- Ethereum whales gathered $26M in ETH as dev exercise surges and worth reveals early restoration.

- Vitalik warns in opposition to meme tradition, urging builders to construct significant apps atop Ethereum’s impartial base.

As Ethereum [ETH] as soon as once more tops the charts in growth exercise, a recent wave of on-chain intrigue has emerged: An unidentified whale has quietly gathered practically $26 million value of ETH.

The timing is hanging. With Ethereum’s worth hovering close to the $1.6K mark and co-founder Vitalik Buterin doubling down on his criticism of meme-fueled crypto tradition, questions are mounting.

Is that this a calculated guess on the community’s long-term utility, or a sign that good cash is making ready for a rotation again into fundamentals?

Code is impartial, apps should not

Buterin has sounded a well timed warning: the rise of application-layer exercise isn’t only a signal of progress – it’s a name for values.

In a latest put up, he drew a pointy distinction between general-purpose infrastructure like Ethereum’s base layer and the extremely ideological nature of apps constructed atop it.

Whereas Ethereum’s core might stay structurally impartial, “apps are 80% particular objective,” he wrote, arguing that what builders select to construct displays their beliefs about Ethereum’s function on the planet.

As memecoins dominate headlines, the message is obvious: tech with out imaginative and prescient is simply noise.

Ethereum’s subsequent transfer?

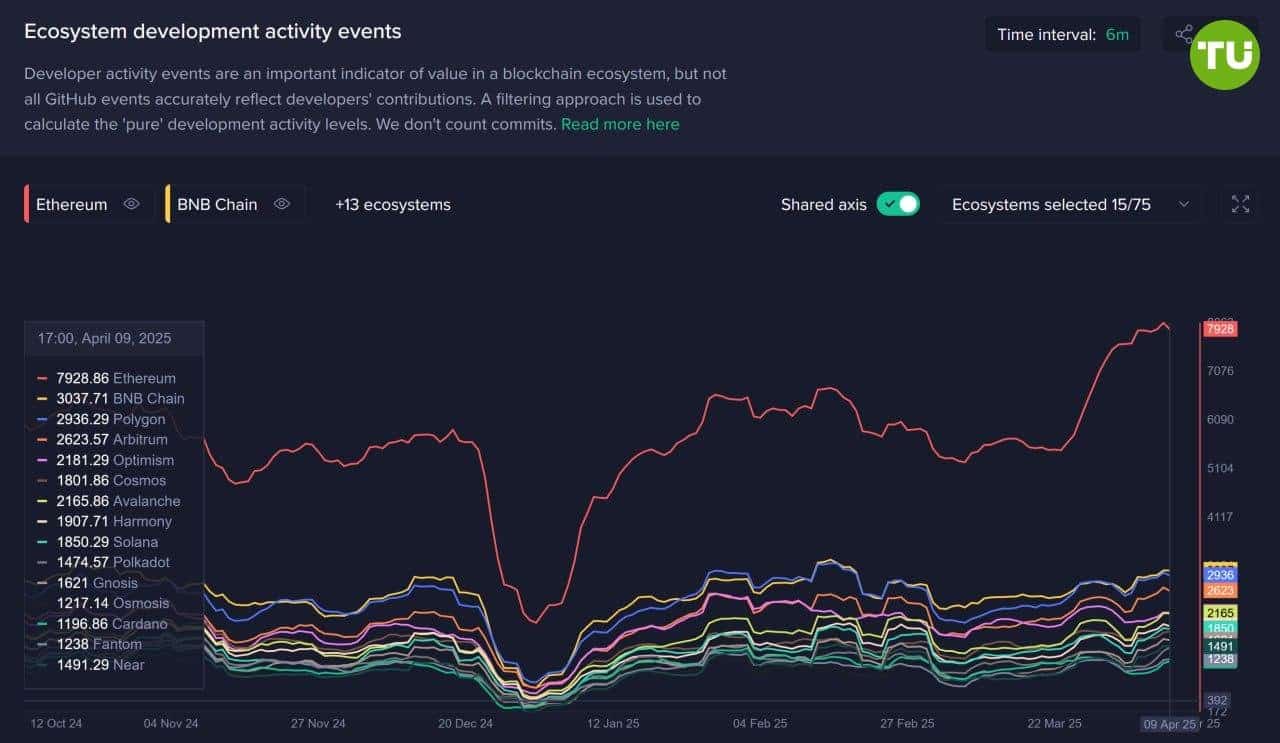

Though Ethereum’s worth lags, its fundamentals current a contrasting narrative. Current information reveals Ethereum’s dominance in crypto growth.

It has recorded over 7,900 growth occasions, considerably surpassing all different ecosystems. BNB Chain follows with 3,037 occasions, whereas Polygon[POL] recorded 2,639 occasions.

