- Whales have been steadily accumulating BTC, an element that has contributed to the current worth surge.

- Additionally, there was little liquidity under Bitcoin’s worth, with main resistance ranges above, particularly at a brand new worth goal.

Prior to now 24 hours, Bitcoin’s [BTC] has gained 2.73%, recovering from a dip that noticed the worth drop to $94,150.05 after hitting a excessive of $104,000 earlier this month.

The current rally in BTC’s worth is basically pushed by rising investor demand, as large-scale acquisitions proceed to push costs upward.

Whales lead the cost

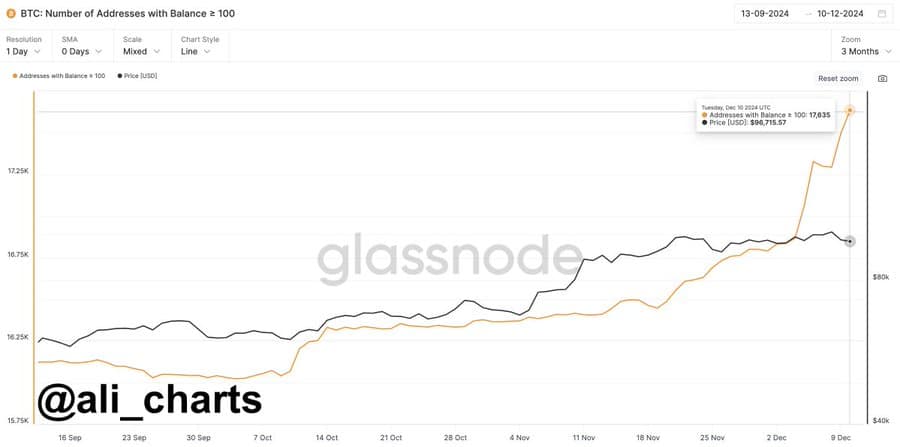

Curiosity in Bitcoin has surged once more, with whales enjoying a key function within the current worth improve, in accordance with cryptocurrency analyst Ali Chart utilizing knowledge from Glassnode.

The chart highlighted that giant traders, or whales, have been buying BTC in vital portions. He pointed to a chart exhibiting 342 wallets, every holding over 100 BTC (valued at roughly $10 million primarily based on CoinMarketCap), profiting from BTC’s sharp drop to $90,000.

Notably, such strikes sometimes point out that whales view the dip as a possibility to amass BTC at a reduced worth in anticipation of one other market rally, which has already materialized as BTC now trades above $100,000.

BTC could possibly be aiming for a brand new excessive

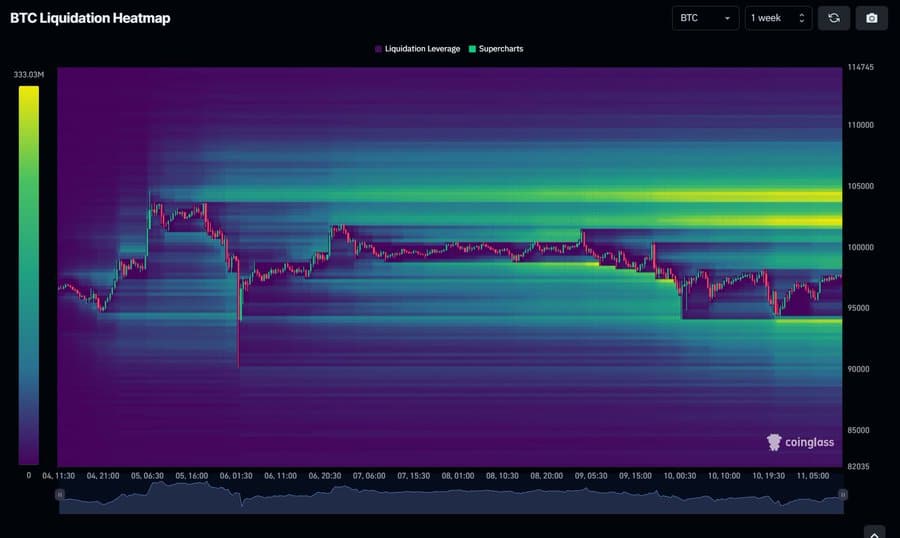

Liquidity knowledge from Coinglass, shared by analyst Mister Crypto, means that the coin is poised to focus on a brand new excessive, doubtlessly sustaining its worth above the $100,000 threshold.

Liquidity ranges point out key worth factors the place property are likely to gravitate, performing as magnets that appeal to worth motion.

On the time of writing, BTC has cleared all vital liquidity ranges under its present worth. The subsequent important resistance level is at $105,000, which surpasses its earlier all-time excessive goal of $104,000.

Increased liquidity available in the market

Whale Tracker reports that Tether (USDT) has minted an extra $1 billion at Tether Treasury. This signaled an inflow of liquidity into the market.

This surge in liquidity displays rising demand for USDT, which market members are doubtless to make use of to amass crypto. With BTC positioned as a primary candidate, it stands to learn from this influx as merchants leverage USDT to buy Bitcoin.

In a associated report, Whale Tracker notes that market confidence within the coin is returning. A serious holder lately transferred 7,999 BTC—valued at over $800 million—again to safe wallets for safekeeping.

Given these developments, BTC appears more and more more likely to attain a brand new all-time excessive quickly.