- US authorities moved $1.92 billion in Bitcoin, fueling considerations about potential market influence.

- Bitcoin sale fears rise, however transfers could also be for safekeeping, not imminent liquidation.

As Donald Trump’s administration prepares for its official transition on twentieth January, 2025, the US authorities has taken vital steps involving its Bitcoin [BTC] holdings.

Not too long ago, $1.92 billion value of BTC, primarily seized from the Silk Street operation, was transferred into new wallets.

Of this, $963 million was instantly despatched to Coinbase, a transfer that alerts potential future gross sales.

This switch is a part of a broader pattern the place the U.S. authorities has shifted substantial Bitcoin belongings—roughly $2.6 billion between July and August—additional hinting at preparations for liquidation.

Is the Biden admin planning one thing large?

Amid rising considerations, group members speculate that President Joe Biden could also be making an attempt to dump the U.S. authorities’s BTC reserves earlier than Trump’s inauguration, probably undermining plans to determine a Bitcoin Reserve.

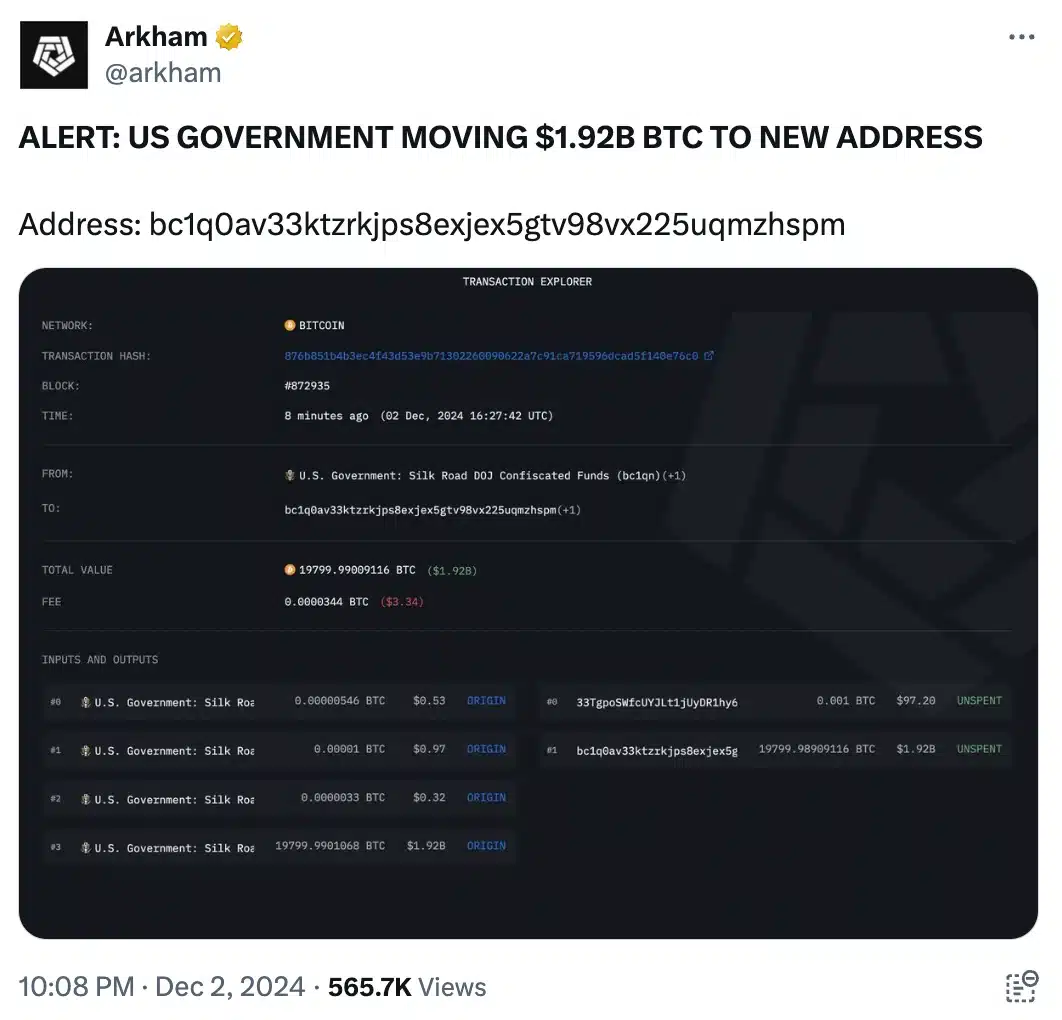

On 2nd December 2024, information from Arkham, an on-chain intelligence platform, revealed that the U.S. authorities moved $1.92 billion value of BTC into new wallets.

This switch concerned splitting the belongings between two wallets, with one subsequently shifting $963 million in Bitcoin to Coinbase, fueling additional hypothesis about future gross sales and their potential influence available on the market.

The Bitcoin belongings in query have been seized from the notorious Silk Street, and since they’re legally owned by the U.S. authorities, there are rising considerations that they may very well be offered off in giant volumes, resulting in a possible market downturn.

Bitcoin’s latest and upcoming tendencies

Such a sale may exert vital downward stress on BTC’s worth, inflicting unease amongst traders.

This worry materialized swiftly, as Bitcoin’s worth, which had been nearing the $100k threshold, dropped to $95,229.66, reflecting a 0.20% decline within the final 24 hours, in line with CoinMarketCap.

Remarking on the state of affairs, Carl B. Menger, an trade commentator mentioned,

“Is the federal government planning to promote Bitcoin earlier than Trump takes workplace? Outgoing administrations shouldn’t undermine the incoming President, because the folks have already voted them out.”

Nevertheless, regardless of considerations over the potential slowdown of the cryptocurrency market following Donald Trump’s inauguration the crypto group stays cautiously optimistic.

Challenges forward

Historic information means that market rallies usually lose steam after presidential transitions, however the crypto area has proven resilience prior to now.

As an illustration, when the U.S. authorities ready to promote $600 million in Bitcoin 4 months in the past, the market initially faltered however rapidly rebounded as institutional funding surged.

Furthermore, whereas the latest transfers of Bitcoin by the Biden administration have sparked hypothesis, they could not point out imminent gross sales.

The U.S. Marshals Service, which has a safe custody settlement with Coinbase Prime, means that the belongings have been moved for safekeeping quite than rapid liquidation, with regulatory procedures nonetheless to be adopted earlier than any sale can happen.