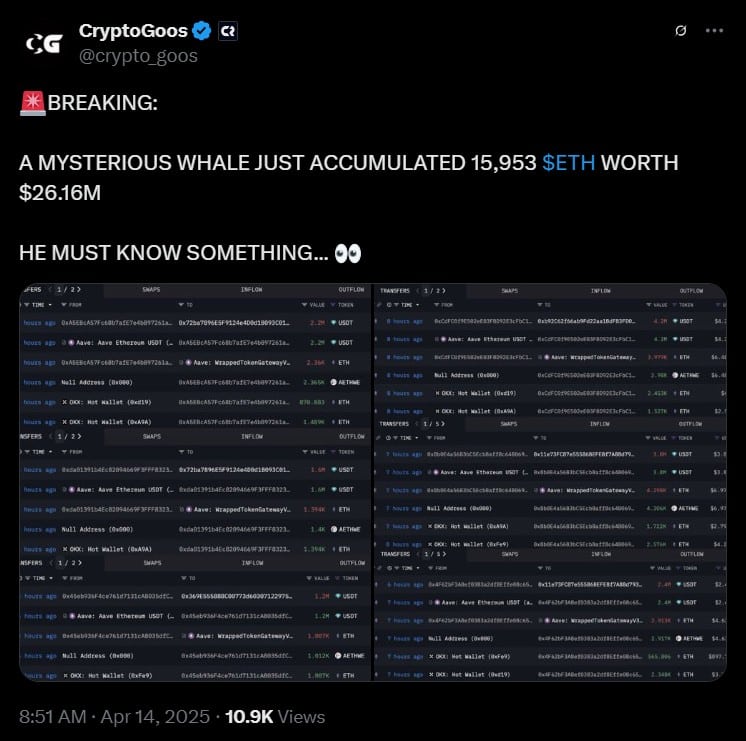

On the similar time, a mysterious ETH whale has simply made headlines by accumulating 15,953 ETH value $26.16 million. The buildup — break up throughout Aave [AAVE] and OKX wallets – has raised eyebrows throughout the area, sparking hypothesis that there’s extra to this than what meets the attention.

The timing is curious. With surging developer exercise and a daring whale guess, some are questioning if ETH is quietly setting the stage for a breakout – no matter its sluggish worth.

Indicators of a possible shift

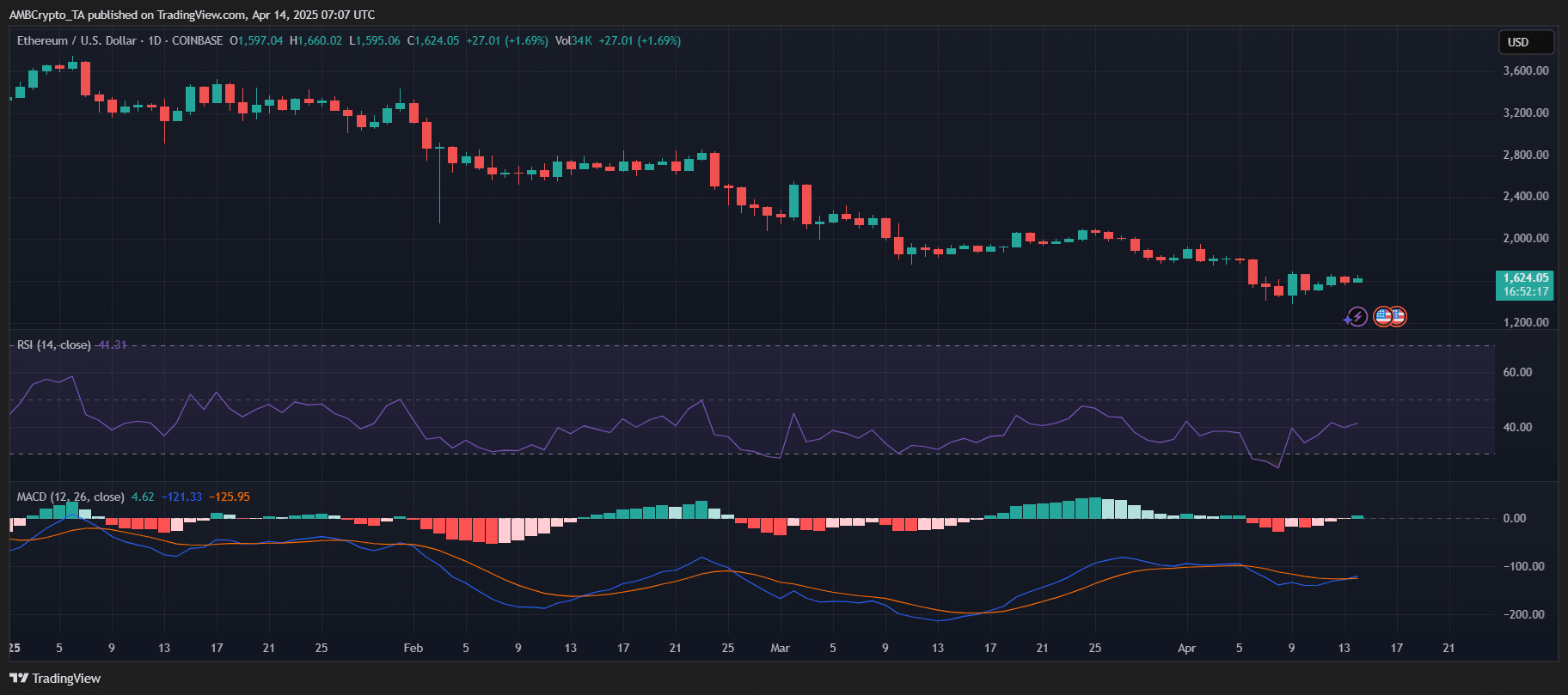

Buying and selling at $1,624 at press time, ETH posted a 1.69% achieve on the day. The RSI climbed to 44.31, reflecting recovering shopping for curiosity however nonetheless shy of bullish territory.

In the meantime, the MACD confirmed narrowing bearish momentum, with the MACD line approaching a crossover above the sign line – a typical precursor to development reversals.

Whereas not a definitive breakout, these technical indicators recommend that Ethereum could possibly be bottoming out. If supported by continued whale exercise and growth power, a rally is probably not far off.