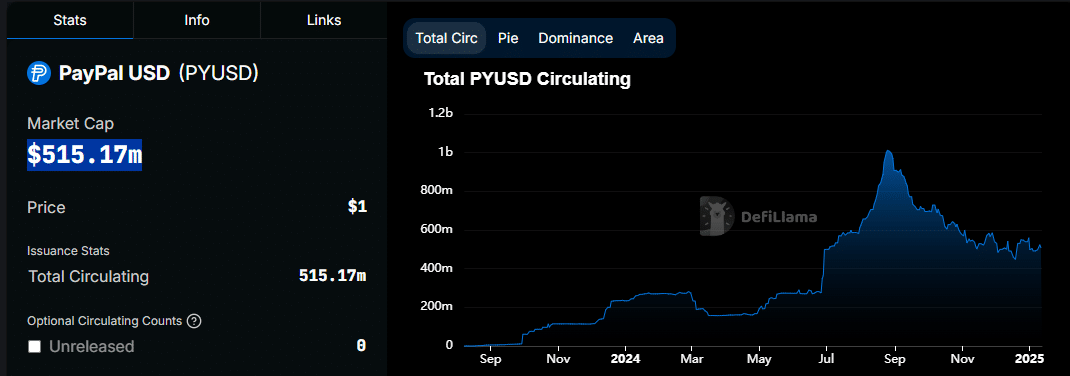

- PayPal USD marketcap is down significantly from its historic peak

- Regardless of current restoration, it is probably not sufficient in the long term

PayPal USD made a splash available in the market within the second half of 2024 for a number of causes. It was the primary time {that a} conventional fee supplier tried to enterprise into Web3 in a mainstream approach. It additionally marked a brand new daybreak for tokenized belongings.

PayPal USD’s expectations had been excessive, however quick ahead to the current and it seems that the tokenized belongings narrative has been operating out of steam. The preliminary pleasure after it was launched on Solana was evidenced by its efficiency, with the identical since having cooled down.

The PayPal USD marketcap peaked at $1.01 billion on 25 August. It has been declining steadily since then and even dropped beneath $500 million in December. PYUSD had a $515.17 million marketcap, on the time of writing.

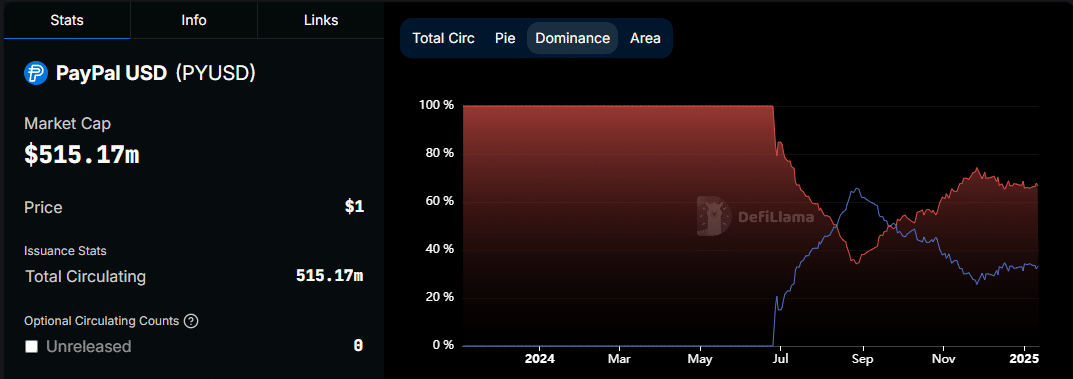

The dip in PayPal USD marketcap occurred across the identical time that its dominance on Solana began declining.

Its preliminary pleasure beforehand allowed PayPal USD’s marketcap dominance on Solana to outperform Ethereum. At its peak, the marketcap dominance on Solana was 65.79% on 29 August. Its dominance on the Solana blockchain bottomed out at 25.42% on 27 November.

The whole PYUSD marketcap efficiency aligned with the Solana dominance. This discovering confirmed that its utility on the Solana community was not sustained. The truth is, Ethereum managed 67.21% of the PayPal USD circulating provide, at press time.

What fueled the preliminary PayPal USD marketcap progress and what’s completely different now?

The PYUSD marketcap began declining because the crypto market began seeing strong demand. Previous to that, it rallied from 26 June to 30 August 2024. This was simply earlier than the interval of market pleasure. There have been extra stablecoin holders again then and the PayPal stablecoin provided enticing yields on Solana.

Nevertheless, with with the market turning extraordinarily bullish, yield miners could have pulled out their liquidity and pumped it into crypto. The truth that PayPal USD was nonetheless comparatively new meant it had additionally not managed to acquire sustainable transaction volumes.

Whereas the aforementioned could clarify why the PayPal-related stablecoin has been shedding liquidity, it may very well be on the sting of hypothesis. The truth is, the stablecoin remains to be having fun with important on-chain exercise. For instance – Its circulating provide on each networks was up significantly within the final 30 days.

For instance, it was up by 5.31% on Ethereum and 4.12% on Solana within the final 4 weeks. This appeared to verify that the stablecoin remains to be having fun with some demand. Nevertheless, it is just restricted to the 2 networks and this has been a hindrance so far as adoption is anxious.