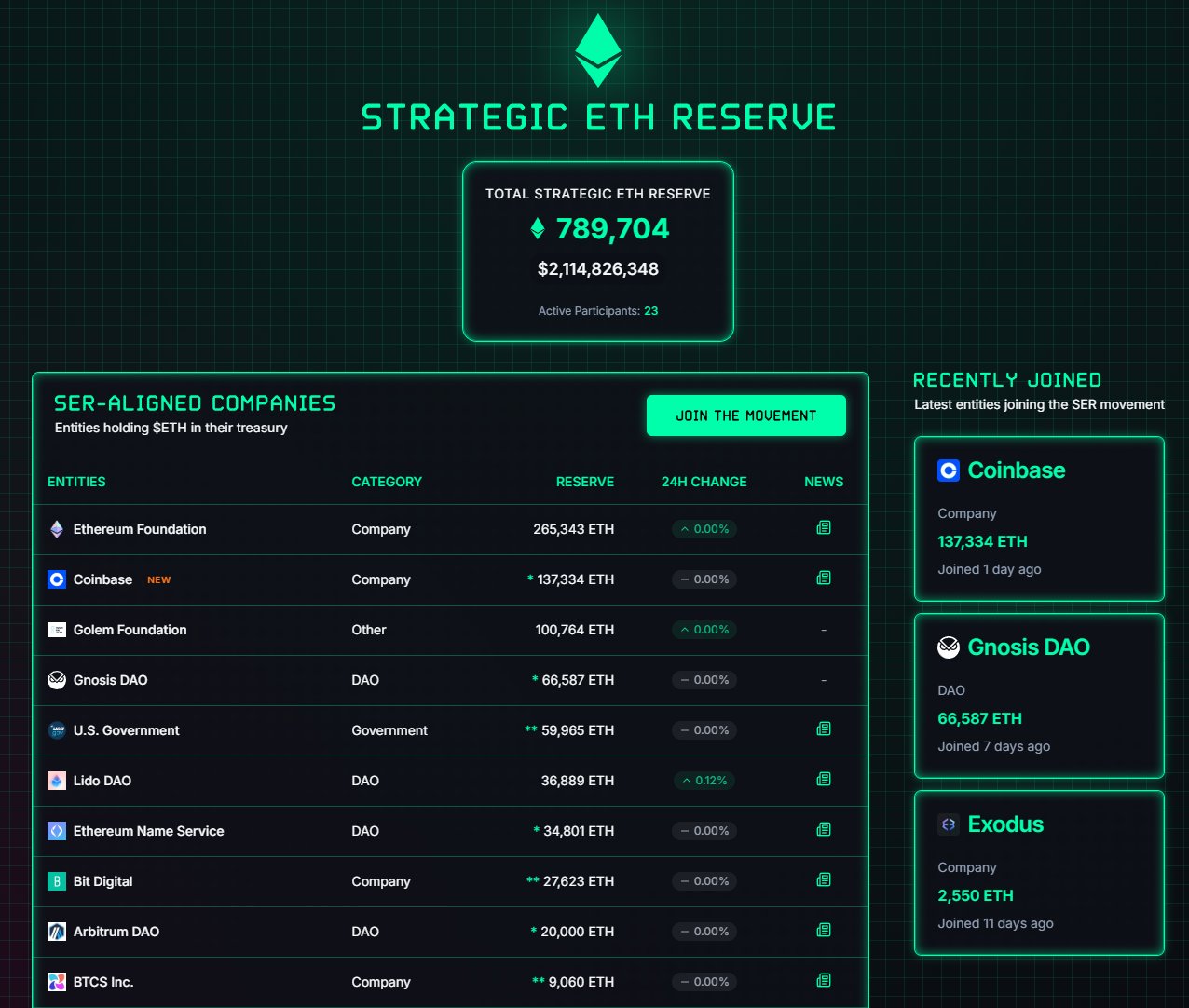

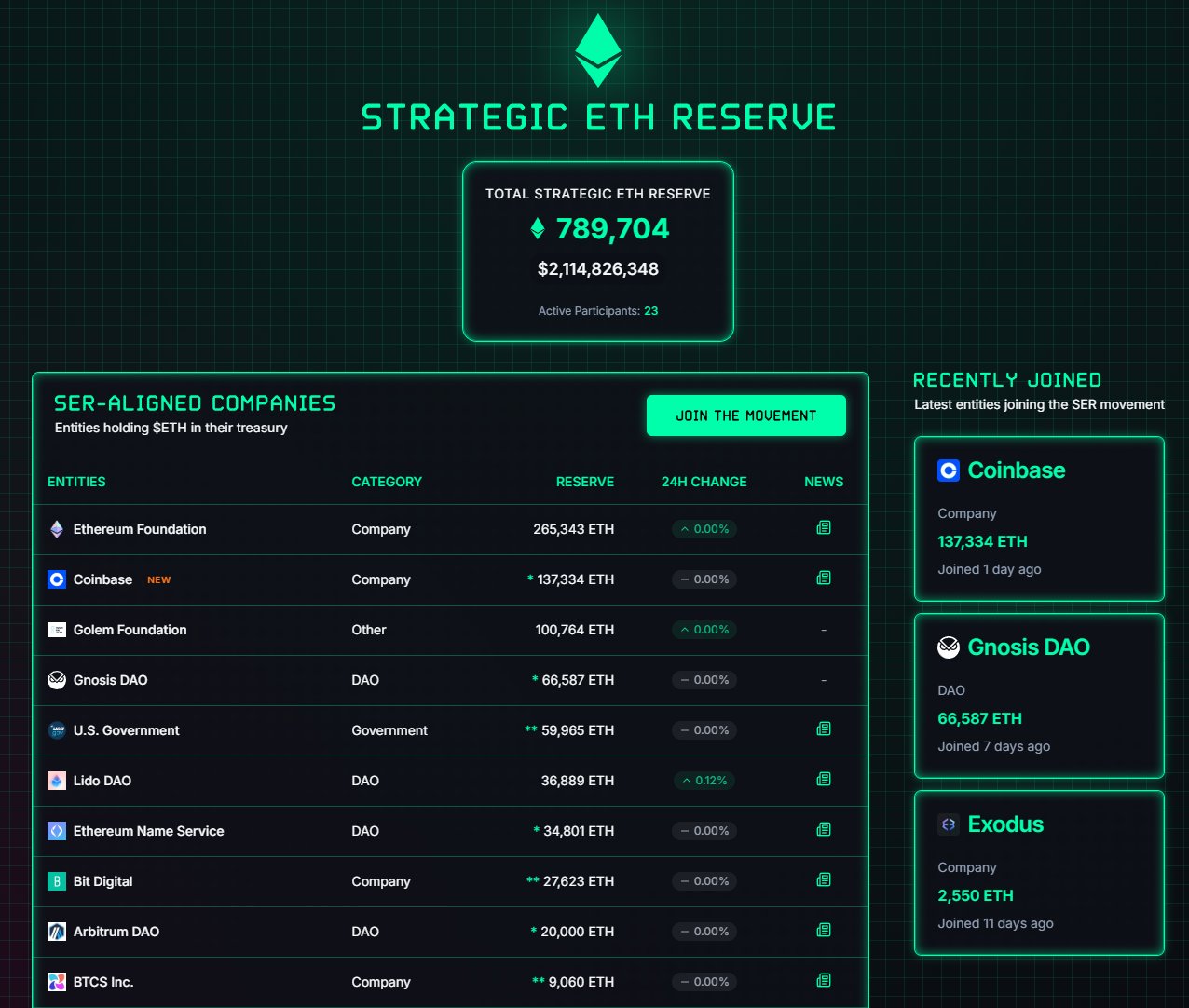

Establishments and even the state of Michigan collectively personal $2.1 billion of ETH (789,905 cash).

Ethereum Basis, Coinbase, and Golem Basis prime the charts on the leaderboard.

Supply: SER

The U.S authorities holding was 59,965 ETH whereas the state of Michigan has 4000 ETH. The Royal authorities of Bhutan, a distinguished BTC miner, collected 495 ETH.

Will institutional demand gas ETH?

An analogous rising demand for company treasury within the BTC ecosystem, from companies like Technique, has fueled BTC costs. Will ETH file the same progress?

Based on CryptoQuant, ETH demand was primarily concentrated within the palms of enormous gamers, probably establishments.

Since late 2024, giant holders with 10K-100K ETH (blue) and 1K-10K ETH (orange) have elevated their holdings since mid-2024.

Supply: CryptoQuant

These two whale classes had 16.7 million ETH and 12.5 million ETH, respectively.

However, these with 100-1K ETH, probably retail (inexperienced), have decreased their holdings from about 14 million ETH to 9 million ETH.

In different phrases, establishments have been dominant within the ETH market, and the rising strategic reserve pattern may gas additional accumulation and worth appreciation.

That stated, ETH has recovered over 90% from its April low of $1,385 and briefly retested $2.7K for the primary time since February. Analysts linked the rally catalysts to a profitable Pectra improve and renewed risk-on sentiment.

Now, ETH was again to the August-November 2024 value vary of $2.3K-$2.8K. Escaping the vary and clearing the overhead resistance at $3K (purple zone) would verify additional upside transfer. In any other case, a short cool-off could also be probably.

Regardless of the sturdy rebound, there was nonetheless criticism in opposition to ETH on Crypto Twitter (CT).

Based on Zach Rynes, Chainlink’s group liaison, ETH was in a three-pronged struggle and was removed from profitable.

Supply: X

Though different market watchers disagreed with Rynes’ opinions, the ETH market appeared strongly positioned for additional upside.

CoinGlass data revealed that Binance’s prime merchants elevated their ETH lengthy positions from 63% in early Might to 74% over the previous 4 days. Merely put, sensible cash was nonetheless bullish on ETH regardless of its large 90% restoration.